Monthly Market Update: Residual values hold steady in April

04 May 2023

Absolute residual values (RVs) of three-year-old used cars saw double-digit year-on-year growth across European markets last month. However, the wider market trend was one of marginal stability. Values as a percentage of retained list price (%RV) made only single-digit gains on April 2022 in many countries.

Italy and France were the %RV outliers with year-on-year increases of 11.4% and 10% respectively. This was followed by Austria (up 8.9%), Spain (up 8.8%) and Germany (up 6.2%). Switzerland and the UK followed closely with year-on-year gains of 5.9% and 5% respectively. Meanwhile, European markets saw marginal month-on-month adjustments in both RV and %RV terms.

The average number of days it took to sell a used car grew last month compared with April 2022. Spain experienced the largest increase at 17.2 additional days, followed closely by Switzerland and Austria with 15.6 and 15.4 more days respectively. The UK bucked this trend, with used cars taking 13 fewer days to sell compared with April 2022. Once again, these changes were more marginal month on month, with fluctuations ranging from 1.6 additional days in Switzerland to 1.8 fewer in the UK.

There was little relief for electric vehicles (EVs) with models continuing to see a range of influencing factors. In particular, battery-electric vehicle (BEV) list price decreases caused RV fluctuations, with France a notable example. Over time, this will only push values downwards. Furthermore, the rapid development of EV technology could drive customers in the new and used-car markets to hold out for longer, awaiting the latest capabilities and ranges.

EVs are continuing to benefit from the implementation of low-emission zones, with hybrid-electric vehicles (HEVs) a particular beneficiary. This is likely due to their advantageous price positioning, making the powertrain an affordable access point into electric mobility, as well as a stepping stone technology into all-electric drives.

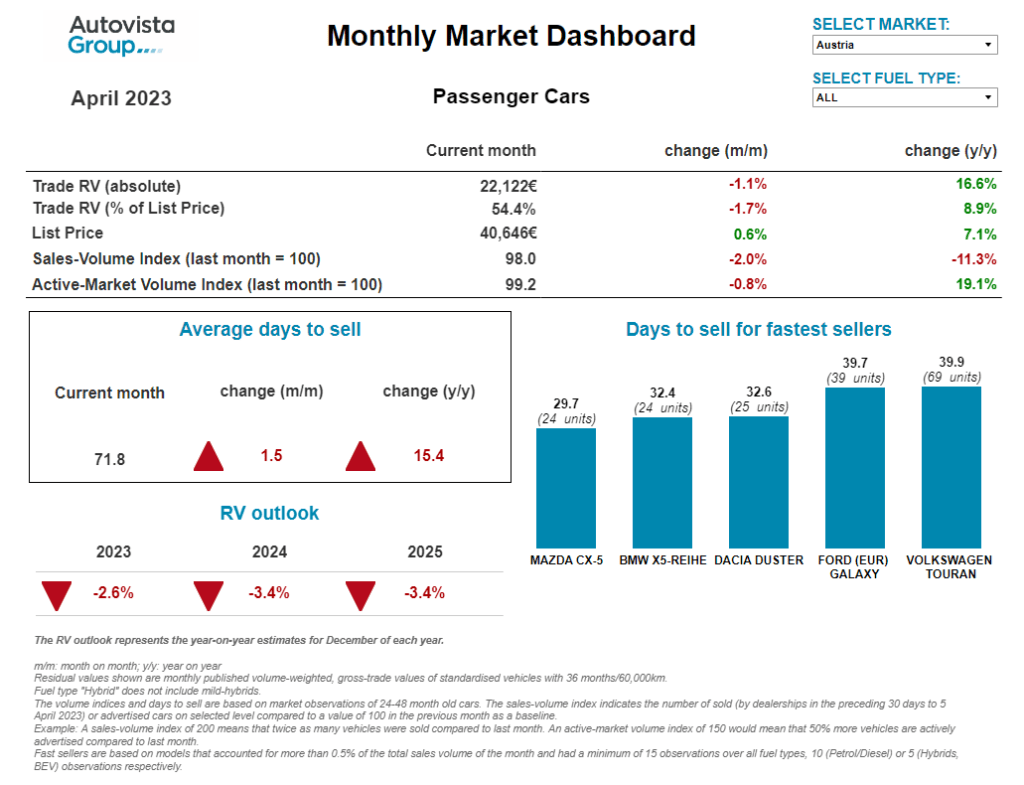

The interactive monthly market dashboard examines Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators by fuel type, including RVs, new-car list prices, selling days, sales volume and active market volume indices.

Scenario analysis

There are upsides and downsides to the base-case scenario of low supply and falling demand. Used-car prices would come under increased strain if Europe’s economic situation worsens, with demand likely shrinking. Any uptick in supply would only add to this pressure.

