How will COVID-19 shape used-car markets?

31 March 2020

31 March 2020

In the first of a two-part series in which Autovista Group assesses the impact of the coronavirus, chief economist Christof Engelskirchen analyses the pressure building on residual values around the Big 5 European markets as they grapple with the economic and social fallout of the pandemic.

Signs are emerging that the Chinese government may have contained the coronavirus (COVID-19). The country looks to be emerging on the other side of peak infections while the rest of the world stands at the beginning of a very dynamic development.

Severe measures implemented in Italy are now hinting at the beginning of a flattening of the curve of infections. In Germany, a bit over a week of strict measures implemented by the Government, have not yet resulted in a substantial slowdown of infection rates. The US has just surpassed China in the number of infections and the states of New York and Louisiana are particularly hard hit. In India, the biggest citizen lockdown has been implemented, affecting a population of 1.3 billion.

Elsewhere, countries appear ill-prepared to cope with the potential impact that the virus will have on their societies. For most, business activity has largely come to a stop. However, there is ample monetary and fiscal support, most notably the $2 trillion from the US Government, which has effectively doubled public debt. Stock markets have reacted positively over the past few days to monetary and fiscal stimuli. The Dow Jones Industrial Average index rose more in one day than ever in its history.

However, the situation remains far from being contained and the full extent of the implications that COVID-19 will have on economies and societies has yet to emerge. Significantly, on 27 March there was another substantial downward correction on stock markets. It would seem that China could be heading towards producing items that no one in the west will be in a position to buy under the strict regimes to combat infection. This would be a risk for the Chinese economy.

As forecast providers, we are challenged by these developments like anyone else. We have mapped out various scenarios, which we will update regularly as assumptions are adjusted and more robust data emerges. We will start with coverage of the Big 5 European markets France, Germany, Italy, Spain and the UK, with additional markets to follow.

