Monthly Market Update: BEV residual values suffer across Europe in April

02 May 2024

Battery-electric vehicle (BEV) residual values (RVs) continued to suffer across Europe’s major used-car markets in April. Autovista Group (part of J.D. Power) experts examine the data with Autovista24 editor Tom Geggus.

Three-year-old BEVs at 60,000km continue to see low RVs presented as a percentage of list price (%RV). Across Austria, Germany, Italy, Spain, Switzerland and the UK, the technology’s value retention is far behind that of the other major powertrains.

Austria saw BEVs achieve one of the highest %RV levels at 45.1%. This was still below the overall market average of 51.8% and even further behind full hybrids (HEVs) which retained 55.8% of their original list price. In Germany, BEV %RVs sat at 40.1%, once again trailing HEVs (54.3%). The all-electric powertrain was also behind the powertrain average of 50.2% in the country.

BEVs saw the lowest %RV result in Italy, with such models only retaining 35.9% of their original list price value after three years and 60,000km. This was far below diesel as the leading powertrain at 57.1%, and the market average of 53.1%.

At 49.4%, BEV %RVs appeared to perform better in Spain. However, there was still a considerable gap between this result and HEVs, which led the market with a value retention rate of 64.7%. The wider market saw %RVs reach 59.3%.

HEVs also led value-retention rates in Switzerland at 51.6%, with the overall market reaching 47.7%. This left BEVs behind, holding onto only 44% of their original list price. Meanwhile, BEVs reached a %RV of only 37.1%, while the powertrain average sat at 51.7% and HEVs led the way with 54.2%.

The interactive monthly market dashboard examines passenger-car data by fuel type, for Austria, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators, including RVs, new-car list prices, selling days, sales volume and active-market volume indices.

Electric values suffer

Many European used-car markets saw BEV %RVs fall both month on month and year on year. The reasons behind these falling all-electric values are numerous. First of all, the rapidly advancing technology in new BEVs is aging older models significantly, making their ranges and capabilities look dated.

Secondly, companies like Hertz are reportedly seeing lower demand and higher repair costs for electric vehicles (EVs). This led to large-scale de-fleeting, with the company already planning to sell 30,000 plug-in units this year.

This will not only increase supply into the used market but will dent public confidence in EVs. This could lead to the popularity of stepping-stone technologies like HEVs and plug-in hybrids (PHEVs) increasing. These vehicles benefit from green credentials alongside the security of an internal-combustion engine (ICE).

With incentives ending across many European new-car markets last year, carmakers are also under increasing pressure to adjust BEV prices. With more affordable models arriving from China, a price war will only serve to damage used BEV values as the apparent value of existing models drops.

