Monthly Market Update: February’s residual values succumb to diminishing demand

02 March 2023

The average residual value (RV) of a three-year-old used car remains high in European markets by historic standards but fell last month in Italy, Spain, and Switzerland. Where RVs did rise in absolute terms, they were largely influenced by list-price developments.

Represented as a retained percentage of their original list price (%RV), prices held firm or gained in Austria, France, and the UK last month. In other key European markets, the %RV is already succumbing to weakening demand.

The cost-of-living crisis will further erode consumer demand for used cars, which would ordinarily put pressure on RVs. However, in addition to new-car supply challenges, the COVID-19 pandemic significantly derailed the European new-car market from March 2020 onwards. This will acutely reduce the volume of cars de-fleeting after three years.

So, undersupply into the used-car market is expected to persist, which will compensate for diminishing demand. Accordingly, Autovista Group forecasts that the %RV will not decline significantly across European markets in 2023 and 2024.

Battery-electric vehicles (BEVs) face unique challenges. On one hand, the surge in all-electric registrations in Germany at the end of 2022 and the imminent de-fleeting of vehicles that benefited from higher incentives introduced in mid-2020 do not bode well for RVs. Conversely, BEV prices are rising in France for example, albeit from a low level, with values of the youngest used BEVs benefitting from improved range.

As countries such as France and Spain introduce more low-emission zones, BEV RVs stand to make gains. This development is also boosting prices of used hybrid-electric vehicles (HEVs) as they offer the most affordable access to electrified mobility and buyers are not afflicted with range and/or charging anxiety.

The interactive monthly market dashboard examines Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators by fuel type, including RVs, new-car list prices, selling days, sales-volume and active market-volume indices.

Scenario analysis

There are upsides and downsides to this base-case scenario of undersupply and diminishing demand. Used-car prices will come under greater pressure if the economic situation deteriorates in Europe, with a more negative impact on demand. This would be compounded if there are significant supply improvements.

For example, lower demand for consumer electronics could see a quicker resolution to the semiconductor shortages in the automotive industry. According to VNC Automotive, the ‘semiconductor drought could soon become a flood of chips.’

Conversely, there are risks of greater disruption to new-car supply, which would benefit used-car prices. Automotive suppliers could succumb to mounting costs and economic headwinds. The risk of the war in Ukraine escalating remains too, with potential consequences for Europe’s fragile supply chains. Any unforeseen improvement in used-car demand, either if fewer new models can be delivered or consumers defect to buying used instead of new, would also push RVs higher.

Slowing activity in Austria

As elsewhere in Europe, living costs are rising in Austria and used-car transactions are slowing compared to last year. The sales-volume index clearly shows weakening demand with a decline of 26.1% compared to February 2022. HEVs are impacted the most, with a sales volume decrease of approximately 49% year on year.

In contrast, the supply of passenger cars aged two-to-four years was 24% higher in February than a year earlier. But supply was significantly lower in 2022 than before the COVID-19 pandemic struck at the beginning of 2020.

Average days to sell increased to 75.7 days, which confirms the slowdown in used-car demand. HEVs are currently selling the fastest, averaging 44.3 days, followed by BEVs with 69.4 days, plug-in hybrids (PHEVs) with 72 days, and petrol cars with 75.5 days. Diesel cars are selling the slowest, averaging around 77 days.

Despite weakening demand and improving supply, RVs of 36-month-old cars have remained stable. The average %RV increased slightly by 0.8% month on month in February, with cars retaining 55.3% of their list price on average. This marked a solid 15.4% year-on-year gain.

HEVs are currently leading with a trade value equating to 59.2% of their original list price, followed by PHEVs (55.5%), petrol cars (55.4%), and diesel cars (55.3%). 36-month-old BEVs retain the lowest value, at 53.8% of their original list price.

