MG5 brings new estate experience to BEV market

11 November 2022

Autovista24 principal analyst Sonja Nehls and Dennis Borscheid, market analyst Autovista Group, consider the remarketing outlook for the MG5.

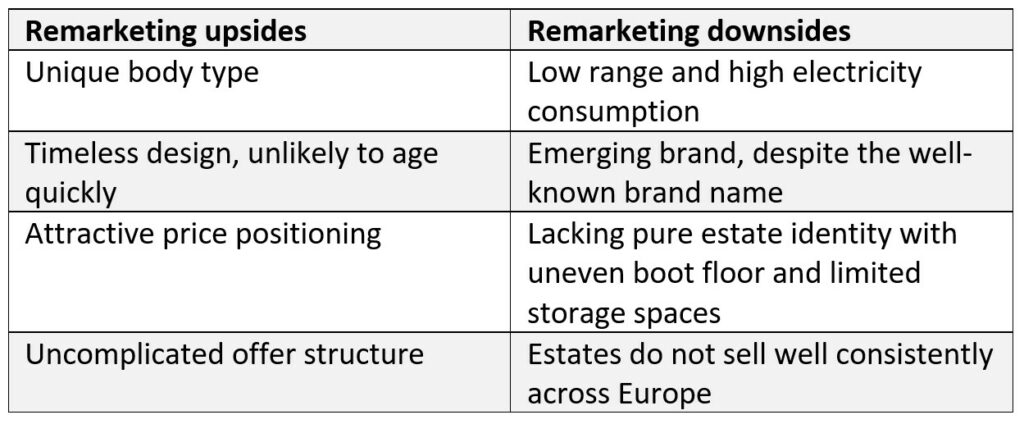

The new MG5 combines attractive price positioning with a decent amount of equipment and a mature design, on top of its unique estate body style for a battery-electric vehicle (BEV).

The Chinese-manufactured contender does not outshine its competitors in any particular aspect and falls behind in terms of power, consumption and range. However, its calm and composed flair, combined with an attractive price, might be exactly what a range of customers has been waiting for.

The first of its kind

The new MG5 has just been launched and is the first compact BEV estate to be offered in Europe. While SUVs have become the go-to body style, especially for families, estates are still popular with customers in many countries. Given their lower height and more aerodynamic silhouette than SUVs, they also offer efficiency advantages.

So, the MG5 has a head start over the competition with a unique offering, but will this be leveraged?

Another potential advantage is the brand itself. Although considered an emerging player, MG can rely on a brand name with heritage, which helps stoke relevance and potential buyer interest.

In the UK, the brand never really vanished following the collapse of the MG Rover Group in 2005. It remained operational under new ownership and was acquired by the largest Chinese state-owned car manufacturer, SAIC Motor, in 2007.

MG5 remarketing potential

Getting behind the wheel

The incredible acceleration offered by BEVs is very exciting. But in everyday driving, this can get old quickly and the amount of torque is not necessarily a pleasant experience for passengers.

A standard version of the MG5 is available with a power output of 130kW/177hp and a long-range version offers 115kW/156hp. The model therefore positions itself as a rational car with sufficient power but can be clearly differentiated from performance-driven BEVs.

The direct torque of the electric powertrain does, however, enable drivers to pull away from the traffic lights faster than the typical internal-combustion engine (ICE) vehicle in the next lane.

The MG5 is on a mission to deliver all that is expected from a BEV, such as direct acceleration and silent travel. But it does away with any shenanigans like Tesla’s wild acceleration, instead simply being a rational and decent travel companion.

