How is electrification changing Europe’s luxury car segment?

23 February 2023

Luxury vehicles do not play by conventional market rules. But what happens when this immovable segment meets the unstoppable force of electrification? Autovista24 deputy editor Tom Geggus investigates.

Luxury vehicles have a unique clientele. Unlike in other segments, these consumers are far less likely to be influenced by wider socio-economic trends. Peaks and valleys in market performance are more heavily determined by the coming and goings of models.

However, some trends are inescapable. Advancing emissions targets and calls for greater sustainability mean even this segment is undergoing electrification. As new luxury electric vehicles (EVs) hit the market, battery-electric vehicle (BEV) and plug-in hybrid (PHEV) registrations are on the rise.

All-electric influence

Data from EV-volumes.com highlights that registrations of F-segment EVs in Europe increased by 148% from 8,256 units in 2021 to 20,478 last year. This was heavily influenced by all-electric models, which saw registrations increase 881.6% year on year (YoY). 2022 saw 10,169 F-segment BEVs take to the roads, against 1,036 in 2021. This tally was only slightly behind PHEVs.

The F-segment’s triple-digit BEV increase far exceeds the 29.3% YoY growth seen across all segments in 2022, according to data published by the European Automobile Manufacturers’ Association (ACEA). This outstanding all-electric performance also casts a shadow over 2022’s 42.8% YoY growth in F-segment PHEV registrations. But this looks healthy compared to the 2.7% YoY decline suffered by PHEVs across all segments.

With a combined total of 20,478 units, the 148% growth in F-segment EVs last year far exceeds the 14.6% increase across all EV segments, with 2,588,906 registrations. This means F-segment BEVs and PHEVs only made up 0.8% of all EV registrations in Europe last year. While this is a relatively small number, it is double the 0.4% market share recorded in 2021.

Unstoppable electrification

Luxury vehicle consumers are backed by a large amount of spending power. This means registrations are less likely to follow wider market trends caused by the phase-out of incentives and are more likely to track alongside the latest model launches. This certainly appears to be the case in 2022 with F-segment BEV figures peaking particularly around the Mercedes-Benz EQS.

José Pontes, sales and data analyst at EV-volumes.com, pointed out the car plays to the brand’s usual strong suite of refinement, comfort and build quality. It also brings a large battery, excellent efficiency, and speedy charging to the table.

In February, chairman of the board of management of Mercedes-Benz, Ola Källenius, once again committed the luxury brand to electrification. ‘We want to achieve the goal of CO2 neutrality along the entire value chain in the new vehicle fleet by 2039 at Mercedes-Benz and to become 100% electric as early as 2030 wherever market conditions permit,’ he said.

From engines to motors

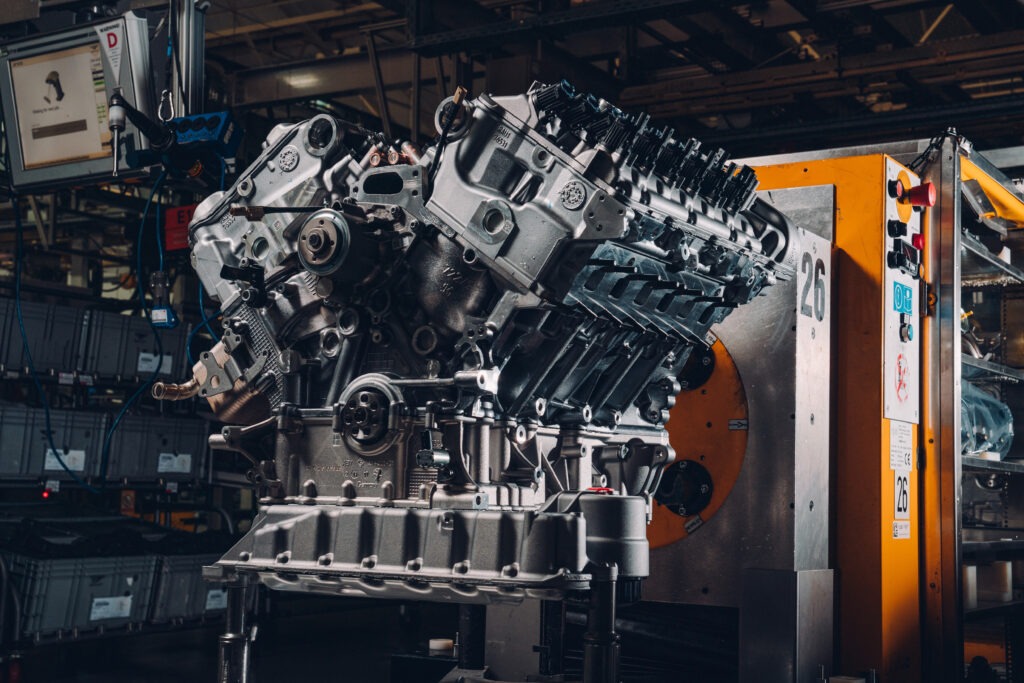

Electrification is apparent among other luxury brands such as Bentley. In April 2024, the Volkswagen (VW) Group subsidiary will pack up production of its W12 engine. The final 12-cylinder petrol-powered unit will be the most powerful version to date, with 18 examples of the Batur lining up to receive the engine.

