Is France keeping pace in Europe’s electrification race?

29 November 2022

José Pontes, data director at EV-volumes.com, examines one of Europe’s most important electric-vehicle (EV) markets, France.

Norway is by far the most electrified country in Europe, although Germany is the continent’s biggest EV market. But given that it once led the way, how is France performing?

An electric history

At the beginning of the twentieth century, nearly one third of France’s automotive fleet was electric. Manufacturers such as Jeantaud and Milde, provided the bulk of EV sales.

But internal-combustion engine (ICE) technology soon began outpacing contemporary EVs. Petrol also became more widely available and denser roads meant safer long-distance travel. Expensive, limited-range EVs quickly became less competitive than newer ICE models, with the Ford Model T a major catalyst of this change.

France rediscovered EVs in the 1990s, with support from local manufacturers, such as Peugeot (106 Electrique), Citroen (AX, Saxo and Berlingo Electrique) and Renault (Clio and Kangoo EV). While carmakers offered electric versions of popular models, limited ranges (around 100km) and prices almost three times higher than ICE counterparts, inhibited any commercial success. Peugeot made just 6,400 electric 106 models, a far cry from the expected 100,000 units. Most were sold to the local French administration or companies like La Poste.

Still, this was enough to establish France as Europe’s largest EV market in the late 1990s and early 2000s. Thousands of EVs went into circulation before 2010, acting as an important stepping stone towards the rise of EVs in the country.

Just 180 electric passenger cars were sold in 2010, representing only 0.01% of the total market. From 2011 to 2013, however, France was once again the biggest EV market in Europe. Fast forward to the end of 2019 and EVs captured 1.9% of the French market with 42,763 units. Since then, France’s leadership has faded as other automotive markets have electrified more quickly.

Market evolution

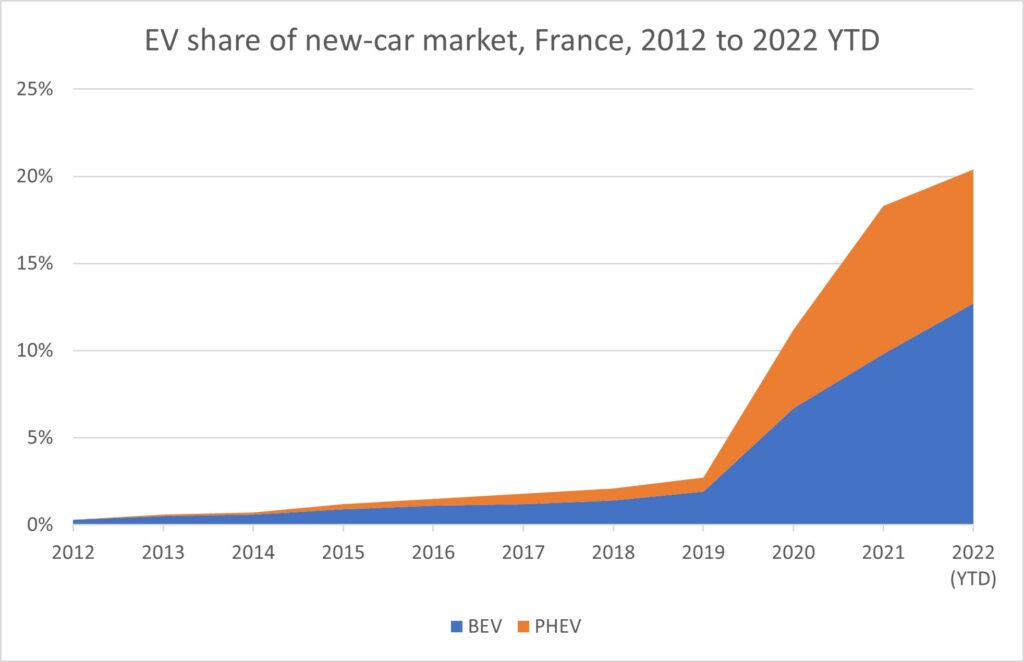

Over the last decade, the French EV market experienced three different stages. Initially, there was a steady, albeit not disruptive, growth up to 2019. This was followed by unprecedented growth in 2020 and 2021, whereas the share of plug-in hybrids (PHEVs) has fallen this year.

