Europe’s big five new-car markets to stay under pre-pandemic level in 2025

21 February 2022

Mixed market conditions are set to hamper growth and recovery in Europe’s big five new-car markets, Autovista24 senior data journalist Neil King explains.

For four of Europe’s big five automotive markets, there were only single-digit improvements last year on 2020, when markets were dominated by the COVID-19 pandemic. Germany suffered an unexpected further deterioration. The recovery will be hampered by ongoing supply shortages this year, with the backlog carrying over into 2023, as well as mounting inflationary pressure. Autovista24 forecasts that the five markets will be at least 7% smaller in 2025 than in pre-pandemic 2019.

A return to comparative normality is unlikely until 2024, a year which is expected to benefit from a pull-forward effect as automotive manufacturers and consumers seek to register cars ahead of the EU Commission’s target of a 25% reduction in CO2 emissions in 2025, compared to 1990 levels.

Autovista24 expects a modest correction in 2025, except in Spain as the anticipated slower recovery means the market will be the furthest adrift in 2024.

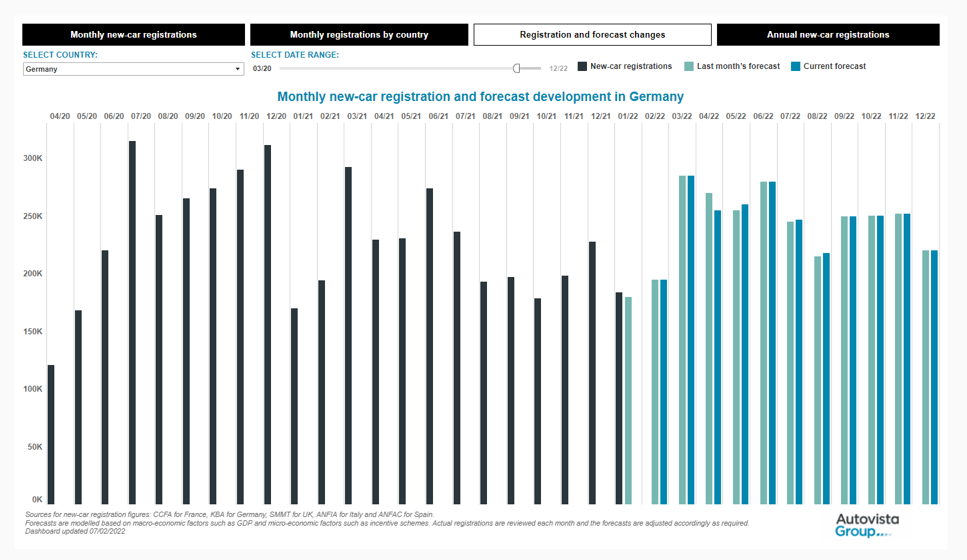

Monthly new-car registrations, Germany, April 2020 to December 2022

The image above shows the monthly developments and forecast for Germany, as well as the previous month’s forecast. The full interactive dashboard also presents the latest annual and monthly forecasts for the big five European markets to 2025.

UK to surpass two million cars

The UK market recorded the highest year-on-year growth of the big five in January, of 27.5%. This was compared to an incredibly low base, however, as national lockdowns in England and Scotland were announced on 5 January 2021, with ongoing restrictions across the rest of the UK. The January volume slightly exceeded expectations but was still 25% lower than the 10-year monthly average (between 2010 and 2020).

Autovista 24 calculates that the seasonally-adjusted annualised rate (SAAR) rose slightly to 1.74 million units last month, compared to the average SAAR of 1.7 million units in the second half of 2021. This underlying measure of demand is forecast to improve gradually and gather pace in the second half of 2022, climbing to two million units. This then leads to a forecast of just under 1.9 million new-car registrations for the year, equating to year-growth of 15.1%. However, risks are mounting as energy costs, inflation, and interest rates rise, leading to smaller household budgets. Furthermore, a tax hike has been announced for April.

A further recovery, close to 2.1 million units, is predicted for 2023, 10% up on 2022, supported by a backlog of unfulfilled orders. Modest growth of 3.5% is expected in 2024, to 2.16 million registrations before a modest contraction takes the market back to 2.14 million units in 2025, 7.6% lower than in 2019.

Three million registrations in Germany

As in the UK, new-car registrations in Germany had a positive start to 2022, with an 8.5% increase in January compared to a year ago. However, adjusted for working days, Autovista24 calculates that new-car registrations grew by only 3.3% last month. It is also noteworthy that dealerships were closed in the country until March last year, so the latest figures compare to a relatively low base.

