Insight: Diesel RV retention rates fall further across the EU5

24 May 2018

24 May 2018

Residual values (RV) across the EU5 remain broadly stable even though demand for used cars struggles to keep pace with the increasing supply. The situation for diesels, however, is completely different: over the last 12 months, residual values have fallen in all EU5 markets[1]. Petrol values have gained ground in three out of five markets, Spain and Italy being the exceptions.

The percentage point (pp) difference between diesel and petrol has eroded further over the last twelve months in all EU5 markets except Spain, where it widened slightly by 0.3 pp. The diesel advantage over petrol in both Germany and the UK in April 2018 stood at just 0.1 pp and 1.2pp in France. In Spain the difference stood at 3.4 and in Italy it was 8.7pp, although this is down from 9.7 pp just 12 months ago. As expected, the values are converging in the markets where pressure on diesels has been particularly intense – namely the UK, France and Germany.

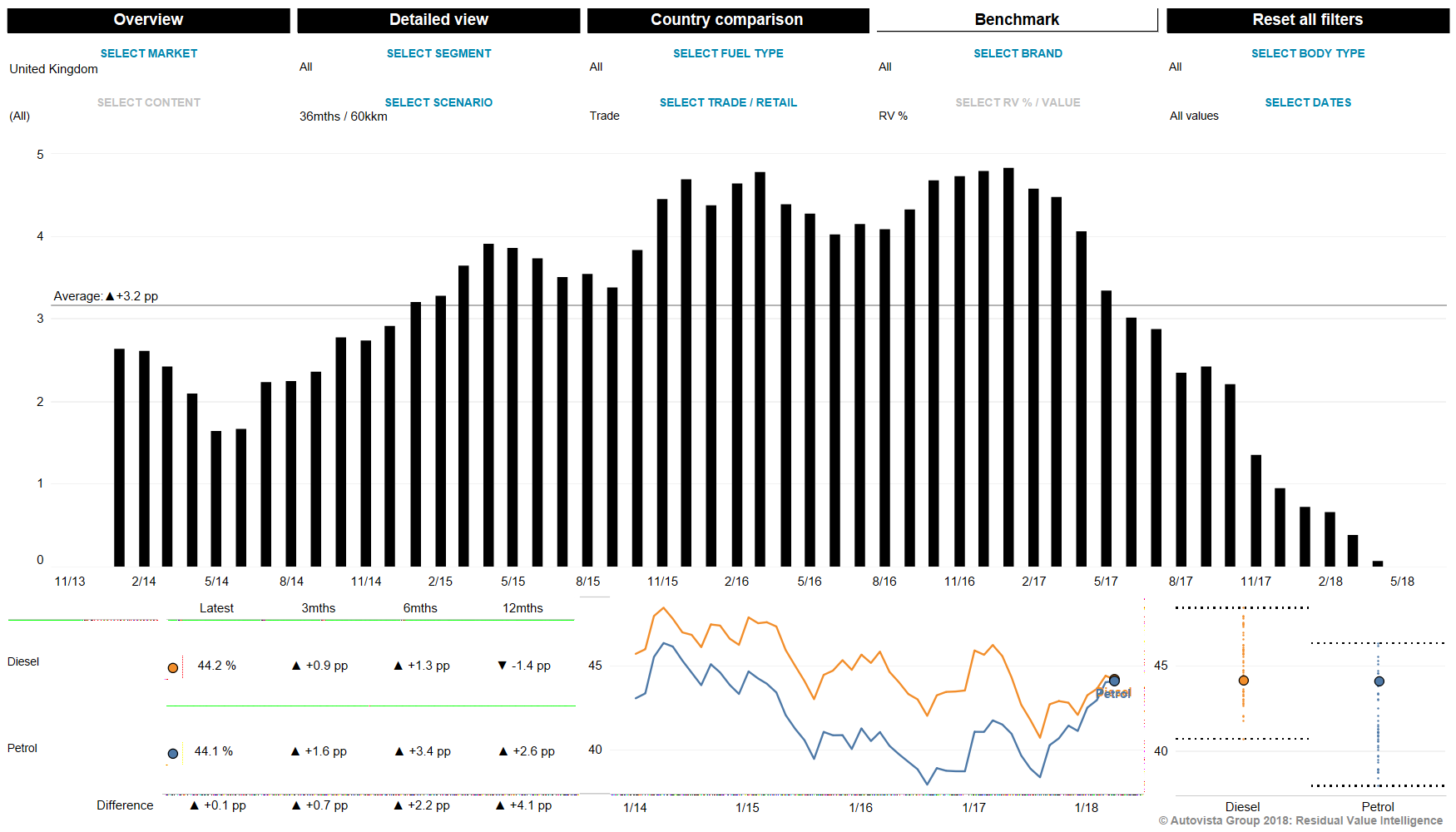

The UK has experienced the greatest narrowing of petrol and diesel residual values over the last 12 months, with the 4 pp advantage of diesels in April 2017 reduced to just 0.1 pp in April 2018. The negative media coverage of diesel in the UK has had a significant impact, which has undoubtedly been compounded by the fact that the UK is the only EU5 market where diesel costs more at the pump than petrol. Values are under acute pressure in the UK as used car demand has suffered the greatest contraction in the EU5 so far in 2018 (down 4.8% in the first quarter) and ongoing economic weakness and political uncertainty surrounding Brexit continue to weigh heavily on both new and used demand. The latest outlook from Glass’s, the UK division of Autovista Group, forecasts a 1% reduction in values in 2018 and 2019.

UK petrol vs diesel trade residual values (in %), 36 months/60,000km, January 2014 – April 2018

