Monthly Market Update: European used-car markets slow in September

03 October 2023

Compared to both August 2023 and September 2022, European used-car markets hit the brakes last month. Average days needed to sell a vehicle increased across the majority of countries examined, as demand fell below supply.

Indicating the number of used-car transactions, the sales-volume index (SVI) fell month on month in six major European markets. This included Italy (down 34.5%), Spain (down 15.7%), Austria (down 11.6%), France (down 11.5%), the UK (down 10.7%), and Germany (down 4.5%). Only Switzerland bucked the trend, recording growth of 8.8% compared with August.

The active-market volume index (AMVI) revealed that Austria, France, Germany, Italy and the UK all saw supply outperform demand in September. The two outliers were Switzerland and Spain, both posting better results in the AMVI than the SVI. However, Spain’s 15.7% month-on-month decline in demand was only marginally better than the 15.8% drop in supply.

The SVI and AMVI drops were not as severe when compared with September 2022. Italy saw the greatest year-on-year fall in demand at 26.2%. However, the trend of supply exceeding demand remained, with only France posting better SVI (down 3.2%) than AMVI results (down 11.7%).

Increased stock days in September further confirmed slowing demand, with dealers needing more time to sell used models. The small amount of speed picked up in August all but dissipated in many markets. Italy saw the greatest increase, up 8.1 days to hit nearly 72 days on average. Meanwhile, the UK saw one of the smallest increases (0.2 days), but sales were achieved in just over 38 days. Stock days were the highest in Switzerland at over 83 days on average.

Increasing supply and falling demand will continue to put pressure on used-car residual values (RVs). Compared to August, both absolute trade values and RVs presented as a percentage of the original list price (%RV), saw mainly marginal downturns. Italy saw the greatest month-on-month fall, with absolute values down 3.6%. Meanwhile, the UK was the only market to see growth, up 2%.

The interactive monthly market dashboard examines passenger-car data by fuel type, for Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators, including RVs, new-car list prices, selling days, sales volume and active-market volume indices.

