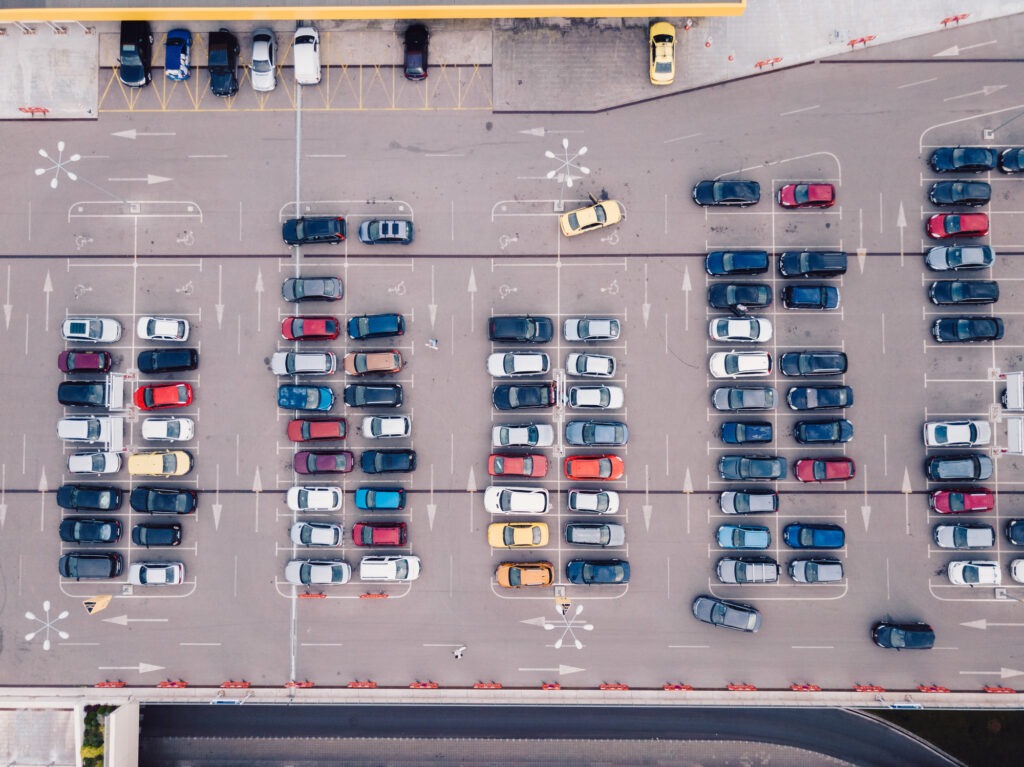

Expecting EU new-car market to fall again, ACEA calls for policy support

09 October 2022

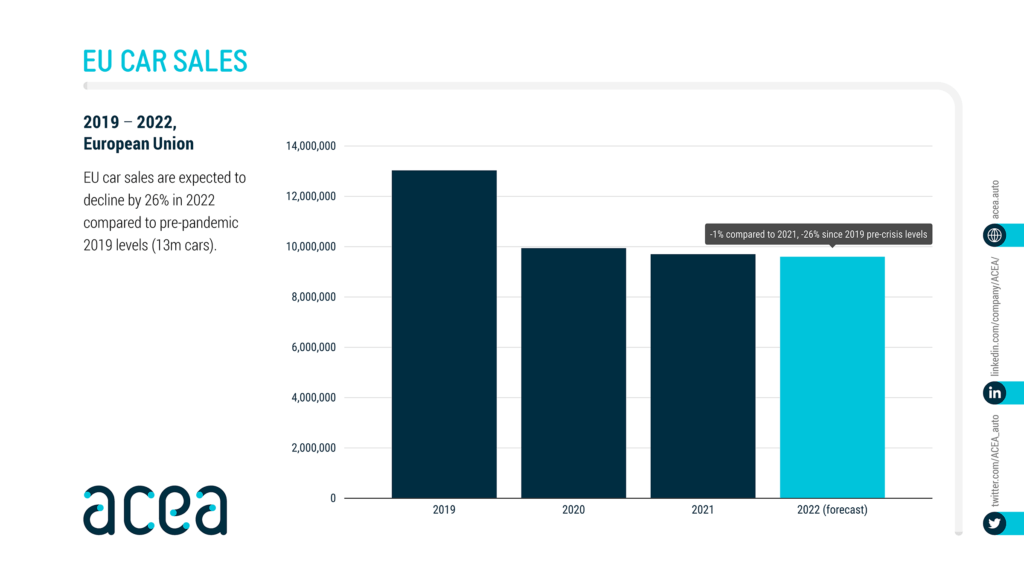

The European Automobile Manufacturers’ Association (ACEA) predicts that the EU’s new-car market will shrink by 26% this year, compared with the pre-pandemic level of 2019. So, the industry body is calling for a supportive policy framework that champions both market recovery and a shift to zero-emissions mobility.

