How will COVID-19 shape used-car markets – July 2020 update

07 July 2020

The July update of Autovista Group’s whitepaper: How will COVID-19 shape used-car markets? considers the ongoing impact of COVID-19 across Europe.

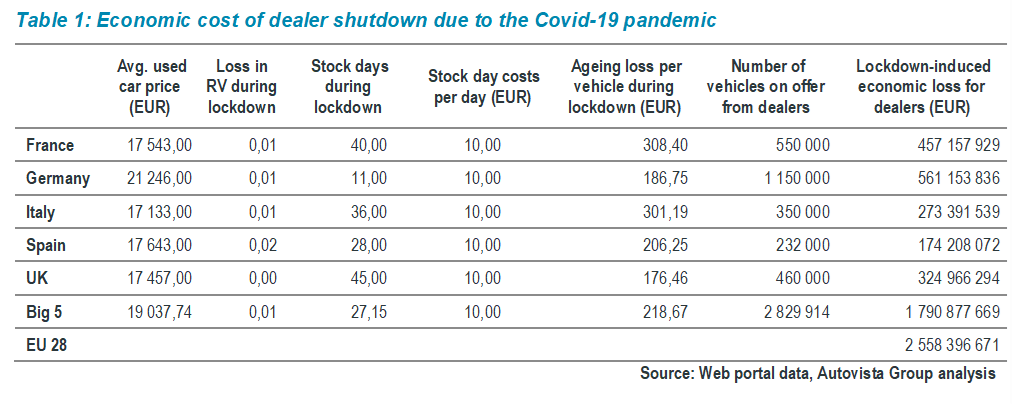

€2.6 billion of economic losses for dealers in Europe during lockdown

We have reported on the grinding halt of the automotive industry and the impact of the lockdown in several stories and podcasts over the past weeks.

The industry is slowly emerging from the pandemic lockdown and markets are in the ramp-up phase. These steps, even if they feel small, are crucial, as industry needs to progress to a new normal. The main reason is that economic losses, which have been building up, are tremendous. For dealers in Europe the losses amount to €2.6 billion for their used car operations alone during the lockdown, not taking into account possible losses in the ramp-up phase.

In Table 1, we have laid out the mechanics for this estimate. There are three elements to the calculation.

Firstly, there are – albeit currently small – losses in residual values (RVs) across all markets for the period of the lockdown. We expect them to continue to build up over the coming weeks and months and have laid out our scenarios later in this whitepaper.

The main reason for the pressure on RVs is the developing economic crisis. Latest forecasts estimate economies in Europe could contract by 8% or potentially more in 2020. Forecast institutes do not anticipate a quick economic recovery and this will wash through to purchasing power and private demand.

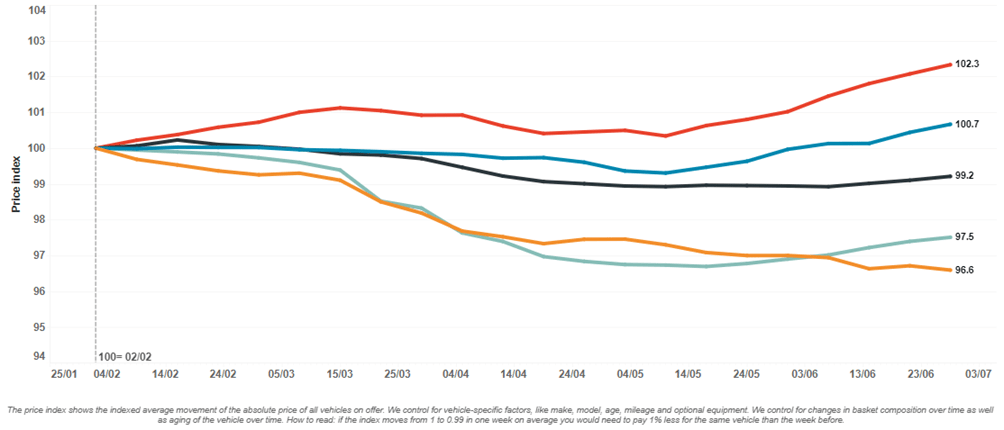

We also see a more negative development of used car prices in countries that have had no or a more relaxed lockdown but more exposure to the economic impact of the crisis.

Used car values in Sweden, which did not enforce a lockdown, and in Finland and the Netherlands, where dealers remained open, show a bigger decline in RVs than those markets that were largely closed, e.g. France, Germany and the UK (Figure 1). The economic pressure to reduce prices may outweigh any benefits from pent-up demand and shortage of new car supply.

