Monthly Market Update: Demand overshadowed by supply in May

02 June 2023

Absolute residual values (RVs) in many European markets maintained a trend of double-digit year-on-year growth last month. Values represented as a percentage of retained list price (%RV) also rose when compared with May 2022, although this was primarily at a slower, single-digit rate.

Meanwhile, month on month, RVs were broadly stable. Italy saw the highest absolute growth at 0.8% and France felt a %RV improvement of 0.8%. Absolute RVs in Switzerland’s used-car market took the greatest fall at 1.3%. However, RV fluctuations do not tell the full story of how European used-car markets performed in May.

As indicated by the sales-volume index, demand saw double-digit year-on-year drops in France (down 38.4%), Spain (down 23.6%), Italy (down 22%) and Austria (down 19.7%). While Germany, Switzerland and the UK saw demand rise, up 15.6%, 4.3% and 1.6% respectively, this was still below their respective levels of supply.

Switzerland (up 36.4%), Austria (up 19.7%), Germany (up 16.1%) and Spain (up 8.3%) saw greater supply than in May 2022. While France and Italy noted negative year-on-year results from the active market volume index, down 28.9% and 11.6% respectively, supply to their used-car markets still outstripped demand. The UK was the only country to see this trend inverted, with supply falling 12.4% year on year.

Compared to May 2022, the average number of days needed to sell a used car last month increased in Austria, France, Germany, Spain and Switzerland. This further confirms the observed trend of falling used-car demand.

Carmakers are continuing to surmount supply-chain challenges initiated at the beginning of the COVID-19 pandemic. This means the volume of young used cars entering the market will likely keep growing. However, if demand does not keep pace, RVs will face increasing pressure as more models hit the market.

The interactive monthly market dashboard examines Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators by fuel type, including RVs, new-car list prices, selling days, sales-volume and active-market volume indices.

Scenario analysis

Defined by undersupply and falling demand, the current base-case scenario contains the potential for positive and negative outcomes. Should Europe’s economic situation worsen, used-car prices would experience greater pressure, with demand taking a bigger hit. Should the supply situation suddenly experience significant improvement, this would only compound the situation.

The semiconductor crisis is still sending sizeable ripples across the automotive industry. However, if this situation were to become inverted by lower demand for consumer electronics, carmakers could see a deluge of essential electronic components. This would mean a greater supply of vehicles, but without a corresponding upswing in demand, RVs would suffer.

On the other hand, if new-car supply was disrupted, the used market would benefit as more consumers explore available alternatives to factory-fresh models. Should automotive suppliers hit economic turbulence, this could also happen.

Conflicts around the world threaten stability too, with the war in Ukraine a key example. Europe’s already weakened supply chains would see additional disruption should the war escalate even further.