Calm and collected

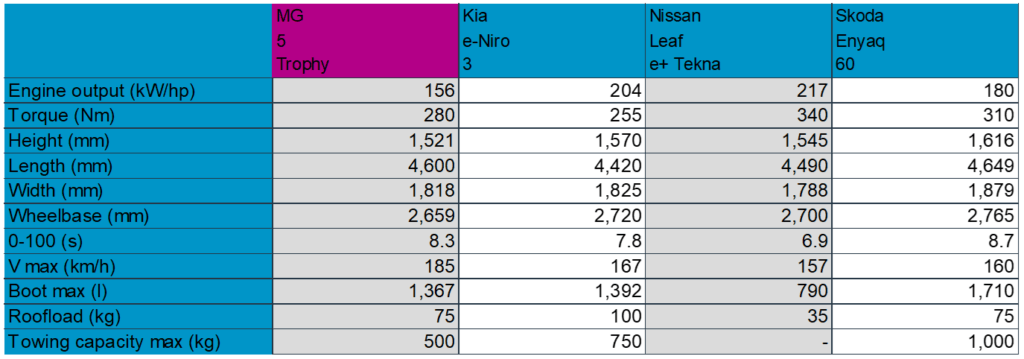

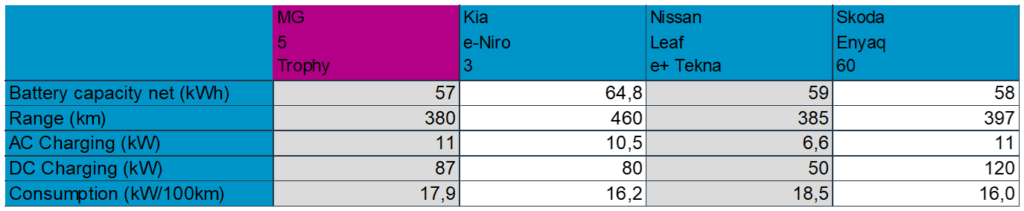

As the first available compact BEV estate, selecting direct competitors is a little more difficult than for the many upcoming electric SUVs or SUV coupés. In this remarketing outlook, the MG5 is benchmarked against the Kia e-Niro, Nissan Leaf, and Skoda Enyaq.

Despite not being exactly comparable, the selection is a good indication of what the potential customer base can choose from. The Nissan Leaf represents the lower end of the spectrum in terms of size and price, while the Enyaq sits on top.

The exterior design of the MG5 is remarkably unremarkable. It does not turn heads and is instead a rather timeless and practical car. This may well pay off on used-car markets as the MG5 avoids the risks of a love-it-or-hate-it design and appeals to a broad range of customers.

The interior is a bit more out there, for example using a blue-coloured line to give the impression of ambient lighting and combining different materials (fabric, black and brushed-metal-like hard plastic). Nevertheless, it does not give the impression of being futuristic like the e-Niro or a little outdated like the Leaf. It fits right in the middle, offering modern flair without trying too hard to be trendy. Something used-car buyers likely will appreciate.

Specifications and dimensions versus main rivals

The MG5 has decent boot space, with up to 1,367 litres of capacity. However, there is not an even loading sill, which is very untypical for an estate and a missed opportunity.

Unlike the Nissan Leaf, the MG5 can mount a towbar and has a capacity of 500kg. While the e-Niro and Enyaq can tow more, this is sufficient for a small trailer. The nose weight of 50kg can support a bike carrier and two to three bikes, for example.

Interior space is generous even for taller people. The absence of practical storage solutions, such as a dedicated tray with incorporated wireless charging for a smartphone, is a minor drawback.

Pretty quick charging

Range anxiety is less of an issue for BEVs nowadays, but efficiency and charging specifications have taken centre stage as important differentiators in new- and used-car markets.

This might be a real danger for the MG5 on the used-car market as its power consumption (17.9kWh/100km) and therefore range (380km) are slightly worse, compared with its competitors.

Notably, both SUVs in the comparison consume less electricity than the MG5. There is definitely room for improvement here, especially considering the cost-consciousness of used-car buyers and rising energy prices. MG has the potential to leverage the estate body style’s aerodynamic advantages but has not seized the opportunity so far.

Battery specifications versus rivals

Charging specifications are in line with current expectations in this segment, especially when considering the MG5’s price position. It charges as quickly as the new e-Niro and quicker than the Leaf, only losing out to the more expensive Enyaq.