Secondly, stock days rise during lockdowns and each day costs money, in particular associated to lending. We estimate that these costs are around €10 per day of lockdown.

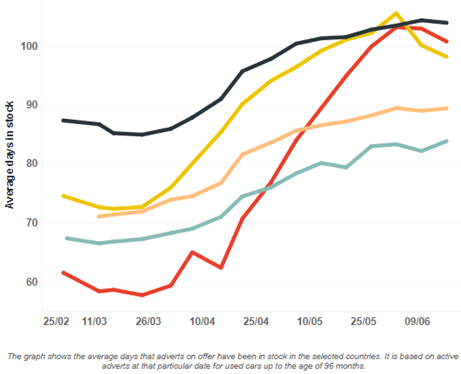

Figure 2 demonstrates how sharply days in stock of active adverts increased during the lockdowns: They are now slowly declining. Meantime in Finland and Sweden, the no-lockdown markets, there had been a rise in days in stock that washed through to lower residual values.

Thirdly, we estimated the loss in value due to the ageing of the individual vehicle. These costs come on top of the cost incurred due to capital employed.

Figure 1: Used car price index for selected markets

Note: Finland (orange). Germany (black). France (blue). Sweden (green). UK (red).Source: Autovista Group, Residual Value Intelligence (RVI), COVID-19 tracker

Figure 2: Days in stock of active adverts

Note: Finland (pink). Germany (black). Spain (yellow). Sweden (green). UK (red). Source: Autovista Group, Residual Value Intelligence (RVI), COVID-19 tracker

Fending off coronavirus – measures post lockdown

As markets begin to ease out of lockdown, setbacks are emerging during the ramp-up phase. Ford had to close its Chicago assembly plant twice in less than 25 hours as two workers tested positive for Covid-19. There are more cases like this. It is no surprise that the European Automobile Manufacturers Association ACEA has published 25 actions for a successful restart of the EU’s automotive sector. Recommendation No. 1: ‘Issue harmonised guidance on health and safety precautions for the workplace’. This is imperative as employers are responsible for the wellbeing of their staff.

Besides a thorough assessment of the supply chains and a re-start of cross-border logistics, another topic resurfaces – ‘vehicle renewal schemes for all vehicle categories’. Many agree that the automotive industry requires a stimulus package but there is ongoing debate in many markets about what shape a scheme should take.

Pressure continues to rise on dealers to turn stock, as inventory ages. Stimulus packages do not only support OEMs but dealers who will be under more stress than before. For dealers it will be pivotal to avoid giving in to the temptations of discounting. ‘Our advice is to reduce exposure to cars and model years that had been difficult to sell in normal times and focus on high-quality used vehicles and stick to price for those,’ says Dr Christof Engelskirchen, Chief Economist of Autovista Group. Patience will be required as we see that activities at dealers are not at the pre-lockdown level. There is still 20%-40% less activity in new used car advertisements across Europe as dealers are still selling off existing stock and there is a reduced supply of used cars coming in.

Digitally enabled buying

One of the most annoying things when shopping for a car is the haggling for the best price. The expectation of many customers is that the price published on a web portal or the dealer website is a ballpark figure. This strategy was time-consuming before the pandemic. Now it is excessively so. Dealers will not be able to sell like this. We now need more efficient, digitally enabled shopping experiences.

Leasing, financing and other benefits

It is likely that we will see some pent-up demand over the coming weeks, but it is also possible that consumers could be reluctant when it comes to making longer-term financial commitments like those associated with a traditional vehicle purchase. There are powerful and smart ways to avoid highlighting discounts: dealers should focus their attention on offering excellent leasing and financing conditions. Discounts can be incorporated via free service components, 0% financing, no down-payments or delaying the first instalment by several months. There may be other impactful ways for dealers to offer a benefit without talking discounts, e.g. an extended right to cancel the contract or shortened leasing periods.

Used car leasing and car subscriptions

In periods of economic uncertainty, flexibility is key. Long-term financial commitments are challenging to obtain. We are already seeing a surge in demand for used car leasing and subscription models, and there are several start-ups and incumbents in this line of business. These business models, if dealers adopt them, would help soften the crisis during this transitional period. Individually, dealers and dealer groups can think about creating attractive offers for smaller businesses and fleets. What is a company with five to 10 company cars looking for? How can you offer financial flexibility to these businesses?

