Huge growth for EV manufacturers, others left in the dust

10 December 2019

10 December 2019

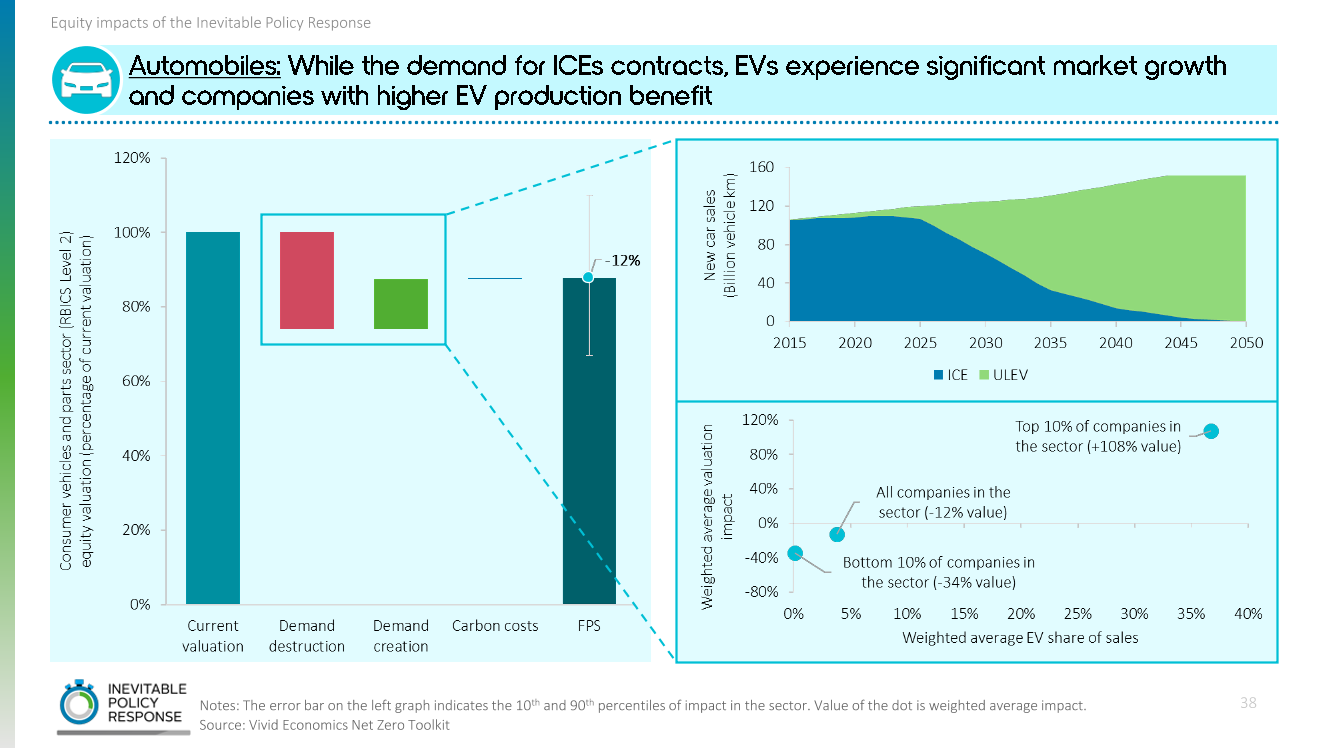

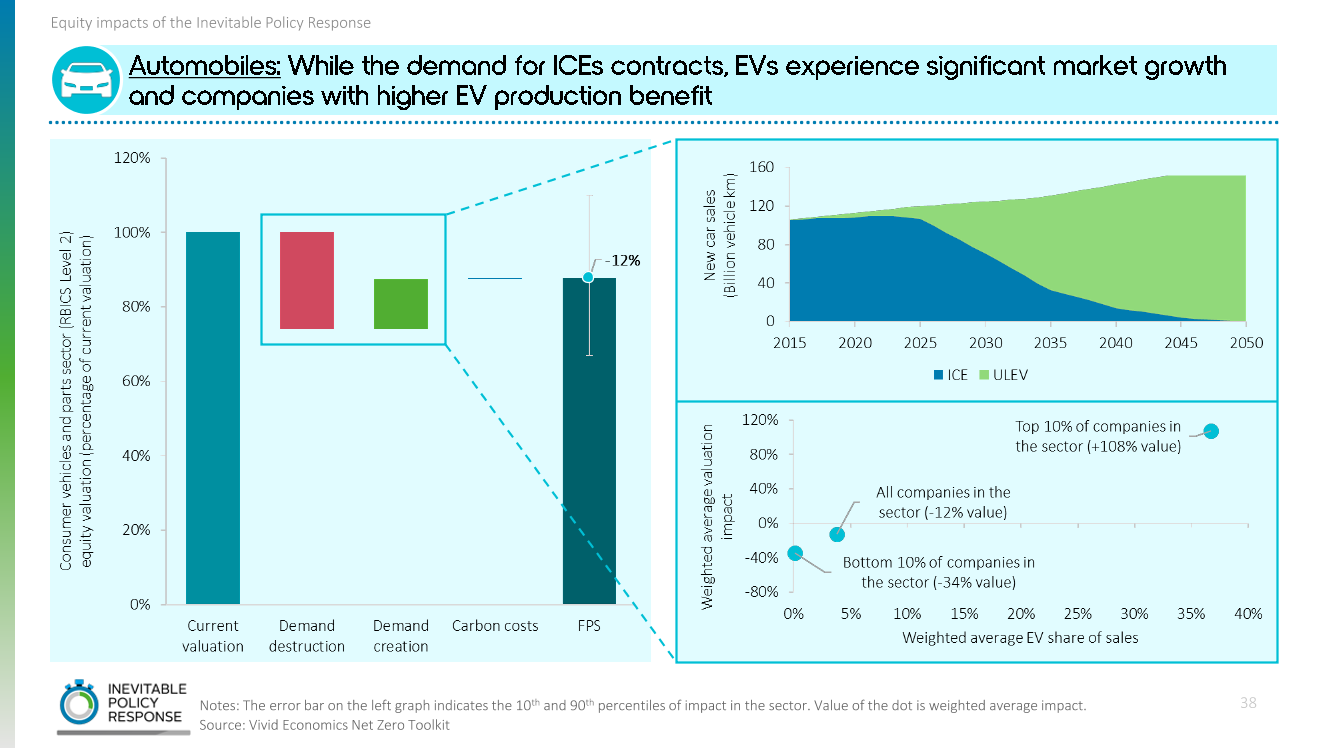

New multi-sector analysis has highlighted automotive manufacturers that make the highest investment in electric vehicles (EVs) will see a 108% rise in value, those that don’t will suffer. The findings are part of forecasts suggesting that abrupt and disruptive policy response to climate change will cause re-pricing of many the world’s most valuable companies by 2025.

Switching to ultra-low emission vehicles (ULEVs) is one of the forecasted policies that will have the greatest financial impact, says the report, and will have an impact on green minerals demand creation.

The economic analysis was conducted by The Inevitable Policy Response (IPR), a consortium which includes Vivid Economics, Energy Transition Advisers and the UN-supported organisation, Principles for Responsible Investment, and others.

Demand destruction dominates

Demand destruction and demand creation is evident in the automotive sector and affects different products, says the report. Demand destruction has a greater impact overall because the majority of businesses studied in the index have a high internal combustion engine (ICE) share in production and are just starting to ramp up EV production.

A spokesperson for the Society of Motor Manufacturers and Traders said: ″Vehicle manufacturers and suppliers are investing vast sums in ultra-low and zero emission vehicles to help meet the same environmental goals. [Now] we need the right conditions to encourage investment, innovation and a competitive market. This must include giga-scale battery production and electrified supply chains, massive skills and infrastructure investment and long-term incentives to help companies and consumers make the shift sustainably.″

With sales of ICE vehicles expected to hit zero in 2050, sales of EVs will experience significant market growth, making up almost 70% of passenger vehicles by 2040. In value terms, this means that the best-performing 10% of car manufacturers will experience 108% upside, and produce on average 37% of EVs, says the report.

