UK new-car market enjoys precarious second consecutive month of growth

05 October 2022

The UK new-car market enjoyed its second consecutive month of year-on-year growth in September following declines from March through to July. This was also despite there being one less working day than in September 2021 because of the funeral of Queen Elizabeth II. However, the base of comparison last year is low as ‘the industry recorded its weakest September since 1998’ according to the Society of Motor Manufacturers and Traders (SMMT).

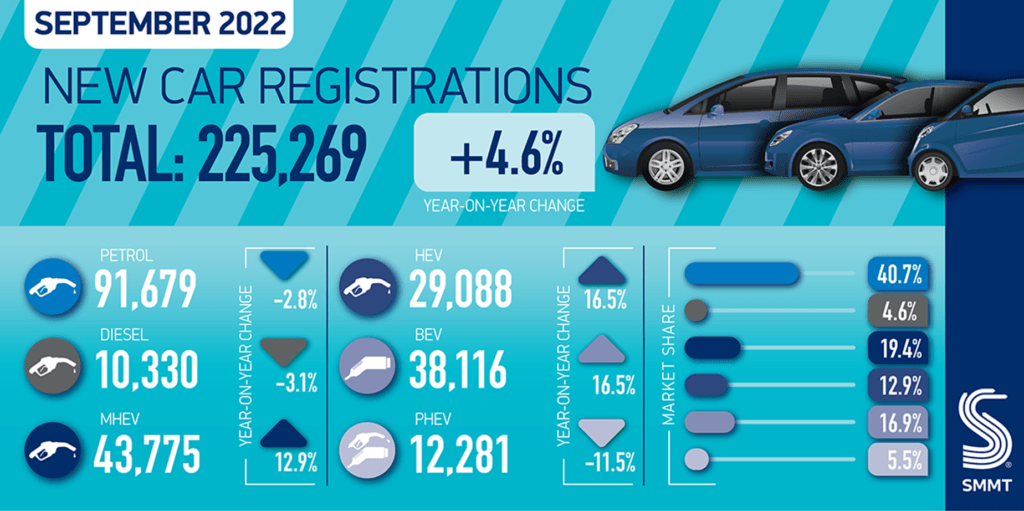

The SMMT reports that ‘during what is typically the second biggest month of the year for the sector, 225,269 cars joined Britain’s roads.’ This equates to year-on-year growth of 4.6% but the association cautioned that ‘overall registrations for the month are still some 34.4% below pre-pandemic levels as the industry continues to battle issues constraining supply to fulfil a backlog of orders.’

Factoring in the extra working day last year (22 in September 2021 versus 21 last month), Autovista24 estimates that the volume of registrations grew 9.6%. While this marks an improvement on the adjusted 3.4% downturn in August, the cost-of-living crisis shows no sign of abating and the outlook for the country’s automotive sector is precarious.

Devaluation of pound threatens sector

UK new-car registrations topped 1.2 million units in the first three quarters of 2022. However, the SMMT highlighted that ’while growth is welcome following a torrid first half of the year, total registrations for 2022 remain down 8.2% on a weak 2021 performance and more than a third (35.1%) below the first three quarters of pre-pandemic 2019, equivalent to 653,903 fewer units.’

The new-car market performed below Autovista24’s prediction for September, although last month’s forecast did not factor in any impact on activity due to the period of national mourning for the Queen. This inevitably displaced some registrations into October and supply is expected to continue to improve throughout the remainder of 2022.

‘The overall market remains weak, however, as supply-chain issues continue to constrain model availability. Whilst the industry is working hard to address these issues, the long-term recovery of the market also depends on robust consumer confidence and economic stability,’ commented SMMT chief executive Mike Hawes.

The consumer prices index (CPI) was at 9.9% in the 12 months to August 2022, albeit down slightly from 10.1% in July. Moreover, inflation is expected to rise further following the devaluation of the pound in the wake of the UK government tax cuts announced on 23 September, which risks carmakers increasing list prices. This also means further interest-rate hikes are expected as the Bank of England attempts to bring rising prices under control.

The mounting financial pressure on businesses and consumers alike will inevitably suppress underlying demand and Autovista24 has downgraded its 2022 forecast for UK new-car registrations, to 1.56 million units. This equates to a year-on-year decline of 5.2%, and a 32.4% contraction compared to the pre-pandemic level of 2019.

Although countless new-car orders will not be fulfilled this year, the weaker demand assumption means Autovista24 has also reduced its new-car registrations outlook for 2023, to 1.8 million units.

One million EVs

Despite the UK government’s termination of the plug-in car grant (PiCG) on 14 June, the SMMT notes that ‘electric-vehicle uptake continued to rise, albeit at a slower rate of growth than seen earlier in the year, with the second highest monthly volume of battery-electric vehicle (BEV) registrations in history, up 16.5% to 38,116 units.’

Conversely, registrations of new plug-in hybrid (PHEV) vehicles declined 11.5% year on year, with their share falling to 5.5%, down from 6.4% a year earlier. Nevertheless, electric vehicles (EVs), comprising BEVs and PHEVs, accounted for 22.4% of registrations last month. Almost a quarter of a million EVs were registered in the UK in the first nine months of this year, accounting for more than one in five new cars.

‘September has seen Britain’s millionth electric car reach the road – an important milestone in the shift to zero-emission mobility. Battery-electric vehicles make up but a small fraction of cars on the road, so we need to ensure every lever is pulled to encourage motorists to make the shift if our green goals are to be met,’ said Hawes. Although the withdrawal of the PiCG – along with rising interest rates, inflation, and electricity costs – will have a detrimental impact on EV uptake, their 2022 share ‘will continue to grow, to reach 22.6% as manufacturers prioritise investment in zero-emission vehicle production,’ according to the SMMT. The association’s latest forecast predicts that their share will rise further in 2023, to 27.8%.