Attractive pricing meets simple equipment

The price positioning of the new MG5 is attractive, sitting below its competitors. Looking at prices in the UK, the MG5 is positioned below the three competitors selected, and by quite a margin.

For the top Trophy trim, the price difference against competitors’ models with comparable trims are £6,050 against the e-Niro, £2,950 against the Leaf, and £5,475 against the Enyaq. Standard equipment is roughly comparable among the models and configuration is straightforward.

With only two trim lines and no additional options on offer, the equipment structure of the MG5 is one of the simplest around. The customer picks a colour and the trim and that is it, easy. Therefore, the likelihood of poorly equipped cars coming to the market is non-existent as both trim lines are well-equipped.

The homogeneity of cars generally ensures eligibility for a broad target audience and enables cross-border remarketing. However, with many vehicles available with almost the same configuration, transparency on the used-car market is high and individual cars stand in stark competition with each other.

Shaking up the continent

MG claimed a significant piece of the BEV cake in recent years, making it the most successful Chinese brand currently operating in the European BEV market. EV-volumes, the electric-vehicle (EV) world sales database, reports that the brand sold 22,269 BEVs in Europe in 2021, up 68% compared to 2020. This volume ranks it 18th among the best-selling BEV brands in Europe.

In the UK, MG even makes the top 10 at rank nine, outperforming the likes of Peugeot, Renault, Skoda, and Fiat. An impressive fourth rank in Sweden was reportedly achieved through extremely attractive leasing rates and strong partnerships with local dealers.

Top 20 BEV sales in Europe by brand, 2021

MG has managed to secure trusted and well-known dealerships as partners for sales and servicing, meaning the MG5 can rely on an existing and growing network. Limited new-car availability has also opened windows of opportunity with rental and leasing companies. MG was able to deliver cars when other manufacturers could not.

This is a good starting point for new-car sales, and could also become critical for used-car remarketing. Significant volumes could be absorbed in the new-car market. However, this might also lead to an oversupply on the used-car market, which would harm the residual value (RV) of the MG5.

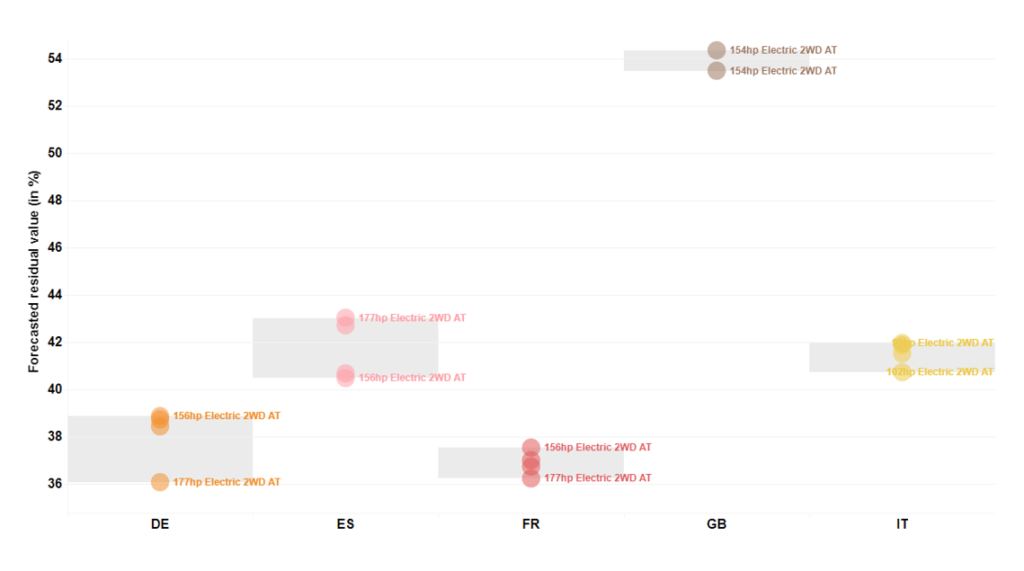

MG5 RV forecast 36months/60,000km, November 2022

When looking at the country-level %RVs of the MG5, it becomes clear that the model, as well as the whole brand, is well accepted within the UK, where it exhibits by far the strongest %RVs across the big five countries.