E-commerce as a response to an anticipated second wave of the pandemic

The coronavirus pandemic has painfully proven that the lack of digitisation of the automotive sales and marketing value chain is a burden that the industry must overcome. In the absence of access to shops and dealers, customers have focused their attention on e-commerce. An omnichannel strategy will be more resilient than other single-channel strategies in the future.

‘It is beneficial to look at markets like the Netherlands or the Nordics and see what can be copied. They are more active in the digital space. This will be crucial not only when considering a possible second or third wave of the pandemic,’ claims Roland Strilka, Director of Valuations at Autovista Group.

Dealers need to work on an inclusive strategy, which conserves the achievements of physical reach and network coverage. Both are crucial ingredients for addressing customer needs, irrespective of the business model.

Mergers and partnerships

Mergers and partnerships continue during the crisis, e.g. the FCA-PSA merger is on course for completion before the end of Q1 2021. But there is always a risk that stakeholders fear that the valuation will differ post Covid-19. So far, share prices are down 45% for both companies.

Meanwhile, VW and Ford are moving ahead with technology sharing around electric and self-driving to save costs.

Coronavirus scenarios – how swiftly will economies recover?

In our ambition to support analysis of the impact of the coronavirus on the automotive industry, we have developed a number of scenarios. The scenarios are based on risks associated with the following five mandatory parameters, as well as other country-specific factors that influence RV development:

- How long until the spread of infections is contained;

- The economic outlook for 2020, 2021 and 2022;

- On the supply side, expected issues in the supply chain for new car production;

- On the demand side, development of private consumption over the coming years; and

- An assessment of how effectively fiscal and monetary policy measures are working.

Views on the economy darken

Since the publication of previous versions of this report in May and June 2020, the view of the crisis and its economic impact has darkened. Before the lockdown, forecasts of GDP growth were around 2% for 2020 globally and slightly below 1% in the Eurozone – an outlook that had already been depressed compared to January and February baselines.

Over recent months, economic forecasts have been declining. They continue to decline but more gradually over the past 30 days than during the months before. They seem to be bottoming out at low levels.

For Global GDP development, Moody’s has reduced its 2020 outlook from -4.5% to -4.8%. The IMF is slightly more positive; other institutes are more negative. ‘Existing statistical models fail to provide consistent economic forecasts under the current conditions, in particular due the unknown impact of the many variables around the pandemic,’ according to Christof Engelskirchen. One of the biggest economic concerns relates to a second or third wave of the pandemic, which could have a lasting impact on consumer spending. The re-emerging conflict between China and the US may create further economic pressure.

Stock markets on the other hand are more positive in assessing the current situation. They look beyond this and next year towards the longer-term earning potential but are susceptible to volatile swings, should more news that is negative emerge. We have seen some drops in share prices during June.

For the Eurozone, Moody’s confirms a GDP contraction of around 7% in 2020 and a substantial but still only partial recovery in 2021 (+4.5%). The IMF forecasts at similar levels, -7.5% in 2020, in its April assessment. Forecasts for the UK have worsened to -8.3% (from -7.4%) for 2020 (Moody’s). There are worse scenarios than these, but all research institutes signal that forecasts are just ballpark estimates at this stage. There is too much uncertainty around how big and long a post-pandemic economic crisis might be.

Governments and authorities, such as France and the EU, have put a lot of emphasis on lifting bans on manufacturing and returning as many people as possible back to work. Tourism, travel, leisure and events will continue to be affected. There is a likelihood that this will have a more sustained effect on the demand side and private consumption. That is why we could expect a w-type recovery, i.e. a second dip towards the end of the year after a temporary recovery phase in Q3 brought on by the release of pent-up demand. Whether this ‘w’ will be very pronounced, depends a lot on how successful the current infection containment measures prove to be. The only true solution would be a breakthrough in the quest for a vaccine or an effective treatment.

