Monthly Market Update: Pressure mounts on RVs as supply outweighs demand in March

03 April 2023

In absolute terms, residual values (RVs) of three-year-old used cars rose year-on-year across European markets last month. While values represented as a retained percentage of the original list price (%RV) also grew, it was to a lesser extent across the board.

Austria saw the greatest increase in %RV at 13.6%, with Italy and Germany following closely behind, posting 11.4% and 10.7% respectively. Meanwhile, the UK was the outlier with a growth of just 0.5% in %RV terms compared to March 2022.

This was not the only instance where the UK went against a larger market trend. Alongside Italy, both countries saw demand outstrip supply. Other European markets experienced the reverse with a greater number of used-car adverts than sales, putting more pressure on RVs.

The %RV of battery-electric vehicles (BEVs) increased across markets, except in the UK where a 9.6% decline was recorded. However, some carmakers recently lowered new-BEV prices to attract consumers outside the early-adopter sphere.

This will most heavily impact the absolute RVs of directly comparable used cars, including very-young used models, demonstrators, and rental vehicles. While older models will also be affected, it will take longer for this effect to cascade.

More broadly, the continual acceleration of electric vehicle (EV) technology means consumers of both new and used cars may hold out for longer as they wait for the latest technological developments and improved ranges. This could mean both lower supply and demand for the used-BEV market.

The interactive monthly market dashboard examines Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators by fuel type, including RVs, new-car list prices, selling days, sales-volume and active market-volume indices.

Scenario analysis

The base-case scenario of low supply and falling demand comes with positives and negatives. If the economic situation in Europe continues to diminish, used-car prices will experience greater pressure as demand drops. Big improvements to supply would only serve to compound this effect.

For example, the automotive industry is still struggling with supply-chain constraints and semiconductor shortages remain. However, a sudden reversal caused by lower demand for consumer electronics could mean a faster solution for carmakers.

VNC Automotive pointed out that the ‘semiconductor drought could soon become a flood of chips.’ If that were the case then supply would likely increase while demand continues to drag, weighing down RVs.

Any increased disruption of new-car supply would benefit used-car prices. This could happen if automotive suppliers suffer from increased costs and economic difficulties. The possibility of the war in Ukraine escalating further also remains. This could damage Europe’s already fragile supply chains. RVs might also climb if there is an unexpected improvement in used-model demand. If new-car deliveries take a hit, more consumers might veer away from the market and buy used cars instead.

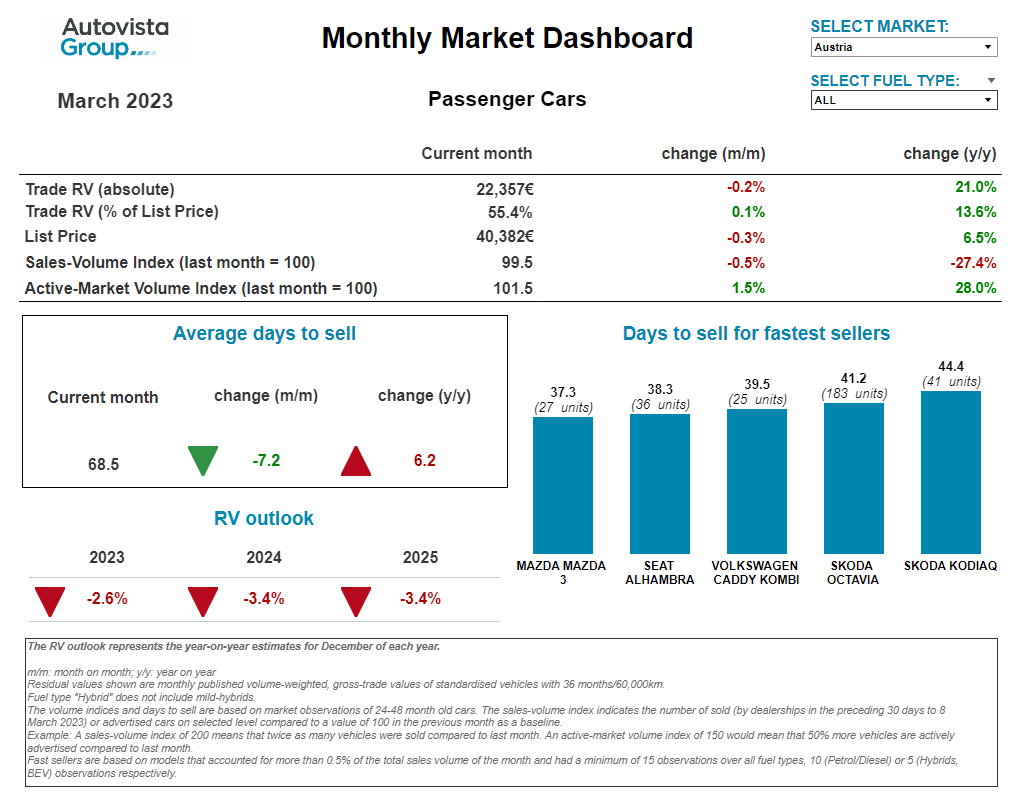

RV pressure expected in Austria

Living costs continue to rise in Austria and used-car transactions are slowing compared to 2022. The sales-volume index highlights the weakening demand with a 27.4% decline compared to March last year. Hybrid-electric vehicles (HEVs) were hit hardest once again, suffering a 32.4% year-on-year drop.

