Carmakers send semiconductor SOS as Bosch invests €400 million

01 November 2021

The European Automobile Manufacturers’ Association (ACEA) has warned production will be ‘substantially lower’ through to next year because of semiconductor shortages. The association confirmed deliveries will be postponed with supply not meeting demand.

There is some hope on the horizon, however. Bosch has confirmed it will invest more than €400 million in wafer fabrication in Dresden and Reutlingen, Germany, as well as its semiconductor operations in Penang, Malaysia.

COVID-19 complications continue

In a recent letter, ACEA’s director-general Eric-Mark Huitema stressed the need to rapidly increase the EU’s semiconductor manufacturing capacity. The automotive industry is currently undergoing a period of electrification and digitalisation. This is dramatically increasing the sector’s need for semiconductors.

‘Think for example of electrified powertrains, systems to reduce emissions, active safety features, driver-assistance systems, automated and autonomous-driving functions, connectivity services and even something like digital radio,’ Huitema wrote. ‘Looking at the future, semiconductors are also key to artificial-intelligence-based processes and other innovations that will make our vehicles even smarter.’

Furthermore, demand for this all-important part is increasing across many different industries. COVID-19 accelerated this trend, with locked-down consumers going online to buy electronic goods such as TVs, computers, and games consoles. Meanwhile, car dealerships locked their doors and commuters worked from home, resulting in shrinking demand for new vehicles. This put the automotive industry lower down semiconductor suppliers’ priority list.

ACEA reports output fell by 23.3% during last year’s crisis, down 5 million units compared to 2019. Now as the automotive industry attempts a comeback, this bottleneck is slowing production and supply. EU new-car registrations contracted by 20.7% in September, with the volume 188,000 units lower than the same month in 2019.

Q3 disquiet

In their recent Q3 reports, carmakers highlighted semiconductor supply issues as a chief cause of delivery difficulties. Stellantis saw shipments in Europe shrink 36%. It said this was ‘mainly due to Q3 2021 production losses as a result of unfilled semiconductor orders.’

Elsewhere, BMW Group had to make individual adjustments to its production programme. The company expects the situation to remain difficult, not ruling out the potential for sales to be affected in the coming months.

‘Following a record result in the first half of the year, the semiconductor bottlenecks in the third quarter made it abundantly clear to us that we are not yet resilient enough to fluctuations in capacity utilisation,’ said VW Group CFO Arno Antlitz. ‘This clearly shows that we must continue to work resolutely on improving our cost structures and productivity in all areas.’

Shortage, not short term

‘When we take a closer look at the magnitude of the chip shortage’s impact on the automotive industry, everything seems to indicate that this problem will persist for a long period of time, possibly even stretching into 2022,’ Huitema explained. ‘As a result, production volumes in Europe will likely be substantially lower than the recovery initially expected for this year and next.’

So, supply will not be in line with consumer demand. This will mean more postponed deliveries. It also means shrinking employment numbers across the automotive supply chain, although ACEA hopes this will be a temporary side effect.

The solution requires localised production, Huitema surmises, with a caveat that new capacity provides the correct type of chips for vehicles. Upping the availability of 14-28nm microchips will remain a priority for the automotive industry. Increasing the production of cutting-edge chips as small as 2nm will also be important. Additionally, chips 7nm and smaller are currently being used in specific cases but advances in AI and displays will only increase the sector’s demand in the future.

In his letter, Huitema references European Commission president Ursula von der Leyen’s State of the Union address last month. She pointed to an EU still largely dependent on chips made in Asia, which is not only an issue of competitiveness but technological sovereignty. This is why announcements of European semiconductor suppliers ramping up manufacturing have been so well met.

The Commission is also expected to launch the European Chips Act later this year. This will reportedly help build a European microchip ecosystem. Other initiatives like the EU Industrial Alliance for Processors and Semiconductor Technologies are also important steps in this direction.

Bosch builds

Bosch is one such manufacturer hoping to improve the supply of semiconductors. The supplier plans to invest over €400 million next year in its Dresden and Reutlingen plants in Germany. Its operations in Penang, Malaysia are also slated to receive a boost.

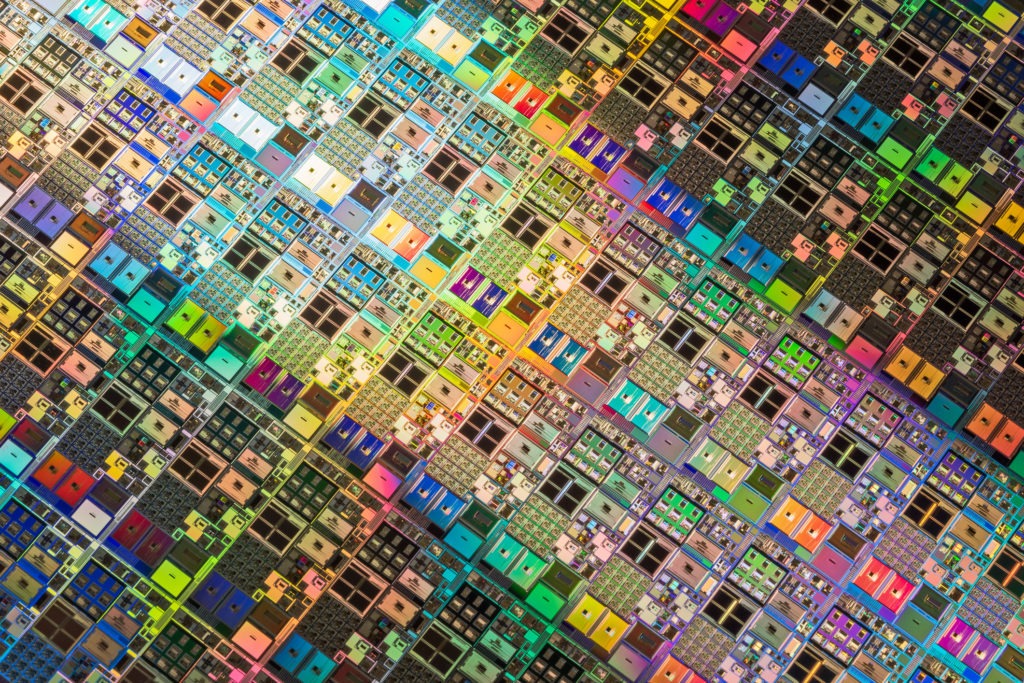

Most of the investment will be injected into Bosch’s new 300mm wafer fab in Dresden, helping to quickly expand manufacturing capacity. Around €50 million will go towards the Reutlingen wafer fab in the coming year. Another €150 million in additional clean-room space will then be added from 2021 to 2023. In Penang, Bosch will build a semiconductor test centre from scratch, which is scheduled to open for business in 2023.

‘Demand for chips is continuing to grow at breakneck speed. In light of current developments, we are systematically expanding our semiconductor production so we can provide our customers with the best possible support,’ said Dr Volkmar Denner, chairman of the board of management of Robert Bosch GmbH.