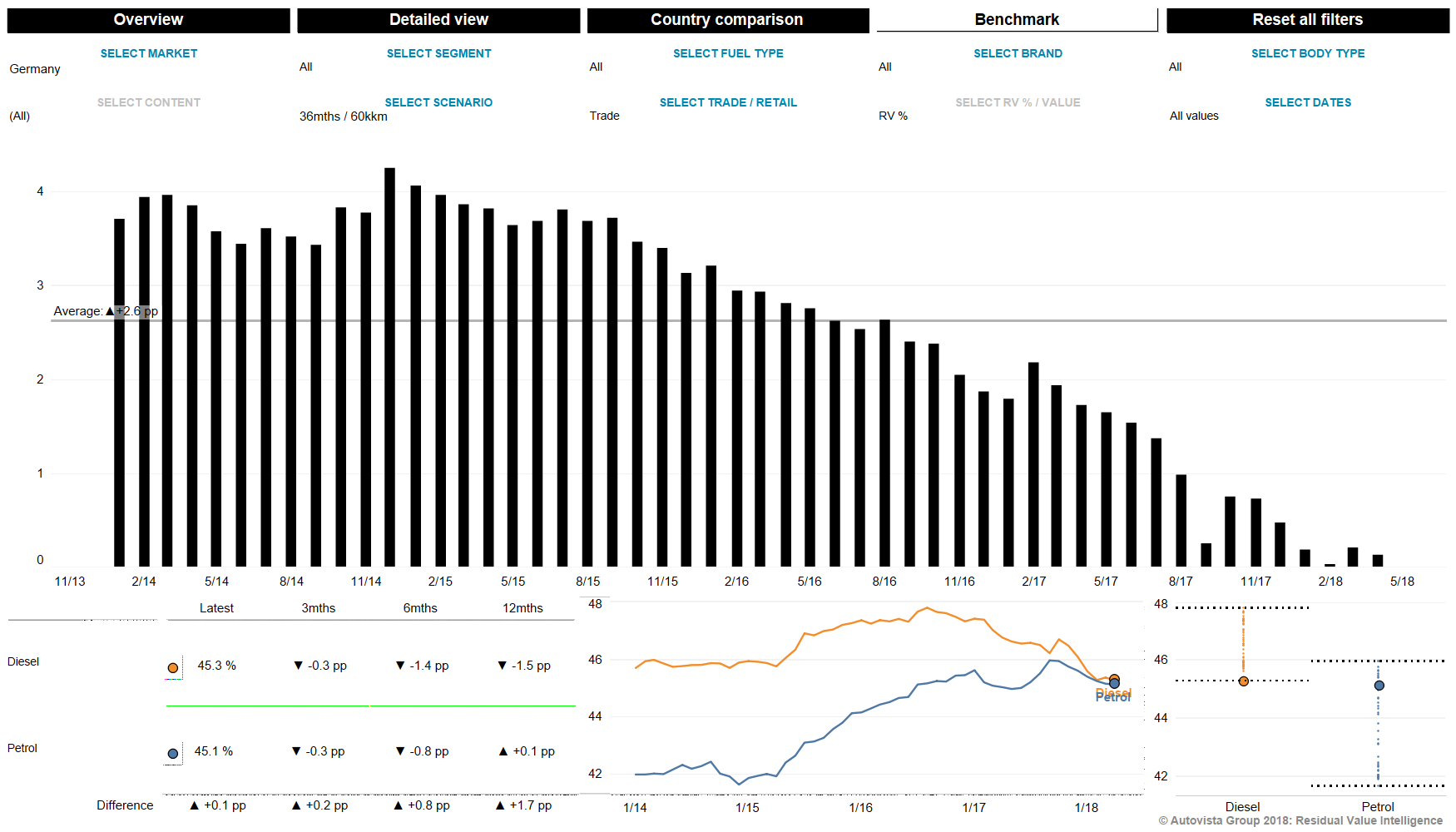

Following healthy growth in 2015 and 2016 and stability in 2017, German residual values are now starting to struggle. Petrol values have shown a consistent trend of growing at a quicker rate than diesels since 2014. The diesel advantage is now just 0.1 pp (the same as in the UK), and diesels are now on the cusp of retaining less of their new value than their petrol counterparts. Despite the tarnished image of diesel in Germany, the convergence has been slower than in the UK, with the gap narrowing by just 1.6 pp over the last 12 months compared to 4pp in the UK. Overall, values are forecast to decline by 1% in 2018 and 2019 but diesel values will be increasingly challenged as the likelihood of driving bans grows. In fact, at the time of writing, the city of Hamburg has already put up around 100 signs in preparation for a ban in two streets that will take effect from 31 May. Looking ahead, residual values are forecast to hold steady for most fuel types in Germany but the 1% fall in diesel residual values in 2018 and 2019 is dragging down the overall outlook.

Germany petrol vs diesel trade residual values (in %), 36 months/60,000km, January 2014 – April 2018