Most likely scenario: ‘medium risk’

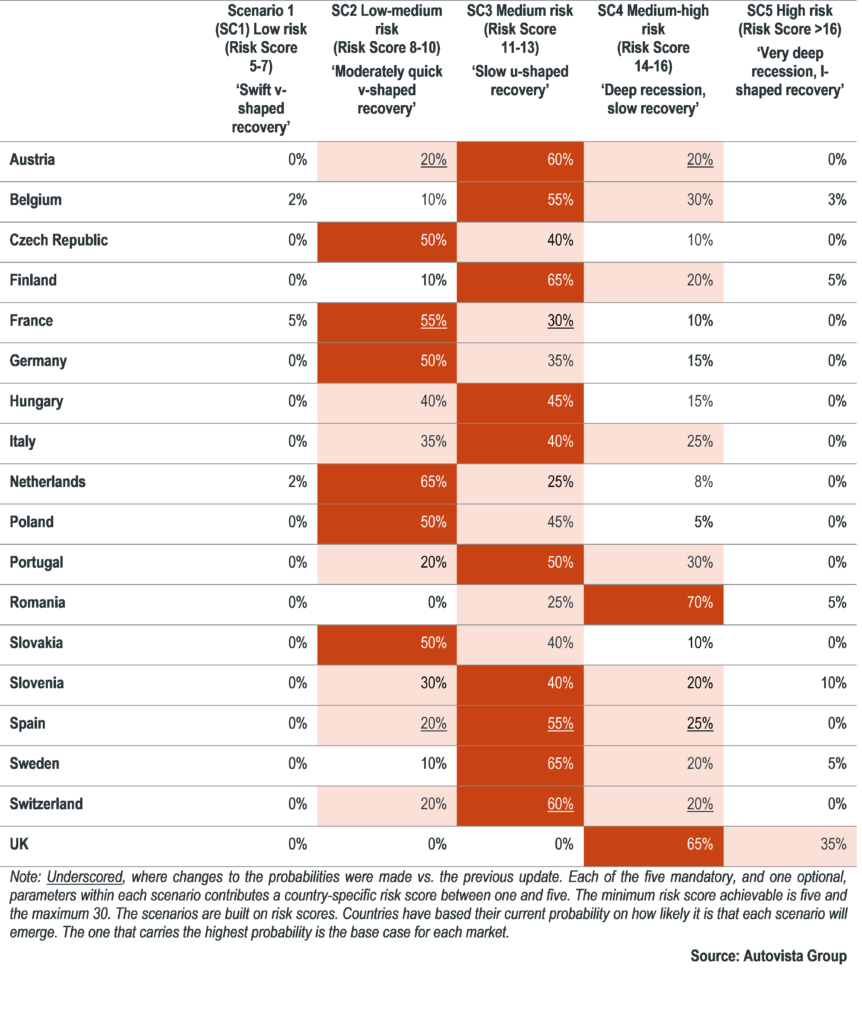

Most markets have confirmed their expected risk scenario. 10 of 18 markets assign the highest risk to scenario 3, ‘medium risk: slow u-shaped recovery’ (see Table 2).

According to João Areal, Editorial Manager at Autovista Eurotax Portugal: ‘Almost 1 million employees are in furlough or have been laid off, resulting in a severe reduction in salaries. The recession will be longer, and recovery will not be v-shaped but u-shaped.’

Hungary has confirmed equal probabilities of scenario 3 and the more positive scenario 2 (40% likelihood). Zsolt Horvath, Operations Manager, Eurotax Hungary explained: ‘Hungary has been in ramp-up since the third week of May. A key factor for the future is the expected weak Forint against the Euro, which will put pressure on new car sales. In the best-case scenario, new car sales will drop by 20-25%. Pressure on used car prices may be lower than initially expected.’

Belgium also confirms scenario 3. ‘We see the pressure on prices building up. Dealerships only opened at the end of May. We expect a drop in new car sales activities by around 20% in 2020, with the latest projections targeting 450,000 registrations in 2020 vs. 550,000 in 2019,’ says Idesbald Vanniewenhuyze, Executive Chief Editor Benelux. ‘Belgium is highly dependent on economic revival from surrounding countries’ he continues. ‘The country still has no government, for more than a year, making quick decision taking unlikely’.

Romania and the UK still present the most pessimistic outlooks in this line-up. 70% and 65%, respectively, are the probabilities for scenario 4: ‘Deep recession slow recovery’. ‘Various institutes calculate the GDP drop for Romania in 2020 at between -6% and a rather disappointing -9%. More than 30% of Romania’s GDP comes from recreation, retail, food and accommodation and these sectors are most affected. The gradual relaxation of lockdown measures announced for June include reopening of restaurants as well as announcing new measures that allow summer tourism to take place, albeit under stricter rules than usual,’ says Ulmis Horchidan, Chief Editor at Autovista Romania.

