Calendar effect sees European car registrations drop in June

17 July 2019

17 June 2019

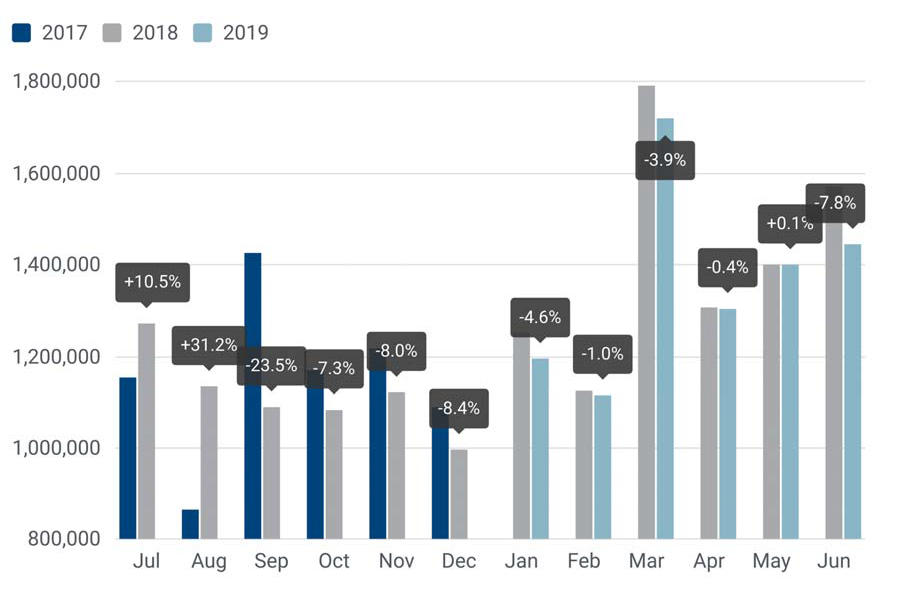

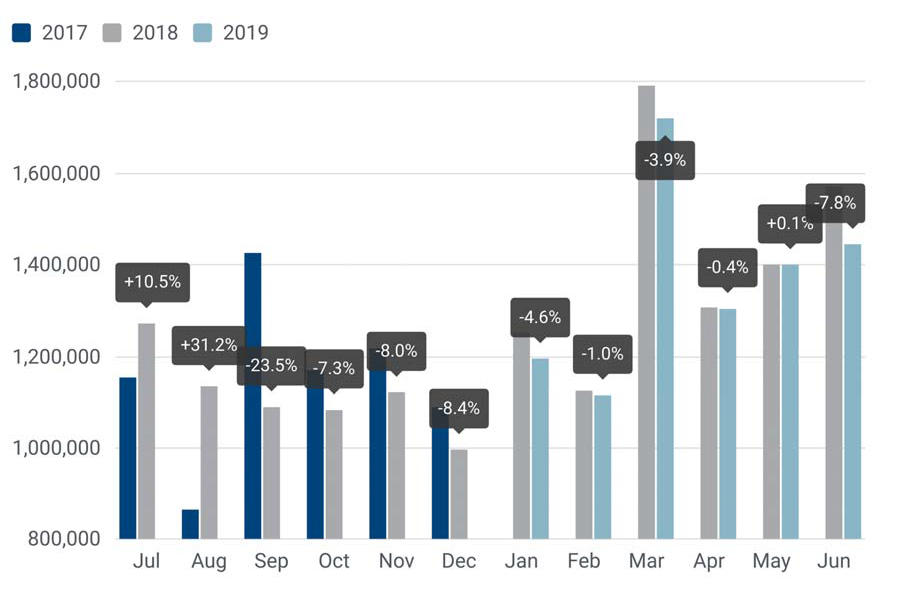

Europe saw new car registrations fall in June, with a ′negative calendar effect’ the most likely cause.

The month saw just 19 working days, compared to 21 in 2018. The European Automobile Manufacturers Association (ACEA) believes this is complicit in the 7.8% decline recorded in June, with a majority of countries and manufacturers suffering.

Source: ACEA

All of the big five European markets suffered a sales drop in the sixth month of 2019. Of these, France posted the biggest dip (8.4% down), while Spain was not far behind, dropping 8.3%. The UK saw sales fall 4.9%, and German registrations were 4.7% down. The best performing of the big five was Italy, although it too posted a loss, 2.1% down compared to the same month last year.

Of all European countries, only Cyprus (0.9%), Greece (4.5%), Ireland (12.7%), Lithuania (41.1%) and Romania (15%) saw increases, albeit on smaller totals than bigger markets.

