Carmakers look to slowly reopen factories in Europe

09 April 2020

9 April 2020

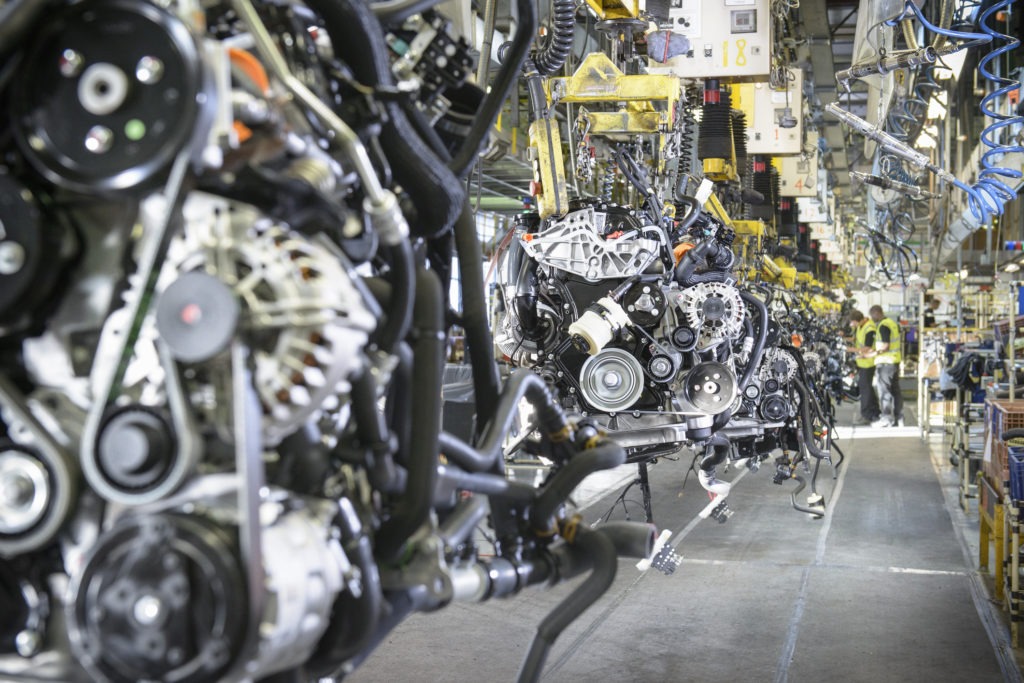

Production losses in Europe could begin to slow, as carmakers look to restart manufacturing in some of their European plants.

Audi is looking to resume engine production at its plant in Hungary next week, to build up supplies for other factories on the continent, which the carmaker hopes to open again by the end of April. Hungary has just 980 confirmed COVID-19 cases.

Daimler is also making plans to restart production at its engine facilities in Germany, with the carmaker targeting 20 April to resume manufacturing. The Mercedes-Benz passenger car plants in Sindelfingen and Bremen will follow this. During the staggered start-up, these factories will initially produce in one-shift operation, with hygiene stations in place and new regulations over behaviour in the workplace.

Volkswagen (VW) is also looking to slowly increase production at facilities in Germany so that it can increase the number of components being sent to factories in China. The carmaker will put new measures in place to protect the 1,700 employees who will return to work next week.

′The protection and health of our workforce take priority. Nothing is more important for us,’ says Ralf Brandstätter, VW’s chief operation officer. ′Our employees can rely on us doing everything possible to ensure that they can work safely. This is why we have set clear standards together with the General Works Council and defined a timetable for various phases in the return to normal operation.’

Screening potential

Fiat aims to restart operations at three Italian sites as soon as the Government lifts coronavirus restrictions on manufacturing, while supercar manufacturer Ferrari is piloting its ′back on track’ scheme as it looks to resume production.

This plan involves the voluntary screening of Ferrari employees with blood tests to check their health in relation to the virus. This service is available to the ‘Ferrari Community’ – any interested cohabiting relatives of employees, and the staff of suppliers. Each worker is also offered the opportunity to use an app to receive medical support for monitoring symptoms.

If successful, other manufacturers may look to roll out similar initiatives, although as a niche carmaker, Ferrari’s workforce is much smaller and therefore such testing is easier to conduct. Other options for carmakers could include temperature screening and increased hygiene awareness, as rolled out by Geely in China following the reopening of its factories and offices.

Production impact

Almost 1.5 million vehicles have been lost in production shutdowns related to the coronavirus (COVID-19) pandemic, as Europe slowly starts to plan for the post-virus future.

Figures released by the European Automobile Manufacturers Association (ACEA) show that, to date, 1,465,415 passenger cars, trucks, vans, buses and coaches, have not rolled off production lines around the continent as would be expected in normal working conditions.

ACEA cautions that this number could climb further if shutdowns are prolonged or more plants are closed. The average shutdown duration EU-wide currently stands at 18 working days.

As may be expected, Germany is the hardest-hit country in terms of production losses, with 456,977 vehicles failing to exit manufacturing facilities, almost a third of Europe’s total losses. Spain’s production halt has seen a loss of 284,364 vehicles, while the UK has lost 127,310 units and France is down 114,354 vehicles.

Worsening numbers

With infection and mortality curves only just starting to flatten in Europe, and no clear timeline as to when the crisis may end, ACEA’s warnings of increasing production losses are likely to come true. Indeed, the number of losses across the continent has grown by around 300,000 in just a week.

The figures show that even when the effects of the pandemic lessen and things start to return to normal, the automotive market will feel the repercussions of COVID-19 for some time to come. While sales across Europe have dropped, carmakers will need to ramp up production and adjust to demand, depending on how economies recover.