Is the global EV market slowing down?

03 September 2024

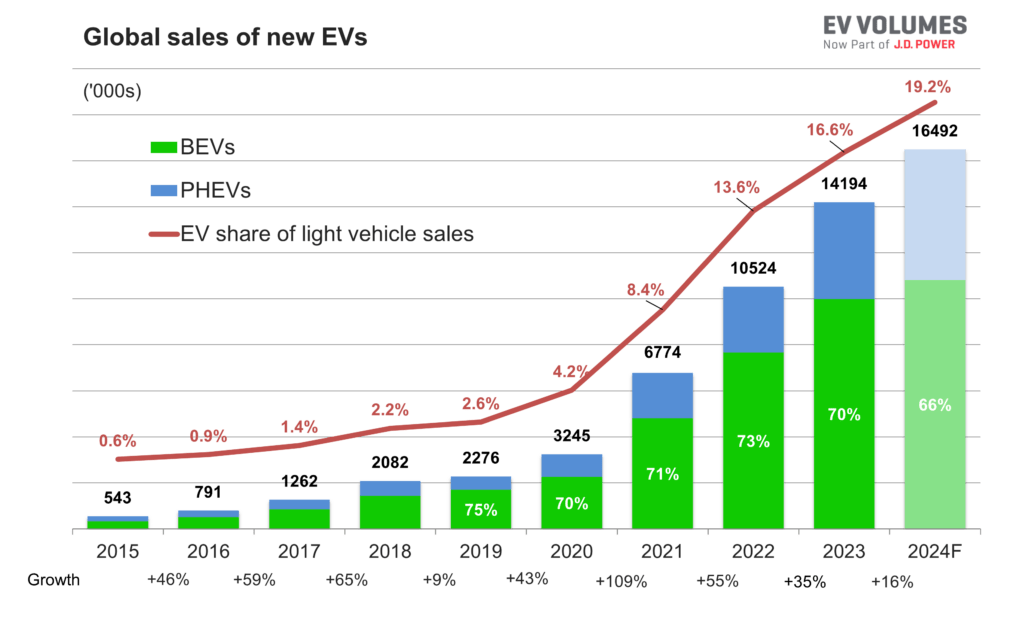

New electric vehicle (EV) sales across the world continued to grow across the first half of 2024. But did the market show signs of slowing? EV Volumes founder, Roland Irle, explores the progress of plug-ins with Autovista24 editor Tom Geggus.

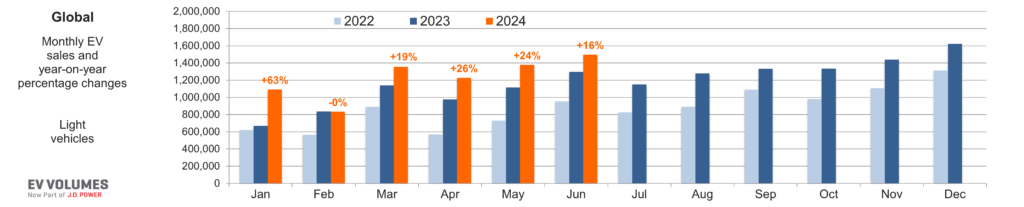

The global new light-vehicle market, including passenger cars and light-commercial vehicles, grew by 3.7% in the first half of 2024. Within this, combined battery-electric vehicle (BEV) and plug-in hybrid (PHEV) sales increased by 22% year on year to 1.35 million units.

As confirmed by EV Volumes data, deliveries of new EVs did grow relatively consistently between January and June 2024. Because of the Chinese New Year, February was the only month not to record double-digit growth in the first half.

This consistency and competitively high level of growth appears promising at first. However, it does represent a slowdown from the same point last year. In the first half of 2023, the global EV market saw deliveries climb by 35% year on year.