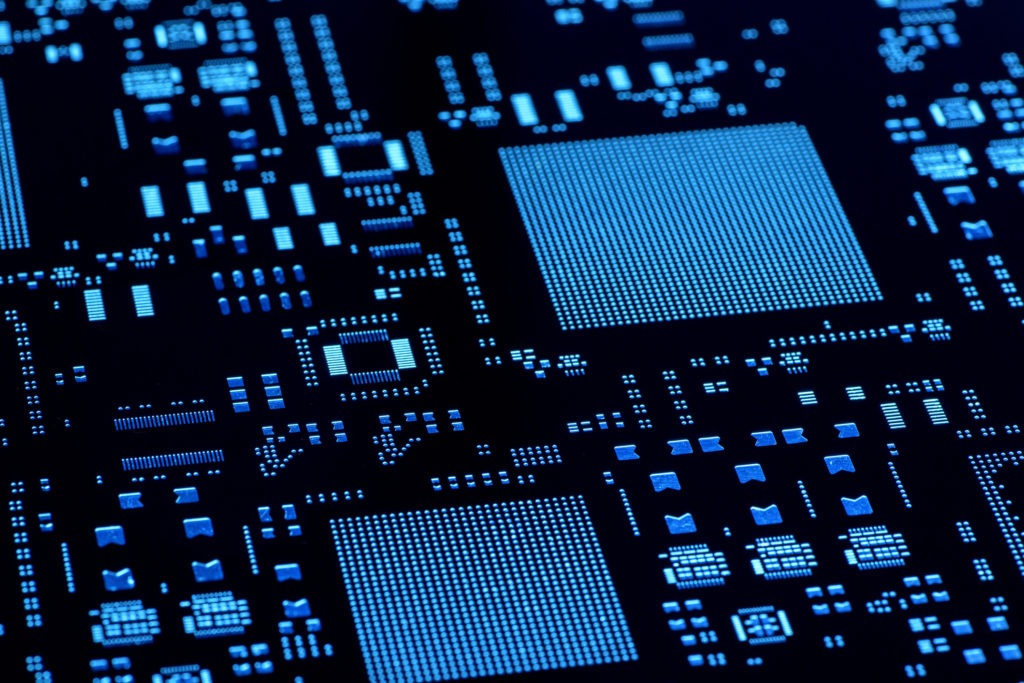

While automotive optimists might have hoped for a rebound once lockdowns lifted, a flurry of new crises has prevented any such recovery. Supply shortages, such as semiconductors, the war in Ukraine, and growing economic turmoil, have kept the market under pressure. Initially, supply bore the brunt of the impact, but now concerns over decreased demand are coming to the fore.

Forecast revision

In the first eight months of 2022, ACEA recorded a 12% decline in new-car registrations, with fewer than six million new passenger cars sold across the EU. Earlier falls continue to outweigh recent improvements, resulting in the negative cumulative figure. The EU’s four key markets, Italy, France, Germany, and Spain fell by 18.4%, 13.8%, 9.8%, and 9.4% respectively in the reporting period.

ACEA president and BMW CEO, Oliver Zipse, outlined some of the major contributing factors to the negative market performance. ‘The last years have been marked by major events like Brexit, the coronavirus pandemic, semiconductor supply bottlenecks and the war in Ukraine, with its impact on prices and availability of energy,’ he said.

‘All of these things underline how quickly, how profoundly and how unpredictably our world is changing. This applies not least in the geopolitical context – where there are direct consequences for our globally interconnected industry and its close-knit value chains,’ Zipse added. While supply has taken most of these hits, inflation and fears of a recession could impact demand as purchases are delayed while money is tight.

This led ACEA to adjust its February forecast, which originally predicted the EU new-car market would return to growth this year, rising by 7.9% to reach 10.5 million units. Instead, it now believes the region will suffer a year-on-year fall of 1%, down to 9.6 million units. Compared to the pre-pandemic figures of 2019, this equates to a drop of 26% within three years.

In September, Autovista24 downgraded its 2022 EU new-car market forecast to 9.18 million units, representing a year-on-year contraction of 5.3%. In the UK, where inflation already topped 10% in July, a 1.6% year-on-year downturn is expected. This led Autovista24 to adjust its forecast for the wider European region to 11.2 million new car registrations in 2022, equating to a decline of 4.8%. Autovista24 predicts that the European new-car market will not return to pre-pandemic levels until the next decade.

Functioning framework

This is where ACEA asserts the need for a supportive policy framework. ‘To ensure a return to growth – with an even greater share of electric-vehicle sales so climate targets can be met – we urgently need the right framework conditions to be put in place,’ said Zipse.

He outlined the need to include greater resilience in Europe’s supply chains, an accelerated rollout of electric-vehicle (EV) charging infrastructure, and an EU Critical Raw Materials Act that guarantees access to the base components needed for electromobility.

‘Despite the contracting market and pressure from inflation and energy costs, the automotive industry continues to invest massively in R&D and in the skills and technologies driving the green and digital transition,’ explained ACEA’s director general, Sigrid de Vries.

But she pointed out that a transformation on this scale could only be achieved by a competitive industry, capable of remaining so well into the future. But this edge is dependent upon what de Vries called ‘the right political framework conditions.’

There does appear to be movement on this front. After the semiconductor shortage resulted in manufacturing delays and stoppages for many sectors, the European Commission outlined a policy in February this year to turn the region into a chip powerhouse. By reducing dependence on Asia and the US, the European Chips Act hopes to deliver on green and digital ambitions in Europe.

Policymakers are also hoping to address concerns over EV infrastructure with new introductions such as the Alternative Fuels Infrastructure Regulation (AFIR) proposal, and the Energy Performance of Buildings Directive (EPBD). Electric cars will only succeed if they can be recharged as required. While localising supply chains, installing infrastructure, and ensuring the continued development of electromobility should help the automotive sector, there remains a problem. If inflation does shrink spending power, lowering demand alongside economic prospects, there will be fewer people able to take advantage of available new cars, especially expensive electric vehicles.