Three trends to watch out for as 2022 concludes

12 October 2022

Dr Christof Engelskirchen, chief economist of Autovista Group, discusses the easing of supply pressures, the all-time high of used-car prices and how Asian brands may thrive in a more permeable environment.

Central banks are biting down hard on inflation, with limited success so far. Economies are on the brink of a recession and demand has come down notably on both new- and used-car markets.

New-passenger-car registrations in the big five European markets were down 10% year-to-date in September 2022, compared to last year. Yet, August marked a turning point in this downward trend and closed almost 5% higher than a year ago. September continued this trajectory with 8% growth. In Germany for example, there were 14% more new-car registrations than a year ago.

Autovista24 expects 2022 to end below 2021 in terms of new-car registrations – and around 30% below 2019 levels. However, a new-car market recovery is also expected over the coming months as supply pressures begin to ease notably for many car manufacturers, if not for all.

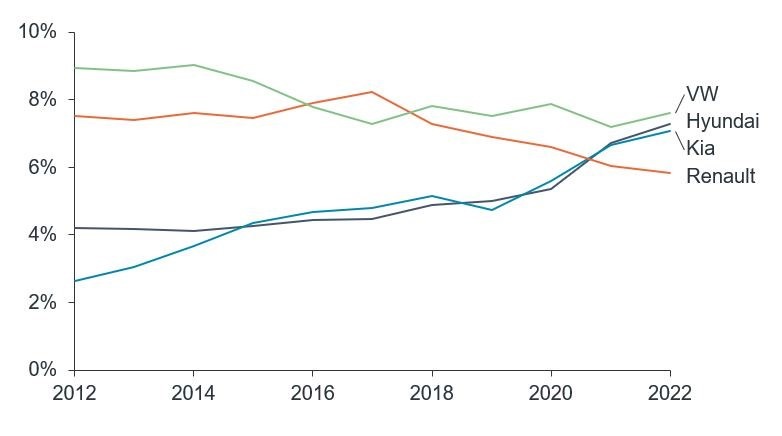

Over the past three years, Autovista24 observed how carmakers were differently exposed to supply-chain issues. Some were more resilient and built market share in that timeframe, for example, Hyundai and Kia. A recovery in 2023 can be expected as more and more carmakers will have successfully tackled some of the imminent supply-chain issues. However, it will not be a rebound scenario. Economic challenges look set to grow and any rise in new-car registrations will be largely due to full orderbooks and pent-up demand from corporate fleets.

New-car market share development in Spain

Used-car markets coming under pressure

After the initial lockdown-induced slowdown in used-car transactions in 2020, there was a strong rebound of sales in 2021. 2022 has obliterated this rebound. The proclaimed used-car market resilience has largely disappeared.

A 10% year-on-year drop in used-car transactions is expected in 2022 for the big five European markets. This represents a 15% contraction when compared with 2019 levels. Europe’s used-car markets are now experiencing the unfavourable combination of a dried-up supply of fresh used cars into the funnel, an outflow of attractive used cars over the past three years, a strong rise in transaction prices, and rising economic pressures. What is more, private buyers are beginning to postpone vehicle replacements.

