Insight: UK New Car Market Outlook, March 2018

27 March 2018

27 March 2018

February figures

The UK’s new car market is still suffering, and posted its eleventh monthly decline in a row in February. According to the latest figures released by the SMMT, new car registrations declined by 2.8% compared to February 2017. Following the 5.3% drop in demand in January, the market has contracted by 5.1% year-on year in the first two months of 2018.

There was yet another large decline in diesel car sales, which were 23.5% lower year-on-year. This is in line with January, when diesel sales fell by 25%. In total, diesel car sales are down by 24.9% over the first two months of the year, with a 35.6% market share. With higher vehicle excise duty (VED) rates being applied to diesel cars for their first year of registration from 1 April, it is now highly likely that diesels will account for less than 1 in 3 new car sales in 2018.

Demand for petrol vehicles rose again during February, with year-on year growth of 14.4% compared to February 2017. Alternative fuel vehicles, including electric and hybrid cars, saw sales up by 7.2%, but still only captured a 4.4% share of the market. However, these results were still not enough to offset the large decline in diesel demand. This is a key area of concern as the resurgence of demand for petrol cars contributed to the first rise in CO2 levels in the UK for 20 years.

In its release, the SMMT said it believes this is a disappointing performance, given the latest low emission vehicles, including new cleaner diesels, can help address air quality issues.

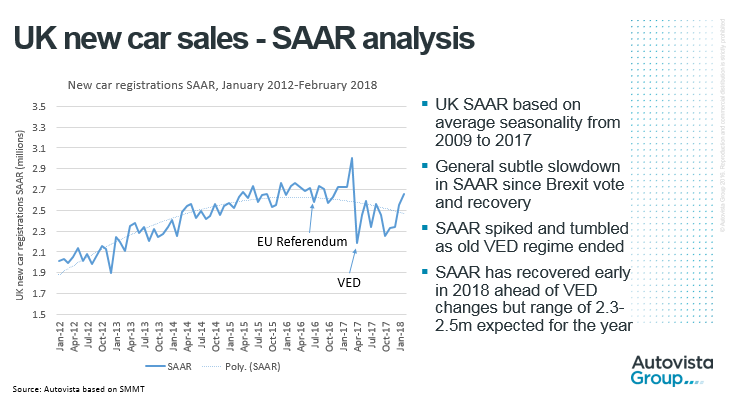

SAAR analysis

Considering the new car market in seasonally-adjusted terms reveals a truer picture of market developments than tracking the monthly movements in actual terms. Autovista Group has developed an average seasonality of the new car market based on registration figures between 2009- and 2017. The SAAR (seasonally-adjusted annual rate) of new car sales highlights the weakness in demand since the VED-induced fluctuations in March to May 2017. Essentially, the SAAR averaged at 2.82 million units in Q1 2017 but slumped to an average of just 2.39 million units in the nine months from April to December. New car registrations amounted to 2.54 million units in 2017, equating to a year-on-year contraction of 5.7%. This is exactly as forecast in the December 2017 edition of the Glass’s monthly car market report.

For the first two months of 2018, the SAAR improved slightly, averaging at just over 2.6 million units. With the hike in VED for the first year of registration for new diesel cars from April, some demand will be pulled forward into March. However, this will be less significant than occurred in March 2017. There are also two fewer working days in March 2018 than in March 2017, largely due to the earlier timing of Easter, which will naturally reduce the volume of new car registrations in the month.

With the implementation of the new VED rates and the UK economic outlook uncertain at best, a recovery in demand is clearly not expected over the remainder of 2018. Ultimately, the SAAR is forecast to run at between 2.3 and 2.5 million units.

Outlook for 2018 and 2019

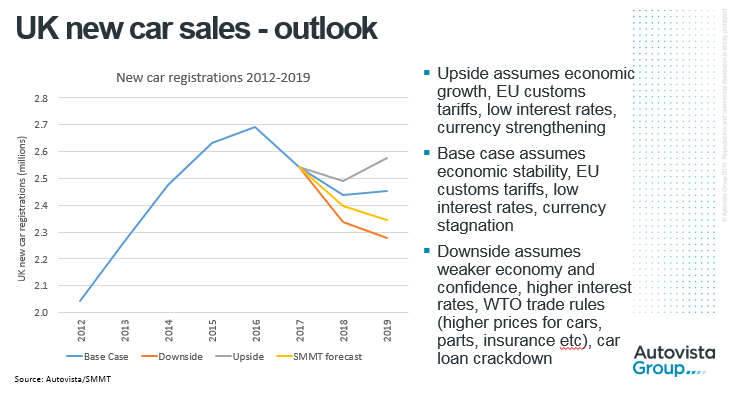

At the end of January 2018, the SMMT released its official forecast for new car sales in the UK for 2018 and 2019. It expects the UK market to contract again in 2018, with a 5.6% reduction in sales compared to 2017’s 2.54 million units. Another drop is forecast for diesel demand, with less than 900,000 units to be sold, capturing just 37.3% market share. This is a contraction of more than 30% compared to the volume of diesel cars sold as recently as in 2016. For 2019, the SMMT estimates that registrations are likely to decline a further 2.1%, with diesel falling an additional 8.2%, to a market share of 35.2%.

At Autovista Group, our base case forecast calls for a 4% decline in UK new car registrations in 2018. Year-on-year growth rates are expected to be weakest in Q1 given the high base of new car registrations in Q1 2017. This is essentially because the VED changes in April 2018 are less dramatic than in April 2017 and so the selling rate is not expected to deteriorate as much as it did throughout 2017. The recent confirmation of a 20-month transition period after the UK leaves the EU in March 2019 may also improve consumer confidence and have a positive knock-on effect on new car demand. Year-on-year comparisons will therefore be more favourable than the 5% contraction in the first two months of the year.

For 2019, Autovista forecasts that the new car market will expand, albeit by just 0.5%, as the country finalises its deal with the EU, interest rates stabilise as a result and consumers are encouraged to spend again. This is the base case scenario, which assumes that the economy will be broadly stable, punitive customs tariffs will not be introduced, interest rates will remain low, and the pound will not suffer significant further devaluation.

As far as the diesel share is concerned, the SMMT forecast of a 37.3% share in 2018 already appears ambitious given that diesels only gained a 35.6% market share in the first two months. Unless there are any unexpected changes to the taxation on diesel cars or fuel or an improvement in the image of diesels, it is difficult to envisage that more than 1 in 3 new cars sold in 2018 will be diesels. Similarly, the SMMT diesel share forecast of 35.2% in 2019 now seems unachievable too and barring any change in legislation or customer perception, the diesel share could even fall below 30%. In a recent report by the University of Aston, Professor David Bailey suggested that diesel will fall to just a 15% market share by 2025.

Autovista Group forecasts are based on a number of factors, including the latest sales figures, the seasonally adjusted annual rate (SAAR), economic trends, interest rates and vehicle taxation changes. Aside from the base case scenario, upside and downside scenarios have also been developed. Our downside forecast for 2019 assumes a weakening of the UK economy, falling consumer confidence, higher interest rates and WTO trade rules, resulting in higher prices for cars, parts and insurance. In this scenario, our market forecast is more bearish than that issued by the SMMT; new car sales are forecast to decline by 8% and 2.5% respectively in 2018 and 2019.