German new-car registration figures down 32% in June

03 July 2020

German new-car registrations dropped by 32.2% in June, compared with the same month in 2019. Some 220,272 new cars were registered, according to the latest figures from the automotive authority Kraftfahrt-Bundesamt (KBA).

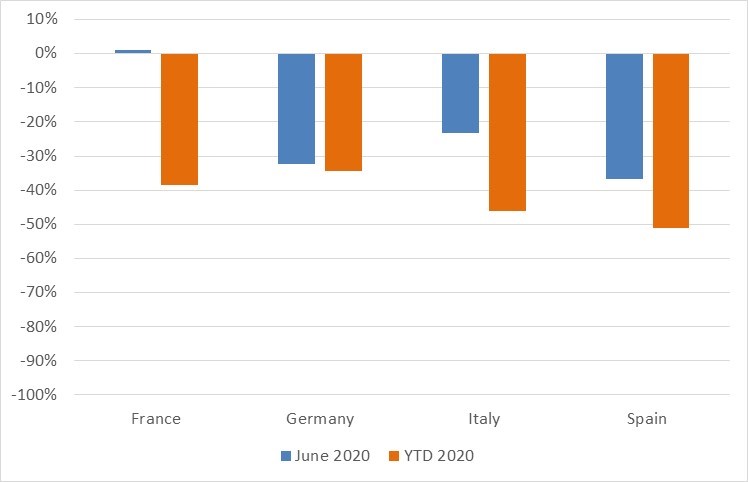

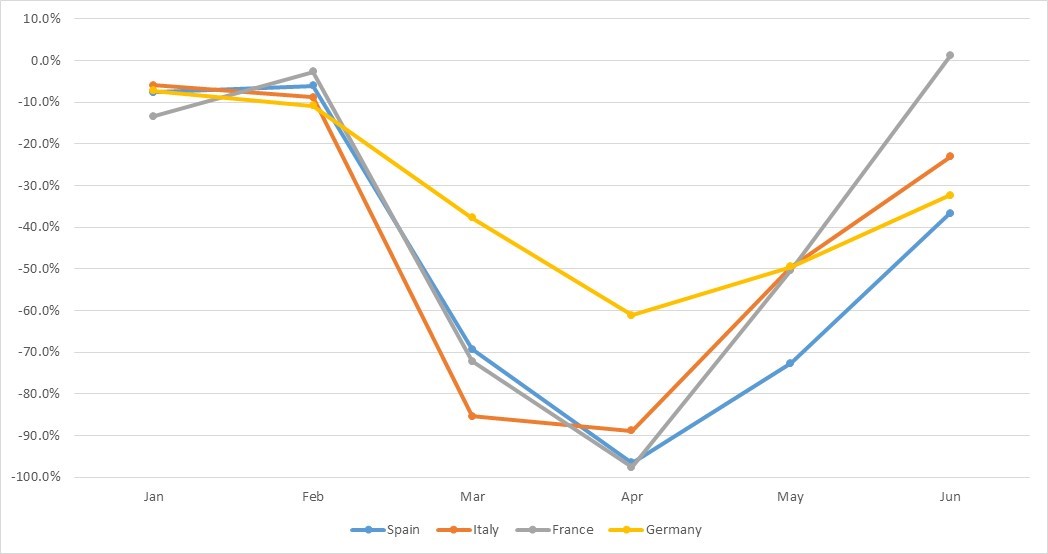

This marks another marginal improvement for the German market, up from the 49.5% declines recorded in May and 61.1% in April. These latest figures put Germany ahead of Spain, where registrations declined by 36.7%, but behind France which saw an increase of 1.2% and Italy which recorded a decline of 23.1%.

New-car registrations in Germany, France, Italy and Spain, year-on-year percentage change, June and year-to-date 2020

3 July 2020

Source: CCFA, ANFIA, ANFAC, KBA

Source: CCFA, ANFIA, ANFAC, KBA

Brands and types broken down

The number of private registrations in Germany fell by 38.2%, with a share of 32.7%. Commercial registrations fell slightly less, by 29%. A total of 1,210,622 brand-new passenger cars were registered in the first six months of the year, 34.5% less than in the first half of 2019.

Compared with June last year, registration figures were down for all German brands. Porsche recorded the smallest decline at 0.5%. The decline at Mercedes-Benz was also in the single-digit range at 8.7%. For other brands, drops ranged from 23.8% for Mini to 83.6% for Smart. With 17.8%, VW again achieved the largest share of new registrations in June.