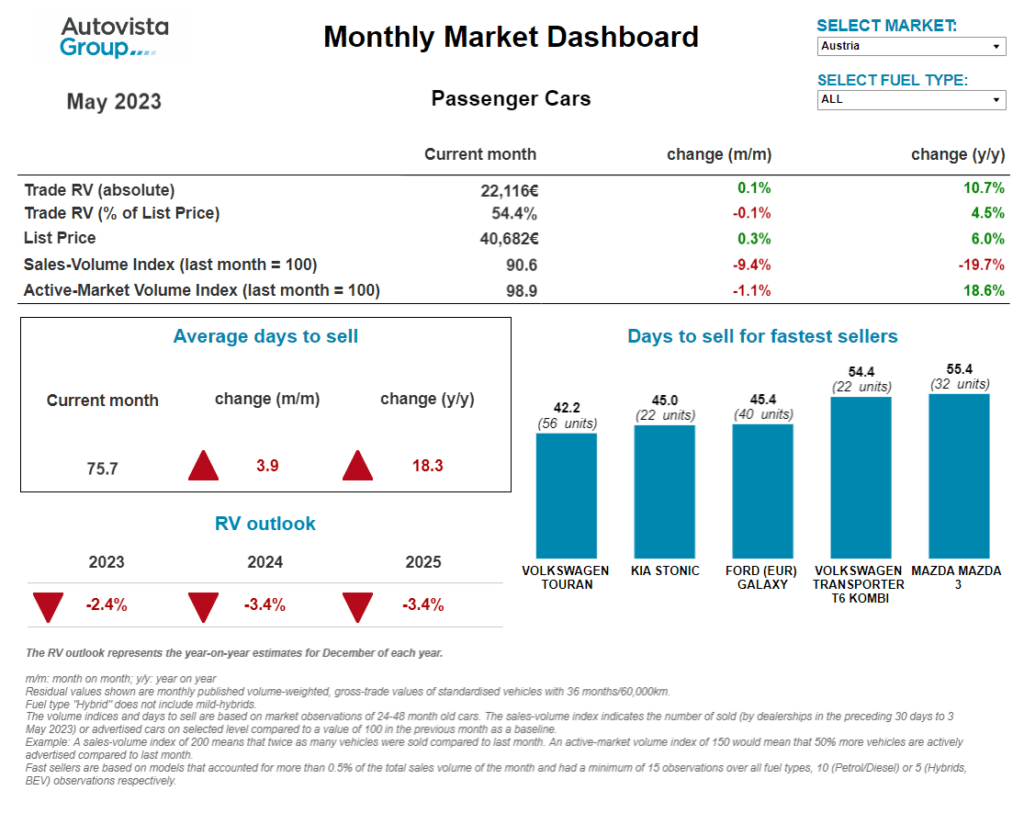

RV pressure increases in Austria

In May, Austria saw the continuation of a trend of rising living costs and slowing used-car transactions compared to 2022. The sales-volume index confirmed demand shrank, declining 9.4% compared to the previous month and a drop of 19.7% compared to May 2022. Conversely, the supply of passenger cars aged two-to-four years was around 19% higher in May 2023 than a year earlier. But last year, supply was significantly lower than before the COVID-19 pandemic.

Average days to sell increased again to 75.7 days, confirming a slowdown in used-car demand. Hybrid-electric vehicles (HEVs) sold the fastest, averaging around 49 days, followed by diesel cars and plug-in hybrids (PHEVs) with 75 days. Battery-electric vehicles (BEVs) sold slightly slower at around 76 days, only just ahead of petrol cars with 78 days.

‘Despite weakening demand and improving supply, RVs of 36-month-old cars have remained stable compared to April,’ said Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland. ‘The retained percentage of original list price was 54.4% on average. This marked a 4.5% year-on-year gain but shows that pressure on RVs is increasing.’

With a %RV trade value of 57.4%, HEVs are currently leading the way, followed by petrol cars (55.3%), diesel cars (54.3%) and PHEVs (53.5%). Meanwhile, 36-month-old BEVs retained the lowest value, at 49.5%. As demand is expected to weaken while supply recovers, further pressure on RVs can be expected. The RVs of three-year-old used cars will remain relatively high but with a decreasing trend.

‘The %RV is forecast to end 2023 down approximately 2.4% on December 2022,’ said Madas. ‘In 2024, %RV is expected to decrease further by around 3.5% year on year, due to weakening demand and increasing supply.’

Electric RVs to drop in France

Stability continued for France’s used-car market last month, with higher absolute RVs and marginally larger values in %RV terms. Climbing prices in the past did not influence RVs owing to the steep nature of increases. The average time to sell was slightly longer, as price continued to influence buyers. Those who did pursue a purchase were budget conscious and looked to older vehicles or a lower segment. Cars over 12 years of age suffered the least.

‘A homogeneously priced range of EVs entered the used-car market in May, which explains the lower absolute RVs and list prices compared with April,’ said Ludovic Percier, Autovista Group residual value and market analyst for France. ‘Regarding Tesla, absolute RVs will likely drop in the coming months, especially for the Model 3 and Model Y. Other manufacturers have already dropped their list prices to stay competitive, which will result in an overall decrease in their absolute RVs as well.’

