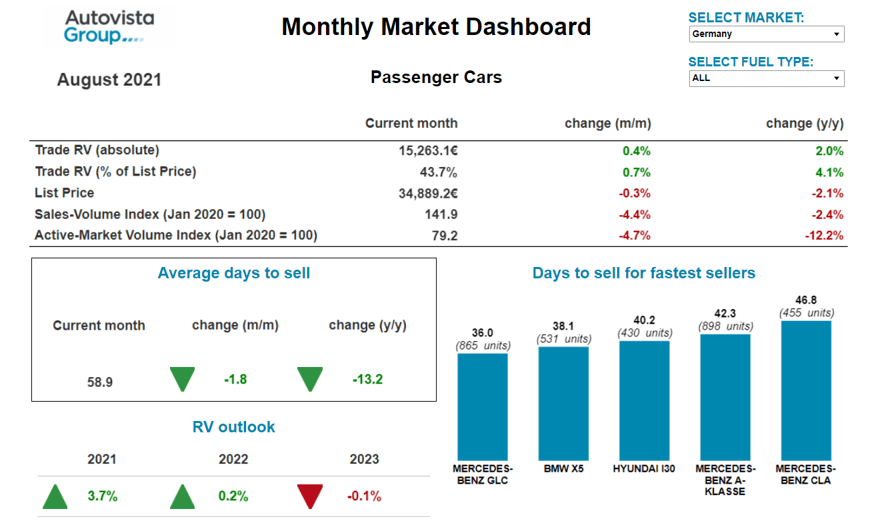

Monthly Market Update: RVs hold firm in August despite seasonal slowdown in sales activity

02 September 2021

The sales-volume and active-market-volume indices are in retreat across Europe’s used-car markets because of the seasonal implications of August. However, as the region continues to contend with insufficient supply to meet demand, residual values (RVs) have held firm, or even increased further, compared to last month. Accordingly, the 2021 RV outlook has been upgraded in Austria, Germany, Spain, and the UK.

Autovista24 has extended its coverage of used-car markets in the dashboard to include Austria and Switzerland, in addition to France, Germany, Italy, Spain and the UK. It also includes a breakdown of KPIs by fuel type, average new-car list prices and sales-volume and active-market volume indices.

Whereas most fuel types continue to enjoy healthy RVs, battery-electric vehicles (BEVs) are coming under increasing pressure in many markets, despite improving sales activity. The higher supply volumes are simply not meeting sufficiently increased demand on used-car markets. In conjunction with faster technology-ageing and enticing incentives, stock days are also rising.

Subtle seasonal slowdown in Austria

Since the beginning of the year, the Austrian used-car market has been characterised by stable demand and continued low supply, says Robert Madas, Eurotax (part of Autovista Group) valuations and insights manager, Austria, and Switzerland. On average across all two-to-four-year-old passenger cars, the active-market volume in August was around 10% lower than at the start of 2020. Diesel vehicles are especially missing from the market, with a drop of 20% compared to the beginning of last year. At the same time, sales activity in August has decreased by 6.8% compared to July, this being in line with expectations during the holiday season. Average days to sell have slightly increased, by 0.9 days compared to last month, but this is still substantially below the figures from last year: On average, a two- to four-year-old car is currently on offer for 55.9 days, down from 67.1 days a year ago.

This market environment has led to a further increase in values of 36-month-old cars: RVs, in percentage terms (%RV), have risen by 3.3% year on year to average value retention of 44.1%. In particular, hybrid electric vehicles (HEVs) were able to make strong gains (to 46.4%). In contrast, three-year-old BEVs have declined significantly and currently stand at 37.0% (down 6.6%). ‘The reasons for this, apart from the now significantly higher supply volumes, are above all the faster technology ageing of older electric vehicles as well as attractive subsidies on the new-car market in Austria,’ Madas explains.

‘We assume that the market parameters will not change in the medium term so that RVs for three-year-old passenger cars will probably continue to rise this year and next,’ Madas added. Only when the new-car market picks up significantly and thus volumes on the used-car market also increase, are residual values likely to come under pressure. This will probably not be the case before 2023, he concludes.

Private buyers desert the new-car market in France

The French new-car market dropped to a very low level in July, in line with that of 1975, mainly because of the desertion of private buyers, says Yoann Taitz, Autovista Group’s regional head of valuations and insights, France & Benelux.

Because of the semiconductor crisis, delivery delays are longer than ever. This also explains the list-price increases on the new-car market, which private buyers are less inclined to pay. Coupled with uncertainties surrounding low-emissions zones, low charging-point density, and high list prices for BEVs all disrupting the French market, private buyers are now looking at the used-car market. There is also a wait-and-see attitude among private buyers, the majority of which are not making the ecological transition, as evidenced by the sales figures.

‘New-car sales have been low for several months and used-car stocks have been very low since summer 2020,’ Taitz added. This has translated into reductions in selling days, month after month. The rise in selling days in August, and the modest year-on-year reduction in the sales-volume index can be explained by the strong sales dynamic in the summer of 2020 because of government incentives.

Low stock levels and the rise in used-car demand explain the year-on-year growth in values, both in absolute and percentage terms. Despite low-emissions zones and speeches about diesel bans in France, even diesel RVs remain high, retaining 50% of their value after 36 months and 60,000km, Taitz notes.

New-car market distortions drive German used-car market

The German used-car market continues to be driven by strong external factors, which primarily result from distortions in the new-car sector, says Andreas Geilenbruegge, head of valuations and insights at Schwacke. The recent lack of new cars due to pandemic-related production downtimes and the shortage of semiconductors, combined with the ongoing bonus-driven conversion to electrified powertrains, is resulting in ever more highly-priced young used internal-combustion-engine (ICE) vehicles.