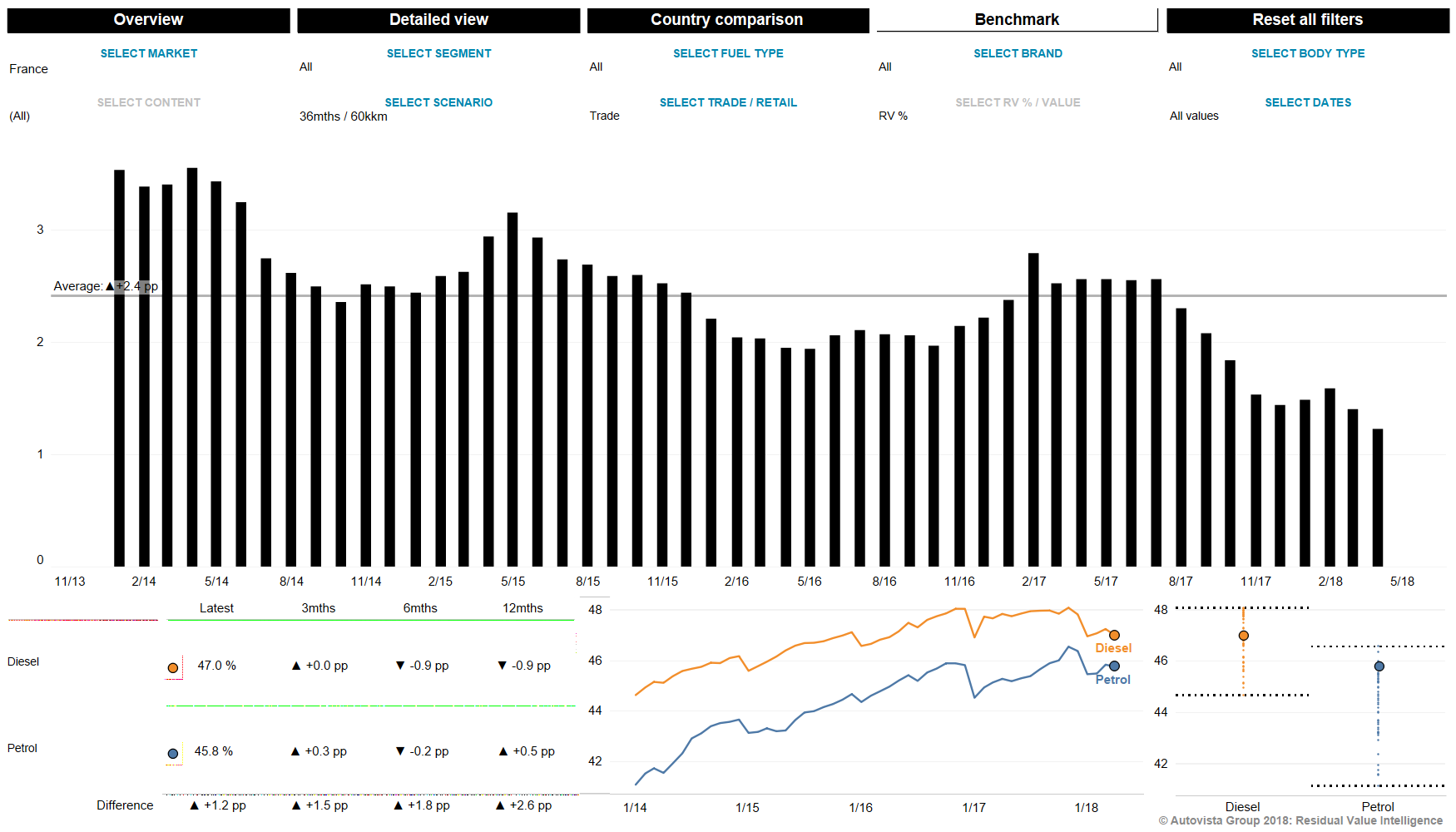

Over the last 12 months in France, diesel residual values have fallen by almost 1pp with petrol values gaining just 0.5pp. Accordingly, the gap between diesel and petrol values narrowed from 2.6pp to just 1.2pp in April 2018. The diesel RV advantage has especially eroded since July 2017 following the announcement by the French Government that tax on diesel fuel would be increased to bring it closer in line with that of petrol. In fact, the price advantage of diesel at the pump in France is now €0.08 compared to an average of €0.15 in 2017. Looking ahead, legislation will continue to weigh heavily on diesel and whereas petrol values are forecast to increase by 1% in 2018 and 2019, diesel values will merely hold steady.

France petrol vs diesel trade residual values (in %), 36 months/60,000km, January 2014 – April 2018