Petrol and diesel RVs remained stable month on month in both absolute and percentage terms. Diesel models did see a marginal RV increase, with figures stable globally, but sales volumes experienced a drop. As new-car buyers have been switching from diesel to petrol (or other powertrains), the fuel type’s availability has been lower on the used-car market due to this drop in registrations. However, lower used-car demand for the powertrain has compensated for this.

Diesel RVs have seen little movement, even with the fuel type’s tarnished reputation and the implementation of low-emission zones (ZFEs). These zones only impact cities with 150,000 inhabitants or more and high-mileage drivers are unaffected. Diesel vehicles will be more heavily impacted from late 2024 and into 2025.

Once again, HEVs saw RV stability, with %RVs growing marginally and absolute RVs dropping because of lower list prices. PHEVs saw steady volume, but more premium and SUV models were present. These vehicles are capable of longer ranges in full-electric mode which explains the higher RVs in absolute and percentage terms. A major decrease is still expected in the coming months.

High-price points in Germany

New-car figures in the first four months of 2023 show that production appears to be recovering slowly. With just under 8% growth compared to the previous year, there is a glimmer of hope. However, this should not obscure the fact that with some 870,000 units, the first four months of 2023 are still far below the seven-digit figures recorded before the COVID-19 pandemic.

In particular, the number of PHEV registrations, which collapsed due to the discontinuation of government incentives at the turn of the year, are weighing on the overall balance. Meanwhile, internal-combustion engine (ICE) vehicles continue to see production and market demand. BEVs are also increasingly joining the roads and continue to benefit from the country’s eco-bonus.

There are, however, a few registration losers. First, the Tesla Model 3 has seen its numbers halved, while its stablemate, the Model Y, was registered three times as often. On the upside, some newcomer brands such as BYD, Lucid, Maxus, Nio, Ora and Wey, are now appearing and will enrich the used-car market.

‘A few older-generation models that used to see strong registrations have finally been phased out, such as the BMW i3 and Smart forfour, so that they will only be encountered on the used-car market,’ said Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

‘RVs of expensive used cars are declining, which could be due to their low age, premium brands, or expensive segments. However, their more premium prices are straining already reduced purchasing power,’ he added.

Meanwhile, used cars with lower prices and combustion engines continue to see demand and are capable of maintaining their price position. The declining inflation forecast after 2023, rising new-car prices and ongoing low volumes mean the used-car market is likely to see higher prices remain in the coming years, and maybe even rise further.

Signs of trend reversal in Italy

While months of steady growth brought double-digit year-on-year %RV increases (up 11.4%) in May, a small, but expected, change is worth highlighting. Compared to April, May saw %RVs drop by 0.2%. This is too slight a change to indicate a rapid return to pre-crisis levels, but it is likely the first sign of a reversing trend that will be monitored closely in the coming months. Nevertheless, the decline is proving slower than expected, which has informed a revision in the 2023 RV outlook to an increase of 4.7%.

This trend is observable across almost all fuel types, with the exception of HEVs and PHEVs, both of which grew by 0.5% compared to April 2023. PHEVs saw their list prices increase 44% year-on-year, which is significant compared to an average growth of 9.5%.

‘However, this is not due to any particularly aggressive pricing strategies, but rather that the technology features in larger and more expensive segments, where its advantages are easier to appreciate,’ explained Marco Pasquetti, head of valuations, Autovista Group Italy. ‘Even if transactions are few, it is not surprising that the Porsche Cayenne or BMW X3 are among the fastest-selling models.’

Compared to April, the average sale time increased by 10.7 days, so that the cars sold in May remained in stock for around two months. Finally, the second-hand market for CNG-powered cars is becoming increasingly difficult, with models taking 140 days on average to be sold.