Meanwhile, the supply of two-to-four-year-old passenger cars was 28% higher in March 2023 than a year earlier. Yet supply was lower in 2022 than prior to the COVID-19 pandemic, which started affecting the market at the beginning of 2020.

After a slow February, average days to sell decreased to a total of 68.5, confirming the weakening in used-car demand. HEVs and plug-in hybrids (PHEVs) sold the fastest, averaging around 48 days, followed by diesel cars with 67.8 days, then petrol models and BEVs with around 71.7 days.

‘Despite weakening demand and improving supply, residual values of 36-month-old cars have remained stable,’ explained Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland. ‘The %RV remained almost unchanged in March with cars retaining 55.4% on average. This marked a 13.6% year-on-year gain.’

HEVs currently have the highest %RV trade value at 60.2%, followed by petrol (55.8%), diesel (55.3%) and PHEVs (55.1%). Meanwhile, 36-month-old BEVs retained the lowest value at 52.2%. While supply recovers, demand is expected to weaken. Therefore, pressure on RVs can be expected. Prices of three-year-old cars will remain relatively high, with just a slightly decreasing trend.

‘The %RV is forecast to end 2023 approximately 2.6% down compared to December 2022. For the year 2024, %RV is expected to decrease further by around 3.4% year on year due to weakening demand and increasing supply,’ Madas added.

BEVs shaken in France

The used-car market was stable in France last month, with slightly lower absolute residual values but marginally higher values in %RV terms. Climbing prices have not influenced RVs as increases have been too steep in recent months.

Fewer private buyers purchased a used vehicle in March. Those who did focused on older models or a lower segment, mainly led by budget. Cars above the 12-year age bracket suffered the least, highlighting that consumers are not following list-price increases.

‘BEV residual values decreased in March. The market has been shaken by lower Tesla list prices, as the brand acts as a BEV reference point,’ said Ludovic Percier, Autovista Group residual value and market analyst for France. ‘Big list price decreases have been followed by drops in %RV, although this has been more severe in absolute terms. Some manufacturers are already following the trend and lowering prices to stay competitive.’

Compared to February, petrol followed the marginally declining market trend in March, while diesel was stable in list price and residual value terms. As new-car buyers have been switching from internal-combustion engine (ICE) models to other powertrains in recent years, used-car market availability is lower.

Despite the implementation of low-emission zones (ZFE) and the diesel’s blemished reputation, their RVs did not drop by much compared to February. ZFEs only impact cities with 150,000 inhabitants or more and does not affect drivers covering high mileages. However, from late 2024 and into 2025, diesel will be more heavily impacted.

‘Hybrid RVs remained stable with a very slight increase in absolute terms,’ Percier said. ‘PHEVs experienced an increase month on month, as there were a lower number of vehicles compared with February. There were also more premium models present on the used-car market, with higher ranges in full-electric mode. A major decrease is still expected in mid-2023.’

Market sensitivity in Germany

Looking back at new-vehicle registrations over the past six months from February, production capacity appears to be slowly recovering. Compared to the previous year, more than 200,000 additional units were registered, which was driven in no small part by the expiry or reduction of PHEV and BEV subsidies.

‘Tactical registrations are also picking up speed again, growing by 13% over the same period. At least 60% of this growth is due to electrified powertrains and foreshadows growing price pressure on the young-used-car market,’ explained Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

The consequences are already visible with stronger price corrections for PHEVs and BEVs, while registrations of ICE models are up slightly again. However, this should not obscure the fact that the total number is still well below the pre-COVID-19 level and will contribute to the stability of RVs in the long term.

‘Overall, offer prices across all ages and drive types remain high, but increasing stock days will encourage some sellers to lower prices,’ Geilenbruegge said. ‘The used-car market’s usually strong summer months are set to follow. Inexpensive mobility seems to be in particularly high demand, considering the continuous positive developments in the small and mini segment.’

In general, classic body types are doing better than their SUV counterparts thanks to their usually lower price. This highlights the market’s current sensitivity and level of consumer exhaustion in terms of purchasing power and willingness to buy.

Stability indicated in Italy

Last month’s new-car market sales volumes confirmed the recovery observed in January, with an increase of 18.4% compared to the first two months of 2022. However, the sales-volume index highlights that transactions on the used-car market are still not declining, with a growth of 1.4% compared to February, and even 25.7% compared to a year ago. In general, almost all fuel types are seeing sales up compared to February or are at least relatively stable.

‘The only exceptions are HEVs and PHEVs, down 10.3% and 5.4% month-on-month respectively. Meanwhile, CNG suffered the biggest drop at 56.4%. The fact that most manufacturers have abandoned this fuel type, alongside its rising cost per kilogramme, is certainly influencing this trend,’ commented Marco Pasquetti, head of valuations, Autovista Group Italy.