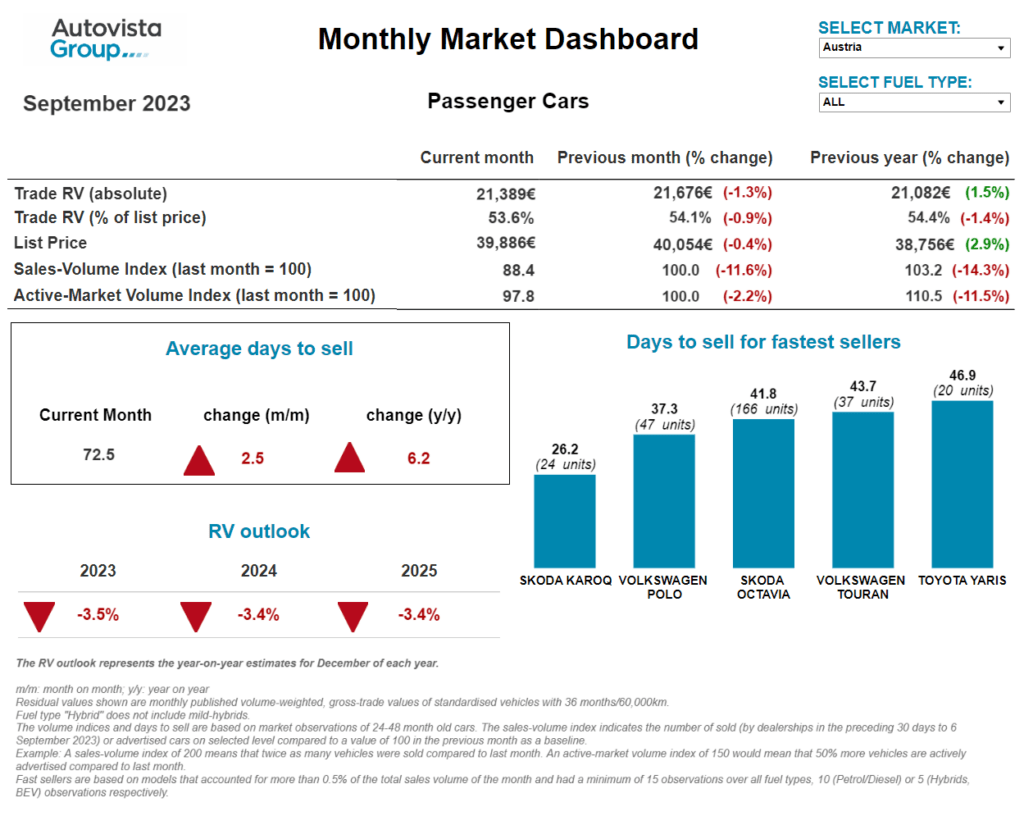

Demand drops again in Austria

Compared to 2022, Austria keeps seeing its living costs grow as used-car transactions wither. In September, the SVI revealed significantly weaker demand, with a month-on-month decrease of 11.6% and a year-on-year decrease of 14.3%. At the same time, the supply volume of two-to-four-year-old passenger cars was around 2.2% lower in September than a month earlier.

It took 72.5 days on average to sell a used car in the country last month. This increase confirms a further slowdown in demand. Hybrid-electric vehicles (HEVs) sold the fastest, averaging around 65 days, followed by diesel cars at 68 days, petrol cars at 72 days and plug-in hybrids (PHEVs) at around 84 days. Battery-electric vehicles (BEVs) sold more slowly at around 99 days.

‘With weakening demand and generally improving supply, %RVs of 36-month-old cars declined to 53.6% on average. This marked a 1.4% year-on-year decrease and shows that pressure on RVs is increasing,’ explained Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

HEVs led the way with a %RV trade value of 57% followed by petrol (54.6%), diesel cars (54.1%) and then PHEVs (51.7%). Meanwhile, 36-month-old BEVs retained the lowest value, at 46.2%. As demand is expected to weaken while supply recovers, further pressure on RVs can be expected.

‘The market’s average %RV of a 36-month-old car at 60,000km is forecast to end 2023 approximately 3.5% down compared to December 2022. For 2024, %RVs are expected to decrease further by around 3.4% year on year due to weakening demand and increasing supply,’ added Madas.

Waiting effect in France

‘RVs of used cars in France fell slightly from August to September. While the year-on-year gap shrank, the overall market still appears to be in decline, although petrol and diesel values remained stable,’ said Ludovic Percier, Autovista Group residual value and market analyst for France.

There were slight fluctuations in the sample, which played on list prices and %RVs. HEVs saw values increase slightly, however, this is the result of premium models entering the used-car market. If only mass-market models were considered, this trend would be reversed.

PHEVs saw stable absolute RVs and %RVs in September, but the supply of premium vehicles fell. The market is also becoming more crowded with French models, such as the Peugeot 3008 and Renault Captur.

‘Moreover, newer cars are arriving on the used market with greater ranges, around 100km (WLTP). This affects currently available vehicles, including returning leased cars,’ Percier added.

BEV values were stable in September, with less expensive vehicles on offer. This meant %RVs increased, but absolute trade RVs remained consistent. Some declines have been observed at the 12 and 24-month marks, with 36 months soon to follow.

Supplies of the Tesla Model 3 increased with the launch of the refreshed version. Lower Tesla prices can be expected in the coming months, something which always impacts the wider electric vehicle (EV) market. As new EV brands, including those from China, make an entrance with lower-priced models, established manufacturers are seeing customer loyalty challenged.

Once again, the SVI was lower than it should be, however, the year-on-year gap is diminishing. Purchases are still driven by budgets, generating a ‘waiting effect’ as consumers put off expensive decisions, hoping for prices to come down. In the meantime, drivers will likely wait for the vehicle they want, or explore cheaper options in a lower segment.