Rentals reign in Spain

The end of April saw new-vehicle sales stay on a positive trajectory established in the first few months of 2023, with an accumulated growth of 34%. According to ANFAC data, sales of EVs continued to rise, up 45% compared to 2022.

This means they are already equal in weight to petrol vehicle sales, although this is still far from the government target. By channels, fleets brought stability, while rental channel renewals brought dynamism to the second-hand market.

‘Rental sales have sustained the second-hand market in recent months, which continues to rapidly absorb these in-demand young vehicles,’ said Ana Azofra, Autovista Group head of valuations and insights, Spain. ‘Despite this, the market is down 2%, due to a shortage of stock in the other channels.’

Meanwhile, previously reported transaction price trends continued, with some stability amidst small negative adjustments for petrol and diesel vehicles. There were improvements in the average transaction price of HEVs and slightly positive adjustments for BEVs. This was more related to the change in mix, with additional weight from premium models and better performance.

In recent weeks a negative trend in PHEV offer prices has been observed. But PHEVs are not alone, with BEVs also coming under pressure. This will eventually be reflected in a fall in transaction prices.

‘This early trend is already being observed in other important European markets, such as Germany and neighbouring Portugal, a market that is further down the electric road than Spain,’ Azofra added. ‘The need for brands to comply with emissions targets, meet infrastructure requirements to enable electric-vehicle development, alongside a certain price war in the new market, might be behind this drop.’

Switzerland sees transaction slump

The Swiss used-car market has experienced significantly increasing supply for several months and is only at a lower level for young-used cars when compared to the pre-COVID-19 era.

The active market volume index for two-to-four-year-old passenger cars was 1.3% lower in May than in April, but 36.4% higher than a year earlier. Additionally, as the cost of living increased, used-car transactions dropped at the beginning of 2023 and show no clear sign of making a recovery from a weak 2022.

Compared to April, the sales-volume index dropped by 12.3% but went up 4.3% year on year. With higher supply and diminished demand, the average value retention of a 36-month-old passenger car fell once more to 50.9% in May, down 0.4% month on month, but up 3.6% year on year.

The %RV of HEVs posted a particularly strong year-on-year gain of 18.6%, to 55.7%. This was followed by petrol cars (51.7%), diesel models (49.6%) and BEVs (48.6%). 36-month-old PHEVs retained 48.4% of their original list price.

The average days to sell increased slightly in May, with a passenger car aged two-to-four years in stock for 77 days. HEVs sold the quickest after an average of 43 days, followed by diesel cars after 74 days and petrol cars after 77 days, then PHEVs with 81 days and finally, BEVs after 91 days.

‘As used-car demand is expected to weaken amid overall increasing supply, a further and slightly accelerated decreasing trend can be expected, although values of three-year-old used cars remain relatively high,’ said Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group). ‘The %RV is forecast to finish 2023 down roughly 4% on December 2022. In 2024, RVs are expected to fall by around 3.7% year on year due to increasing supply and lower demand.’

UK used market stays strong

‘The UK’s used-car market remained strong in May,’ said Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles. ‘An average three-year-old car retained 65.9% of its original price, an increase of 8.2% compared to a year ago. That said, compared to April, RVs fell by 0.5%, although this is below the depreciation normally expect at this time of year.’

The sales-volume index reveals that retail activity calmed a little in May, falling 4.1% compared to April. The active market volume index showed 5.5% more used cars were available month on month, so the market appears to be slowing slightly which is not uncommon in the run up to summer. At 38.9 days, the average days to sell indicator backs up this change, although this is only an increase of one day.

The %RV of BEVs fell again in May, but this time by only 1.4% month on month, so it could be that they are beginning to find a new price level. BEV models still appear to be a retail challenge, however, with their average days to sell increasing by 5.6 days, up to 58.7 days. That is over 25 days longer than May last year. Their rate of sale also suffered in May, falling by almost 19%, although 256% more BEVs were sold than last year, so it is clear that there remains reasonable demand, just not enough to cope with the increased supply.