First half

During the first six months of 2019, demand for passenger cars across Europe was down by 3.1% compared to the same period last year, with 8.2 million registrations in total.

In the big five, Spain is the worst-performing, with sales down 5.7%. Italy is next, dropping 3.5% of sales, with the UK not far behind with a 3.4% decline. France has seen a fall of 1.8%, while Germany is the only market that has posted a sales increase, although slim at just 0.5%.

June’s performance has seen the market drop by a further 1% since May’s figures were announced by ACEA.

Manufacturer performance

All but two manufacturing groups recorded losses in June as the market struggled.

Volkswagen Group, still the continent’s market leader with a 24.6% share so far this year, saw sales decline 9.6% in the month. Its core VW brand suffered the most of its high-volume marques, with a drop of 13.7%. All the German carmaker’s brands suffered, except SEAT, which once again was the best performing Group company, posting an increase of 7.4%.

PSA Group saw a decline of 8%, mostly caused by a 10.5% drop in Peugeot sales, and a 9.5% fall in Opel/Vauxhall registrations. Domestic rival Renault Group also suffered, but only losing 3.6% compared to last year, with Dacia being the French firm’s saviour, up 4.5%.

Hyundai Group saw a drop of 3%, while Fiat Chrysler Automobiles (FCA) has a sales fall of 13.6%.

Only Toyota Group and Mazda were able to improve their sales in June, up 1.9% and 1.7% respectively. Of those who posted a loss, Nissan was again the poorest performer, the embattled Japanese carmaker selling over a quarter (25.6%) fewer vehicles compared to the same period last year.

Year-to-date, VW Group is down by 4.3% and this figure would be higher without the positive contribution of SEAT, which was up 6% over the first six months of 2018. PSA Group, Renault Group and Hyundai Group are relatively stable, down 1%, 0.9% and 0.6% respectively, while the top five is made up by FCA, which is currently 9.5% down year-to-date.

Source: ACEA

All of the big five European markets suffered a sales drop in the sixth month of 2019. Of these, France posted the biggest dip (8.4% down), while Spain was not far behind, dropping 8.3%. The UK saw sales fall 4.9%, and German registrations were 4.7% down. The best performing of the big five was Italy, although it too posted a loss, 2.1% down compared to the same month last year.

Of all European countries, only Cyprus (0.9%), Greece (4.5%), Ireland (12.7%), Lithuania (41.1%) and Romania (15%) saw increases, albeit on smaller totals than bigger markets.

First half

During the first six months of 2019, demand for passenger cars across Europe was down by 3.1% compared to the same period last year, with 8.2 million registrations in total.

In the big five, Spain is the worst-performing, with sales down 5.7%. Italy is next, dropping 3.5% of sales, with the UK not far behind with a 3.4% decline. France has seen a fall of 1.8%, while Germany is the only market that has posted a sales increase, although slim at just 0.5%.

June’s performance has seen the market drop by a further 1% since May’s figures were announced by ACEA.

Manufacturer performance

All but two manufacturing groups recorded losses in June as the market struggled.

Volkswagen Group, still the continent’s market leader with a 24.6% share so far this year, saw sales decline 9.6% in the month. Its core VW brand suffered the most of its high-volume marques, with a drop of 13.7%. All the German carmaker’s brands suffered, except SEAT, which once again was the best performing Group company, posting an increase of 7.4%.

PSA Group saw a decline of 8%, mostly caused by a 10.5% drop in Peugeot sales, and a 9.5% fall in Opel/Vauxhall registrations. Domestic rival Renault Group also suffered, but only losing 3.6% compared to last year, with Dacia being the French firm’s saviour, up 4.5%.

Hyundai Group saw a drop of 3%, while Fiat Chrysler Automobiles (FCA) has a sales fall of 13.6%.

Only Toyota Group and Mazda were able to improve their sales in June, up 1.9% and 1.7% respectively. Of those who posted a loss, Nissan was again the poorest performer, the embattled Japanese carmaker selling over a quarter (25.6%) fewer vehicles compared to the same period last year.

Year-to-date, VW Group is down by 4.3% and this figure would be higher without the positive contribution of SEAT, which was up 6% over the first six months of 2018. PSA Group, Renault Group and Hyundai Group are relatively stable, down 1%, 0.9% and 0.6% respectively, while the top five is made up by FCA, which is currently 9.5% down year-to-date.

Source: ACEA

All of the big five European markets suffered a sales drop in the sixth month of 2019. Of these, France posted the biggest dip (8.4% down), while Spain was not far behind, dropping 8.3%. The UK saw sales fall 4.9%, and German registrations were 4.7% down. The best performing of the big five was Italy, although it too posted a loss, 2.1% down compared to the same month last year.