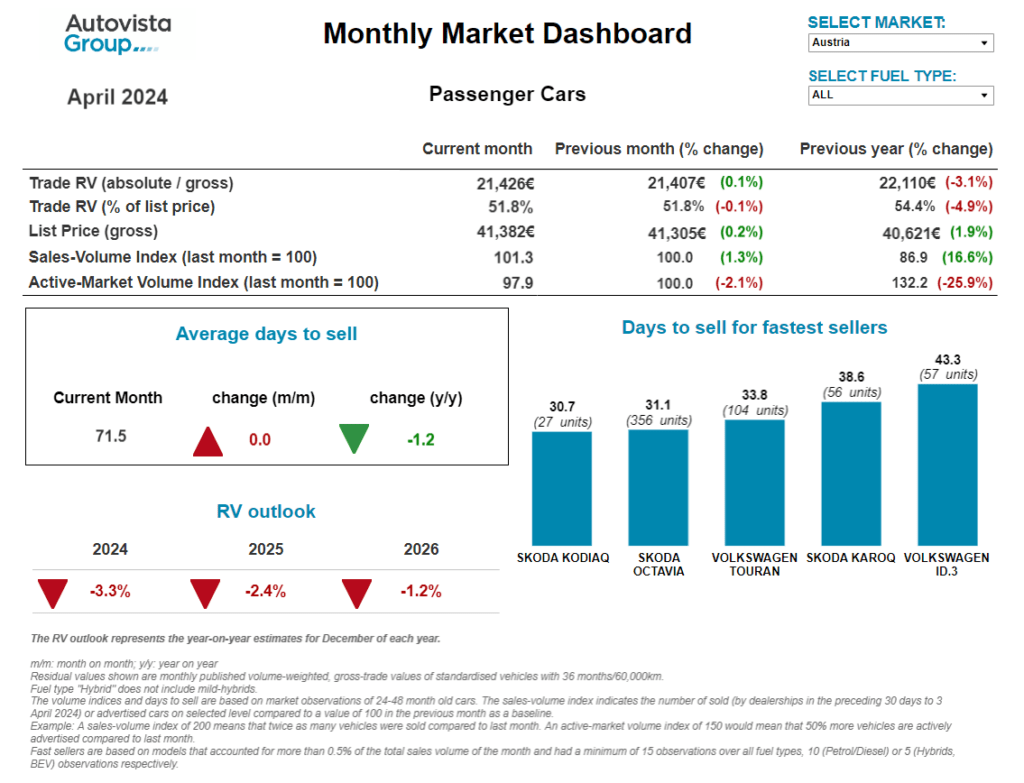

Slight value slump in Austria

After a slight improvement in March, the sales-volume index (SVI) for Austria increased by 1.3% month-on-month in April, and 16.6% year on year. At the same time, the supply volume of two-to-four-year-old passenger cars was slightly lower than in March, down by 2.1%. However, this meant that the supply volume dropped sharply, by 25.9% compared to April 2023.

The average amount of time needed to sell a used car increased slightly in April, to 71.5 days. Diesel vehicles sold the fastest, averaging 61.2 days, followed by petrol vehicles at 76.6 days and HEVs at 84 days. BEVs sold after 86.4 days, while PHEVs sold more slowly, after 93.6 days.

‘The %RVs of 36-month-old cars decreased slightly month on month to 51.8% on average,’ explained Robert Madas, Eurotax (part of J.D. Power) regional head of valuations, Austria, Switzerland, and Poland. ‘This marked a decrease from 54.4% in April 2023 and shows that pressure on RVs is increasing.’

HEVs led the way with a %RV trade value of 55.8% followed by petrol with 54.4%, diesel at 50.4%, and then PHEVs at 49.5%. Meanwhile, 36-month-old BEVs retained the lowest value, at 45.1%. As demand for BEVs is forecast to weaken, this will increase the RV pressure.

%RVs are expected to fall further this year. Flagging demand and firm supply will result in a drop of around 3.3% year on year. While %RVs are forecast to keep falling in 2025 (down 2.4%) and 2026 (down 1.2%), they will do so at a slower pace.

EVs generate growth in Germany

Between January and March, used-car transactions in Germany increased approximately 8% year on year. EVs, made up of PHEVs and BEVs, continued to represent a small percentage of this market, sitting at only 10% in the first quarter.

However, 60% of the country’s used-car market’s overall growth was generated by EV transactions. This was almost double the result compared to the same period in 2023. The real problem is that this growth is being paid for by a sharp fall in used EV prices, which has a number of reasons.

Incentive-driven stimulation of new electrified cars in recent years created oversupply, alongside significant list-price reductions. Additionally, an intensifying public debate around the future of EVs, fuelled by the media, is unsettling some interested buyers.

Newcomers such as BYD and GWM only achieved double-digit unit used transactions so far this year. Meanwhile, MG will soon be reaching the 1,000 mark. Tesla has recorded a 56% year-on-year increase in transactions, albeit with severe price losses.

Unfortunately, the price index for BEVs continues to point downwards. Meanwhile, the ICE price trend has largely stabilised. Additionally, the previously resilient A and B-segments are now unable to keep pace with the stabilisation of the market and are continuing to see asking prices fall.

‘With inflation still dropping and economic strength expected to recover in 2025, there is some hope that price levels will not suffer too much damage this year, with recovery starting next year,’ pointed out Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of J.D. Power).

‘What continues to be absent, is clear outlines of the benefits of operating EVs as well as a campaign to install confidence back into the public debate. Both would help to better remarket used EVs which continue to flow in,’ he added.

Falling RVs forecast in Italy

Used-vehicle values in Italy continued to fall in April. %RVs fell to 53.1% from 53.6% in the previous month, mirroring what happened in March. In absolute terms, RVs only fell by €61. This contrasts with the growth in list prices three years ago, which were up by more than €200.

Compared to 2023, %RVs fell significantly for most powertrains. The exception was HEVs, which saw values increase to 55.3% from 55.2% in April 2023. Compressed-natural gas (CNG) vehicles also saw %RVs increase, up to 44.4%, and liquid-petroleum gas (LPG) models grew to 49.4%.

BEVs experienced the greatest %RV decline, down to 35.9% from 37.9% 12 months ago. PHEVs also fell, down from 54% in April 2023 to 50.8%. Both saw significant growth in the SVI, while average stock days fell. This indicates a slight increase in interest from buyers.

‘Apart from CNG models, RVs are forecast to decline throughout 2024. This is expected to lead to a 3.7% year-on-year fall in December, slightly more negative than the 3.3% annual drop expected in March,’ explained Marco Pasquetti, head of valuations, Autovista Group Italy (part of J.D. Power).

Easter slowdown for Spanish market

For the first time since the end of 2022, March delivered negative new-car registration figures in Spain. However, this was largely due to the earlier Easter holidays. April, however, has seen the market return to an environment of growth, with a 23.1% year-on-year improvement according to ANFAC.