For example, the automotive industry is still dealing with the fallout from semiconductor shortages and supply-chain constraints. However, if demand for consumer electronics suddenly plummeted, carmakers might see what VNC Automotive called a ‘flood of chips.’ This would result in increased supply while demand continues to drag, weighing down RVs.

Conversely, used-car prices would only stand to benefit from increased disruption to new-car supply. Should automotive suppliers suffer rising costs and economic upset, this could come to pass. Should new-car deliveries take a hit, more consumers might turn to the used-car market as a viable option.

There is also the looming threat of conflicts around the world escalating further, with the war in Ukraine a primary example. Should this region take a further plunge, Europe’s already shaken supply chains would only see additional disruption.

HEVs lead in Austria

The trend of rising living costs and slowing used-car transactions (year on year) is persisting in Austria. Demand weakened with the sales volume index declining by 11.3% compared to April 2022, and dropping 2% compared to March this year.

There was a 19% year-on-year rise in the supply of passenger cars aged between two-and-four-years in April. However, supply was significantly lower last year compared to before the COVID-19 pandemic at the beginning of 2020.

‘With weakening demand and improving supply, RVs of 36-month-old cars have decreased,’ said Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland. ‘The %RV fell by 1.7% in April compared to March with cars retaining 54.4% on average. This still marked a solid 8.9% year-on-year gain but shows that pressure on RVs is increasing.’

Following a slight recovery in March, average days to sell increased to 71.8 days. This development confirms that the demand for used cars is slowing. HEVs sold the fastest, averaging around 48 days, followed by BEVs with 59 days, and PHEVs with 66 days. Petrol cars sold somewhat slower at around 72 days, only slightly ahead of diesel cars with around 73 days.

In %RV terms, HEVs stayed in the lead with a value of 60.3%, petrol cars came next (55.1%), then diesel cars (54.3%), followed by PHEVs (53.6%). At 50.2%, 36-month-old BEVs retained the lowest value. Continued pressure on RVs is likely as demand is expected to weaken while supply recovers. The retained value of three-year-old used cars will remain comparatively high but with a decreasing trend.

‘The %RV is forecast to end 2023 approximately 2.6% down compared to December 2022,’ said Madas. ‘For 2024, %RV is expected to decrease further by around 3.4% year on year, due to weakening demand and increasing supply.’

Electric impact in France

The French used-car market saw stability in April with marginally higher absolute RVs and slightly greater values in %RV terms. Given the rapid growth in recent months, values have not been influenced by climbing prices.

The average time to sell is slightly longer as used-car buyers were driven increasingly by price. There were also fewer private used-car purchases in April. Those who did were budget-conscious and looked to older models or lower segments. Cars over 12-years-of-age suffered the least.

‘More high-priced EVs are entering the used-car market, including Tesla models, due to lower prices on the new-car market which is artificially increasing RVs and %RVs,’ said Ludovic Percier, Autovista Group residual value and market analyst for France.

‘However, the absolute RVs of Tesla models will likely drop in the coming months, especially for the Model 3. Other manufacturers have already dropped their list prices to stay competitive, which will result in an overall decrease in their absolute RVs too,’ he added.

In absolute and percentage terms, petrol and diesel RVs remained stable between March and April 2023, but their sales volume decreased. While demand has shrunk, diesel vehicles have seen fewer sales on the new-car market in the past year, compensating for the lower demand currently seen on the used-car market.

The decline of diesel RVs is still relatively small, even with the fuel type’s tarnished reputation and the implementation of low-emission zones (ZFEs). These zones only impact cities with 150,000 inhabitants or more and high-mileage drivers are not affected. From late 2024 and into 2025, diesel will see a heavier impact.

HEV RVs remained roughly stable with a marginal increase in percentage terms and reduced absolute values as a consequence of lower list prices. PHEVs were almost stable after an increase in March, but this was due to a lower base of comparison in February. A major decrease can still be expected in the coming months.

Ups and downs in Italy

New-car registrations in Italy have been rising sharply year on year. Greater product availability has slowed the increase in %RVs, which are still up slightly compared to March 2023 (0.5% increase). But the recent trend of double-digit month-on-month growth has come to an end.

The sales-volume index, on the other hand, fell considerably, down 37.6% compared to March. However, this does not signal a wider drop in demand. The sales volume index grew by 26.2% year on year, meaning the recent decline is more likely due to seasonality.

On average, cars were sold in just under 51 days in April, a month-on-month decline of 0.3, but a 6.1 increase year on year. The top performers were the Dacia Duster, the Peugeot 308 and the Alfa Romeo Stelvio, which with its recent restyling, continues to see segment popularity in Italy.