The supply of 2019 and 2020 vehicles has halved compared to pre-crisis levels. With sales volumes only slightly lower than a year ago, this is leading to an unbroken upward trend in RVs. ‘Stock days are significantly lower than last year, when they were at a high point due to the preceding lockdown, and the trend is still downwards,’ Geilenbruegge clarifies.

The situation is different for BEVs. While both new and used sales volumes continue to swell rapidly, offer prices and stock days remain under pressure. However, the actual number of units sold in remarketing is still very limited and often comes to a standstill as stock days increase.

As of July, just under a disappointing 1% and 2% of the changes of ownership of cars registered new in 2021 were BEVs and plug-in hybrids (PHEVs), respectively, compared to a new-car registration share of almost 11% and 12%. Not least because of the bonus-related minimum ownership period of six months, the BEV and PHEV shares of used cars that were registered new in 2020 were also well below the new-car share of 6% to 7% last year, at just over 3% and 4% respectively. The demand for used BEVs and PHEVs does not seem to have taken off yet and certainly needs a motivational boost on all sides, just like the new-car market, Geilenbruegge concludes.

Shortage of used-car supply further boosts RVs in Spain

Despite the Spanish government’s attempt to incentivise new-car sales through a temporary reduction in the vehicle-registration tax, the market has not yet picked up. ‘A more positive impact is expected in the coming months, with the recovery of mobility and the wider economy,’ says Ana Azofra, Autovista Group head of valuations and insights, Spain.

In contrast, the used-car market continues to grow as much as product availability allows. In volume terms, it is far higher than in the fateful first half of 2020 but still below 2019. Not only is the market weighed down by the crisis, but it is also heavily conditioned by the shortage of supply, as evidenced by the declines in both the active-market-volume and sales-volume indices.

This shortage of product is causing price inflation, with average RVs growing by 0.7% year on year in August and increasing by 4% in %RV terms. There is .optimism and little pressure in practically all age groups, with used cars over seven years of age standing out, Azofra noted.

In addition to the ageing of the Spanish market, which is being reinforced by the economic crisis, there is also a lack of young used vehicles, i.e. less than one year old. The lack of movement in the car-rental market due to the pandemic, coupled with the current shortage of new cars due to the semiconductor crisis, is preventing rental companies from renewing their fleets, leaving the market short of young used cars.

The shortage of diesel cars in the used-car market, compounded by their sales decline in recent years, means that their values are the ones showing the greatest upwards evolution, increasing 3.4% year on year in August. The growth trend in the RVs of ICE vehicles will continue in the coming months, Azofra believes, and this price inflation may yet continue over a longer period.

Conversely, as anticipated in recent months, the RVs of BEVs show a very negative evolution (down 19.5% year on year in August). Values are weighed down by both the MOVES plan, which reduces their new price and increases pressure on used cars, and the lack of new product that is currently on the used-car market, Azofra explains. Among the fastest-selling models, as shown in the dashboard, there is a strong presence of older EVs that are at a very advanced stage of their life cycle.

Supply is decisive in Switzerland

The Swiss used-car market continues to be characterised by stable demand and low supply, says Madas. On average, across all two to four-year-old passenger cars, the active-market-volume index in August was 18.5% below the level at the beginning of 2020. Diesel models are particularly missing on the market, with stock approximately 33% down compared to the beginning of 2020. At the same time, the supply of hybrid and electric vehicles has increased. The average days to sell have fallen further: a passenger car aged two-to-four years is currently in stock for 62 days, with petrol cars selling especially quickly, at an average of 59 days.

This market environment has led to a further increase in the average %RV of 36-month-old passenger cars to 42.8% (+9.1% compared to August 2020). Petrol cars were able to post strong gains of 9.5%. HEVs, PHEVs and BEVs also increased, albeit less than petrol and diesel. The reason for the stronger increase for petrol and diesel cars is the lower supply, whereas the supply of hybrid and electric vehicles corresponds with current demand, Madas explains.

Regarding the future development of residual values, supply will be decisive. As cumulative new-car registrations in Switzerland are markedly lower than before the crisis (down 21% compared to 2019), we assume that market parameters will not change in the medium term. RVs for three-year-old used cars will continue to rise this year, and at the beginning of next year, before stabilising over the course of 2022. Only when new-car markets pick up significantly and volumes subsequently increase on the used-car market are RVs likely to come under pressure. Madas believes this will probably not be before 2023.

Staggering 20% year-on-year rise in UK values

The UK’s used-car market was buoyant again in August. Auction hammer prices remained high due to a lack of available stock, leading Glass’s values to rise 4.3% in August for a 36-month-old car, says Jayson Whittington, Glass’s chief editor, cars and leisure vehicles. This takes the year-on-year average increase to a staggering 20.6%.

The outlook remains strong for wholesale activity as there seems to be no let-up in retail demand. That said, Autovista Group’s sales-volume index reports a 3% fall compared to July. Now we are in the main holiday season, it is possible that consumers’ focus is elsewhere. However, according to the active-market index, 4.5% fewer vehicles were advertised for sale in August than in July and 18% less than a year ago, reflecting the lack of available stock for dealers to buy in wholesale channels.

Stock is ordinarily short in August as fewer lease de-fleets and part-exchanges are generated from the new-car market, and people tend to wait until September’s numberplate change to take their new car. September will likely be a disappointing new-car month due to stock constraints, so used cars could be in short supply then too, with residual values likely rising again.

View the August 2021 monthly market dashboard for the latest pricing, volume and stock-days data.