The UK confirmed its scenario and continues to be the only country that is currently allocating a substantial risk of 35% to our scenario 5: ‘Very deep recession, l-shaped recovery’. The combination of the negative economic consequences of the pandemic and Brexit are behind this gloomy outlook. Anthony Machin, Head of Content and Product, Glass’s said: ‘Increasing redundancies in parallel to the entry into a likely severe recession is starting to wobble the British people’s resolve. Dealers in England re-opened from 1 June but demand for used cars will take longer to recover than initially forecast.’

V-shaped recovery still possible?

Not every market will be equally affected, and some may be able to recover more swiftly. Poland confirmed its view that it may emerge out of the crisis more successfully than many other markets in Europe. ‘Market participants have been active in preparing special programmes to support demand. After a bigger decrease of demand in March and April, we should expect a phase of recovery,’ according to Marcin Kardas, Head of the Editorial Team at Autovista Polska. ‘Currently, we can observe quite a good level of demand for new vehicles, especially for premium makes, but the big jump in official sales figures we saw at the beginning of June is due to postponed registrations from previous months. The situation is still volatile and real picture of the market should take shape after the holiday season’.

Germany has started a ramp-up phase, so far with moderate success. Head of Valuations & Insights at Schwacke, Andreas Geilenbrügge, reduced last month’s outlook, being critical about the German stimulus package that has been announced: ‘The government-funded stimulus package, effective July 1, will negatively impact residual value development. Doubled incentives on BEVs/PHEVs as well as a temporary VAT drop will lower the transacted price levels especially on the electrified used cars. ICE vehicles will also be affected as OEMs have started to react with discounts already in advance of the VAT effective date. Therefore, our outlook for 2020 and 2021 comes down.’

For Belgium, S1 2020 registration figures show a drop of 20% compared to 2019 – mainly driven by orders placed during the Brussels Motor Show, company car registrations and pre-summer sales – while private consumer demand has not yet recovered.

The Netherlands, Czech Republic and Slovakia confirm scenario 2. The Dutch market, according to Nico Vanhalst, RV Manager, Eurotax Nederland ‘has been transforming into a market with many electric vehicles. There is still too little supply and thus less pressure on RVs. In addition, the sale of electric vehicles (new and used) will be financially supported in 2020 by the Dutch government with a subsidy of €4K for new cars, €2K for used cars. This subsidy counts only for private purchases and private leases’.

A notable change happened in our assessment for France: we moved from the medium risk scenario 3 to the low-medium risk scenario 2. ‘The government stimulus package, effective as of June 2020 with a total budget of €6 billion, has the potential to soften any impact on residual values. New car and used car buyers benefit and in particular those with lower incomes,’ according to Yoann Taitz, Operations and Valuations Director, Autovista France.