Meanwhile, BEVs are bucking the trend with RVs falling 0.3% month on month. As this can still be considered a new technology, sales are relatively few. But it will take some time to reverse this trend and reach the level of internal-combustion engine (ICE) vehicles.

‘While overall RV growth has slowed, these values have not yet entered a downward phase,’ said Marco Pasquetti, head of valuations, Autovista Group Italy. ‘Therefore, the outlook for 2023 has been slightly adjusted to a growth of 4.7% year-on-year. From 2024 onwards, a gradual descent can be expected.’

Rental revival in Spain

The changing trend in new-vehicle sales continued at the end of the first quarter of 2023, with a year-on-year growth of 45% in Spain. Although all channels are benefiting from greater supply, the market’s key rental channel is responsible for a large part of this growth.

According to data from the manufacturers’ association ANFAC, sales to rental companies grew by 270% in March compared to the same month last year, and by almost 220% in the first quarter. This channel’s new-car market demand is helping revive the stock of available young-used vehicles.

‘So, sales of young-used vehicles have grown the most in this period, an age group with an optimal turnover and fast absorption rate into the market,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain. ‘In any case, used-car transactions continue to grow and are double those of new car registrations, although their growth is more contained.’

Transaction price trends from previous months have also continued. There is a level of stability with small negative adjustments for petrol and diesel vehicles. Meanwhile, BEVs have seen a slightly positive adjustment, more related to the change in the mix, with an increasing weight of premium models capable of better performance.

PHEVs are experiencing a negative trend. Stock is increasing, days-on-sale are rising, while transaction prices continue to fall month on month. This fuel type does not seem to be benefiting from the creation of low-emission zones in almost 150 cities, even though this is profiting HEVs. ‘These vehicles are still experiencing a ‘sweet moment’ with rising used-vehicle prices and very dynamic turnover,’ Azofra confirmed.

Some stability in Switzerland

‘Across all two-to-four-year-old passenger cars, the active market volume index was 1.1% higher in April than in March, and 39.1% higher than a year earlier,’ said Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group). ‘Moreover, with the rising costs of living, used-car transactions slowed down at the beginning of 2023 but now show signs of recovery compared to 2022.’

The sales-volume index continues to see growth, up 1.6% compared to March, and up 10.7% year on year. With increased supply and slightly weaker demand, the average %RV of 36-month-old passenger cars decreased to 51.1% in April, down 0.4% month on month, but still up 5.9% year on year.

In %RV terms, HEVs once again posted a particularly strong year-on-year gain of 19.3%, reaching 55.3%. Petrol cars were not too far behind (51.9%), and then came diesel models (49.8%), followed by BEVs (48.9%). Meanwhile, 36-month-old PHEVs retained 48.9% of their original list price.

April saw days to sell remain effectively static once again, with two-to-four-year-old cars in stock for 76 days. Petrol cars sold the fastest, after an average of 75 days, followed by diesel cars after 76 days and HEVs after 80 days, then BEVs with 81 days and finally PHEVs after 89 days.

‘As used-car demand is expected to weaken amid stable supply, a further decreasing trend is to be expected although values of three-year-old used cars remain relatively high. The %RV is forecast to finish 2023 around 3% down on December 2022. For 2024, RVs are expected to fall by around 3.6% year on year, due to increasing supply and weakening demand,’ Annen added.

UK sees determined demand

Although UK consumers have experienced significant financial pressures due to the rising cost of living, it does not seem to have dampened used-car demand. Retail activity in the first quarter of 2023 has been very buoyant, which led to busy wholesale channels as dealers sought to replenish stock more frequently.

‘Demand outstripped supply at auction throughout March, which led to Glass’s average RV for a three-year-old car to increase by 1.4% in April. Although, a year-on-year comparison shows that RVs increased by 5%. Only plug-in vehicles bucked the upward trend in April, with month-on-month falls for PHEVs of 0.1% and BEVs of 9.7%,’ explained Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

The average number of days to sell shrank again last month, dropping 1.8 days to 38 days. This is almost two weeks shorter than twelve months ago, underlining just how buoyant retail activity has been. However, it did take dealers much longer to sell used PHEVs and BEVs, at 49 and 53 days respectively, with HEVs taking 40 days, diesel 39 days and petrol leading the way at just 36 days.

‘The rising cost of living and further planned increases in energy costs have led Glass’s to expect RVs to fall around 5% by the end of the year. However, with demand outstripping supply and no obvious increase in stock on the horizon, this outlook is now less pessimistic, with values expected to end the year in line with December 2022. There will of course be exceptions to this, in particular for BEVs, where supply continues to outstrip demand and values remain volatile,’ Whittington concluded.