Stagnation takes grip in France’s electric used-car market

24 November 2021

Yoann Taitz, regional head of valuations and insights for France and the Benelux countries at Autovista Group, considers the state of the French battery-electric vehicle (BEV) market.

Buyers of BEVs in the new-car market seem to be embracing the technology, with registrations accounting for between 10% and 12% of the total share each month this year. But demand for used electric cars is struggling to take off and even stagnating at less than 1% of the market.

On the new-vehicle side, due to corporate average fuel economy (CAFE) standards, manufacturers are prioritising BEVs over internal-combustion engine (ICE) vehicles, leading to an increase in the new-vehicle offer. However, on the used-vehicle side, the buyer’s budget is limited and is not increasing, even though the price of a new BEV is much higher than its ICE equivalent.

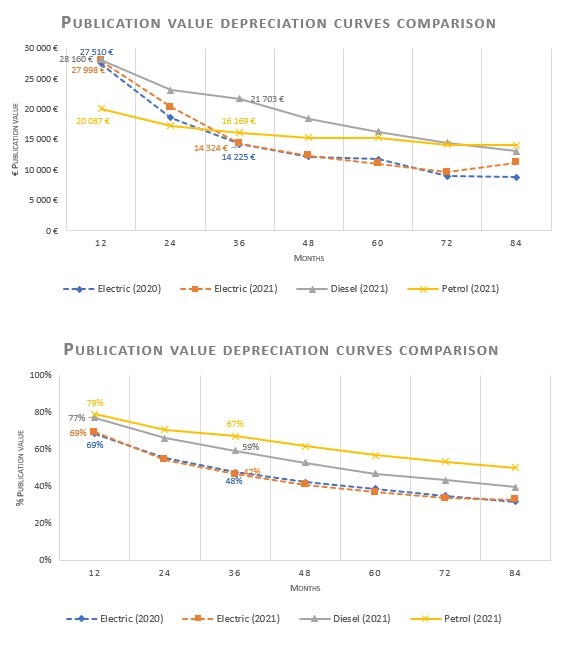

The two graphs below compare depreciation curves between the different powertrains in 2021 – in percentage terms (top) and Euros (bottom). These charts combine all segments. Looking at these representations, we can see:

- In 2021, at 12 months, a BEV sells for the price of a diesel vehicle, which proves that the car buyer’s budget does not increase despite the price differences between them

- Between 12 and 36 months, BEVs undergo a very strong depreciation (high new-car bonus, continuous technological improvement), to end up at 36 months lower than a petrol vehicle

- From 36 months, depreciation is then very low until eight years, corresponding to the end of the battery warranty. After eight years, there is a further decline in the RV, but it is less marked.

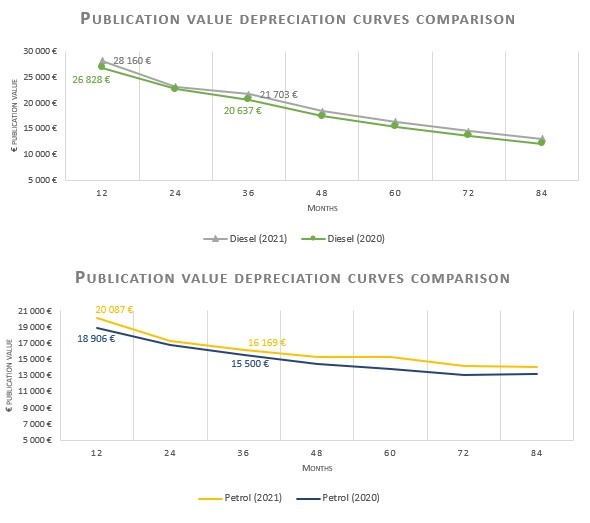

Between 2020 and 2021, there is a clear increase in residual values (RVs) for ICE vehicles in Euro and percentage terms (see both charts below). The semiconductor crisis has led to a transfer from new to used vehicles, thus causing a drop in stocks, which were already strongly impacted from the summer of 2020 onwards, following the resumption of the first lockdown period. The increase in Euro terms for BEVs is minimal (up €100 at 36 months on average) and non-existent in percentage terms.

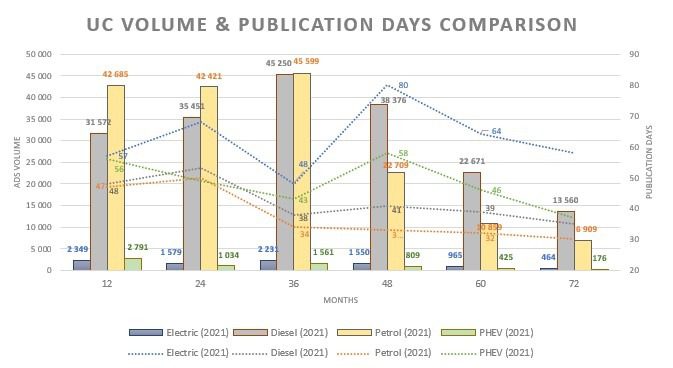

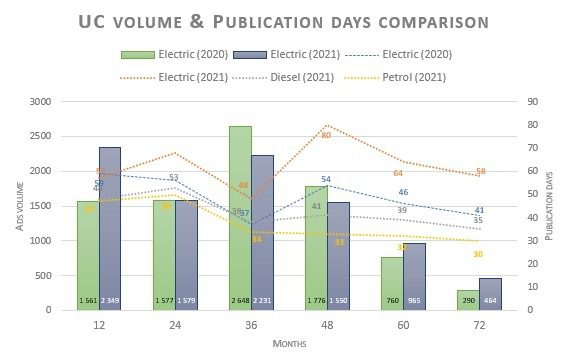

The graphs below show that the increase in the BEV offer, even if it remains small in volume compared to the ICE offer, directly impacts RVs, with, in particular, publication days that are higher than for ICE vehicles. The top graph compares each powertrain with advert volume and publication days, while the bottom chart shows BEVs compared to petrol and diesel models.

