Sixt plans to enter car-sharing market following the sale of its stake in DriveNow

19 March 2018

19 March 2018

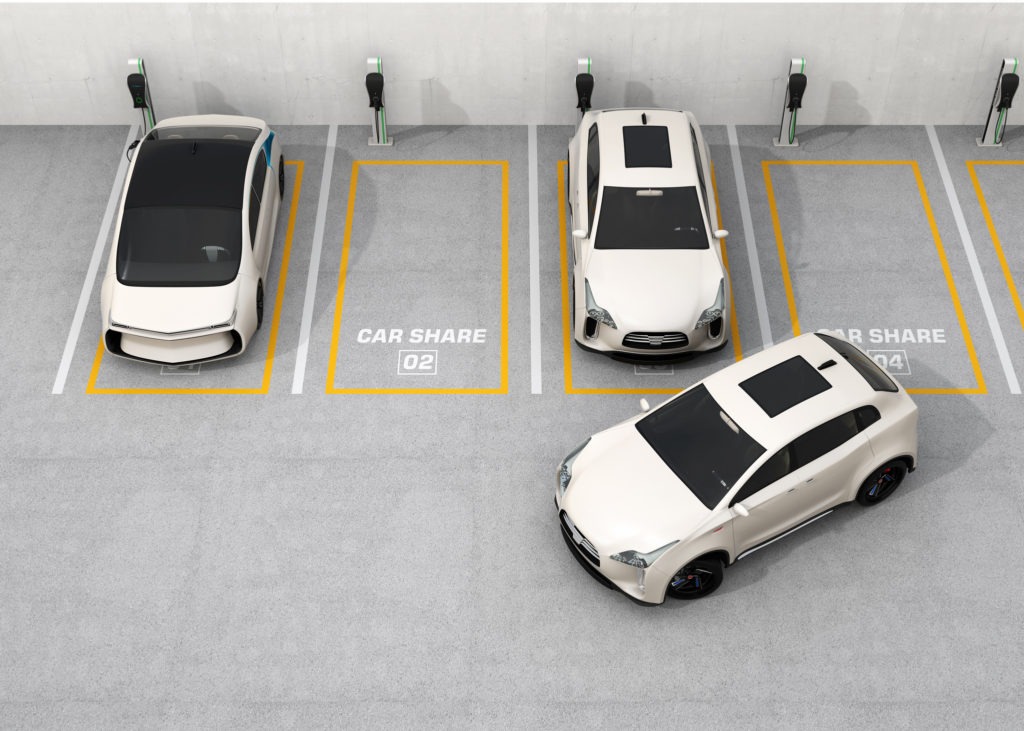

As car-sharing becomes a viable alternative for drivers who don’t want to own a vehicle, rental firm Sixt has announced the establishment of its own platform with which it hopes to challenge rivals.

The company recently sold its stake in DriveNow, another car-share program, to its partner in the venture, BMW. This was widely seen as an opportunity by the vehicle manufacturer to pave the way for a merger between its platform and that of Daimler’s car2go.

Sixt was reportedly paid €209 million by BMW for its 50% share of DriveNow, following the hire firm’s reluctance to allow any merger with car2go to happen. However, even after the sale, DriveNow will continue to use and therefore pay for, IT infrastructure behind the car-sharing platform which was developed by the rental car company.

Using its knowledge of the market as well as the money from the sale, Sixt will set up a new venture, combining car-sharing, car rentals and transfer services within the year. The decision is in line with a broader change in Sixt’s corporate strategy which increasingly views the company as a holistic mobility provider, offering vehicle leases ranging from a few minutes to several years.

At the time of the sale of DriveNow, Alexander Sixt, member of the Managing Board of Sixt SE, responsible for Group Strategy commented: ′The joint development of DriveNow impressively demonstrates the innovative strength of Sixt and the BMW Group. We would like to thank the DriveNow employees and the BMW Group for this success and look forward to continuing our strategic partnership with the BMW Group through our contracts for delivery of BMW and MINI brand vehicles.’

With a potential change in ownership patterns, manufacturers are looking for new ways to engage with consumers, with ride-sharing services coming out on top. While many car-sharing projects have been struggling to turn a profit, in Germany alone, the customer base for such projects has risen rapidly to 2.1 million people. This is expected to increase further across Europe as people stop viewing a car as a necessary purchase, instead wanting to relieve themselves of associated costs of ownership by sharing vehicles to get from A-B.

Daimler also recently bought Europcar’s stake in car2go, giving it total control and allowing it to make the decision to merge with DriveNow. It is unclear yet whether the rental firm will follow Sixt in developing its own car-sharing platform.