In contrast, the worst-performing 10% of car manufacturers – which do not have an EV pipeline – are forecast to experience 34% downside.

The report finds that the weighted average impact across all car manufacturers is therefore a negative one of -12%.

Source: IPR

There is increasing collaboration in the automotive industry to produce electric vehicles, the most recent example being General Motors and LG Chem, who are joining forces on EV-battery production. Also consumers are turning increasingly to means that will align with climate-change efforts. More than 50% of global consumers are willing to consider buying an electric or hybrid vehicle when they next purchase a car, according to a just-published report by OC&C.

Source: IPR

There is increasing collaboration in the automotive industry to produce electric vehicles, the most recent example being General Motors and LG Chem, who are joining forces on EV-battery production. Also consumers are turning increasingly to means that will align with climate-change efforts. More than 50% of global consumers are willing to consider buying an electric or hybrid vehicle when they next purchase a car, according to a just-published report by OC&C.

Source: IPR

There is increasing collaboration in the automotive industry to produce electric vehicles, the most recent example being General Motors and LG Chem, who are joining forces on EV-battery production. Also consumers are turning increasingly to means that will align with climate-change efforts. More than 50% of global consumers are willing to consider buying an electric or hybrid vehicle when they next purchase a car, according to a just-published report by OC&C.

Source: IPR

There is increasing collaboration in the automotive industry to produce electric vehicles, the most recent example being General Motors and LG Chem, who are joining forces on EV-battery production. Also consumers are turning increasingly to means that will align with climate-change efforts. More than 50% of global consumers are willing to consider buying an electric or hybrid vehicle when they next purchase a car, according to a just-published report by OC&C.