‘At the end of the first quarter, the slowdown in the private and corporate channels continues to cause concern,’ said Ana Azofra, Autovista Group head of valuations and insights, Spain (part of J.D. Power). ‘Meanwhile, the rental car channel continues to support registrations.’

As for the different powertrains, interest in HEVs continues to rise. This was to the detriment of all other technologies except LPG, which grew for the third consecutive month. BEVs and PHEVs have yet to break the 12% market-share barrier. This puts them far behind the European average of 22%.

The early Easter holiday also slowed down the used-vehicle market, with transactions down 12% year on year. However, the cumulative figures continue to show a positive evolution. In Spain, two used vehicles are currently sold for every new vehicle.

As in previous months, renewals from car-rental companies and the slowdown in demand for new models are increasing the stock of young used vehicles in dealerships. This continues to put downward pressure on the prices of used models up to two years of age.

Increased BEV supplies

This effect is less visible for three-year-old vehicles. Only slightly negative adjustments have been observed so far, although this is more pronounced for diesel vehicles. The stock of diesel-powered models is the only one to have fallen compared with last year, down 20%. This drop in supply will reduce pressure on the powertrain’s transaction prices.

‘On the other hand, the supply of used BEVs is up by 75% compared to April 2023,’ explained Azofra. ‘Moreover, these all-electric vehicles take over two weeks longer on average to sell compared with 2023, which does not relieve the pressure on professional stocks.’

PHEVs are gaining increased importance in Spain, and deserve special attention. The volume of used stock has doubled compared with April 2023, likely linked to an increase in imports. The expected evolution in transaction prices, although negative, is not as dramatic as in other Northern and Central European countries, where demand for this technology is slipping.

Faster sales in Switzerland

‘Used-car supply in Switzerland stabilised on pre-COVID-19 levels in 2023 before slightly decreasing again in 2024,’ said Hans-Peter Annen, head of valuations and insights, at Eurotax Switzerland (part of J.D. Power).

The active-market volume index for two-to-four-year-old passenger cars increased by 1.9% from March to April 2024. Year on year, this indicator dropped by 11.6%. Meanwhile, the supply of younger used models has only become more constrained. The SVI decreased by 5.2% month on month and 12.8% year on year.

Slightly lower supply and stabilised demand resulted in overall stability for %RVs of 36-month-old cars. This level remained almost unchanged, from 47.6% in March 2024 to 47.7% in April. However, the year-on-year drop was more severe as the %RV level sat at 51.1% in April 2023.

HEVs retained the greatest amount of value of all powertrains in Switzerland, with a %RV of 51.6%. Petrol cars followed with 48.6%, then came diesel models with 46.9%, followed by PHEVs with 45.5%. 36-month-old BEVs retained 44% of their original list price.

Two-to-four-year-old passenger cars sold more quickly in April than in March, remaining in stock for 80.7 days on average, down by 3.3 days. HEVs sold the fastest on average after 62.1 days, followed by diesel and petrol cars, both after 77.7 days. PHEVs took 86.1 days to sell while BEVs needed 97.3 days.

Demand for used cars is forecast to fall slightly while supply remains effectively stable. The average value of three-year-old cars is forecast to decline from a relatively high level, set against a wider declining trend.

‘The %RV level in Switzerland finished 2023 down 5% on December 2022. In 2024, levels are expected to fall by roughly 5.5% due to stable supply and lower demand,’ Annen outlined.

Stock moving quickly in UK

For the second consecutive month, the average number of days it took a dealer to sell a used car fell by over a week. At just 31.5 days, this is the lowest average seen since the extraordinary results of 2021, when strong demand led values to rise significantly.

‘Dealers have clearly been able to move stock quickly,’ commented Jayson Whittington, Glass’s (part of J.D. Power) chief editor, cars and leisure vehicles. ‘While the sales-volume index reflects a rise in activity, up 1.8% on last month, it is perhaps surprising that there has not been a greater spike in sales.’

The active-market volume index shows an 11.1% month-on-month increase in the number of cars advertised by dealers. So, there does not seem to be a shortage of stock, but perhaps the most in-demand stock is not currently plentiful. Therefore, when these models do hit forecourts they sell very quickly, affecting the overall average days-to-sell figures.

The wholesale market remained reasonably steady in late March and throughout the first half of April. Auction conversion rates have been satisfactory but have now begun to decline. Buyers appear more cautious of late, with some limited to only cherry-picking the best stock.

Cars with condition issues have been particularly difficult to sell, with rising costs of repair and delays in bodyshops deterring dealers. Hammer prices have been described as ‘seasonal’ by some commentators.

The average value of a three-year-old car, presented as a percentage of cost-new price, fell from 52.5% in March to 51.7% in April. Although this is 14.5 percentage points lower than April last year, it remains 4.4 percentage points higher than the equivalent value three years ago.