Dealer activities at a halt

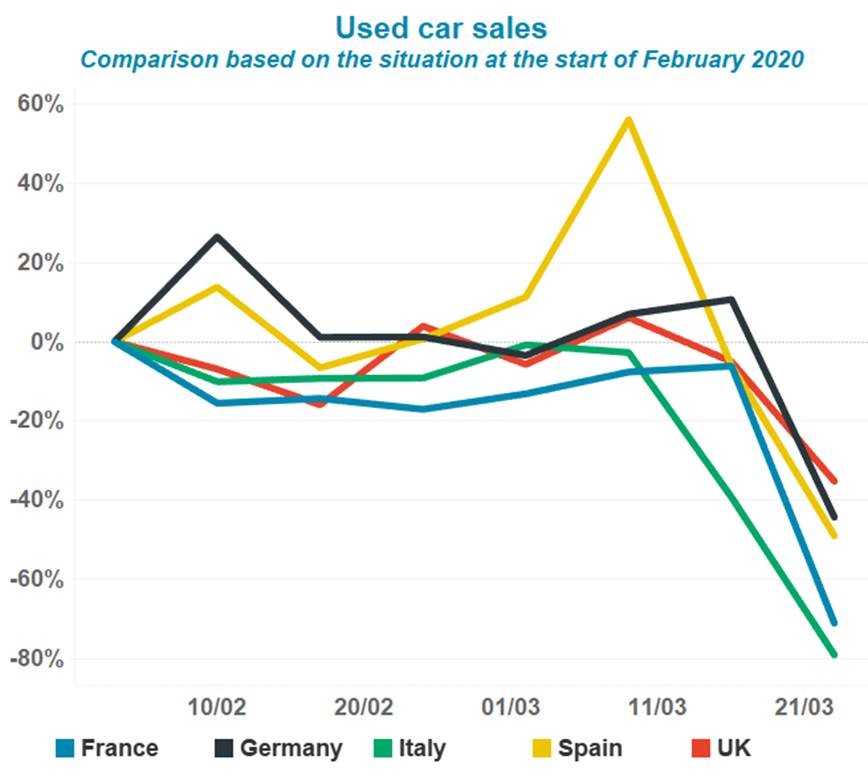

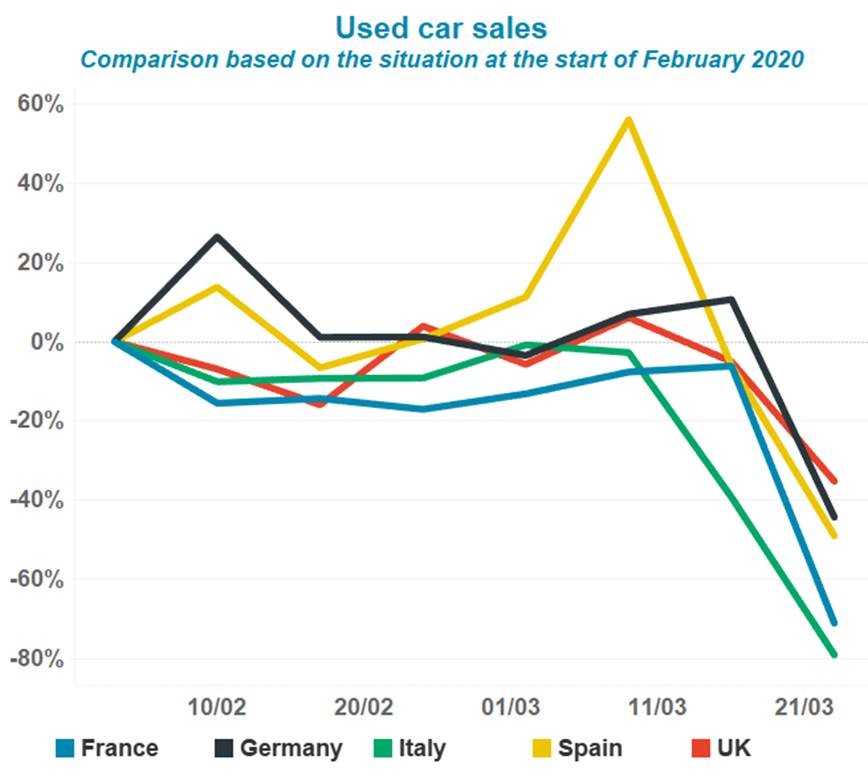

Markets are reporting a standstill, as dealers are closed and economic activity has largely come to a stop. These developments are also visible in our data. Activity on portals has halted and the number of used cars sold via them (Figure 1) has dropped by 65% between 16 and 23 March in Italy. In the UK, which was late in implementing severe measures to combat the virus, the number of cars sold experienced a 32% decline during the same period. In France, Germany and Spain the decline is between 45% and 69%, also correlating with the extent and timing of the lockdown. We expect these numbers to worsen substantially over the coming weeks as the short-term demand shock will become even more visible and dealers remain closed with too little activity on the e-commerce front.

Figure 1: Change in used-car sales by dealers via automotive portals, w/w in % since February 2020