Of all European countries, only Cyprus (0.9%), Greece (4.5%), Ireland (12.7%), Lithuania (41.1%) and Romania (15%) saw increases, albeit on smaller totals than bigger markets.

First half

During the first six months of 2019, demand for passenger cars across Europe was down by 3.1% compared to the same period last year, with 8.2 million registrations in total.

In the big five, Spain is the worst-performing, with sales down 5.7%. Italy is next, dropping 3.5% of sales, with the UK not far behind with a 3.4% decline. France has seen a fall of 1.8%, while Germany is the only market that has posted a sales increase, although slim at just 0.5%.

June’s performance has seen the market drop by a further 1% since May’s figures were announced by ACEA.

Manufacturer performance

All but two manufacturing groups recorded losses in June as the market struggled.

Volkswagen Group, still the continent’s market leader with a 24.6% share so far this year, saw sales decline 9.6% in the month. Its core VW brand suffered the most of its high-volume marques, with a drop of 13.7%. All the German carmaker’s brands suffered, except SEAT, which once again was the best performing Group company, posting an increase of 7.4%.

PSA Group saw a decline of 8%, mostly caused by a 10.5% drop in Peugeot sales, and a 9.5% fall in Opel/Vauxhall registrations. Domestic rival Renault Group also suffered, but only losing 3.6% compared to last year, with Dacia being the French firm’s saviour, up 4.5%.

Hyundai Group saw a drop of 3%, while Fiat Chrysler Automobiles (FCA) has a sales fall of 13.6%.

Only Toyota Group and Mazda were able to improve their sales in June, up 1.9% and 1.7% respectively. Of those who posted a loss, Nissan was again the poorest performer, the embattled Japanese carmaker selling over a quarter (25.6%) fewer vehicles compared to the same period last year.

Year-to-date, VW Group is down by 4.3% and this figure would be higher without the positive contribution of SEAT, which was up 6% over the first six months of 2018. PSA Group, Renault Group and Hyundai Group are relatively stable, down 1%, 0.9% and 0.6% respectively, while the top five is made up by FCA, which is currently 9.5% down year-to-date.

Source: ACEA

All of the big five European markets suffered a sales drop in the sixth month of 2019. Of these, France posted the biggest dip (8.4% down), while Spain was not far behind, dropping 8.3%. The UK saw sales fall 4.9%, and German registrations were 4.7% down. The best performing of the big five was Italy, although it too posted a loss, 2.1% down compared to the same month last year.

Of all European countries, only Cyprus (0.9%), Greece (4.5%), Ireland (12.7%), Lithuania (41.1%) and Romania (15%) saw increases, albeit on smaller totals than bigger markets.

First half

During the first six months of 2019, demand for passenger cars across Europe was down by 3.1% compared to the same period last year, with 8.2 million registrations in total.

In the big five, Spain is the worst-performing, with sales down 5.7%. Italy is next, dropping 3.5% of sales, with the UK not far behind with a 3.4% decline. France has seen a fall of 1.8%, while Germany is the only market that has posted a sales increase, although slim at just 0.5%.

June’s performance has seen the market drop by a further 1% since May’s figures were announced by ACEA.

Manufacturer performance

All but two manufacturing groups recorded losses in June as the market struggled.

Volkswagen Group, still the continent’s market leader with a 24.6% share so far this year, saw sales decline 9.6% in the month. Its core VW brand suffered the most of its high-volume marques, with a drop of 13.7%. All the German carmaker’s brands suffered, except SEAT, which once again was the best performing Group company, posting an increase of 7.4%.

PSA Group saw a decline of 8%, mostly caused by a 10.5% drop in Peugeot sales, and a 9.5% fall in Opel/Vauxhall registrations. Domestic rival Renault Group also suffered, but only losing 3.6% compared to last year, with Dacia being the French firm’s saviour, up 4.5%.

Hyundai Group saw a drop of 3%, while Fiat Chrysler Automobiles (FCA) has a sales fall of 13.6%.

Only Toyota Group and Mazda were able to improve their sales in June, up 1.9% and 1.7% respectively. Of those who posted a loss, Nissan was again the poorest performer, the embattled Japanese carmaker selling over a quarter (25.6%) fewer vehicles compared to the same period last year.

Year-to-date, VW Group is down by 4.3% and this figure would be higher without the positive contribution of SEAT, which was up 6% over the first six months of 2018. PSA Group, Renault Group and Hyundai Group are relatively stable, down 1%, 0.9% and 0.6% respectively, while the top five is made up by FCA, which is currently 9.5% down year-to-date.