Disillusion grows in Swiss new and used-car markets

18 July 2022

Hans-Peter Annen, head of valuations and insights Switzerland at Eurotax (part of Autovista Group), analyses how the Swiss automotive market is holding up.

The war in Ukraine and the COVID-19 lockdown in China are still causing production problems in the automotive industry. High inflation and supply fears for the autumn also continue to cloud outlooks. After developments on the Swiss new- and used-car market offered a glimmer of hope in May, the latest figures for June are less uplifting.

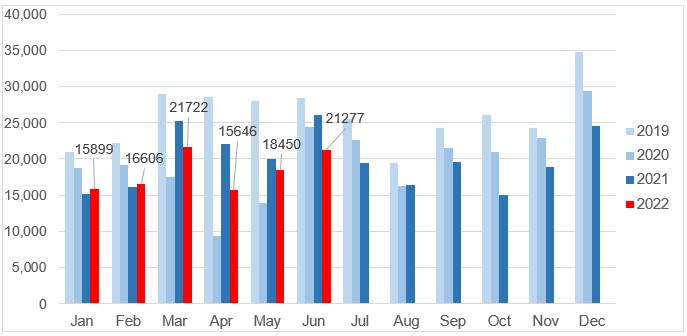

Last month, 21,277 passenger cars were newly registered in Switzerland, a year-on-year fall of 18.2%. Compared to the same period in 2019, this figure is down 25.1%. The first half of the year saw a decrease of 12% (-30.3% vs 2019). Despite the foreseeable end of the lockdown in China, no significant improvement for the new-car market is in sight for the remainder of the year due to the Ukraine war and inflation.

The weakness of the new-car market, in conjunction with the rising share of electric vehicles (EVs), means Switzerland is also contending with lower tax revenues. Penalties applied to new cars with CO2 emissions over 118g/km plummeted from CHF132.1 million (€134.1 million) in 2020 to only CHF28.1 million (€28.5 million) last year. To tackle the growing shortfall, the government is considering how to tax EVs to finance the road network. The precise details are under discussion, but the federal council assumes measures will come into force by 2030.

New-car registrations by month: 2019-2022

Strong used-car demand, low supply

Despite a falling supply in the Swiss used-car market, which has reached a stable but low level, there is still a strong demand.

But the upward trend of the last two years has now been broken. At 66,324 passenger cars, used-car transactions in June fell 10.3% compared to the previous year’s figure of 73,961. During the first half of the year, volumes were down 8.5% year on year (-7.9% vs. 2019). This negative development is likely to continue for as long as new-car registrations remain as low as they currently are.

Although the supply situation has improved slightly, the volume of active offers on the used-car market is still down 23% compared to the beginning of February 2020, i.e. before the COVID-19 pandemic disrupted the market.

Residual values (RVs) of diesel and petrol vehicles continue to benefit from this shortage. Hybrid-electric vehicles (HEVs) and plug-in hybrids (PHEVs) have also been able to profit since autumn 2021, albeit less strongly. However, all these fuel types/drives have recently been declining. Battery-electric vehicles (BEVs) are showing a positive trend (across all age groups), after experiencing a dip in mid-2021 and stagnation until early 2022.

Used-car transactions by month: 2019-2022

With COVID-19, the war in Ukraine, and imposed sanctions further complicating supply chains, the recovery of new-car registrations is slow. All of this continues to have an impact on both the supply situation and used-car prices.

While supply is constant, it remains at a low level. The rise in RVs of used cars is levelling off, but at a very high level. The supply situation is the decisive factor for the future development of the used-car market, also taking into consideration consumer sentiment and overall demand.

If new-car registrations remain as low as in 2020, the supply of used cars will be tight due to a lack of sufficient supply, and prices will remain high. Unless used-car demand collapses sharply due to the bleak economic outlook and fears about energy supplies, residual values are likely to remain high and will only decline when supply improves significantly. However, this is not expected to happen in the foreseeable future.