‘In %RV terms there was weak growth (up 0.3%), indicating a more stable situation. This is probably the prelude to a trend reversal that has not yet materialised, but which some remarketing professionals are beginning to detect and report,’ Pasquetti said.

From Q4 2022 onwards, however, the price has been falling sharply. This trend is likely to have a positive influence on %RVs, which currently stand at 44.3% compared to an average of 55.6%, down 4.4% compared to March 2022.

Breathing space for Spain

With more caution than optimism, the first quarter of 2023 gave Spain’s automotive sector a little breathing space. New-vehicle registrations were up 20% year on year in February. Although some of these deliveries come from orders placed in 2022, supply capacity has improved. This increase helps fulfil demand from fleet operators, enabling renewals and injecting young used vehicles into the market.

‘In this respect, used-vehicle transactions improved month on month and year on year. Although the overall variation is slight – up 3% in both cases – the age of these vehicles is significant. Sales of used models less than a year old and those between one- and three-years-old grew more than 20% and over 10% respectively,’ said Ana Azofra, Autovista Group head of valuations and insights, Spain.

‘This rejuvenation of supply is a relief to professionals who have capitalised on most of these sales. In any case, the market has quickly absorbed these young vehicles and the active supply of used models is again down by 20%, so the outlook remains optimistic,’ she added.

The month saw almost imperceptibly small negative adjustments to the transaction prices of petrol and diesel vehicles compared to February 2023. BEVs saw a slightly positive correction, more related to the change in the mix, with an increasing share of premium models featuring better performance.

The winners continue to be HEVs, with a growth of 2.3% compared to the previous month. Toyota led the ranking of models but this was not only among hybrids, where it is more logical to find them due to the weight of the brand, but also in the general ranking of all fuels. The five fastest-selling models in March were the Toyota RAV-4, Yaris, C-HR, Aygo and Citroën C4.

Meanwhile, the volume of used PHEVs on offer rose 75% compared to 2022. But they are not performing well in terms of turnover, with the number of days needed to sell increasing and transaction values showing a negative trend.

Transactions slow in Switzerland

The Swiss used-car market continued to see rising supply, with young used cars the only exception compared with the pre-COVID-19 period. The active-market volume index was 1.8% higher for two-to-four-year-old passenger cars in March compared to February, and 40.7% higher year on year.

‘With the rising costs of living, used-car transactions continued slowing compared to 2022,’ said Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group). ‘The sales-volume index remains on the growth path with a 4.2% increase compared to February, and a 3.2% increase year on year.’

As supply rose and demand sank slightly, the average value retention of 36-month-old passenger cars decreased to 51.3% in March, down 0.8% month on month, but still up 7.5% year on year.

HEVs posted a particularly strong year-on-year %RV gain of 20%, retaining 54.7% of their list price value. This was followed by petrol (52.1%), diesel (50%) and BEVs (49.4%). Meanwhile, 36-month-old PHEVs retained the lowest value, at 48.9% of their original list price.

The average days to sell remained unchanged in March, two-to-four-year-old passenger cars in stock for 76.5 days. HEVs sold the quickest, after an average of 66.7 days, followed by BEVs after 73.7 days and PHEVs at 75.2 days, then petrol and diesel cars after 76.5 and 77.4 days respectively.

‘Used-car demand is expected to weaken amid stable supply, a further decreasing trend is to be expected although values of three-year-old used cars remain relatively high,’ Annen said. ‘The %RV is forecast to finish 2023 around 3.1% down on December 2022. For 2024, RVs are expected to fall by around 3.7% year on year due to increasing supply and weakening demand.’

Mixed electric fortunes in UK

The UK’s used-car market was buoyant in March, with the number of days to sell falling by 4.8 days compared to February. At just 39.3 days, this was 15.9 fewer than last year. The sales-volume index confirms that strong retail demand was present, with 17.3% more cars sold compared to March 2022. At the same time, supply slowed, as confirmed by the active-market volume index which shows 25.1% fewer cars were available compared to March 2022.

‘As a result of increased demand and diminished supply, the average residual value of a three-year-old car grew by 2.4% compared with February,’ explained Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles. ‘Although a proportion of the uplift is due to March’s registration plate change effect, a direct comparison with the same plate last year still shows an increase of 0.5%.’

Petrol cars experienced a %RVincrease of 1.8% year on year, meanwhile, diesel models fell by 1.3%. HEVs were down by 0.3% and PHEVs increased by 0.5%. BEVs experienced the largest movement, falling 9.6% in %RV terms compared to March 2022.

All-electric models remain under serious pressure in wholesale channels, with RVs expected to continue to decline in the short term. But BEVs do continue to see very good retail demand. The sales-volume index shows a massive 386.6% year-on-year increase in sales. However, demand is failing to keep pace with the increase in supply.

‘One factor of concern for dealers is the length of time it takes to sell a BEV, which is currently 52.5 days on average, versus the general average of just 39.3. Therefore, with the potential risk of two costly book drops before retailing a BEV, it is easy to understand why dealers have become cautious and auction hammer prices have been in decline,’ Whittington added.