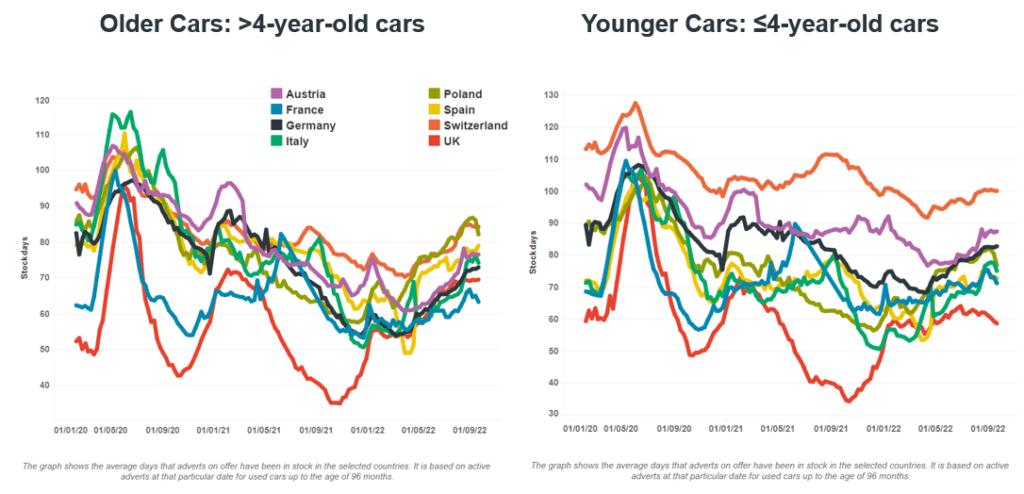

This creates momentum, which will also likely affect used-car prices over the next months and into 2023. Used car prices are not expected to fall off a cliff in the coming months – supply constraints still prevail; so does inflation of new-car prices. But prices may develop differently depending on age cluster. Days in stock have risen more for older used cars (more than four years old) than for younger ones, relatively consistently across Europe. This can be considered an early indicator of pressure building up on prices for older used vehicles, especially considering they had been rising more than those of younger used cars over the past three years.

Day in stock by age cluster, January 2020 to September 2022

Asian carmakers target Europe

Europe used to be a difficult-to-penetrate market for Asian manufacturers, with strong domestic brands and substantial differences in demand between countries. The barriers to entry are lower than initially thought, considering the success that Tesla demonstrates with software-led vehicle architecture and electric-vehicle (EV) powertrain and battery competence.

Asian brands have understood that electrification and infotainment present a more level playing field, where the typical ‘glass ceiling’ between the C- and D-segments (D-segment being dominated by strong, mostly premium, European incumbents; C-segment and below being permeable for non-domestic brands) has disappeared.

‘To date, more than 10 Chinese car manufacturers have launched, or are about to launch, EVs in Europe. Two of them have achieved some initial success: Polestar and MG have made themselves among the top 20 best-selling EVs in Europe,’ Jan Yang, senior managing director at global consulting firm Simon-Kucher, told Autovista24. MG is owned by SAIC Motors and Polestar by Geely, both Chinese businesses.

The inability of incumbent carmakers to supply vehicles in line with demand has also opened new avenues for new players. A recent example is the formation of a ‘long-term partnership’ between Sixt and BYD. Sixt intends to purchase 100,000 electric vehicles from BYD until 2028, which also seems to be a strong reaction to the dried-up supply of cars from European brands into rental channels.

European manufacturers may have successfully leveraged supply constraints to improve margins and prioritise more profitable sales channels, but customers are starting to shop around. There are now competence areas where European brands meet new players on a level playing field – that is infotainment and electrification.

If new (Asian) players can deliver attractively priced and well-performing vehicles, they will not only take market share but also push the supply of cars up, putting pressure on new-car and used-car prices.

Inflation-proof service plans

Established European carmakers should leverage a unique selling point (USP) that is difficult, if not impossible, to replicate: the own-dealer network and the advantages this brings to customers. There are powerful ways to leverage this model to create customer intimacy and loyalty.

A broad physical network can deliver valuable touchpoints for customers and the brand across the entire value chain, from buying to after-sales. More recent examples of tying a customer to the brand via this USP are ‘inflation-proof’ service plans, which some manufacturers have begun offering.

The prerequisite for a successfully combined offline and online sales and marketing value chain is the ability of the customer to move seamlessly between the channels. This will lead the way for a rise in the adoption of the ‘agency’ model for new cars.

How far this agency model extends towards used-car transactions and after-sales is an open question. Whatever decisions carmakers implement, they must strengthen their network if they want to cultivate it as one of the few remaining USPs. They will also need to decide on how much of the asset risks they are willing to absorb as supply pressures ease and residual values become more volatile over the coming months and years.