‘As the demand side is expected to weaken while supply recovers, pressure on RVs is to be expected. However, prices of three-year-old used cars will remain relatively high, albeit with a slightly decreasing trend,’ commented Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

Madas forecasts that the %RV will end 2023 approximately 2.4% down on December 2022. For 2024, he expects the %RV to decrease further by around 3.4% year on year due to weakening demand and increasing supply.

Delayed purchases in France

‘The French used-car market has seen drastic changes since 2021, with both higher RVs and list prices as well as reduced offerings of both new and used cars. The stabilisation observed in January was not maintained in February, with increases in RVs for BEVs and petrol cars and slightly for diesel cars. HEVs and PHEVs remain stable, but with lower price increases than at the end of 2022,’ explained Ludovic Percier, Autovista Group residual value and market analyst for France.

However, sales volumes are still falling as many customers are delaying purchases because they understand that prices are high but will not stay that way for long. Accordingly, list prices are no longer influencing RVs as they have increased too much in recent months.

‘The private buyers that are seeking a used car are focused on older vehicles or cars in lower segments, mainly dictated by budget. Cars over 12 years of age are suffering the least, confirming that consumers are not following list-price increases,’ said Percier.

Values of used BEVs are still increasing as RVs were low and the vehicles now available on the used-car market have a higher range than in the past. Petrol and diesel car prices are still rising but should stabilise and a correction is expected in the coming months.

As new-car buyers have been switching from diesel to petrol or other powertrains in recent years, availability is lower on the used-car market. Even with the rollout of low-emission zones (ZFEs) and a tarnished image, RVs of diesel cars are still not falling. ‘ZFEs are only in towns and cities with at least 150,000 inhabitants and do not target high-mileage drivers, but will have a bigger impact on diesel from late 2024 and into 2025’ Percier commented.

PHEVs remain stable for the moment but there was already a slight price decrease at the end of last year and Percier expects a further decline from mid-2023.

Significant drops in Germany

‘In line with expectations, the start of the year was lukewarm on the new-car side in Germany and just below the weak first month of last year. Only HEVs experienced the strongest January ever. Electric vehicles, especially PHEVs, were in an expected hole due to the registration hype at the end of 2022, caused by the reduction or discontinuation of incentives,’ explained Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

As a result, the combined market share of BEVs and PHEVs fell from an exorbitant 55% in December to 15% in January. However, this dip does not detract from the rapidly increasing supply of electric vehicles (EVs) on the used-car market over the past half year.

‘Considerable stock potential has built up, which will continue at a high level with the arrival of three-year-old BEVs that benefitted from the high subsidies available in 2020. Accordingly, we can observe that the price level of BEVs and PHEVs is dropping significantly, regardless of age. Even HEVs, which have been stable for a long time, are now showing first signs of fatigue and have a slightly negative price trend,’ Geilenbruegge commented.

RVs of internal-combustion engine (ICE) vehicles, however, are stable and suffer only from overstretched prices in absolute terms, which many potential buyers simply cannot afford or no longer want to pay. ‘Dwindling purchasing power and steadily decreasing supply are working against each other to keep prices for ICE cars fairly stable, albeit with a slightly negative tendency,’ said Geilenbruegge.

Stock days are growing again across all fuel types and point to an imminent round of price reductions. However, RVs will not fall back to pre-crisis levels because of the low volumes seen in recent years. Although the number of used-car transactions rose slightly in January compared to the same month last year, the volume was more than 140,000 units or 22% below the pre-crisis level. ‘Shortages thus remain the dominant theme,’ Geilenbruegge concluded.

Italy returning to normality?

February’s figures indicate price stability in Italy compared to January, with a negligible decrease of 0.1% in the %RV. Sales observed in online marketplaces, on the other hand, increased significantly, with the sales-volume index up 49%. This recovery is also noticeable in the new-car market, which grew by 19% in January compared to a year ago.

‘This is a sign that we are on the road to a return to normality, but still with a long way to go,’ commented Marco Pasquetti, head of valuations, Autovista Group Italy.

