Pent-up demand drives 11% growth in UK new-car registrations in July

05 August 2020

5 August 2020

New-car registrations in the UK grew 11.3% year-on-year in July, as dealers enjoyed their first full month of trading since February. Nevertheless, the recovery was expected and Autovista Group has maintained its 2020 forecast at a decline of 30%. Senior data journalist Neil King discusses the latest developments and outlook.

The update today (5 August) from the Society of Motor Manufacturers and Traders (SMMT) reports that 174,887 new cars were registered in the UK in July 2020. The 11% growth ′represents a significant improvement on the same month last year, when declining business and consumer confidence undermined the market,’ said the SMMT.

The association added that ′pent-up demand and special offers led to a reprieve for the sector,’ but cautioned that new-car registrations were 41.9%, or 598,054 units, lower in the first seven months of 2020 than in 2019.’

Market fragility

The release of pent-up demand generated 20.4% growth in private demand in July as consumers could finally ′renew their cars after lockdown had forced them to delay,’ according to the SMMT.

′In addition, manufacturer incentives have helped attract customers to showrooms. Eight of the 10 major manufacturers provided attractive finance offers and flexible payment terms in a bid to head off consumer uncertainty – vital as the coronavirus job retention scheme phases out, potentially sparking redundancies across the economy and impacting confidence to invest in big-ticket purchases,’ the SMMT commented.

′July’s figures are positive, with a boost from demand pent up from earlier in the year and some attractive offers meaning there are some very good deals to be had. We must be cautious, however, as showrooms have only just fully reopened nationwide and there is still much uncertainty about the future,’ said SMMT chief executive Mike Hawes.

′By the end of September, we should have a clearer picture of whether or not this is a long-term trend. Although this month’s figures provide hope, the market remains fragile in the face of possible future spikes and localised lockdowns as well as, sadly, probable job losses across the economy. The next few weeks will be crucial in showing whether or not we are on the road to recovery,’ Hawes added.

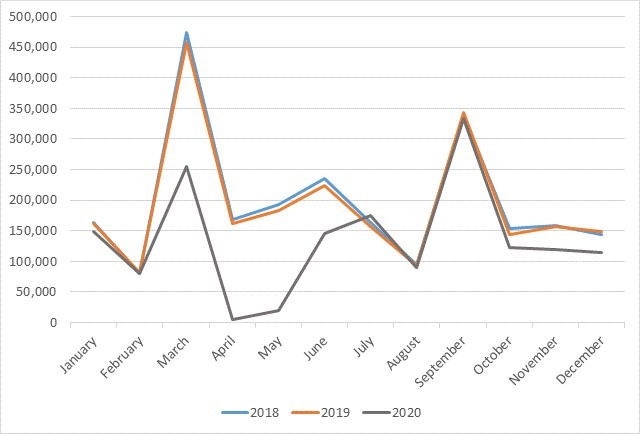

UK new-car registrations, January 2018 to December 2020 (forecast from August 2020)

Source: Autovista Group (forecast from August 2020) and SMMT (historic data to July 2020)

Autovista Group expected the release of pent-up demand after months of disruption and has therefore held its base-case forecast for the UK market, which foresees a 30% contraction in UK new-car registrations in 2020. This is aligned with the SMMT, which has downgraded its outlook for 2020 to a 30% decline in registrations, ′representing more than £20 billion (€22 billion) of lost sales.’

The Autovista Group forecast, first published in June, was a downgrade from the 23% decline forecast in May and 20% forecast in April. In March, before the coronavirus (COVID-19) pandemic took hold, the expectation was that the UK market would only experience a 3% fall in 2020.

In a downside scenario, disruption to new-car registrations (and supply) is assumed to continue for most of this year, resulting in a loss of some 900,000 registrations and limited opportunity for recovery of the losses later in 2020. The forecast for this worst-case scenario is for UK new-car registrations to fall to 1.42 million units, down 38.5% on 2019.

However, in an upside scenario, disruption to the UK automotive sector will be more short-lived as dealers quickly overcome supply shortages and return to full operational capacity, accompanied by a healthy release of pent-up demand in the coming weeks. A less severe impact on the wider economy would also bolster new-car registrations later in the year. In this scenario, about 400,000 registrations will still be lost but the forecast is for 1.91 million registrations in 2020, down 17.5% on 2019.