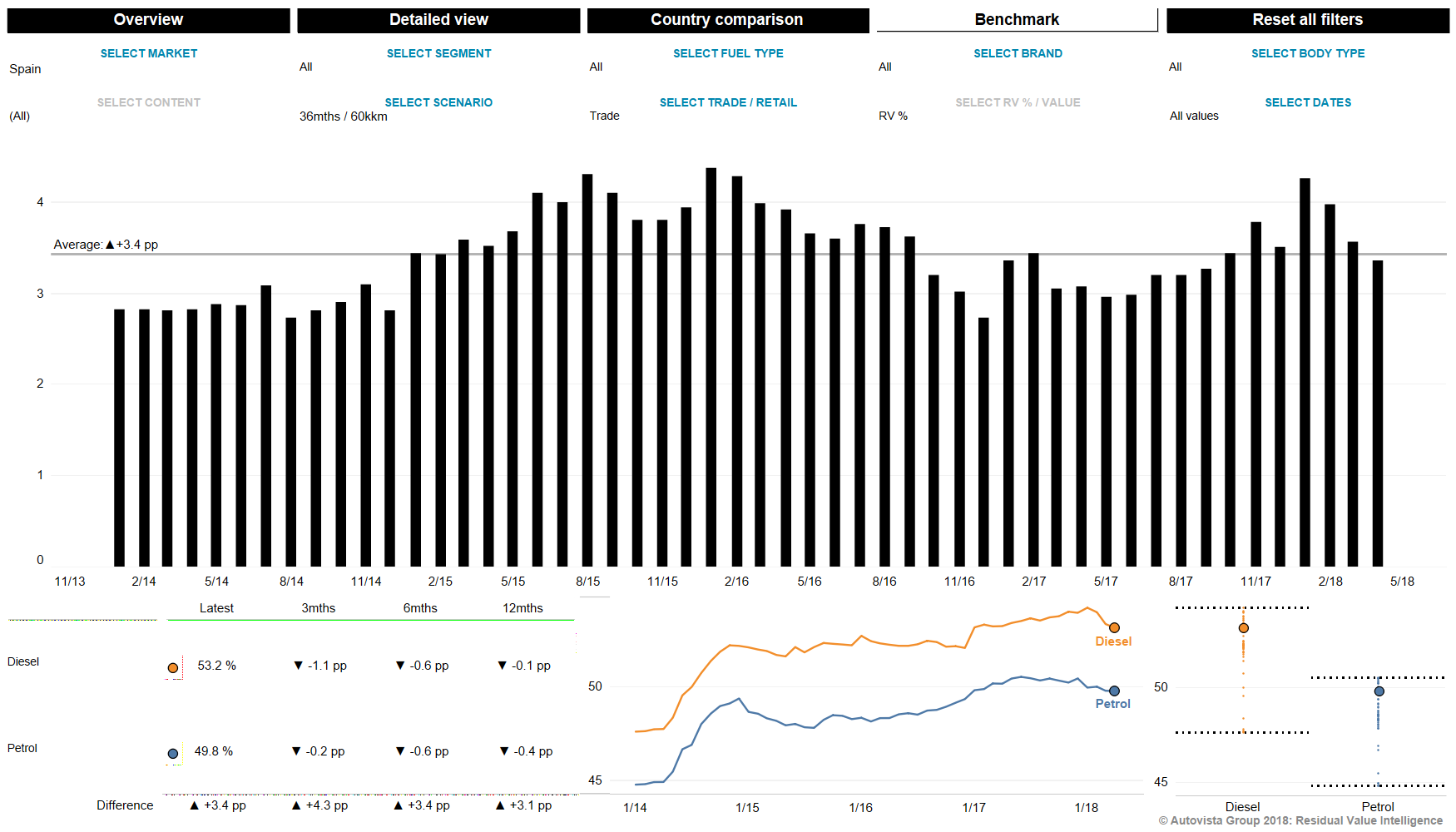

Spain is unique among the EU5 as used car demand continues to rise in 2018: change of ownership is up 8% year-on-year in the first four months according to data from DGT, the Spanish transport authority. This is naturally easing the pressure on residual values, including diesels, more than in the other EU5 markets. Consequently, the decline in the diesel share of the new car market is still not yet mirrored in residual value performance as supply remains constrained, even for diesels, after years of poor new car sales by historic standards. The situation is changing in Spain now too though as the diesel advantage narrowed from four percentage points in January to three percentage points in April. The latest Autovista Group outlook calls for diesel values to fall by 2% and 3% respectively in 2018 and 2019, whereas values are forecast to remain stable overall in both years.

