BMW and electrification – from first-mover to follower

07 December 2021

Newcomers used to be easy prey for the giants in the automotive market, but with the disruption of electrification, they have become hunters. In this new series on brands, José Pontes, data director EV volumes considers the strategies of these giants, starting with BMW.

Going back to 2013, BMW launched the revolutionary i3. It was the brand’s first mass-produced, battery-electric vehicle (BEV), and its first entry into the small-premium car category. The i3 carried a high price for a small BEV, partly due to its carbon-fibre body. However, it found its place in a nascent electric market, thanks to its unique and ageless design and strong ambitions of the i-brand. The i3 was the third-bestselling electrically-chargeable vehicle (EV) in 2014, behind the mass-market Nissan Leaf and the expensive Tesla Model S.

There has been a long period of silence and less electrification from BMW compared to others. The carmaker risks being perceived as a laggard rather than a leader. For example, BMW’s Neue Klasse (new class) models are not expected until late 2025. Electrification targets are less ambitious than those of the Volkswagen (VW) Group and Mercedes-Benz.

The denial years

At the start of 2015, instead of focusing on extending the i3 family by adding larger siblings, like a compact i3L, and maybe a seven-seater i3XL, rumours were circulating about a four-door-coupe follow-up. That route had its pros and cons, such as higher margins and creating a direct competitor to the upcoming midsized Tesla BEV. The main con would have been that the direct competition from that vehicle would cannibalise the traditional BMW internal-combustion engine (ICE) sales. Nevertheless, the coupe would have kept BMW ahead of the curve.

With Dieselgate hitting the industry in 2015, instead of reading the signs correctly, pushing forward with its EV plans and creating its electric four-door coupe as soon as possible, BMW put the brakes on the i-Series BEV development. This led to key executives leaving the company and the business focusing on providing plug-in hybrid (PHEV) versions (called i-Performance) of its main ICE models.

Elsewhere, Tesla unveiled its Model 3 in Spring 2016, and over 300,000 reservations later, it was clear what the future would be like. Many OEMs, including BMW, appeared stuck, and it took over a year for the German brand to move forward. In September 2017, it unveiled the i-Vision Dynamics sports-sedan concept at a time when the Tesla Model 3 was already in its first steps of production.

Instead of focusing on putting this concept into manufacturing, BMW took three years to launch the production version of the concept as the ICE-only 4-Series Grand Coupe. Another year passed before it became electrically available as the i4, thus taking four years for the i-Vision concept to come into focus. In comparison, Mercedes-Benz took only two years to take the EQS from concept to delivery.

Playing catch-up

In the meantime, the global battery-electric vehicle (BEV) market went from less than a million units at the end of 2017, to an expected 4.5 million by the end of 2021. Most importantly, the most direct rival to the BMW i4, the Tesla Model 3, went from 1,800 units delivered in 2017, to an expected 480,000 deliveries by the end of this year. BMW went from leader to follower in five years and are playing catch up, now.

BMW’s main electrification challenges

BMW has a number of challenges ahead when it comes to re-establishing itself as a high-ranking EV manufacturer. These include, but are not limited to the following points

PHEV-heavy line-up

At first glance, the BMW brand’s EV numbers look quite good this year, with over 195,000 units registered up until September. Closer examination reveals that only one in four EVs are BEVs, while in the global EV market, it is the other way around, with the BEV share so far in 2021 at 68% of all EVs registered. Moreover, this trend has been intensifying lately, with BEVs accounting for 75% of all EV registrations in September. Arch-rival Mercedes-Benz has seen the writing on the wall and has announced the stoppage of PHEV development to focus on BEVs.

Limited (and pricey) BEV line-up

Besides the eight-year-old i3, the brand’s current best-selling BEV, the iX3 SUV, is being sold in just one version: 80kWh battery, 460km WLTP range, and rear-wheel drive (RWD). Furthermore, it starts at €71,000. The upcoming i4 is more competitive, starting at €61,000, with an 82kWh battery, 590km WLTP range, and RWD. But to have all-wheel drive, the price jumps to €76,000, while the range drops to 520km. On top of that, the i4 is lacking a standard version. Comparatively, the all-wheel drive (AWD) Tesla Model 3, with 614km WLTP range, starts at €57,000, while the standard version starts at €51,000. Finally, the new iX large SUV carries a €81,000 starting price, which is high compared to the Audi e-Tron (€72,000), since the BMW SUV is lacking an entry version.

Slow EV-production ramp-up

With Tesla operating at a different scale (it works with six-figure numbers annually), it could be said that BMW has lost its lead. BMW’s production levels are still in five digits. When it comes to BEVs, Audi is outselling BMW (54,000 units vs 44,000), and let us not forget that Audi’s first mass-market BEV, the e-Tron, was only launched in 2019 – six years after the i3.

Unambitious EV targets

In the medium term, BMW is betting on its Neue Klasse, a name with weight inside the carmaker’s history, which it hopes will restore it to a position among the leaders. The first model of this new generation will only be unveiled in late 2025. Even then, it will not be a fully BEV-dedicated platform. It will also support PHEV and hydrogen fuel-cell powertrains. This is at a time when most of BMW’s legacy counterparts are focusing on BEV-only platforms. Also of concern is the fact that the carmaker expects only 50% of its sales to come from BEVs by 2030. Porsche and Volvo aim for the same sales ratio by 2025, Audi expects to go full BEV by 2033, and Mercedes looks to abandon ICE altogether by that time.

