Could manufacturers control used-car markets by extending the agency model?

28 November 2022

Dr Christof Engelskirchen, chief economist of Autovista Group, recently explored the risks and rewards of the agency model for new-car sales. But could manufacturers benefit from extending this model to the used-car market?

If an omnichannel, haggle-free, seamless customer journey is desirable for new-car buyers, surely the same should be true for a customer in the used-car market? Considering how challenging it is to assess the condition of a used vehicle and negotiate a fair price, extending the agency model to this market appears to be the next logical step. But this might not necessarily be the case.

Evolving sales models

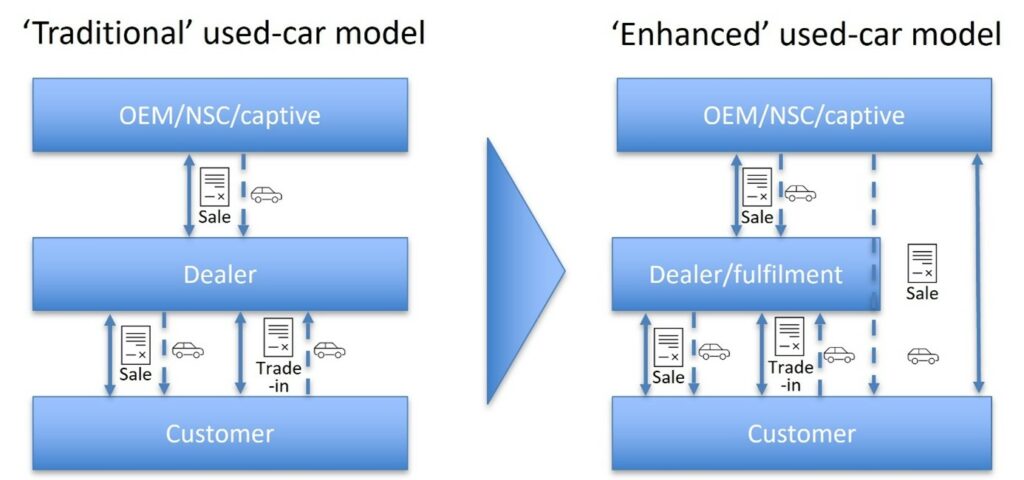

In the ‘traditional’ used-vehicle sales model, the car manufacturer sells to the dealer. These could be buy-backs from the rental channel, staff company cars, or units returning from leasing contracts. The dealer has full control over which cars they buy and at what price. Then comes the transaction between the dealer and the end customer.

The dealer fully owns the commercial risk for the transaction and negotiates the price. Customers may also offer dealers trade-ins when seeking to buy a new or used replacement. Dealers make decisions as independent businesses, assessing cars and any damages before selecting which units to buy at what price point.

This system has already evolved into an ‘enhanced’ model. Here, the manufacturer prices and sells used cars directly to the end customer, bypassing the dealer. Spoticar and heycar are two examples of such direct retail channels.

Dealers are responsible for fulfilment, should they choose to partake in the transaction and receive a commission. However, dealers are still active in their traditional used-car trading roles within the ‘enhanced’ model. They buy directly from the OEM and sell to the end customers – even leveraging the same platforms (e.g. heycar).

The new-vehicle agency model has already affected how used models are traded, without pushing the dealer into an agency role for all used-car transactions. With more direct new-car contracts between the manufacturer and customer, and courtesy cars registered in the name of the OEM, initial used-car transactions are under the control of the carmaker.

What would a used-car agency model look like?

OEMs have already embarked on a high-risk and reward journey with the agency model for new vehicles. But this produces substantial benefits for manufacturers, including full control over pricing, lower discounts, better margins, and better residual values.

However, this also necessitates a massive expansion of the carmakers’ balance sheets and additional asset risks. Vehicle manufacturers risk a loss of entrepreneurial edge, putting volume at risk (particularly relevant for mainstream brands), while costs build up around a central pricing engine and workflow. Furthermore, there will be new types of disputes with agents, for example around pricing.