When looking at registrations by sales channel for EVs, we see peaks in February, June, and September 2021, with more than 30% of these being tactical registrations. Since the beginning of 2021, these tactical registrations (demo cars and rental returning to the used-car market between three and 18 months) have reached an average of 23%.

However, from an RV point of view, it has been observed that when tactical registrations exceed 10 to 12% of total registrations, the used-BEV market, which is an unstable one as it is still building, is no longer able to absorb the increase in supply without impacting on RVs at 12, 18 and 24 months. The greater the impact at these recent ages, the more negative the impact at 36 months and beyond.

The consumer who wishes to acquire a new BEV does so with full knowledge of the facts, whereas the used-car buyer is more pragmatic, first looking at the price in relation to the use and range of the vehicle. At present, the BEV presents too many constraints for the car buyer – too little range for the purpose, especially on long journeys in relation to the price offered and too few recharging facilities, especially on long journeys.

Recently, the problem of the significant rise in energy prices, and in particular electricity prices, has been an aggravating factor, even though France is one of the countries in Europe where electricity is the cheapest. This is another argument that demonstrates the lack of confidence in BEVs among car buyers, even though fuel prices are also rising.

Mainstream versus premium

The situation is not the same between mainstream and premium brands. In both categories, tactical registrations remain important. For premium brands, there is the added problem of a very high price in relation to the final range of the vehicle offered. Premium BEVs are very expensive and remain niche vehicles. However, while for ICE vehicles, the brand image allows premium brands to justify new and transaction prices that are much higher than those of generalist brands, this is less true for BEVs. The technical characteristics of premium BEVs differ little from those of mainstream models and, in some cases, may even have lower technical characteristics, particularly in terms of range. The brand image alone is no longer a sufficient differentiating factor to allow premium marques to offer vehicles at very high prices.

There are also very clear differences in RVs according to the range. Vehicles with batteries of less than 50kWh (approximately 350km of range) show lower RVs in percentage terms and Euros than BEVs with batteries of more than 60kWh, even though these vehicles have a much higher list prices, as the type of customer is not the same.

BEVs below 50kWh tend to attract customers who want to buy a second vehicle, for which the price is a crucial aspect. In this case, the customer is more likely to choose a cheaper urban vehicle. Whereas those with batteries above 60kWh tend to attract customers looking for a first vehicle, as the range is greater. The budget for the purchase of a first vehicle is higher. The available infrastructure will play a more important role in the latter case, particularly for recharging vehicles during long journeys.

Tesla remarketer master

Not all brands are in the same boat. Indeed, Tesla must be differentiated from other manufacturers. A forerunner in BEVs, Tesla is in a class of its own with RVs that are far superior to those of other manufacturers. The carmaker’s low new-car volumes obviously play a role, but RVs remain stable at a fairly high level despite the volume increases in recent months. Tesla has mastered the remarketing of almost all of its used-car sales, with European stock management and the sharing of used cars across the different European territories according to the existing used-car demand.

Currently, BEV RVs have been steadily declining for several months as supply far exceeds demand. This situation is not expected to improve soon. In fact, electric volumes on the used-car market will continue to increase as the public authorities are pushing the technology, whereas the used-car buyer does not see the BEV as a response to his expectations.

We can thus observe a split in the automotive market with, on the one hand, a new-vehicle market that is pushing for BEVs and, on the other hand, a more pragmatic used-vehicle market that is looking for more moderately-priced ICE vehicles. However, it should be borne in mind that it is the used-car market, and it is the acceptance of a product that determines the RV level and, therefore, the level of profitability.

Charging time

While the charging time to recover 80% of the range is an increasingly important factor in the new-car market, this is not yet the case in the used-car market. However, it will become so. Some manufacturers now offer to recover 80% of the range of a BEV in less than 20 minutes, which is already a considerable advance. This should progress further with future technological developments. This is obviously a factor taken into consideration when developing our RV forecasts.

Technological progress has a negative impact on BEV RVs. As it is for smartphones, these improvements that positively impact the range in newer generations have a negative impact on older generations of BEVs. Indeed, a current vehicle advertised with a range of 350km should still have a range of 300km after four to five years, but manufacturers will undoubtedly offer ranges of around 500km on the recent new and used-car markets. The used-car buyer will therefore negotiate down the price of the vehicle with the lowest range, especially as at the same time the rise in the number of BEVs will certainly lead to a drop in prices (economies of scale and lower break-even points), which will contribute to lowering transaction prices even further.

Stellantis announced a few months ago that between 2025 and 2027, the group would be able to offer vehicles with a range of 500km-700km at the price of ICE vehicles. Under these conditions, it is difficult not to see the price of BEVs fall and therefore to see RVs fall, because it should not be thought that at the same time the budget of the used-car buyer will increase. The large proportion of sales of used cars over 10 years old in France clearly proves that the purchase budget is a central issue in the used-car market.