Growth was recorded for imported brands, Mitsubishi was up 11.2%, Honda up 2.8%, Subaru up 2.6% and Fiat up 1.5%. Other imported brands recorded registration declines ranging from 1% for Volvo, to 66.6% for Suzuki. The largest share of new registrations was recorded by Skoda at 6.2%

Some 21% of all new cars came from the compact class, which came out as the strongest segment. SUVs followed in second place with 19.9%. On a half-yearly basis, the balance of these two segments came out at a 20.3% share of new registrations each. Small cars (14.7%) and off-road vehicles (11.2%) also reached double-digit new registration shares in June. The declines in new registrations extended across all segments, with losses ranging from 14.3% in the luxury class to 63.4% in the minivan segment.

Drive-train performance

At 51.5%, more than half of all new cars were petrol-driven (down 42.2%), followed by diesel passenger cars (down 34.5%), which accounted for 30.6% of the market. A total 30,254 new vehicles with hybrid drive led to an increase of 60.8% and a share of 13.7%. A total of 10,479 of these were plug-in hybrids (PHEVs), which, following an increase of 274.4%, achieved a share of 4.9%. Some 8,119 electric vehicles generated an increase of 41%, gaining a share of 3.7%. Liquid gas (0.2%/ up 52.7%) and natural gas (0.3%/ up 5.5%) remained below the one percent mark.

At the end of the first six months of the year, the number of petrol- (down 43.6%), diesel (down 37.0%) and liquefied petroleum gas (down 81.3%) powered passenger cars was down. The alternative drive systems – electric (up 42.7%), hybrids (up 54.6%), including plug-in hybrids (up 199.8%) and natural gas (up 11.2%) – achieved growth rates, some of which were in the triple digits.

Average CO2 emissions amounted to 150.2 g/km and were down 4.3% compared to the same month last year. On a half-yearly basis, average CO2 emissions amounted to 150.8 g/km and were 4.4% lower than in the same period last year.

In June 2020, 762,442 vehicles changed owners, which is 14.7% more than in June 2019. At the end of the first half of 2020, the statistics showed 3,742,318 transfers of ownership, 9.9% less than in the same period last year.

Elsewhere in Europe

France saw its first increase in passenger-car registrations for over six months, as the country’s automotive market bounced back into life. Some 233,820 new cars were registered in June according to the CCFA, an increase of 1.2% compared to the same period last year.

Meanwhile, both Italy and Spain recorded further declines during the month, although these figures show promise that their markets are recovering. In Spain, registrations declined by 36.7% in June, and is down 51% year-to-date, according to industry body ANFAC. Italy did see a smaller drop, with the country’s automotive body ANFIA announcing a decline of 23.1% in the month, and a drop of 46.1% year-to-date.

Monthly performance of Spain, Italy and France registrations from January to June 2020

Source: ACEA, CCFA, ANFIA, ANFAC, KBA

Source: ACEA, CCFA, ANFIA, ANFAC, KBA

The French numbers are a beacon of hope for other markets that incentive schemes can work. The country’s €8 billion package includes a €7,000 grant for BEVs costing less than €45,000 (up from the standard €6,000 premium). Meanwhile PHEVs can claim a €2,000 subsidy.

France also doubled its premiums for those looking to trade in their older vehicles for a cleaner model, with a €3,000 grant for internal combustion engine (ICE) vehicles and €5,000 for BEVs. This means drivers could get up to €12,000 off the list price of a zero-emission vehicle.

German incentive scheme

In June the German Government announced its coronavirus (COVID-19) economic recovery package which leant heavily into incentivising green mobility. Schemes to boost the sales of low- and zero-emission cars were partnered up with investments into green transport infrastructure. Conversely, petrol- and diesel-powered vehicles did not feature in the package.

The federally-backed buyer incentive scheme doubled to €6,000 for battery-electric vehicles (BEVs) and hydrogen fuel-cell electric vehicles (FCEVs) costing less than €40,000. When paired with a manufacturer bonus of €3,000, customers were given the potential to save €9,000 on a zero-emission cars. More expensive BEVs and plug-in hybrids (PHEVs) receive slightly lower subsidy rates as part of the package. These incentives look to be available until December 2021.

New-car buyers will also benefit from a lowering of value-added tax (VAT) to 16% from 19% between 1 July and 31 December 2020. This was one of the few measures announced that also applies to diesel- and petrol-powered vehicles.