Spain petrol vs diesel trade residual values (in %), 36 months/60,000km, January 2014 – April 2018

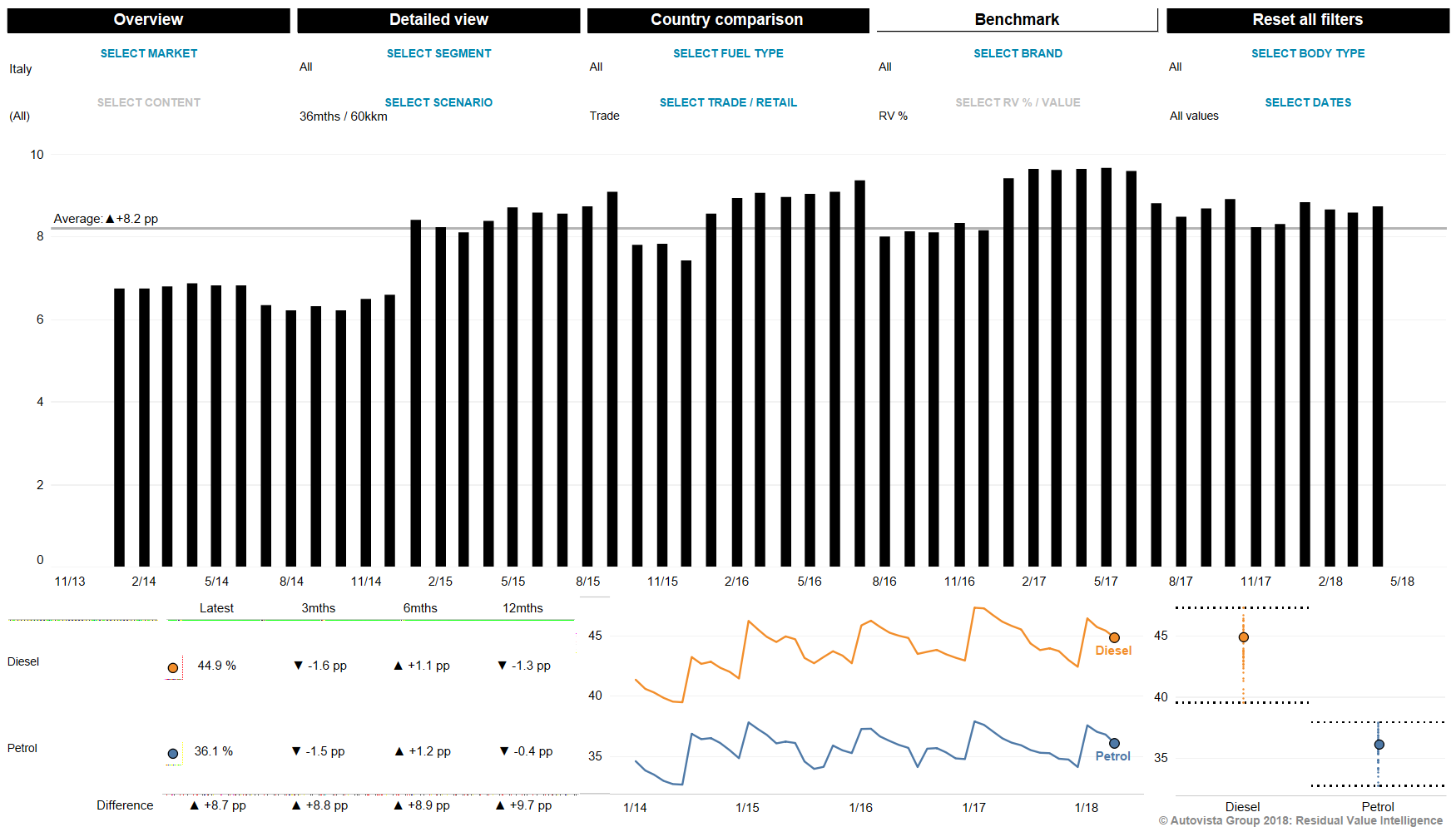

Residual values of diesels in Italy continue to hold up comparatively well. But even here, diesel is exposed to increasing scrutiny, with Rome considering a diesel ban to protect historic monuments. Diesel residual values are forecast to fall, albeit only by 0.3% and 0.5% in 2018 and 2019, whereas values across all fuel types are expected to gain about 1% each year.

Italy petrol vs diesel trade residual values (in %), 36 months/60,000km, January 2014 – April 2018

[1] Based on an age-distance scenario of 36 months/60,000 km