Source: Autovista Group (forecast from August 2020) and SMMT (historic data to July 2020)

Autovista Group expected the release of pent-up demand after months of disruption and has therefore held its base-case forecast for the UK market, which foresees a 30% contraction in UK new-car registrations in 2020. This is aligned with the SMMT, which has downgraded its outlook for 2020 to a 30% decline in registrations, ′representing more than £20 billion (€22 billion) of lost sales.’

The Autovista Group forecast, first published in June, was a downgrade from the 23% decline forecast in May and 20% forecast in April. In March, before the coronavirus (COVID-19) pandemic took hold, the expectation was that the UK market would only experience a 3% fall in 2020.

In a downside scenario, disruption to new-car registrations (and supply) is assumed to continue for most of this year, resulting in a loss of some 900,000 registrations and limited opportunity for recovery of the losses later in 2020. The forecast for this worst-case scenario is for UK new-car registrations to fall to 1.42 million units, down 38.5% on 2019.

However, in an upside scenario, disruption to the UK automotive sector will be more short-lived as dealers quickly overcome supply shortages and return to full operational capacity, accompanied by a healthy release of pent-up demand in the coming weeks. A less severe impact on the wider economy would also bolster new-car registrations later in the year. In this scenario, about 400,000 registrations will still be lost but the forecast is for 1.91 million registrations in 2020, down 17.5% on 2019.

Source: Autovista Group/SMMT

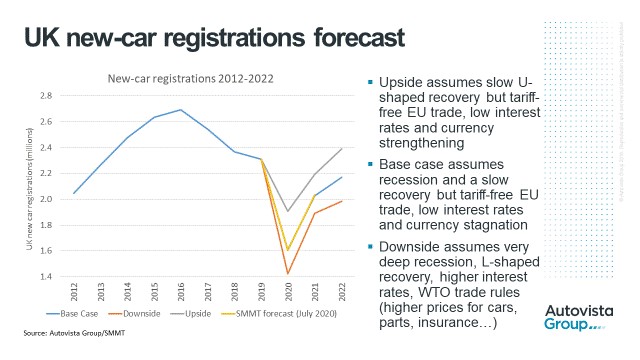

The outlook for 2021 is largely dictated by the extent of the losses to registrations incurred in 2020. The higher the loss this year, the higher the pent-up demand to be released next year. This explains why the steepest growth is forecast in the downside scenario and the weakest growth in the upside scenario.

EU trading relationship

Aside from the dramatic effects of the coronavirus crisis, uncertainty remains surrounding the terms of the UK’s future trading relationship with the EU. Autovista Group’s base-case scenario assumes a deep recession and a slow recovery but ongoing free trade with the EU. In this scenario, the new-car market is forecast to grow 26% and 7% in 2021 and 2022 respectively, returning the market to close to 2.2 million registrations in 2022.

A downside scenario factors in the UK not reaching a trade agreement with the EU, resulting in a very deep recession and L-shaped recovery. The key consequence for the automotive sector is that WTO trade rules would be applied, resulting in higher prices for cars as well as for replacement parts and insurance. In this downside forecast, new-car registrations are forecast to increase by 33% in 2021 but only by 5% in 2022. At just under 2 million registrations, the market would still be 300,000 units lower in 2022 than in 2019.

In an upside ′slow u-shaped recovery’ scenario, the impact of the COVID-19 pandemic in 2020 will be fundamentally recovered in 2021, with registrations growth of 15% anticipated. In conjunction with a trade deal that secures ongoing free trade between the UK and the EU, the new-car market is forecast to grow by a further 9% in 2022. At 2.4 million registrations, the UK new-car market would then be at its highest level since 2018.

Source: Autovista Group/SMMT

The outlook for 2021 is largely dictated by the extent of the losses to registrations incurred in 2020. The higher the loss this year, the higher the pent-up demand to be released next year. This explains why the steepest growth is forecast in the downside scenario and the weakest growth in the upside scenario.

EU trading relationship

Aside from the dramatic effects of the coronavirus crisis, uncertainty remains surrounding the terms of the UK’s future trading relationship with the EU. Autovista Group’s base-case scenario assumes a deep recession and a slow recovery but ongoing free trade with the EU. In this scenario, the new-car market is forecast to grow 26% and 7% in 2021 and 2022 respectively, returning the market to close to 2.2 million registrations in 2022.