This decline can be linked to changes in EV incentives. Back in May 2020, on the back of the COVID-19 relief measures, the French government temporarily increased financial support for EV purchases. This pushed incentives to a maximum of €12,000 for a battery-electric vehicle (BEV) that cost less than €45,000. It included a €7,000 incentive plus €5,000 with the scrapping of an old ICE vehicle.

These generous stimuli, the largest in Europe, allowed the EV market to surge. But as temporary COVID-19 relief measures tapered off, the PHEV market suffered, dropping from a 9% share in 2021 to 8%, so far this year.

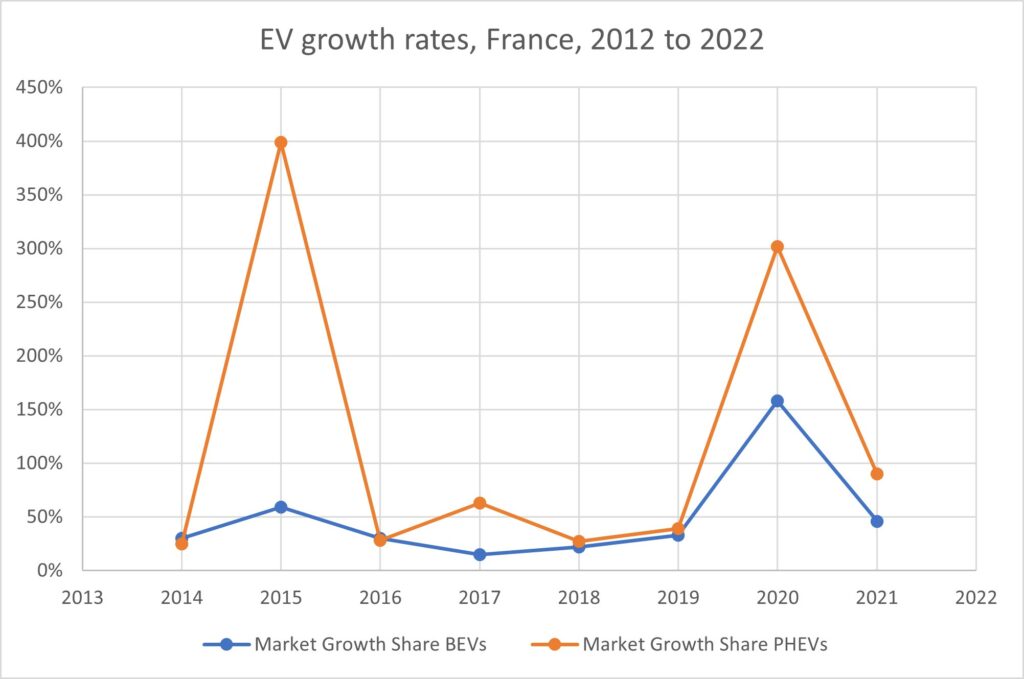

Looking at the growth rates of both powertrains, PHEVs are clearly more sensitive to incentive changes than BEVs. All-electric vehicles follow a relatively straightforward growth trend, gaining around 33% on average year on year. The exception here is 2020, due to the COVID-19-related subsidy increases and the new EU 95g/km CO2 fleet rule for manufacturers.

On the other hand, PHEVs have much higher peaks and troughs, exhibiting a larger vulnerability to incentive changes. This trend can be explained by private purchases, which comprise 60% of BEV sales, being less influenced by incentive changes. Meanwhile, companies, which account for 70% of the PHEV sales total, are much more likely to react to incentive changes.

