Diesel registrations and RVs outperform petrol in Germany

15 July 2019

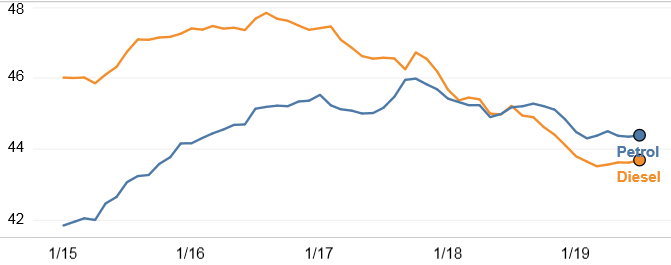

Diesel residual values (RVs) have developed at a better rate than petrol values since April in Germany although diesels still retain less of their value, at 43.7% and 44.4% respectively after 36 months and 60,000km. This recent improvement in diesel values coincides with a subtle improvement in both the registrations volume and market share of new diesel cars in Germany in the first half of 2019. Petrol and diesel %RV, Germany, 36months/60,000km, January 2015 to July 2019

Andreas Geilenbruegge, head of valuations and insights at Schwacke, Autovista Group’s German division, has highlighted that ‘2016 was the last time there were more diesel fleet registrations than in the year before. As these cars return to those who are in charge of their buy-back and remarketing as 3-year-old cars, we expect 2019 to be the last year of significant pressure on diesel values.’ Geilenbruegge added that stock days of 2-4-year-old petrol and diesel cars are ‘slightly regressive due to declining supply and are much closer together nowadays than in the past years when diesels had their peak.’

Diesel cars still account for one-third of the German used car market, with their transaction volume higher in Q1 2019 than in Q1 2014 for example. Although demand is contracting for young used diesels that are less than two years old, ‘used diesels are far from dead’ Geilenbruegge says.

Finally, Geilenbruegge comments that ‘what will be interesting to observe is if manufacturers will start a renaissance campaign of clean EU6d-Temp diesels at the end of 2019 in order reduce their CO2 fleet emissions to avoid penalties.’

He cautions that ‘this could put additional pressure on diesels by increasing supply of young used cars into the market without the used car demand existing anymore. But, in general, both new and used diesel demand appears to be stabilising at the current low level.’

New diesel sales rise

New car registrations in Germany increased by just 0.5% year-on-year in the first half of 2019, but registrations of new diesel cars grew by 3.0%, according to data from the federal motor transport authority KBA. Accordingly, the market share of diesels has expanded slightly to 32.9% in the first half of 2019 compared to 32.1% in the same period in 2018.

The Volkswagen Group (VW) was the biggest winner in new diesel car registrations in the first half of 2019, with the Volkswagen brand alone increasing volumes by almost 38,000 units ‘equating to 28.4% growth year-on-year’ and not just because of new models. However, VW was the biggest loser in demand for electric vehicles, with registrations down almost 44%year-on year ahead of the launch of the ID.3 the car that will lead VW’s electric charge.

Although registrations of new diesel cars have been bolstered by the easing of supply constraints as they have gained WLTP homologation, it does appear that the opinion of diesels is shifting for both the German authorities and consumers. The State Government of Baden-Wuerttemberg is resisting the enforcement of Euro 5 diesel bans in Stuttgart for example. The city banned Euro 4-based diesel vehicles from entering the entire Stuttgart area earlier this year, but it now believes that pollution levels have dropped significantly enough to prevent any further action being required. Similarly, a diesel ban planned for Frankfurt was halted by a German court late in 2018.

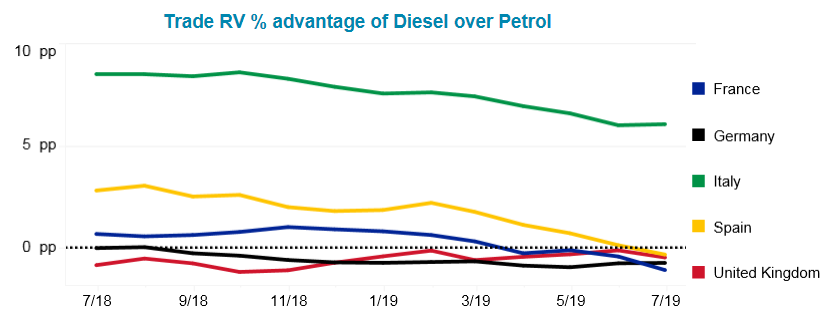

Diesel weakness elsewhere in the EU5

Despite the arrival of cleaner diesels and less negative media coverage about the fuel type, diesel RVs have developed at a slower rate than petrol cars over the three months from April to June in all the EU5 markets except Germany. This follows periods of broad stability, as reported back in November, and even signs of a recovery at the start of 2019.

Moreover, diesel cars are now retaining less of their value than petrol cars after 36 months and 60,000km in all EU5 markets except Italy.

%RV advantage of diesel vs petrol, EU5, 36months/60,000km, January 2018 to June 2019