‘Catastrophic’ magnesium shortage could add to automotive industry production woes

26 October 2021

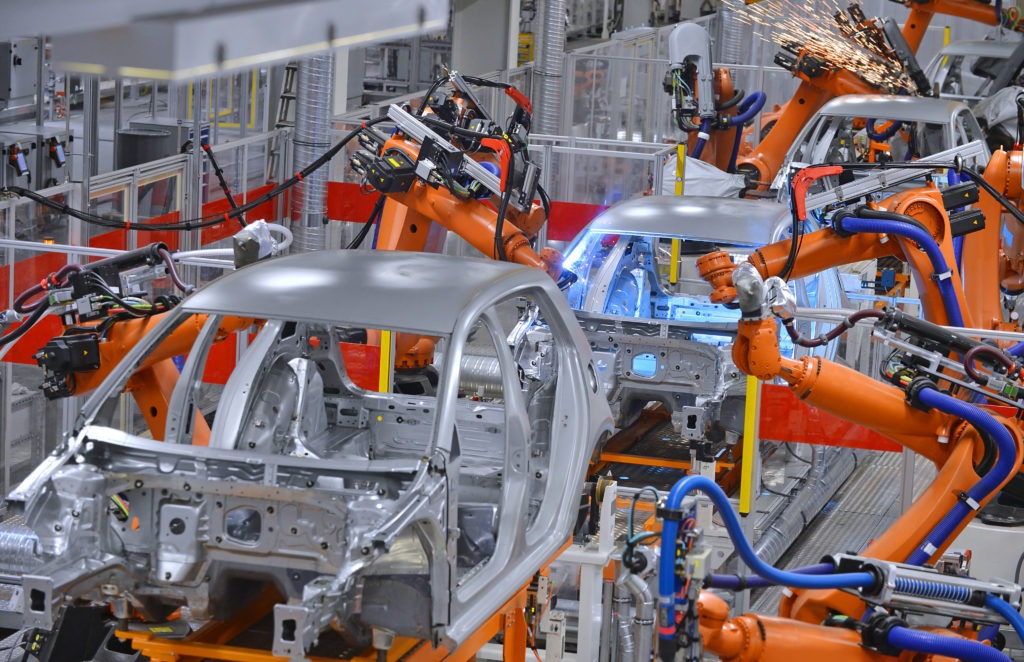

The global automotive industry has not only been impacted by the ongoing semiconductor shortage. But scarce supply of critical raw materials is now also adding to carmakers’ woes, fuelling further concerns.

A European cross-industry group has warned against the ‘catastrophic’ impact a shortage in the supply of magnesium from China could have on various markets – including the car industry.

Among the group’s calling for the European Union to take action were the European Automobile Manufacturers’ Association (ACEA), the Association of European Wheel Manufacturers (EUWA), and CLEPA, a European association of automotive suppliers based in Brussels.

The group said Europe is expected to run out of magnesium stocks by the end of November. This bottleneck will have far-reaching ramifications that could result in production shortages, business closures and job losses.

Magnesium crisis

Magnesium is essential for carmakers because of its lightweight, high strength, and castability, making it a key component for aluminium alloys. It can be found in several car-parts, from gearboxes to airbag housings, and from seat frames to fuel-tank covers.

China has a near-monopoly on magnesium, with Europe heavily relying on its supply. Around 95% of the EU’s magnesium comes from China, but the country is slowing output amid nationwide energy shortages. Supply of magnesium originating from the country has almost come to a halt since September, leading to a crisis of ‘unprecedented magnitude’, according to the cross-industry group.

‘The current Chinese supply shortfall has already resulted in record prices and worldwide distortions in the supply chain. Today’s remaining magnesium imports are trading at extortionate prices of about $10,000 to $14,000/mton, up from approximately $2,000/mton earlier this year, making it almost impossible for European companies to produce or source magnesium-containing materials at a viable level,’ it said.

‘Immediate action’

The group of European industry associations is calling for the EU Commission and national governments ‘to urgently work towards immediate actions with their Chinese counterparties to mitigate the short-term, critical shortage issue as well as the longer-term supply effects on European industries.’

For years, European industries have been concerned about the region’s reliance on China when it comes to the supply of raw materials, which are key to the continent’s economy. The European Commission created a list of critical raw materials that it keeps updating, which also includes magnesium and lithium – another significant component for carmakers.

More disruption

Germany’s association of metals producers, WVM, said automakers will now face more disruption, fearing the magnesium shortage will be similar to the chip shortage that has hampered manufacturing processes.

‘There is a risk of massive production losses,’ the WVM said. ‘The entire aluminium value chain is affected. The severe shortage of magnesium is already leading to record prices, creating global distortion on the market and announces enormous disruptions in the supply chain.’ The association has demanded the German government take action and urgently initiate diplomatic talks with China.

Reuters reports that the European Commission has reacted and is holding talks with China to ease the magnesium shortage.

‘The Commission is aware of the current shortage of magnesium, which is affecting global supply chains, and is monitoring the situation closely. We are raising this issue with our Chinese counterparts in order to address immediate shortages and are assessing long-term solutions to tackle this strategic dependency,’ a spokesperson said.

Meanwhile, China has insisted the shortages would be temporary. It remains to be seen if it kickstarts production before the end of the year.