How desirable are used Skoda models in Germany?

21 October 2021

Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group), takes a look at how Skoda models perform in the German used-car market.

Skoda has had a remarkable run over the past two decades. Every year from 2000 to 2019 has been better in new registrations than the previous one, with only one exception in 2009 due to a scrappage scheme. This generic growth has been accompanied by a steady expansion of the marque’s range, so that the Czechs, as the strongest German importer, are now broadly positioned with eight rather than their initial three models.

As expected, SUVs dominate with a brand share of over 40%, but in a market comparison they are comparatively average, which is due to the popularity of the Octavia, with the highest number of Skoda registrations. The electrified share – battery-electric vehicles (BEVs) and plug-in electric vehicles (PHEVs) – is also lower on the competitive range this year at 19%. However, one should not forget that the brand just had two particularly weak months in terms of registrations, which is certainly not due to a lack of customer demand.

Long delivery times are not a new phenomenon for German dealers and customers, but it has been a very long time since Skoda registrations were below 10,000 per month. The losses are almost as severe as those at the Volkswagen (VW) Group’s sister company SEAT.

Skoda lacks another electric volume generator like VW’s ID.3. But the Enyaq is selling almost as well as the ID.4. The Elroq could provide a remedy but not until the end of 2024, notwithstanding the semiconductor crisis.

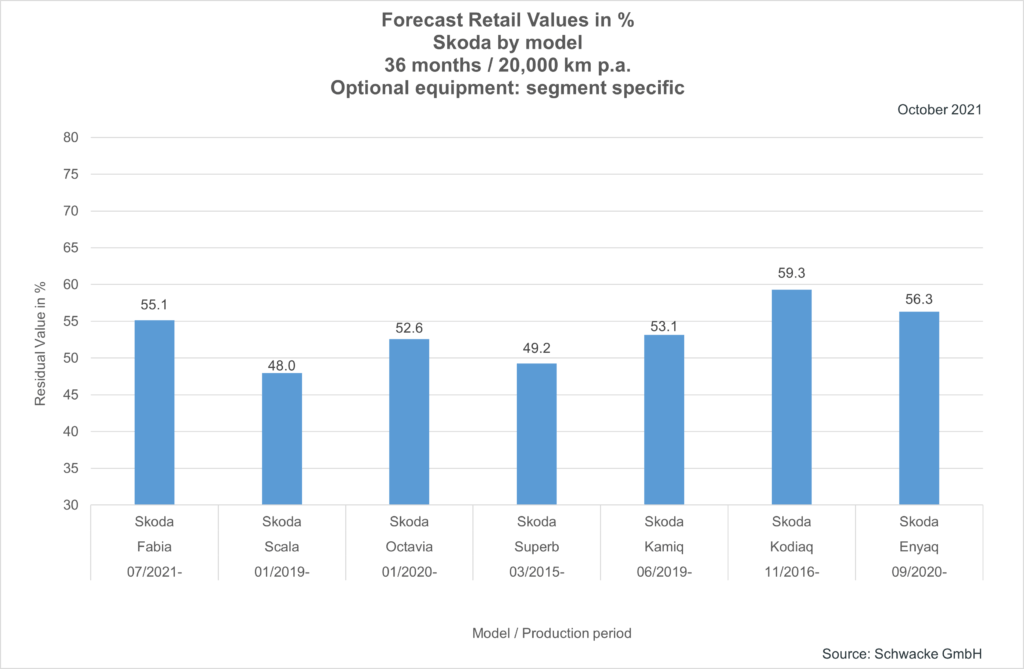

The small BEV will probably hit showrooms before the ID.1 and SEAT Acandra, finally expanding the range downwards. Moreover, looking at the forecast values of current Skodas, given the acute undersupply of new cars, it can be assumed that even in the near future most ‘simply clever’ models will have very stable residual values beyond the 50% mark.