Source: Autovista Group

Pricing heading down

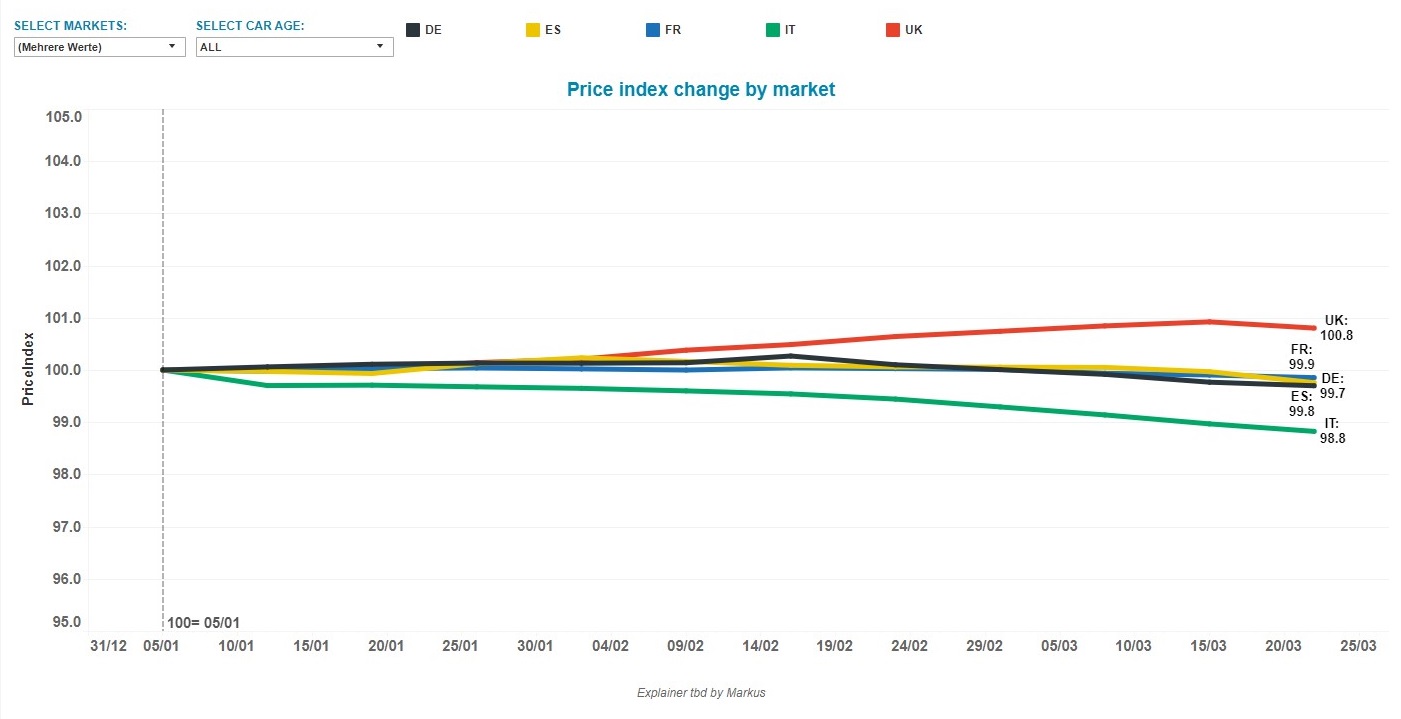

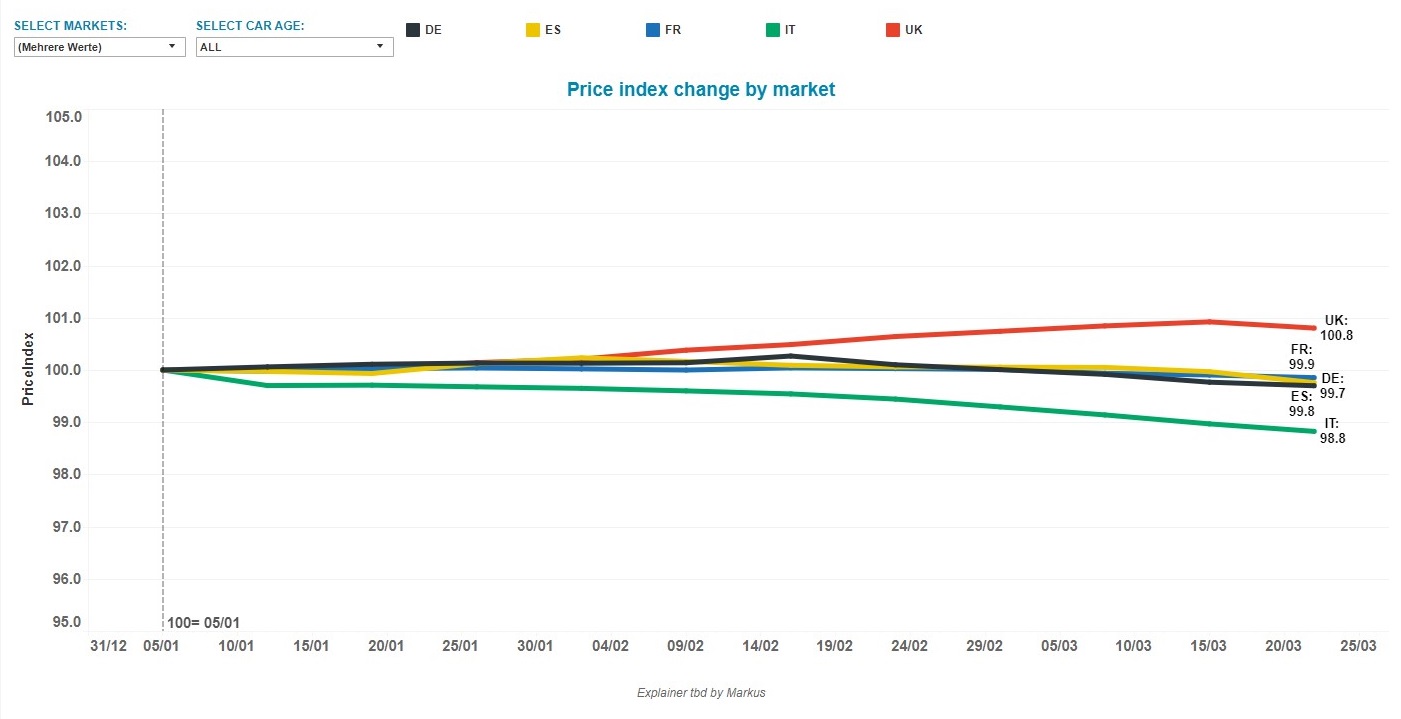

In our used-car pricing data, we see only the most gradual decline in RVs between the beginning of February 2020 and today (Fig. 2) but this is expected to change.

Figure 2: Price index development from 5 January 2020 to 23 March 2020

Source: Autovista Group

Pricing heading down

In our used-car pricing data, we see only the most gradual decline in RVs between the beginning of February 2020 and today (Fig. 2) but this is expected to change.

Figure 2: Price index development from 5 January 2020 to 23 March 2020

Source: Autovista Group

The reasons behind this gradual decline are two-fold:

Source: Autovista Group

The reasons behind this gradual decline are two-fold:

Source: Autovista Group

Pricing heading down

In our used-car pricing data, we see only the most gradual decline in RVs between the beginning of February 2020 and today (Fig. 2) but this is expected to change.

Figure 2: Price index development from 5 January 2020 to 23 March 2020

Source: Autovista Group

Pricing heading down

In our used-car pricing data, we see only the most gradual decline in RVs between the beginning of February 2020 and today (Fig. 2) but this is expected to change.

Figure 2: Price index development from 5 January 2020 to 23 March 2020

Source: Autovista Group

The reasons behind this gradual decline are two-fold:

Source: Autovista Group

The reasons behind this gradual decline are two-fold:

- The key performance indicator incorporates changes in market observations over the past 30 days and gives more weight to more recent changes; nevertheless, its setup mandates a slight lag; and

- We are just at the beginning of a very dynamic development and many dealers have not adjusted prices downward on the portals. This is either because they are closed or feel that there is no particular need to make adjustments at this point, as customers are not currently looking to purchase a car.