The shift comes as the carmaker accelerates forward with its Beyond 100 strategy. When production of the W12 ends next year, Bentley’s entire model line-up will be available with a hybrid powertrain. By the start of the next decade, the company wants all its models to be fully electrified.

To meet these goals, the carmaker has to ensure continuing development. It recently broke ground on a new quality and engineering technical centre in Crewe, UK. Representing a £35 million (€39 million) investment, the site looks to be a cornerstone of BEV development, with a dedicated simulation of an all-electric assembly line.

Electrified chauffeuring

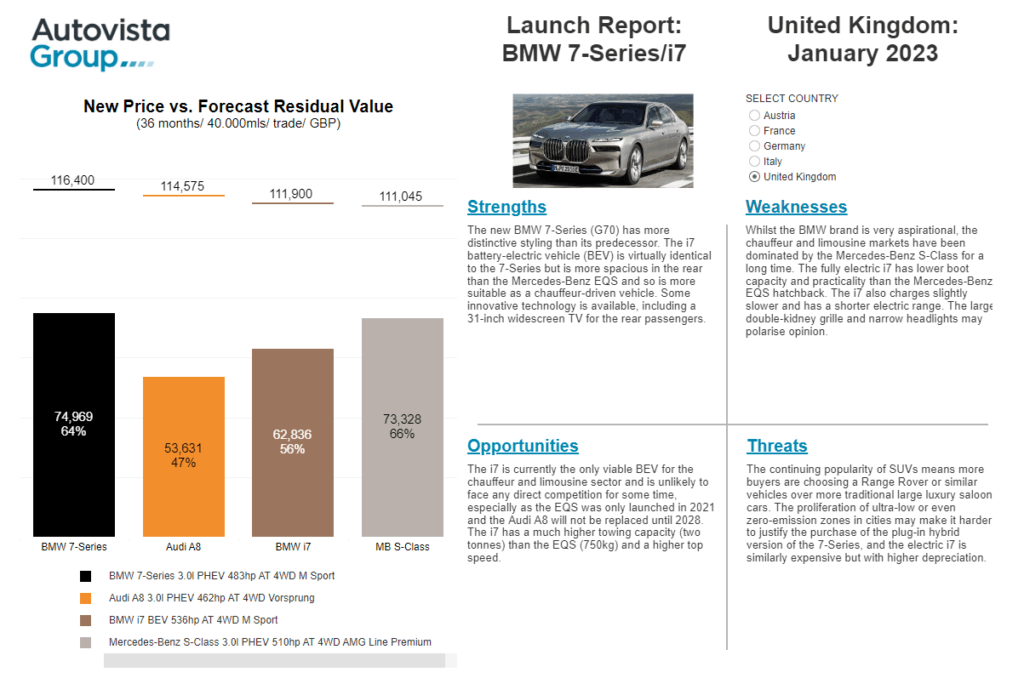

BMW is also working to advance its electrification efforts, with its flagship 7-Series a primary example. Powertrains range from mild-hybrid diesel, to PHEV and a BEV, known as the i7. Seemingly designed to be chauffeur-driven, the vehicle can be fitted with any number of luxury features including an optional 31-inch cinema screen in the rear.

Elsewhere in the BMW Group, Rolls-Royce is sailing ahead with its 2.5-million-kilometre testing programme for its all-electric Spectre. Ahead of the first deliveries in the fourth quarter of 2023, the car has undergone trials designed to replicate almost 400 years of normal use, under extreme conditions.

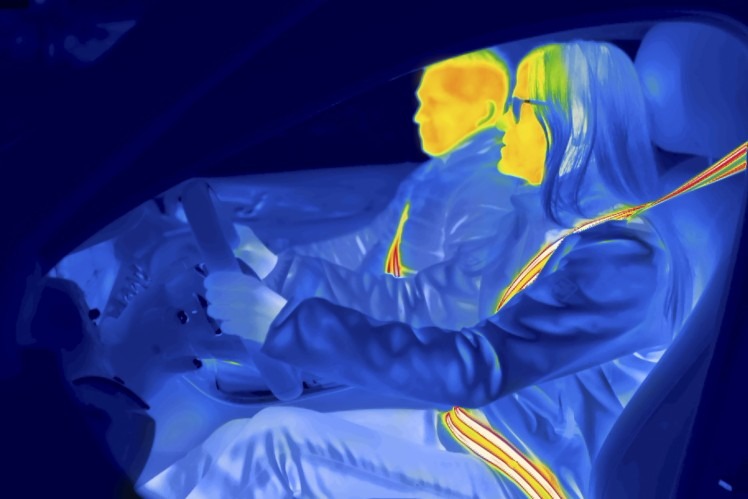

With nearly 80% of the trip already behind it, the car has surpassed every test the brand can throw at it so far, with more to come. The Spectre will have to prove it can pass difficult tests, such as operating in extreme temperatures, to ensure it is fit for the demanding customer base.

Consumers purchasing luxury vehicles pay a premium for the best possible products and experiences. As electrification transforms every aspect of mobility, carmakers like Mercedes-Benz, Bentley, BMW and Rolls-Royce will need to ensure their models deliver.