In general, RVs are fairly stable for all fuel types compared to January, except for BEVs, which dropped by 2.8%. Despite incentives and increased awareness of the technology, BEVs have not yet managed to break through in Italy; indeed, their market share in January was 2.6%, the lowest among the five major European markets.

‘High list prices compared to traditional combustion engines and a recharging infrastructure that is still deemed insufficient to cover motorists’ needs (especially when it comes to fast charging) discourage the deployment of BEVs and will have to be addressed if Italy wants to achieve the emissions targets set for 2035,’ Pasquetti explained.

The average time to sell a used car fell by 11 days compared to January, to less than 62 days. The Toyota C-HR HEV is performing exceptionally well, selling in less than 31 days – practically half the overall average.

Young used cars in Spain

Although the Spanish new-car market showed a clear improvement in January compared to the last two years, it is still 26% below pre-pandemic figures. In addition to supply problems, the market is already impacted by inflation and especially by the rise in interest rates, which are putting pressure on – and holding back – demand.

The second-hand market has also made a positive start to 2023, although it is still 17% below pre-pandemic figures. ‘The market is still clearly weighed down by the endemic weight of transactions involving vehicles over 10 years old (six out of 10). However, January has seen an injection of young used cars (one to three years old) from rental companies de-fleeting as they are gradually gaining access to new cars and are thus able to renew their assets,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain.

‘This influx of younger cars will also be a shot in the arm for dealers, who have seen the turnover of their used-vehicle business fall by 13% in 2022 according to data recently published by Faconauto. This is partly due to the lack of volume and partly due to the lack of younger used cars, which are so important to their business. Profitability has also been low despite average used-car prices, although now undergoing slight adjustments, being 17% higher than a year ago,’ Azofra added.

But demand remains subdued, especially impacted by the economic crisis and the rise in interest rates, and stock days are lengthening, putting prices under mounting pressure.

HEVs continue to escape this trend, with RVs on the rise as they are supported by the creation of low-emission zones in almost 150 cities. ‘Far from already being a reality, communication about the government’s plans – especially in the media and on the street – is favouring HEVs and redirecting demand towards them,’ Azofra commented.

This predisposition of demand is reflected not only in transaction prices but also in stock turnover. The sales period for a used HEV has been reduced to 5 weeks, while an ICE car takes up to two months to sell and a BEV or PHEV just over two months.

‘Despite the greater difficulty in selling BEVs, their average transaction prices have seen a slight upturn but this is more linked to changes in the mix, which now includes more premium models with longer ranges,’ Azofra concluded.

Ups and downs in Switzerland

The Swiss used-car market has experienced increasing supply for several months now, but it is still at a lower level for younger used cars than before the COVID-19 pandemic. Across all two-to-four-year-old passenger cars, the active-market volume index was 1.2% higher in February than a month earlier, and 40.3% higher than in February 2022.

Moreover, with rising costs of living, used-car transactions are slowing this year compared to 2022. The sales-volume index has returned to a growth path with a 20.5% increase compared to the low base of January but with a clear 6.3% decline year on year.

With increased supply and slightly weakening demand, the average value retention of 36-month-old passenger cars decreased to 51.7% in February (down 1.7% month on month but still up 10.1% year on year).

BEVs posted particularly strong year-on-year %RV gains of 19.3%. Nevertheless, petrol cars are currently leading, retaining 52.5% of their original list price, followed by HEVs (51.5%), diesel cars (50.3%) and BEVs (49.8%). 36-month-old PHEVs retain the lowest value, at 49.2% of their original list price.

The average days to sell increased again in February, with a passenger car aged two-to-four years in stock for 76 days. HEVs are currently selling the quickest, after an average of 69 days, followed by diesel cars after 74 days, BEVs and PHEVs after 76 days, and petrol cars after 77 days.