The registrations tally for January was exactly in line with Autovista24’s prediction, as shown in the dashboard screenshot above. The annualised-rate demand forecast is set to improve to average over 2.8 million units in the first half of 2022, up from 2.55 million in the second half of 2021 and pick up further, to close to three million units, in the second half of the year. Autovista24 therefore anticipates 2.9 million new-car registrations in 2022, which equates to a 10.5% increase year-on-year.

This factors in that, from 2023, the German state will only subsidise electrically-chargeable vehicles (EVs) with a positive effect on climate protection, which takes into account electric driving range. Further growth of about 6% is forecast for 2023 and 2024, before a projected subtle contraction of 0.5% in 2025. Although 3.25 million registrations are predicted in 2025, this is about 10% down on the volume of 3.6 million units in 2019.

Spain below expectations

Although new-car registrations in Spain mustered year-on-year growth last month, albeit of just 1%, the volume was less than half of the December tally. This was in part due to the pull-forward effect of the higher registration taxes that came into effect on 1 January 2022. Furthermore, the growth is compared to January 2021, when Spain was afflicted by both COVID-19 and the Filomena snowstorm, which paralysed parts of the country for almost two weeks. There was also one more working day last month than in January 2021 and on a like-for-like comparison, Autovista24 estimates that the Spanish market contracted by about 4% last month.

The January figure was even lower than Autovista24 anticipated but the SAAR of just over 600,000 units will improve as Spanish consumers adjust to the new tax regime. Nevertheless, it is expected to be lower in the first half of 2022 than in the second half of last year. As assumed in all markets, the easing of supply bottlenecks is expected to gather pace later in the year. However, considering the latest figures and the economic weakness in Spain, Autovista24 has revised its forecast for 2022 down to below 893,000 units, equating to year-on-year growth of 3.9%. Looking ahead to 2023, the Spanish new-car market is projected to grow by 12%, to around the one-million mark.

Even with further growth of 7.5% anticipated for 2024, the market will be 14.5% below the pre-pandemic level of 2019, whereas the four other major markets are expected to be less than 10% adrift. Given this, a modest improvement, to 1.08 million registrations, is assumed in 2025 but this would still be 14% lower than in 2019.

Regulatory changes disrupt France

Over 50,000 fewer newer cars were registered in France last month than in December. The volume was below Autovista24’s estimate and equated to a year-on-year contraction of 18.6%. Furthermore, there was one more working day last month than in 2021. On an adjusted basis, Autovista24 calculates that the market fell by 22.5%.

In addition to ongoing supply challenges, and the reduction in incentives for EVs since 1 July 2021, new regulations came into effect in France on 1 January. The malus (penalty) now applies to all cars emitting more than 128g CO2/km and for vehicles weighing more than 1.8 tonnes, including a 75kg allowance for the driver, a weight tax is calculated at a rate of €10 for every excess kilogramme. Battery-electric vehicles (BEVs) and hybrids are excluded because of the extra weight of their batteries, on the condition that they have an electric-driving range of at least 50km. The maximum tax liability is limited to €40,000, even if the combined penalty and weight tax exceed this amount. This means that list prices of many new cars have artificially increased, pulling demand forward from January into the end of 2021.

A further planned €1,000 reduction of EV incentives from 1 January 2022 has been postponed, with the subsidies remaining in place until the end of June 2022. However, the lower incentives will come into effect from 1 July 2022.

In the context of these latest developments, Autovista24 has revised its forecast for 2022 down to 4.7% growth year on year, to 1.74 million units. This is about 22% lower than the volume of cars registered in pre-crisis 2019, although the market is still forecast to expand by 10% year on year in 2023. Further growth of 5.5% is predicted to elevate the French market over two million units in 2024 before a modest correction is assumed for 2025, albeit staying above the two-million mark. Nevertheless, this is 9.2% below the volume of registrations in 2019.

Lack of incentives suppresses Italy

Unlike France and Spain, due to their respective tax changes in January, the Italian new-car tally was higher than in December, but still marked a year-on-year contraction of 19.7%. As in France, Germany, and Spain, there was an additional working day, compared to January 2021. On an adjusted basis, Autovista24 calculates that the market suffered a 23.7% decline.

In addition to supply constraints, rising raw-material costs, surging energy prices and the resurgence of COVID-19, the lack of EV incentives since November is hurting the Italian market. The January SAAR, of less than 1.2 million units, was the lowest since Italy emerged from its first lockdown in May 2020.

An improvement in demand is expected in the coming months, and especially in the second half of the year. However, without a reintroduction of incentives, Autovista24 has reduced its forecast for 2022 down to 1.51 million units, equating to year-on-year growth of 3.5%. At this level, the market will be 19% smaller than in 2019. Registration volumes are forecast to expand by a further 10.5% and 4.5% in 2023 and 2024 respectively. An assumed contraction will reduce the Italian market to 1.74 million registrations in 2025 – 9.4% fewer than in 2019.