Europe seeks sustainable graphite source for EV batteries

31 January 2023

Lithium-ion batteries for electric vehicles (EVs) rely on a mix of materials, one of which is graphite. As such, it plays a critical role in the energy transition. China is a dominant force in the supply chain and has produced most of the world’s natural graphite for decades.

But Europe is intent on decreasing supply-chain dependency on foreign markets like China, where graphite is mainly sourced unsustainably. As technologies advance, the market is ready to favour more environmentally-friendly graphite.

‘The dominance from Chinese resources […] should be addressed,’ Corina Hebestreit, secretary general at the European Carbon and Graphite Association (ECGA), told Autovista24. ‘There are European and other sources that could and should be tapped into in the future to achieve a better balance.’

The common consensus is that Europe needs more sustainable and cost-competitive sources of graphite, especially as supply is struggling to keep up with rising demand.

What is graphite?

As a mineral, graphite is a form of crystalline carbon that has several industrial uses in sectors where ‘green’ technologies are of growing importance. These include steel, renewable energy, EV battery and fuel cells. In lithium-ion batteries, graphite is an anode material that cannot be substituted as it helps improve electrical conductivity and acts as a host for lithium ions.

The mineral is the largest single component by weight in EV batteries and can also be produced synthetically. The ECGA points out that up to 10kg of graphite can be found in a hybrid-electric vehicle while this figure rises to around 70kg in an all-electric car.

Natural and synthetic graphite

Much debate has centred on natural graphite, which is mined, versus synthetic graphite, which is mainly produced from fossil fuels. A natural graphite anode generally benefits from smaller costs and lower energy consumption than a synthetic anode. But synthetic graphite is popular thanks to its higher purity and most lithium-ion batteries rely on it these days.

‘Synthetic graphite is already used in batteries, to varying degrees depending on the types of batteries. The mix of natural and synthetic graphite has proven in many cases to be not just an economic and risk-avoiding solution, but also the best technical solution,’ said Hebestreit.

She explained that a higher percentage of synthetic graphite could help reduce supply-chain risks. ‘The demand for natural and synthetic graphite is expected to grow this year as well as in the coming years,’ she said.

The automotive industry continues to shape graphite demand as carmakers ramp up their electrification targets. EV sales in 2022 surged across Europe, with major carmakers, including Volkswagen, BMW, and Mercedes-Benz all reporting increased deliveries. The trend is expected to continue as Europe shifts to electromobility, with even a small rise in EV adoption having a significant impact on graphite demand.

Benchmark Mineral found that lithium-ion anodes became the biggest end-market for natural flake graphite in 2022. Last year, demand for the mineral far outstripped supply. However, the agency expects 2023 to see a 15% uptick in supply, not least because of new mines and the expansion of existing sites in China and Africa.

But environmental standards are rising and the EU is intent on introducing sustainability requirements for EV batteries from 2024. This will look to increase supply-chain transparency to ensure a circular-economy approach to the production of battery packs. In other words: Europe is placing greater scrutiny on where battery materials are coming from.

Sustainable graphite

Natural graphite mining is known to cause dust emissions. Producing anode-grade graphite for EV batteries is also energy-intensive and if the power source comes from fossil fuels such as coal – which is often the case – this can further increase the impact on the environment.

Both natural graphite and its costlier synthetic counterpart are taking a toll on the environment. The production of synthetic graphite anodes can be four times more carbon-intensive than natural graphite anode production, Benchmark Source reports. This is because synthetic graphite uses more energy, often from fossil fuels.

So, could there be a more sustainable form of synthetic graphite? A young company based in Estonia would like to think so. Up Catalyst wants to reduce the carbon footprint of EV batteries while enhancing their properties by developing sustainable carbon.

‘We want to secure the European supply chain of graphite and carbon nanomaterials, decreasing the foreign dependency from countries like China,’ Gary Urb, CEO of the technology startup, told Autovista24.

‘Europe does not have enough mines to cover the market’s demand for graphite. The only alternative is the production of synthetic graphite out of fossil fuels, which does not align with the [region’s] sustainability goals. There is a possibility that battery manufacturers will have to slow down production due to the inadequate amount of sustainable raw materials,’ Urb added.

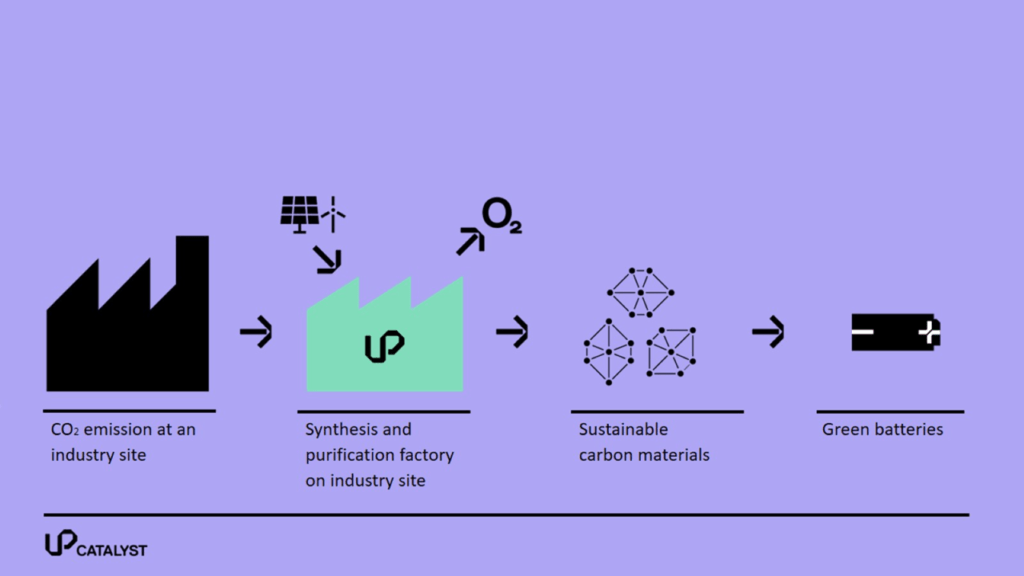

Up Catalyst wants to do things differently, producing carbon-negative graphite by using CO2 as feedstock. To produce one tonne of graphite, the production process consumes around 3.7 tonnes of CO2.

Urb explained that CO2 is provided to the company by partners. This is then inserted into a synthesis reactor, where the process of electrolysis takes place. Molten salt acts like an electrolyte and when heated, the CO2 molecules are broken into pure carbon and oxygen. The company then collects carbon, which undergoes further lab tests to be purified.

The startup has garnered attention internationally and is looking to cooperate with notable EV battery suppliers, including Northvolt, Svolt, and Italvolt. The goal is to produce at least one tonne of graphite per day by 2026.

One of Up Catalyst’s key selling points is that its sustainable graphite can be produced close to manufacturing sites, helping to slash transportation costs and harmful emissions. This is a promising concept as Europe is eager to raise ESG standards in the EV-battery supply chain.

Urb concluded that ‘98% of the graphite used in Europe is imported and a graphite shortage has already begun. We are trying to prevent the upcoming graphite crisis, which will lead to increased prices. At the same time, strict EU legislation does not favour unsustainable products, so fossil-fuel synthesis will not be an option.’