A downside scenario factors in the UK not reaching a trade agreement with the EU, resulting in a very deep recession and L-shaped recovery. The key consequence for the automotive sector is that WTO trade rules would be applied, resulting in higher prices for cars as well as for replacement parts and insurance. In this downside forecast, new-car registrations are forecast to increase by 33% in 2021 but only by 5% in 2022. At just under 2 million registrations, the market would still be 300,000 units lower in 2022 than in 2019.

In an upside ′slow u-shaped recovery’ scenario, the impact of the COVID-19 pandemic in 2020 will be fundamentally recovered in 2021, with registrations growth of 15% anticipated. In conjunction with a trade deal that secures ongoing free trade between the UK and the EU, the new-car market is forecast to grow by a further 9% in 2022. At 2.4 million registrations, the UK new-car market would then be at its highest level since 2018.

Source: Autovista Group (forecast from August 2020) and SMMT (historic data to July 2020)

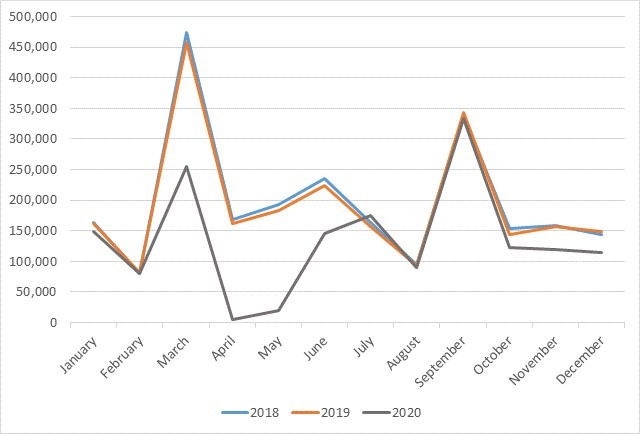

Autovista Group expected the release of pent-up demand after months of disruption and has therefore held its base-case forecast for the UK market, which foresees a 30% contraction in UK new-car registrations in 2020. This is aligned with the SMMT, which has downgraded its outlook for 2020 to a 30% decline in registrations, ′representing more than £20 billion (€22 billion) of lost sales.’

The Autovista Group forecast, first published in June, was a downgrade from the 23% decline forecast in May and 20% forecast in April. In March, before the coronavirus (COVID-19) pandemic took hold, the expectation was that the UK market would only experience a 3% fall in 2020.

In a downside scenario, disruption to new-car registrations (and supply) is assumed to continue for most of this year, resulting in a loss of some 900,000 registrations and limited opportunity for recovery of the losses later in 2020. The forecast for this worst-case scenario is for UK new-car registrations to fall to 1.42 million units, down 38.5% on 2019.

However, in an upside scenario, disruption to the UK automotive sector will be more short-lived as dealers quickly overcome supply shortages and return to full operational capacity, accompanied by a healthy release of pent-up demand in the coming weeks. A less severe impact on the wider economy would also bolster new-car registrations later in the year. In this scenario, about 400,000 registrations will still be lost but the forecast is for 1.91 million registrations in 2020, down 17.5% on 2019.

Source: Autovista Group (forecast from August 2020) and SMMT (historic data to July 2020)

Autovista Group expected the release of pent-up demand after months of disruption and has therefore held its base-case forecast for the UK market, which foresees a 30% contraction in UK new-car registrations in 2020. This is aligned with the SMMT, which has downgraded its outlook for 2020 to a 30% decline in registrations, ′representing more than £20 billion (€22 billion) of lost sales.’

The Autovista Group forecast, first published in June, was a downgrade from the 23% decline forecast in May and 20% forecast in April. In March, before the coronavirus (COVID-19) pandemic took hold, the expectation was that the UK market would only experience a 3% fall in 2020.

In a downside scenario, disruption to new-car registrations (and supply) is assumed to continue for most of this year, resulting in a loss of some 900,000 registrations and limited opportunity for recovery of the losses later in 2020. The forecast for this worst-case scenario is for UK new-car registrations to fall to 1.42 million units, down 38.5% on 2019.