Uneven EV growth

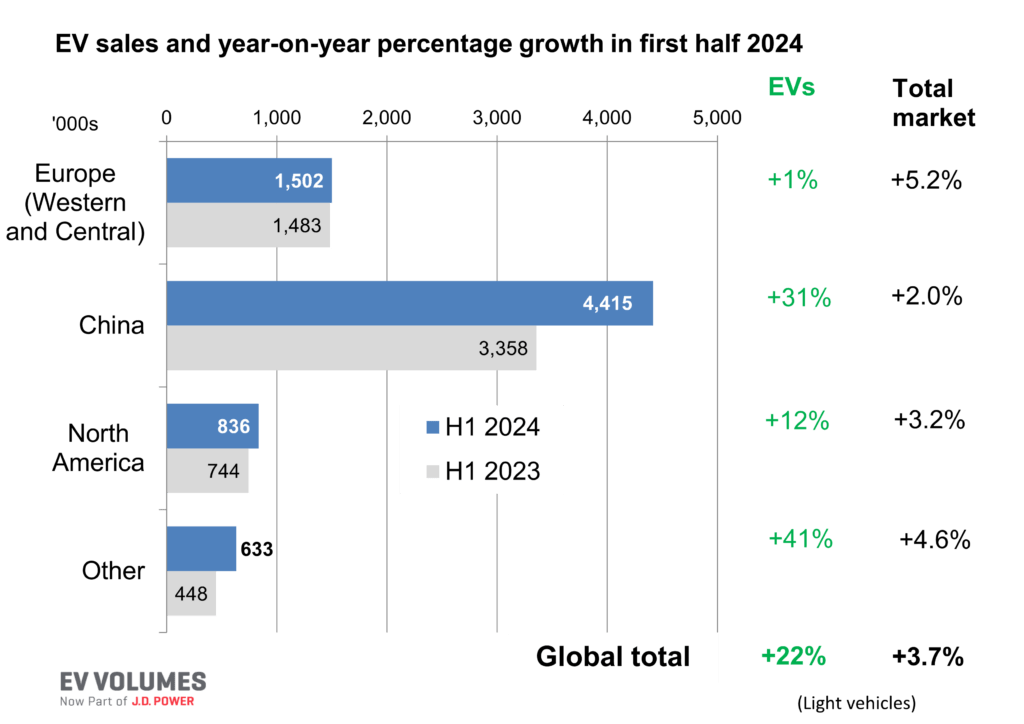

Growth has also become more uneven across the world. Despite accumulating economic woes, China continues to drive the global EV market in terms of volume. The country made up 60% of global electric vehicle sales in the first half of the year. Combined, BEVs and PHEVs represented 46% of the Chinese new-car market in June.

New plug-in volumes also outpaced the wider light vehicle market in China. EVs surged 31% year-on-year in the first half of 2024, while overall sales increased by 2%.

Over-capacity is a common challenge in the country, which means prices are coming down. Growth is particularly strong for both premium segments and extended-range electric vehicles (EREV). This powertrain uses a small internal-combustion engine generator to charge the battery instead of driving the wheels. Like BEVs and PHEVs, EREVs can be charged via the mains.

Sales stagnation in Europe

Europe is continuing to see EV deliveries stagnate following the exceptional growth of 2020 and 2021. While the overall new light-vehicle market continues to recover, growing by 5.2% in the first half, EV sales only increased by 1%. This follows many European countries reducing or removing purchase subsidies, first for PHEVs and then for BEVs.

In the US, the effects of the Inflation Reduction Act (IRA) are wearing off, following a steep growth in EV sales in recent years. On top of this, there are also uncertainties and challenges surrounding the eligibility of different vehicles for grants. The first half of 2024 was characterised by delays of not only vehicles but also batteries, with OEMs having to re-route supply chains to comply with IRA requirements.

EV deliveries in the region jumped by 12% in the first six months of the year, ahead of a 3.2% improvement for overall light-vehicle deliveries.

Elsewhere around the world, some EV markets recorded triple-digit growth, albeit from low bases. The most significant markets in terms of volumes and growth were Brazil, India, Thailand, Turkey, Mexico, Indonesia, Taiwan and Malaysia. However, two of the largest markets in this group, Japan and South Korea, appear to be going into reverse.

Are EV sales really slowing?

So, is the global EV market crashing? Not quite. While growth is slowing, this follows the rapid plug-in increases in both volume and share in 2021 and 2022. But global EV sales are still increasing, up by 22% in the first half of 2024, outperforming the total market growth of 3.7% by a wide margin.

In Europe, EV sales are stagnating, however, following the exceptional growth of 2020 and 2021. Looking back, there is the 2020 95gCO2/km New European Driving Cycle (NEDC) mandate and green recovery support measures to consider.

Introduced during the pandemic, this created an unprecedented EV boom during 2020 and 2021. Volume increases by 136% and 68% year on year respectively. This means CO2 emission targets were easily reached.

Europe’s EV demand outstripped supply, as prices were pushed up and discounts disappeared, creating generous margins for some models. However, the pandemic and its associated costs stressed public budgets. This pushed funds for green projects towards EV charging infrastructure, which remains insufficient.

Grant effect

From 2022 onwards, EV grants in Europe were gradually reduced, first for PHEVs, and then for BEVs. More expensive EVs also saw greater restrictions around subsidies.

By 2024, at least six countries phased out direct purchase incentives. This includes high-volume markets such as Germany, Norway, Sweden, the UK, Italy and Switzerland. However, annual road tax exemptions have remained intact in many locations.

As order backlogs cleared, supply caught up with slower demand. This has hailed a turning point, as a buyers’ market returned. This put margins under considerable pressure, with many EV models starting to lose money.

Having comfortably met the European CO2 mandates between 2020 and 2024, there is currently little incentive for carmakers to push for more EV deliveries. However, this will change in 2025 when fleet emissions will need to be 15% lower than in 2021. Therefore, efforts are better saved for this upcoming challenge.

What comes next?

EV Volumes expects new EV sales to reach a total of 16.5 million units this year worldwide. This would equate to an increase of 16% compared to 2023. Broken down by region, China is forecast to account for 10 million units, Europe 3.3 million units, North America 2 million units, with the rest of the world making up 1.4 million units.

Nearly one in five light vehicle deliveries will be an EV this year. However, PHEVs are gaining more ground globally than BEVs. This is mainly thanks to the growing popularity of EREVs in China, which EV Volumes categorise with PHEVs. While EREVs are less technically complicated than PHEVs, their fuel-saving potential is greater.

The downside of this powertrain is that a larger battery is required than in a standard PHEV. For the driver, there is also a disconnect between the sounds of the engine and the motion of the vehicle.

The first modern EREVs were the Chevy Volt and the BMW i3 Rex, which were both discontinued. Today, EREVs hail from China, with Li Auto kick-starting the recent renaissance.

EREVs cover the typical PHEV domains of midsize and large cars, as well as SUVs. In China, the powertrain now accounts for 18% of all EV sales in these segments, and a third of all PHEVs. BEVs represent 45% of sales in these segments while PHEVs make up 55%.