September illustrated this point, with the smallest cars once again selling the fastest. The Dacia Sandero, Toyota Aygo Yaris and Audi A1 all sold in fewer than 40 days. While this is longer than last month, these models are still the easiest to sell.

Divergent influences in Germany

At first glance, the market indicators for used cars up to five years of age in Germany might suggest everything is running reasonably steadily at a comparatively high level. However, the divergence between different factors, such as fuel type and age, reveals just how much the market is being driven by separate forces.

Internal-combustion engine (ICE) powered vehicles still look to be the least affected by the current recessionary price trend. Meanwhile, younger models, especially BEVs and PHEVs, are suffering from budgetary restraints. This is the result of absolute price levels conflicting with falling spending power.

‘The supply of used cars up to five years of age has already returned to near pre-crisis levels, but determining factors, such as fuel type and list price, have changed considerably,’ stated Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

The light-commercial vehicle (LCV) market, which does not often see the limelight against the passenger-car sector, has also seen some interesting developments. For the last few months, an increasing number of young Volkswagen (VW) ID.Buzz models have entered the market, spearheading a new generation of electric LCVs.

The powertrain’s share of the wider commercial market still lags far behind that of all-electric passenger cars. However, supply volumes of the dealer-desired ID.Buzz, are now consistently in the three-digit range. Time will tell just how in demand these models are on the cost-sensitive, used-LCV market.

All in all, used-LCV demand is currently stumbling after its pandemic-related peak, which was the result of a strong increase in transport volumes. Declining sales and corresponding stock days have already returned to pre-crisis levels. However, the quantities of vehicles on offer are not increasing due to a lack of supply, which means it is becoming increasingly difficult to maintain high price levels.

C-segment SUVs popular in Italy

Italy’s new-car market recovered over the first eight months of 2023, growing 20.3% year on year. Meanwhile, the country’s used-car market continued its decline in September. Most of the events behind the shock increase in used-car RVs have been resolved or are at least stabilising.

%RVs declined month on month to 54.7%. Despite this downturn, the average %RV across all powertrains remained up 8.8% on September 2022. On the other hand, the %RVs of BEVs were up 1.2% against August. Growth was also recorded for natural gas models (up 4.2%) and LPG vehicles (up 0.2%) month on month.

Between August and September, average stock days increased by 8.1 days to nearly 72 days. C-segment SUVs proved the most popular on the Italian used-car market last month, with the Citroen C5 Aircross selling in roughly 44 days on average. The only car from an Italian brand to appear in the top five fastest sellers list was the Alfa Romeo Stelvio.

‘The RV outlook for the Italian used-car market remains positive for 2023, with the market forecast to be up 5.5% year on year. So, used-car values can be expected to continue on a slow path of normalisation back towards pre-COVID-19 levels, before heading into a gradual decline,’ said Marco Pasquetti, head of valuations, Autovista Group Italy.

Timid growth in Spain

New-car registrations in Spain continue to show slight signs of improvement. In the first eight months of 2023, the market saw year-on-year growth of 20.5%. In August, a large part of this momentum came from the private channel, which is typical during the holiday period.

‘Still weighed down by a lack of stock, the used-car market showed more timid growth, remaining close to 3% in the year-to-date. In line with a trend observed across previous months, used-car prices have continued to fall,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain.

September did see a less drastic decline. The average trade transaction price for a three-year-old car at 60,000km hit €19,832 in the month, down from €19,924 in August. Trade prices can be expected to fall below the levels reached in 2022.

Despite the scarcity of stock, demand continues to be held back by rising interest rates and economic uncertainty. As usual, one of the indicators that best reflects the situation is the number of days it takes to sell a car, which has increased by six days, now exceeding 74 days on average.

In the case of BEVs, this period is now eight days longer than in August. The price outlook for all-electric cars is still negative, dragged down by Tesla’s price drop. However, it is less noticeable on average due to high-performance BEVs entering the used market. ICE models continue to show great resistance, especially petrol-powered cars.