Success depends on infrastructure

BEVs are not attractive without dense, reliable charging infrastructure (CI). Drivers should be able to plug in while on the road, avoiding charging anxiety, which can be as damaging for EV adoption as range anxiety. Without a good CI, the EV driver will need to have a Plan B (or even Plan C), in case the initial charging station is offline or busy. CI differs greatly from country to country. For example, in the Netherlands, the density and availability of charging-point operators (CPO) allow drivers to travel without major concerns. In most other countries CI is sparse, limiting BEV success. This is particularly important for models like the BMW i4 or iX that have been designed for road trips. This factor could dampen their success in countries with sparse CI. This is something that Tesla has in mind when landing in any given country, as it deploys its top-notch supercharger network simultaneously with the start of official sales, explaining Tesla’s success in places like Australia and North America.

BMW’s main electrification opportunities

There are also a number of opportunities that could help BMW become a leader again in EV technology. These positives will go some way to make the carmaker competitive as buyers around the world shift their focus to electrification.

BMW does know how to make competitive EVs

The recent large iX SUV is an example of how competitive BMW can be. It is the OEM’s best BEV ever. Its entry-level price may be high compared to an Audi e-Tron at a similar spec level (400km-450km WLTP range). But the iX xDrive 40 version is highly competitive; it ends up being €3,000 cheaper than the e-Tron. Compared with the future standard version of the Tesla Model X, the iX xDrive 50 is €12,000 cheaper, and achieves a greater range (630km vs 560km).

Large customer base and brand recognition

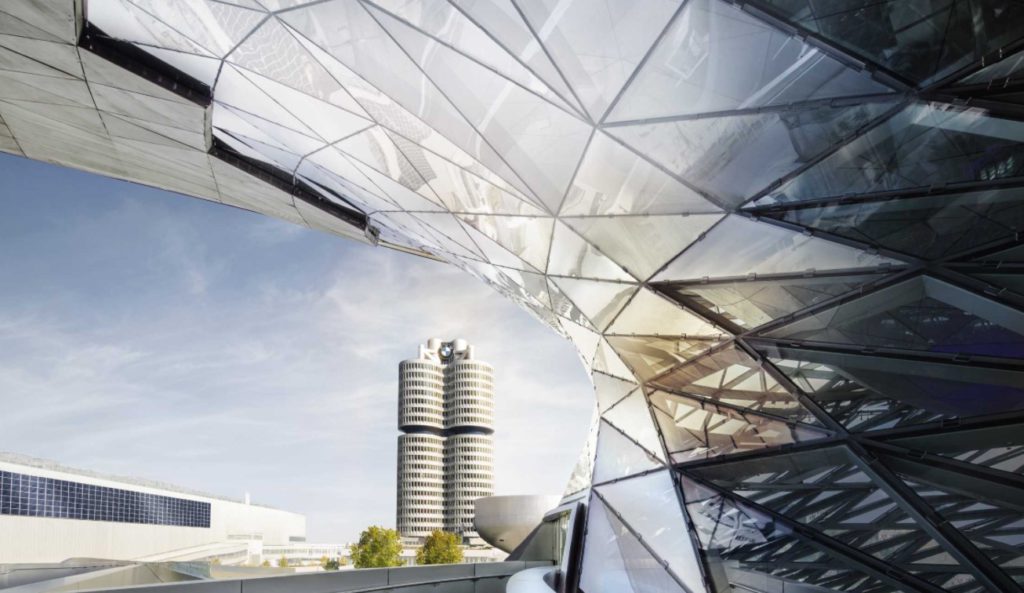

As one of the big three German premium brands (Audi, BMW, Mercedes-Benz), the Munich-based carmaker is a widely established automotive group, with strong brand recognition, and with approximately two million sales per year. It has much low-hanging fruit to pick from, unlike new BEV startups, which have to make themselves known and win the trust of the public. BMW faces no such problem.

Existing partnerships with fleet and leasing companies

A major advantage in BMW’s race to catch up, will be its strong partnerships and acceptance with fleet and leasing companies. While newer brands and start-ups have to invest in winning their trust and are typically hampered by a considerate residual value risk influencing leasing rates, BMW can take profit from the existing relationships.

Dealer-service availability

BMW has an established network of dealerships that are already scaled to respond to a large number of demands from clients, dealer density and service is generally good. It only needs to adapt its processes to electrification, instead of starting everything from scratch. Company-car drivers are especially affected, as convenience and time for servicing and repairs are key. Tesla drivers tell many stories about long wait times and difficult service arrangements following accidents or breakdowns. Other brands not focusing on tight-knit dealer networks will face similar issues. User-choosers and fleets depend on simple, easily accessible and professional solutions, and this clearly influences their buying decision.

Build quality and battery reliability

While the BMW brand and its i3 EV have above-average reliability, according to What Car, the most impressive feat is Samsung SDI’s supplied batteries. Not one of the i3’s high-voltage batteries had to be replaced due to premature ageing, reported Inside EVs. Something few EV models can be proud of.

Road manners, sporty image

While BMW’s latest designs can be polarising (just look at the oversized grilles), there is nothing debatable about their road performance, which continues to be among the best – even in models where it is not high on a customer’s wish list, for example, the 2-Series MPV. All this contributes to a sporty ethos that many competitors try to emulate, but few have succeeded in achieving.

Recovery path

From an early electric leader, the years lost focusing on PHEVs and delaying BEV projects put BMW at the back of the queue. Its BEV sales hovered around 30,000 to 40,000 units per year in the 2017-20 period. But during that time, global BEV sales surged from 800,000 in 2017, to over two million last year.

In order to recover its leading status, BMW needs to focus on increasing the scale of production of its existing EVs, increasing battery availability, bringing forward BEV launches, and offering lower-priced entry versions of its existing models, allowing it to present more competitive pricing.