‘As used-car demand is expected to weaken amid supply recovering further, a slightly decreasing trend is to be expected although values of three-year-old used cars will remain relatively high,’ noted Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group).

Annen forecasts that the %RV will finish 2023 around 3% down on December 2022. For 2024, he expects RVs to fall by around 3.7% year on year due to increasing supply and weakening demand.

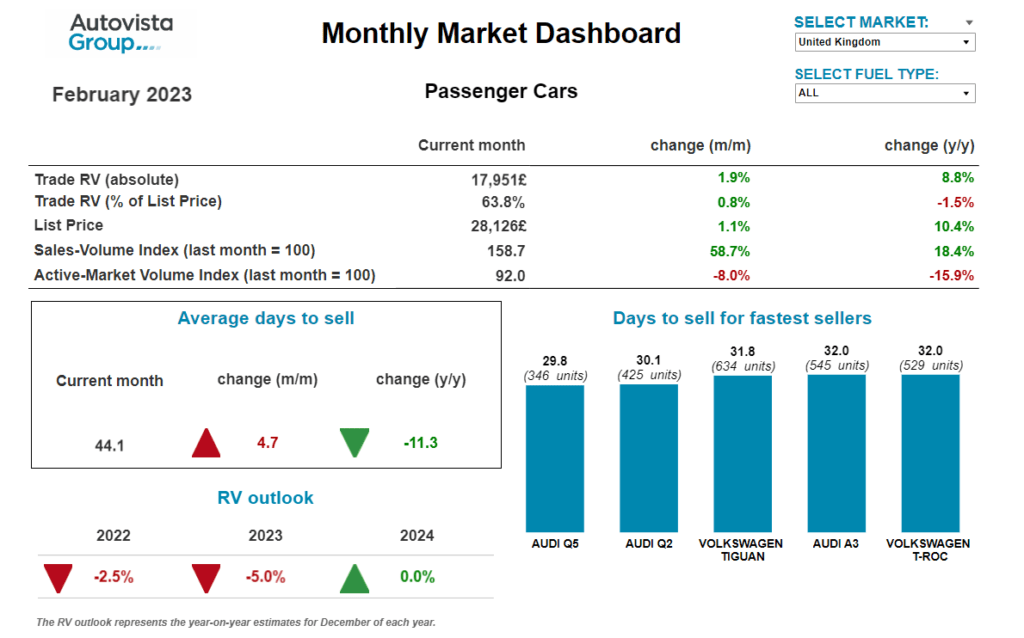

Supply outstripping demand in UK

RVs in the UK experienced modest gains in February. When expressed as a percentage of the original list price, they increased by 0.8% month on month to 63.8%. Although this figure is 1.5% below February 2022’s average %RV, they remain at a remarkably high level considering the significant upward development of RVs over the past two years, being underpinned by continued used-car supply shortages.

‘Used-car wholesale activity throughout February was excellent, indicating that in general, used cars remain in high demand, a result of buoyant retail sales. However, BEVs face continued challenges. Despite the sales-volume index showing a 72% month-on-month increase, there was not sufficient wholesale demand to hold back the BEVs on offer in auction channels, with the conversion rate significantly lower than for other fuel types,’ commented Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

Used BEVs continue to sell at auction, but recent hammer-price performance has led to falling RVs. In February, the average %RV of a three-year-old BEV fell 4.6% compared to January, taking them 1.1% below last year’s figure. RVs of HEVs and PHEVs fared better in February but still declined slightly, falling 0.5% and 0.3% respectively.

‘The outlook for the UK’s used-car market looks fairly encouraging. As long as retail demand remains steady and stock is still in short supply then RVs should follow a traditional depreciation pattern. BEV RVs will be the exception as they continue to find a new level in the market, which could be closer to the pound-note level of similar ICE variants,’ Whittington concluded.

The February 2023 monthly market dashboard provides the latest pricing, volume and selling-days data.