After losing some pace in August, HEVs regained momentum in September. This was probably due to people returning to urban areas, while also being concerned about expected emissions restrictions. Accordingly, the fastest-selling model ranking was once again led by the Toyota RAV-4, then the Hyundai i20, with the Ford Puma in third.

Stock days up in Switzerland

‘Switzerland’s used-car market has seen supply stabilise on pre-pandemic levels in recent months, with low supply only being felt by younger models,’ said Hans-Peter Annen, head of valuations and insights, at Eurotax Switzerland.

From August to September, the AMVI for two-to-four-year-old passenger cars fell by 1.9%. However, it was 18.4% higher than a year earlier. While living costs have continued to climb in the country since the beginning of the year, used-car transactions have slowed.

The SVI increased by 8.8% compared to August and by 10.3% year on year. The recent stabilisation of supply and weakening of demand has resulted in the average %RV of a 36-month-old car falling again. This was only a marginal drop from 50.3% in August to 50.2% in September, while the figure was slightly higher at the same point last year, at 51.1%.

HEVs posted a particularly strong year-on-year %RV gain of 8.6%, reaching 54.1%. This was followed by petrol cars (51.2%), diesel models (49%) and PHEVs (47.5%). Meanwhile, 36-month-old BEVs retained 46.9% of their original list price.

The average days needed to sell increased in September, with two-to-four-year-old passenger cars in stock for some 83 days. HEVs sold the quickest after an approximate average of 71 days, followed by petrol cars after 80 days, then diesel cars at 86 days, PHEVs at 88 days and finally BEVs after 102 days.

Looking ahead, demand for used cars is expected to weaken while supply stays high and stable. A declining trend can be expected; however, the values of three-year-old used cars should stay relatively high.

‘The %RV level in Switzerland is forecast to finish this year down roughly 4% on December 2022. In 2024, levels are expected to fall again by around 4% due to constant supply and lower demand,’ Annen added.

UK feels plate effect

On the face of it, UK used-car values rose again in September, with the average %RV of a three-year-old car rising from 60.6% to 62.1%. However, the ‘plate effect’ is masking the true picture. But what is the plate effect and how is it distorting values in the UK used-car market?

Cars registered at different points in the year will display different registration markers, indicating a vehicle’s age and affecting its value. The first major plate change happens each March with a subsequent variation in September. A final change the following January does not affect the registration mark but does impact a car’s value as it was registered in a different year.

‘In September, a car that was registered three years ago would display a 2020 70 plate. Yet in August of the same year, a three-year-old car would show a 2020 20 plate. The difference in value between these plates is approximately three percentage points,’ explained Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles.

So, if the market remained level between August and September, the average value in this report could be expected to increase from 60.6% to 63.6%. In September this year, values only increased 1.5 percentage points, indicating that the market actually fell.

The safest way to compare values in a plate-change month is against the previous year. This comparison shows that, like-for-like, RVs in September 2023 were down by 0.6 percentage points on September 2022, which is a relatively small RV adjustment considering how high values have been over the past couple of years.

In the 30 days prior to 6 September, retail activity appears to have retracted, with 10.7% fewer cars sold than last month, although 11% more sales were recorded compared with a year ago. This month’s report shows that 4.4% fewer cars were advertised for sale, the third consecutive month a decline has been observed.

The most noteworthy RV trend in the first nine months of 2023 was the fall of BEV values. Driven by an increase in supply, values have fallen significantly more than any other fuel type. However, this is not a result of falling demand, with the BEV SVI up nearly 400% year on year. Demand has failed to keep pace with the increasing volume of end-of-contract vehicles de-fleeting into wholesale channels.

The average %RV of a three-year-old BEV in the UK fell from 67.2% to 44.3% over the course of 12 months. Many in the industry will be hoping that this is the beginning of BEV value stabilisation.

The average number of days it took a dealer to retail a BEV fell by 8.6 days to 37 days, which is faster than petrol and diesel. Consumers may have found that used BEVs are now a reasonable value-for-money proposition, with some reaching price parity with ICE and hybrid models.