Table 2: Risk scenarios for the impact of coronavirus

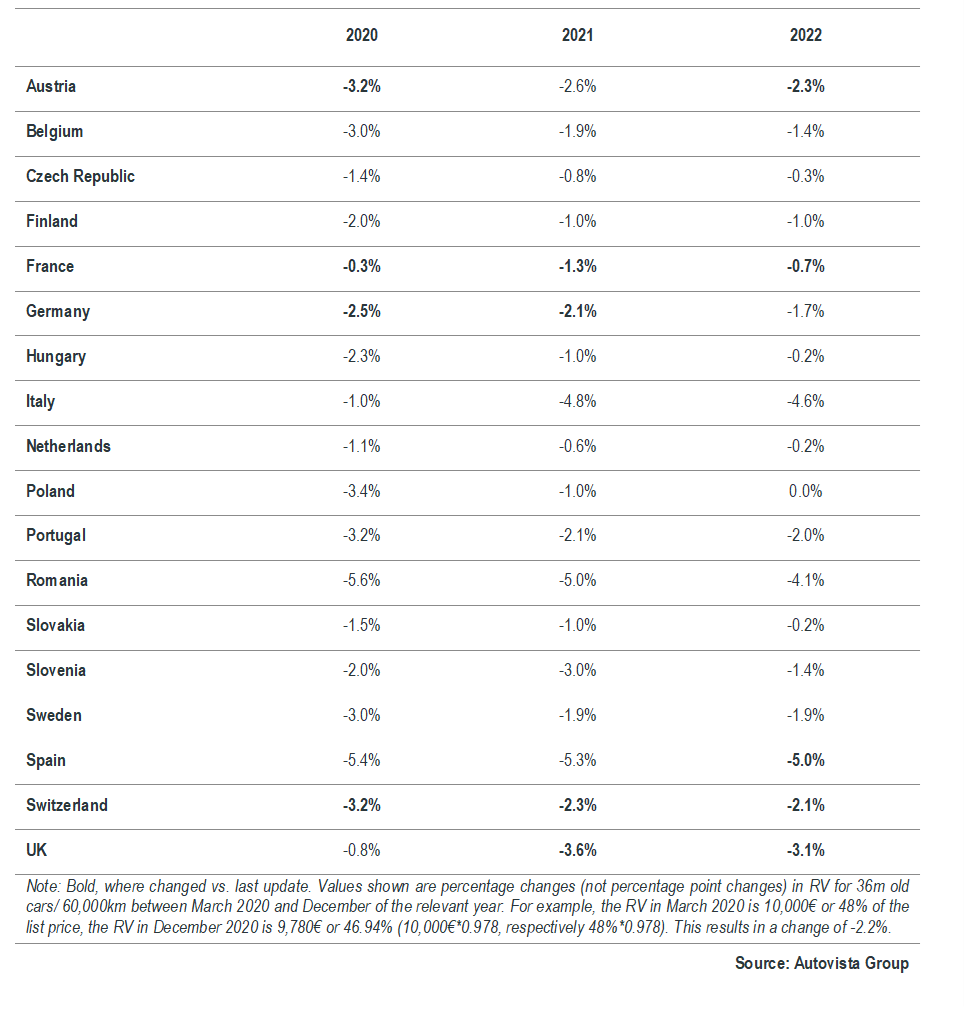

Impact on residual values

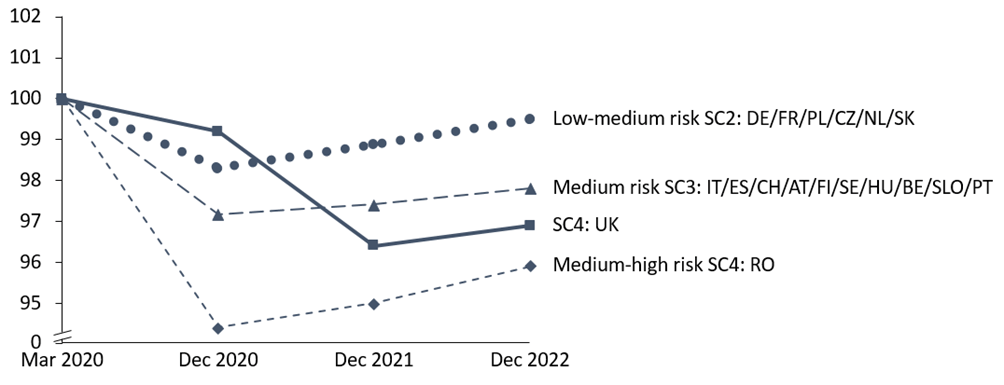

The impact on residual values depends on the most probable scenario and country-specific circumstances. Figure 3 shows the residual value development by scenario cluster, unweighted and indexed. Countries have been allocated to the scenario cluster according to their highest-probability scenario. The more optimistic views in Poland, Germany, Slovakia, the Netherlands, Czech Republic and now France anticipate a more moderate decline in RVs of around 2% towards the end of 2020 and then a relatively swift recovery.

The majority of countries assign a higher probability to the medium risk scenario, which describes a drop in RVs that may extend beyond the end of 2020 and a prolonged recovery phase. Towards the end of 2022, used cars will – on average – still trade around 3% lower than in March 2020.

Romania, confirming a more pessimistic view in this update, anticipates a steeper drop towards the end of 2020 – by more than 5% – and no full recovery by end of 2022.

The outlook for the UK has darkened since our June update. According to Anthony Machin, ‘compared to March 2020, we will see a slight drop still this year, but pent-up demand will lower the impact. The biggest impact will be in 2021 with values trading 3.6% lower than March 2020. The combined effect of the economic stress caused by Covid-19 and the high probability of a no-deal Brexit will stress the economy and private demand.’ In 2022, the UK will continue to see RVs perform at lower levels than in March 2020 (-3.1%).