Effects on the passenger-car fleet

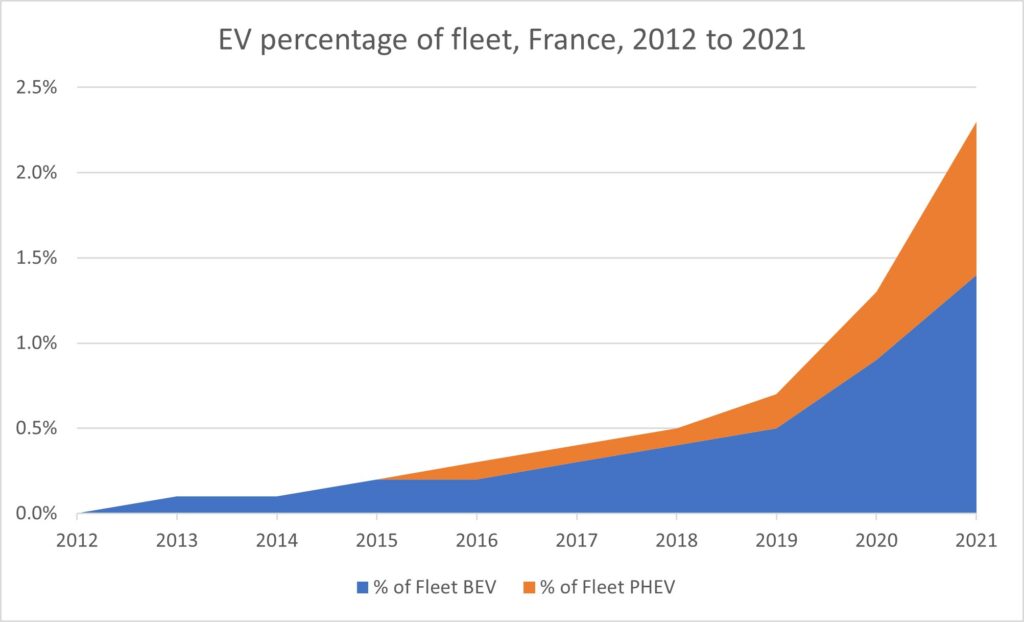

When it comes to fleet numbers, trends broadly follow the market-share graph. The needle only started moving significantly in 2015, followed by slow but steady growth over the next four years. In 2020 and 2021, there were significant rises in the vehicle replacement rate, with the EV share jumping by 1.6% in just two years.

Still, EVs in France currently account for less than 2.5% of the total fleet numbers. Additionally, with the EU’s 100% zero-emission mandate only set to be enforced by 2035, a complete phase-out of ICE models can only be expected by 2050 at the earliest.

How big are incentives?

There is currently a purchase incentive of up to €6,000 for BEVs costing below €45,000 (€4,000 for companies). Meanwhile, above that threshold and up to €60,000, the subsidy sits at €2,000. These offers will remain on the table until the end of 2022.

For PHEVs with at least 50km of electric range and costing less than €50,000, the subsidy is €1,000. Both BEVs and PHEVs are exempt from the local tax (Carte Grise). Electric light-commercial vehicles (LCVs) have a higher purchase incentive, with €7,000 for private buyers and €5,000 for companies. Low-emission cars (less than 20gCO2/km) have a 50% reduction on benefit-in-kind (BiK) taxes for company cars, up to a limit of €1,800 of annual savings.

Used BEVs can receive a €1,000 subsidy if they comply with certain requirements. This includes being registered in the country in the last two years, as well as belonging to the same owner in the same time frame. There is also a €2,500 scrappage subsidy, for old ICE vehicles.

Finally, despite not having a national zero-emission mandate, France will have to comply with the EU’s zero-emission mandate, set to start in 2035, when all new vehicles registered must have zero emissions. France’s EV incentives rely heavily on purchase subsidies, while other tools for EV adoption are generally not applied.

Categorisation of each incentive:

- Purchase tax exemption, purchase incentive, VAT exemption, import tax exemption, etc

- Ownership tax exemption, bus-lane use, toll exemption, free parking, free ferries, etc

- VAT exemption, BiK tax exemption, etc

- Charging cost deductibility, special license plates, EV charger subsidies, etc.