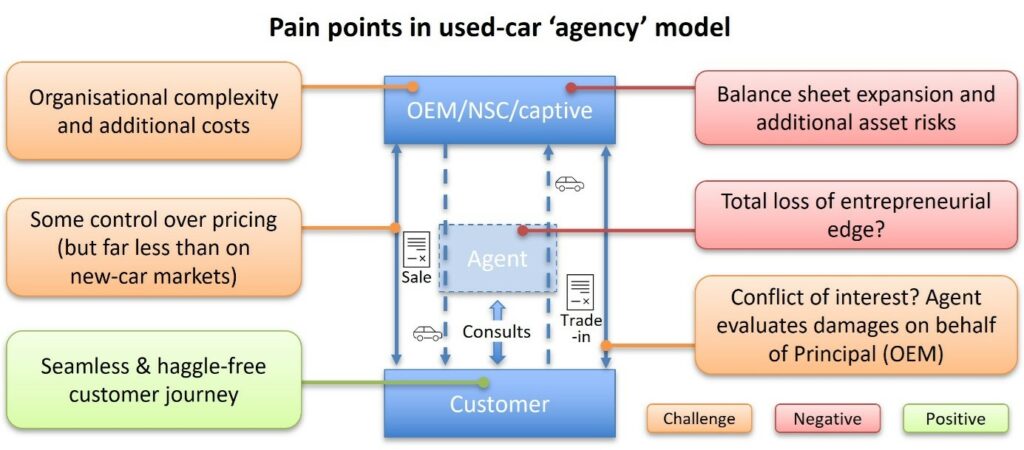

So, applying the agency model to the used-car trading section of the value chain would put OEMs in charge of pricing, establishing them as the contracting party. Furthermore, the carmaker would set the sales price and bear any inventory costs.

As with any new-car sale, the agent would receive a commission for a completed trade-in or concluded used-car sale. The agent could not operate a used-car business on the side as this would be in direct competition with the agency model.

Pain points for the agency model

An extension of the agency model to used-car trade-ins and sales, produces several sizeable pain points. First, manufacturers only gain some control over pricing, but far less than on new-car markets, because there are alternative sources of used cars that OEMs have no control over.

Secondly, high organisational complexity and additional cost layers are required to establish and operate a central pricing engine for used cars. Prices are more susceptible to regional influence and fluctuations. The purchasing process is more complex too, because buying a used car is almost always a compromise between age, mileage, equipment and price.

This model would largely kill off any remaining entrepreneurial edge for the dealer/agent. The total loss of wiggle room and inflexibility of pricing in the new and used-car markets would be compounded, increasing the risk that no deal takes place.

Additionally, a potential conflict of interest between agents and manufacturers could make operations more complicated, and costly to govern. The agent would have the incentive to downplay the damages and overstate the condition of the vehicle to facilitate the trade-in, in order to receive a commission.

Few benefits and high risks

There are substantial challenges when it comes to applying an agency model to new-car sales. Manufacturers should make this their priority, tackling all the relevant issues that arise.

But applied to used-car transactions, an agency model delivers too few benefits and too many risks to be considered an attractive strategy. OEMs cannot control used-car prices like new-car prices. Risks are magnified due to the rigidity of the model (risk of loss of entrepreneurial edge and volume) and additional asset risks.

The COVID-19 pandemic served as a catalyst for the digitalisation of sales and marketing value chains as well as the agency model. But current supply constraints provide a false sense of simplicity of pricing, particularly for used cars.

The agency model for new cars already produces a rising share of used models owned by manufacturers. There should not be pressure to move into an agency model for all used-car transactions with dealer networks. Instead, the focus should be on operating more independently along direct channels when selling leasing returns and courtesy cars to customers (the enhanced model).

Finally, it is more important that OEMs collaborate with used-car pricing specialists and support dealers in setting up potential pricing engines for trade-ins (possibly with elements of risk sharing) and sales. This should facilitate the customer journey, both for trade-ins and used car buying. These engines should enable an omnichannel and seamless customer journey, with offer prices being very close to the final transaction price.