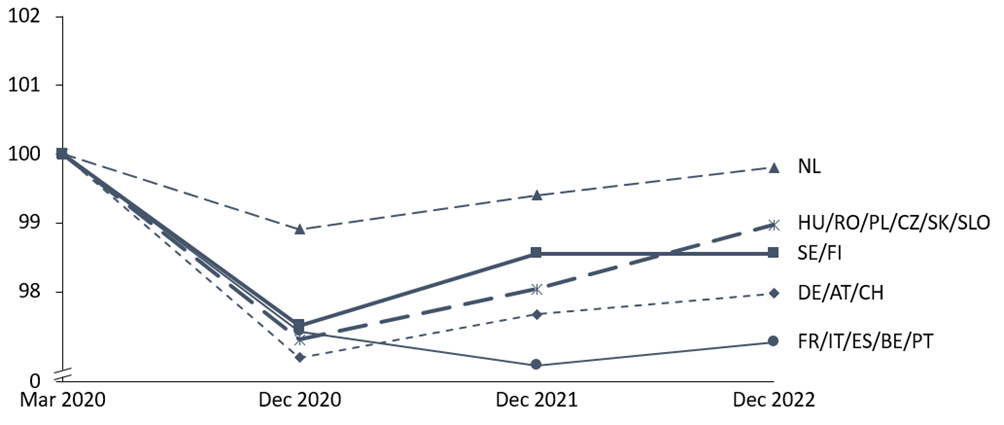

Sorted by country cluster (Figure 4), it becomes apparent that Southern Europe (we include France and Belgium), will be impacted the longest and anticipate the worst impact.

In Austria, Germany and Switzerland, we see a quicker recovery, driven in particular by the still slightly more optimistic view for Germany.

The Eastern European cluster, consisting of Hungary, Romania, Poland, the Czech Republic, Slovakia and Slovenia, shows a more elastic development.

The Nordic region, represented by Sweden and Finland, is most elastic in its recovery but to lower levels until 2022. ‘Towards the end of March and beginning of April we could observe drops in the used car prices in Sweden and Finland and growing stock levels at dealerships. Around the end of April and beginning of May the prices stabilised,’ according to Johan Trus, Head of Data and Valuations Nordics at Autovista. ‘The lower new car registrations and the weak Swedish currency are two factors that will help to keep used car prices from dropping more in the near future’.

Figure 3: Used car price development by scenario cluster; UK separated out (indexed)

Note: These clusters represent unweighted averages of countries and do not represent country-specific forecasts. Please refer to Table 3 for the country-specific forecasts. Source: Autovista Group

Figure 4: Used car price development by regional cluster (indexed)

Note: These clusters represent unweighted averages of countries and do not represent country-specific forecasts. Please refer to Table 3 for the country-specific forecasts. Source: Autovista Group

Italy expects the biggest hit on used car values to occur in 2021, after a more moderate decline in 2020. The supply shortage of new cars in 2020 should soften the blow. The full effect of the crisis should be visible during 2021. Italy has been particularly exposed to the coronavirus pandemic, turning into a full-blown economic crisis that will affect private demand for used cars for a longer period. Italy confirms its assessment vs. the previous update of this whitepaper.

For this update, France has increased the 2020-2022 outlook for RV impact. There should hardly be any drop in RVs in 2020 (see Table 3), given the strong and impactful incentive scheme, which makes new and used car buying more attractive as of June 2020. The scheme – and that is different from the scheme implemented for example in Germany – is targeted in particular at the middle class and those with lower purchasing power, covers ICE as well as electric vehicles and applies to buying new cars as well as used cars. ‘We are observing slight price increases already at dealerships that currently benefit from higher demand and lower supply,’ says Yoann Taitz, Operations and Valuations Director, Autovista France.

For Austria and Switzerland, we expect the biggest impact on RVs still in 2020. RV outlooks have been updated and lowered slightly. Almost three years into the economic crisis, by the end of 2022, residual values will still trade on average more than 2% lower than in March 2020. Robert Madas, Valuations and Insights Manager for the two markets comments: ‘The price decreases in the used car markets in Austria and Switzerland have been moderate so far because of pent-up demand after the lockdown. Some vehicle categories recently even show an increasing trend. However, in both markets we expect to see price decreases in the near future due to a reduced purchasing power and the suppressed economic outlook.’

For Belgium, we expect a downwards correction by the end of 2020, of 3% on average. Used car prices will stabilise around 1.9% lower than March 2020 levels in 2021 and remain at a slightly depressed level in 2022. ‘These are the anticipated average changes but there are substantial differences to be expected between segments,’ according to Idesbald Vannieuwenhuyze.

‘Different factors are at play here. The taxation scheme change planned in 2021 will encourage the switch to a new car. Therefore, the RVs of young used cars, up to 24 months in age, will suffer. Discounts offered during the January Brussels Motor Show have put pressure on prices. More significantly, the Belgian car market is particularly influenced by overseas government policies and discounts. Belgium imports nearly 12% of its vehicles (of which 45% are less than 24 months old), and overseas factors will directly impact the RVs of as much as 16% of the market. A decline in used car prices abroad will impact us, too. For older vehicles, over 36 months, we should see a lesser market correction. And for cars in the €5-4 category, we may even see even a stabilisation, as these vehicles remain important ‘budget’ alternatives in this market.’