Charging-anxiety ratio

EVs do not mean much without a charging infrastructure (CI), because for BEV success, three variables must be met:

- Prices should be close to internal-combustion engine models

- Range should meet the needs of the buying public, avoiding range anxiety

- There should be enough CI for drivers to charge while on the road, avoiding charging anxiety, something that can be as damaging for EV adoption as concerns about range.

CI maintenance is another area of concern. Official numbers assume all charging stations are operational, which is not realistic, so the downtime frequency should also be taken into account. The same logic applies to the EV driver. When preparing a road trip, drivers need to have contingency plans, in case charging stations are offline.

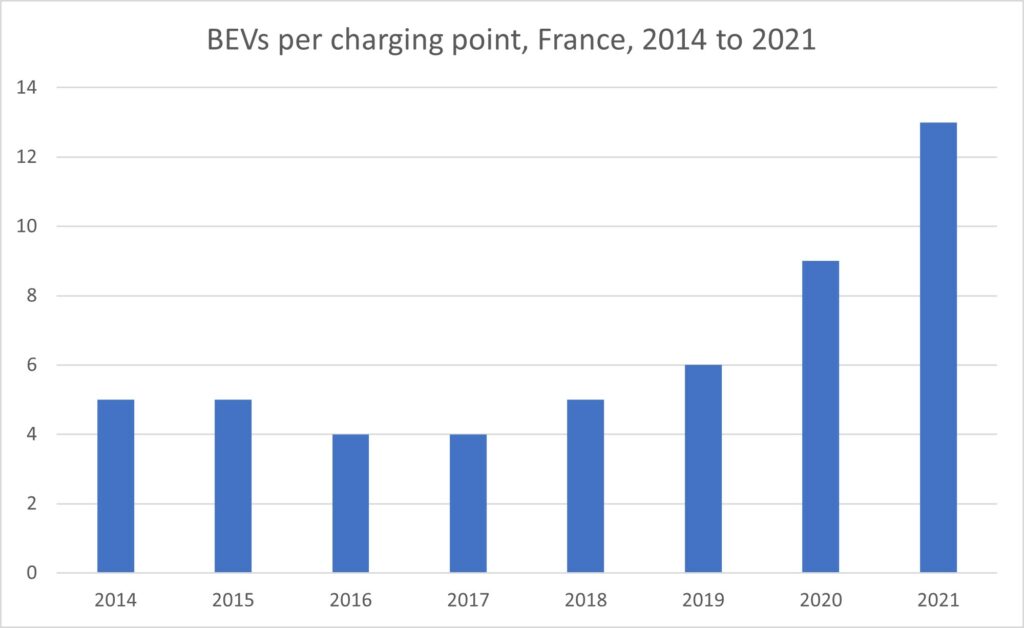

Due to an early focus on CI development and stable deployment of all-electric vehicles, the ratio of BEVs to charging points stayed stable during most of the electrification process. This number only evolved from five in 2014 to six in 2019.

The recent surge in BEV registrations, without a corresponding increase in infrastructure, has led to an imbalance in the CI ratio. While 13 BEVs per charging point in France is still below Norway’s 17, it is above Germany’s 10 and worlds apart from the two BEVs per charging point in the Netherlands.

Experimenting with incentives

France’s electrification demonstrates how fiscal incentives can be a significant factor in EV adoption, particularly regarding PHEVs.

Despite a strong start, which put France ahead in Europe’s EV race between 2011 and 2013, its leadership role was lost to countries like Germany and the UK. This was possibly due to an over-reliance on purchase incentives over other types of subsidies, namely those affecting company cars or charging infrastructure.

In the future, besides limiting the purchase subsidies to cheaper BEVs, the country could try replacing PHEV purchase subsidies with an increase in BEV company car BiK savings, stimulating fleet managers into further electrification.

Used EV incentives are also key to long-term success. Otherwise, new vehicles will have a harder time finding a used-car buyer, hurting leasing and resale values, and delaying total market transformation.