Demand for used cars across Europe outshines new cars in first half of 2021

12 August 2021

Autovista24 senior data journalist Neil King explores how the big five European used-car markets developed in the first half of 2021.

The COVID-19 pandemic may have greatly impacted new-car registrations in Europe’s big five markets since March last year but used-car markets have been less affected. Sales have fallen, due to lockdowns and various economic conditions, but the sector outperformed the respective new-car markets in these countries during the first half of 2021, compared to 2019, except in Italy.

The total volume of transactions only endured single-digit declines in Germany, Spain and the UK, whereas the three new-car markets contracted by at least 20% in the first six months. Italy was less buoyant, with similar double-digit downturns in both used and new-car demand but used-car volumes in France exceeded pre-COVID-19 levels. In the UK, the volume of transactions enjoyed record levels in May and June and could also surpass 2019 by the end of the year.

As countries across Europe were subject to COVID-19 lockdowns in 2020, year-on-year comparisons are meaningless. Therefore, this article focuses on the latest developments compared to 2019, which better represent the true performance of used-car markets.

Used cars outperform new cars in Germany and Spain

In Germany, the used-car market contracted by 6.8% in the first six months of 2021, according to the motor-vehicle authority KBA. However, dealerships in the country could only reopen, conditionally, from 8 March. This naturally impacted the new-car sector more, with registrations down 24.8% in the first half. Schwacke forecast back in December 2020 that slightly more than seven million used cars would be sold in 2021, about the same as in 2020. Moreover, this volume of transactions would fall less than 200,000 units short of the 7.2 million cars that changed ownership in pre-pandemic 2019.

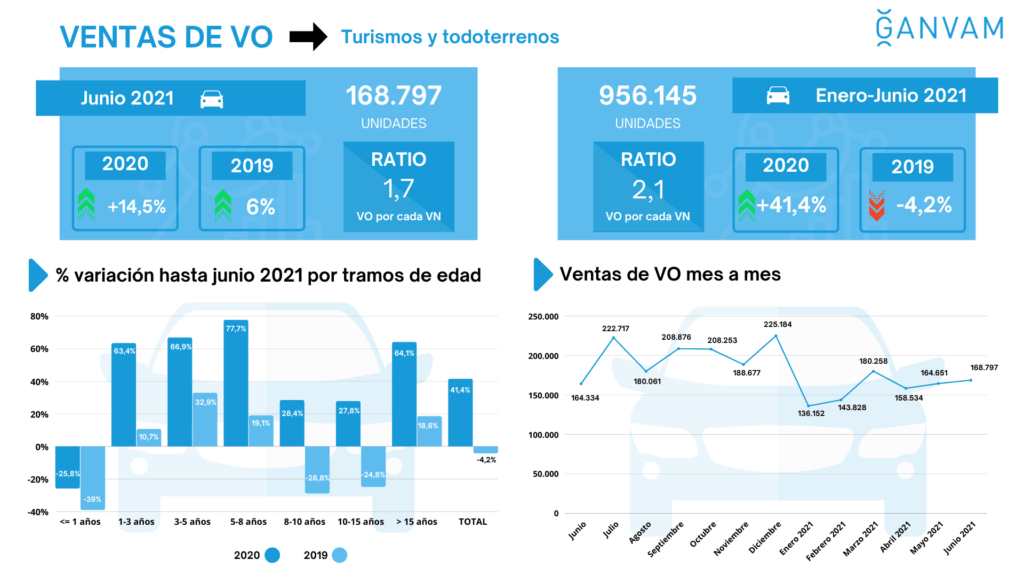

In contrast to the dramatic 34% decline in new-car registrations in Spain in the first half of 2021 compared to two years ago, the volume of used-car transactions only fell by 4.2%, according to GANVAM, the Spanish dealers’ association.

'The used-car market in Spain is always more favoured than the new-car market in times of crisis. The age structure of these sales has changed substantially in recent months and will continue to do so throughout 2021. The most notable change is undoubtedly the lower prevalence of young used cars in the market, caused by the standstill in tourism and the lack of renewal of rental fleets,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain.

However, GANVAM noted that; ‘in the whole of the first semester, young used cars [between three and five years old] - mostly from fleets - accumulated a total of 114,937 units sold, which is almost 33% more than in the same 2019 period, reaching 12% of the total used market so far this year.’ This exemplifies the demand for cheap used cars across Europe as a substitute for public transport in the wake of COVID-19.

Record levels in France and the UK

French used-car transactions in the first half of 2021 were 9% higher than in 2019, according to the automotive data provider AAA Data. This is in sharp contrast to the 20.9% fall in new-car registrations. The volume of used-car sales exceeded 500,000 in June alone, about 20% up on June 2019, taking the total for the first half to a record 3.12 million units.

The UK’s used-car market declined by a similar amount as in Spain, with 4.9% fewer transactions than in the first half of 2019, according to the UK Society of Motor Manufacturers and Traders (SMMT). Again, this compares favourably to the new-car market, which contracted by 28.3%, as it was more adversely affected by the closure of dealers until 12 April. Moreover, the volume of transactions achieved its highest levels ever in May and June.

‘All months in Q2 saw significant growth, with May and June up 9.9% and 4.6% on 2019 respectively, the best performance for both months on record. The increase tracks the country’s gradual emergence from lockdown, as businesses reopened, demand for personal mobility increased and stock shortages in the new-car market forced some consumers to turn to used models,’ the organisation stated.

SMMT chief executive Mike Hawes added; ‘this is welcome news for the used-car market as transactions rebounded following nationwide lockdowns which closed retailers. More motorists are turning to used cars as supply shortages continue to affect the new-car market and the increased need for personal mobility with people remaining wary of public transport as they return to work. A buoyant used-car market is necessary to maintain strong residual values which, in turn, supports new-car transactions. We now need to see a similar rebound in new-car sales to accelerate the fleet renewal necessary to deliver immediate and continuous improvements in air quality and carbon emissions.’

Unfortunately, this used-car positivity is not replicated in Italy. The 18.6% fall in used-car transactions in the first half of this year, according to trade body ANFIA, is on a par with the 18.3% fall in new-car registrations. However, the Italian new-car market has benefitted from purchase incentives introduced earlier in the year. These were exhausted and have since been reintroduced, but the new-car market is expected to underperform the used-car market for the remainder of 2021.

Rising residual values

The ongoing comparative strength of Europe’s big five used-car markets supports Autovista Group’s core prediction, outlined at the start of the year, that residual values (RVs) face limited pressure in 2021.

In fact, the latest rise in COVID-19 cases, and the ongoing aversion to public transport, is expected to support used-car demand and RVs. Furthermore, semiconductor shortages continue to disrupt the supply of new cars, especially favouring demand for young used cars. Autovista Group’s latest monthly market update reveals that RV retention, shown in percentage terms, rose in all of Europe’s leading markets in July, whereas stock days continue to fall. Whereas most fuel types are benefitting from rising RVs, battery-electric vehicles (BEVs) are in decline. In conjunction with faster technology-ageing and enticing incentives, higher supply volumes and low demand on used-car markets are conspiring to decrease RVs and increase stock days.