Table 3: Forecast percentage change in residual values EoY vs. March 2020

Germany sees the biggest drop in RVs occurring in 2020 (-2.5%). There will be almost no recovery in 2021 and then RVs will stabilise in 2022 at a level down by 1.7% compared to March 2020 values. The expectation is that Germany will come out of the crisis more swiftly as private consumption will support the economy, but the incentive scheme effective 1 July 2020 adds pressure to residual values.

Spain has also confirmed its more negative view on used car market development. But it extends the recovery period. Spain expects to see a substantial drop in RVs still in 2020 of 5.4% compared to March 2020 values and that drop will remain stable in 2021 and 2022. One of the main reasons is the very strong RV performance in Spain during the past few years. The downward correction will therefore be more pronounced.

According to Ana Azofra, Valuation & Insights Manager at Autovista Spain, ‘Regarding the impact on RVs we stand by the previous predictions for 2020 and 2021, as the accumulation of stock has been partially offset by the shutdown of production and the new bonus plan will boost sales of new and very young used vehicles: the ones registered in 2020. Part of the discounts we are experiencing these days could be absorbed by the support plan. However, we understand that the pressure on prices will not only continue but will also be extended over time. That is why we have reduced the expectation of recovery in 2022.’

Conclusion

This is the third update to our analysis of the impact that the coronavirus will have on societies, the economy and used-car markets.

The impact of the economic crisis on RVs will be felt differently depending the circumstances in individual countries. Autovista Group expects a sharper drop in RVs in the Southern European countries, in some around 5-6% at the peak of the crisis. In Austria, France, Germany, the Netherlands, Switzerland and the Nordics, the regions will not be hit as hard, based on the current risk assessment. A more elastic recovery could be anticipated in Eastern Europe, in particular the Czech Republic, Poland and Slovakia.

During the 2008/2009 financial crisis, we saw falls in RVs that were substantially higher than currently forecast in our most probable scenarios. At the time, declines of 12% on average across segments built up over 12-18 months into the crisis.

We are currently far from expecting this level of impact on used car markets, as indicated in our risk scenario probabilities and RV forecasts.

Several things have now changed: Eurozone governments have taken much stronger policy actions against the collapsing demand, the current economic shock is not paired with a lack of financing opportunity and after the peak of the crisis, we should see some pent-up demand as private consumers perceive the shock as temporary.

There are some positive signs emerging. For example, ramp-up phases in Austria and Germany have been running smoothly so far. Moreover, the numbers of daily infections appear to be easing in the most affected European markets. However, the US, South America and many developing countries are at risk of easing the lockdown too fast and too early.

On the negative side, we observe discussions around government-funded vehicle incentive schemes that may put further pressure on used car prices, if they are ill designed.

We will continue to update this analysis on a monthly basis and see how assumptions and scenarios evolve and how quickly and extensively the used-car market adapts.

Author

- Dr Christof Engelskirchen, Chief Economist, Autovista Group

Analysts and Contributors

- Hans-Peter Annen, Chief Editor, Autovista Switzerland

- João Areal, Editorial Manager, Autovista Eurotax Portugal

- Ana Azofra, Valuation and Insights Manager, Autovista Spain

- Dejan Butinar, Country Manager, Eurotax Slovenia

- Andreas Geilenbrügge, Head of Valuations and Insights, Schwacke (Germany)

- Ulmis Horchidan, Chief Editor, Eurotax Romania

- Zsolt Horvath, Operations Manager, Eurotax Hungary

- Marcin Kardas, Head of Editorial Team, Autovista Polska

- Anthony Machin, Head of Content and Product, Glass’s (UK)

- Robert Madas, Valuations and Insight Manager Austria & Switzerland, Eurotax

- Marco Pasquetti, Forecast and Data Specialist, Autovista Italy

- Yoann Taitz, Operations and Valuations Director, Autovista France

- Johan Trus, Head of Data and Valuations Nordics, Autovista

- Roland Strilka, Director of Valuations, Autovista Group

- Nico Vanhalst, RV Manager, Eurotax Nederland

- Idesbald Vannieuwenhuyze, Chief Editor and Valuations Manager, Autovista Benelux