France records growth as European new-car sales continue to improve

02 July 2020

2 July 2020

As countries start to put coronavirus (COVID-19) lockdowns behind them, the latest registration figures from some of Europe’s key markets offer hope that the automotive industry has firmly started its recovery period. As Autovista Group Daily Brief Editor Phil Curry notes, the French figures provide evidence that incentive schemes covering all fuel-types can lead to a sharp increase in sales.

France has seen its first increase in passenger-car registrations for over six months, as the country’s automotive market bounced back into life during June. In contrast, both Italy and Spain recorded further steep declines during the month, although these figures show promise that their markets are recovering.

As countries emerged from coronavirus (COVID-19) enforced lockdowns in May, dealers started to welcome customers back to showrooms in the hope that pent-up demand would help drive sales in the following months. Yet with the pandemic has come an economic crisis, with job losses and business closures mounting across Europe. Therefore, customer demand is slower, although incentive schemes are being put in place by various national governments.

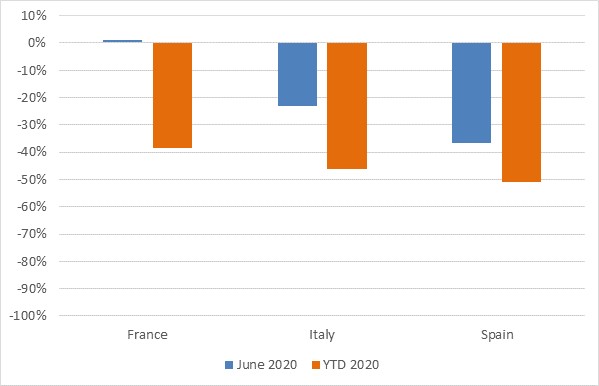

The French market saw 233,820 new cars registered in June according to the CCFA, an increase of 1.2% compared to the same period last year. In Spain, registrations declined by 36.7% in June, and is down 51% year-to-date, according to industry body ANFAC, while Italy saw a smaller drop, with the country’s automotive body ANFIA announcing a decline of 23.1% in the month, and a drop of 46.1% year-to-date.

New-car registrations in France, Italy and Spain, year-on-year percentage change, June and year-to-date 2020

Source: CCFA, ANFIA, ANFAC

The French numbers offer hope to other markets that incentive schemes may work. In May, the market had dropped 50.3%, and year-to-date the market is down 38.6%. However, new incentives aimed at increasing sales came into effect in the country from 1 June. This €8 billion package includes a €7,000 grant for battery-electric vehicles (BEVs) costing less than €45,000 (up from the standard €6,000 premium), while those who are looking at plug-in hybrids (PHEVs) can claim a €2,000 subsidy.

Additionally, France has also doubled its premiums for those looking to trade in their older vehicles for a cleaner model, with a €3,000 grant for ICE vehicles and €5,000 for BEVs. This means drivers could get up to €12,000 off the list price of a zero-emission vehicle. The move has helped the country realise a turnaround in vehicle sales, and provides hope for Spain, whose own incentive package was only announced in the middle of June, and Germany, whose monthly figures are released on 3 July. Italy and the UK are yet to announce any incentive schemes.

Holiday season

Spain usually expects a strong month in June due to its proximity to the holiday season, which often sees a mass-renewal of rental fleets, instead, this sector saw a drop of 76%. A total of 82,651 units left showrooms in the month.

′Although the figures have improved compared to previous months, the market continues to record worrying declines, especially in the rental channel, which should be rising before the end to the summer season,’ comments Noemi Navas, communication director of ANFAC. ′However, uncertainty regarding how the situation will evolve in the coming months complicates the situation. The incentive plan, announced within the automotive sector value chain boost plan, should play a very important role in this market recovery, helping to overcome the impact of the coronavirus crisis in the automotive sector and promoting the renewal of the parc. Still, its rapid entry into force is essential.’

Spain announced its incentive scheme in the middle of June. Buyers will receive between €400 and €4,000 from the government for purchasing a new car that meets certain requirements, and manufacturers and dealerships must match this subsidy. The amount of aid will depend on the vehicle’s emissions: the more polluting ones will receive the lowest subsidies, while zero-emission cars will attract the maximum amount. To be eligible for the subsidies, it will also be necessary first to scrap a car that is more than 10 years old. Scrapped vehicles more than 20 years old will qualify for more funds for their owners.

′The vehicle fleet in Spain is on average 12.7 years old, while the market for vehicles over 20 years old – with higher emissions and lower safety performance than the latest models – has grown by 18% in recent years,’ comments Ana Azofra, valuations and insights manager of Autovista Group in Spain. ′Consequently, this measure aims to replace older vehicles with cleaner and safer models through a renewal programme that incorporates environmental and social criteria.’

Recovery path

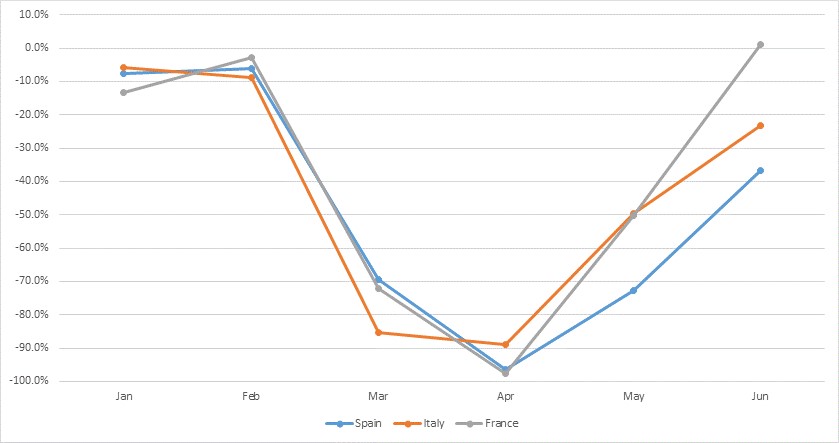

With around two months of trading behind them, we are now able to see how the markets in France, Italy and Spain are starting to recover. While it is expected that sales in Europe will see a decline of around 30% in 2020 due to the COVID-19 pandemic, the rise in sales across the three markets is noticeable.

Monthly performance of Spain, Italy and France registrations from January to June 2020

Source: ACEA, CCFA, ANFIA, ANFAC

Italy was the hardest hit market, recording two months of low registrations as the country became the first to be affected by COVID-19. As cases rose rapidly, the Italian government was the first to enact a lockdown, with others following suit as cases rose.

Of the three markets covered, only France has an incentive scheme in place. Therefore, its steep rise in registrations in the last month must provide hope to Spain, which has recently unveiled its plans. It may also encourage further discussion in Italy, where no package of measures to help the automotive industry has yet been announced.