However, in an upside scenario, disruption to the UK automotive sector will be more short-lived as dealers quickly overcome supply shortages and return to full operational capacity, accompanied by a healthy release of pent-up demand in the coming weeks. A less severe impact on the wider economy would also bolster new-car registrations later in the year. In this scenario, about 400,000 registrations will still be lost but the forecast is for 1.91 million registrations in 2020, down 17.5% on 2019.

Source: Autovista Group/SMMT

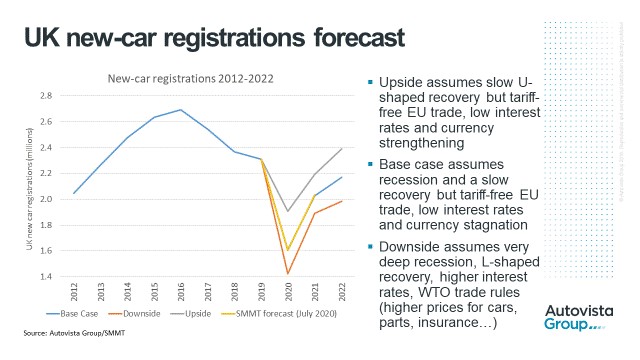

The outlook for 2021 is largely dictated by the extent of the losses to registrations incurred in 2020. The higher the loss this year, the higher the pent-up demand to be released next year. This explains why the steepest growth is forecast in the downside scenario and the weakest growth in the upside scenario.

EU trading relationship

Aside from the dramatic effects of the coronavirus crisis, uncertainty remains surrounding the terms of the UK’s future trading relationship with the EU. Autovista Group’s base-case scenario assumes a deep recession and a slow recovery but ongoing free trade with the EU. In this scenario, the new-car market is forecast to grow 26% and 7% in 2021 and 2022 respectively, returning the market to close to 2.2 million registrations in 2022.

A downside scenario factors in the UK not reaching a trade agreement with the EU, resulting in a very deep recession and L-shaped recovery. The key consequence for the automotive sector is that WTO trade rules would be applied, resulting in higher prices for cars as well as for replacement parts and insurance. In this downside forecast, new-car registrations are forecast to increase by 33% in 2021 but only by 5% in 2022. At just under 2 million registrations, the market would still be 300,000 units lower in 2022 than in 2019.

In an upside ′slow u-shaped recovery’ scenario, the impact of the COVID-19 pandemic in 2020 will be fundamentally recovered in 2021, with registrations growth of 15% anticipated. In conjunction with a trade deal that secures ongoing free trade between the UK and the EU, the new-car market is forecast to grow by a further 9% in 2022. At 2.4 million registrations, the UK new-car market would then be at its highest level since 2018.

Source: Autovista Group/SMMT

The outlook for 2021 is largely dictated by the extent of the losses to registrations incurred in 2020. The higher the loss this year, the higher the pent-up demand to be released next year. This explains why the steepest growth is forecast in the downside scenario and the weakest growth in the upside scenario.

EU trading relationship

Aside from the dramatic effects of the coronavirus crisis, uncertainty remains surrounding the terms of the UK’s future trading relationship with the EU. Autovista Group’s base-case scenario assumes a deep recession and a slow recovery but ongoing free trade with the EU. In this scenario, the new-car market is forecast to grow 26% and 7% in 2021 and 2022 respectively, returning the market to close to 2.2 million registrations in 2022.

A downside scenario factors in the UK not reaching a trade agreement with the EU, resulting in a very deep recession and L-shaped recovery. The key consequence for the automotive sector is that WTO trade rules would be applied, resulting in higher prices for cars as well as for replacement parts and insurance. In this downside forecast, new-car registrations are forecast to increase by 33% in 2021 but only by 5% in 2022. At just under 2 million registrations, the market would still be 300,000 units lower in 2022 than in 2019.

In an upside ′slow u-shaped recovery’ scenario, the impact of the COVID-19 pandemic in 2020 will be fundamentally recovered in 2021, with registrations growth of 15% anticipated. In conjunction with a trade deal that secures ongoing free trade between the UK and the EU, the new-car market is forecast to grow by a further 9% in 2022. At 2.4 million registrations, the UK new-car market would then be at its highest level since 2018.