Following this are Italy and Spain with %RVs in the low- to mid-forties, while France and Germany show the lowest figures due to strong local competitors cutting into the MG5’s RV potential.

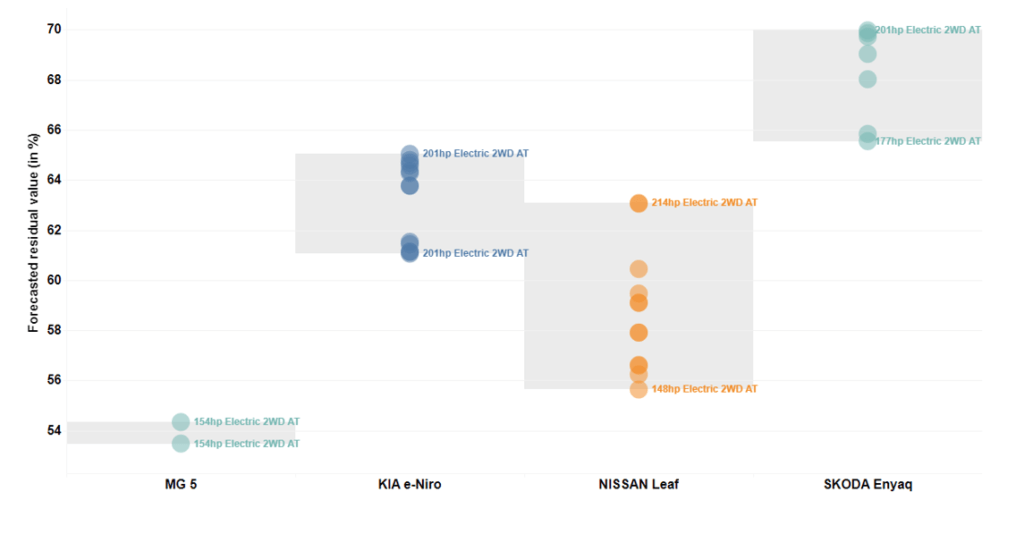

MG5 RV forecast versus competitors, UK, 36months/60,000km, November 2022

Looking at the UK, and comparing it with the main rivals, the MG5’s %RV is among the lowest among analysed models. This is because even though MG is more accepted in the UK than in the other big five markets and does have some degree of heritage, it is still regarded as a new brand and faces the corresponding challenges.

Used-car customers are wary about putting down a significant amount of money if they do not have any information about the durability and reliability of the car in question. In this regard, established OEMs have it a bit easier as customers know and – for the most part – trust their vehicles to be reliable and well-made. The brands shown above are good examples of this trust as Kia and Nissan count themselves among the brands with the longest history of BEV sales in Europe.

Skoda entered the BEV market a bit later but can carry over some of its good brand reputation (clever storage, good value for money) to its two BEV models, the Enyaq SUV and Enyaq Coupé. The Enyaq’s RVs are also supported by limited availability due to supply-chain issues and resulting long delivery times.

This dynamic is seen across countries and segments and is true for ICE and BEV models alike. MG is on its way to becoming an established brand, especially in the UK, but it will take some time for this shift in customer perception to manifest itself in MG5 RVs.

Remarketing the unremarkable

In conclusion, the MG5 avoids a flashy design, says no to unnecessary power trips, refrains from using expensive high-voltage charging and the offer is uncomplicated. It delivers what is expected, from decent space in the interior and the boot, to competitive charging times, and a design that supports its no-nonsense appeal.

It delivers everything expected from a BEV estate – nothing more, nothing less – only falling marginally behind the competition in terms of consumption and range. While there are some minor drawbacks with storage and boot accessibility, most customers will likely overlook this, owing to the MG5’s attractive price positioning.