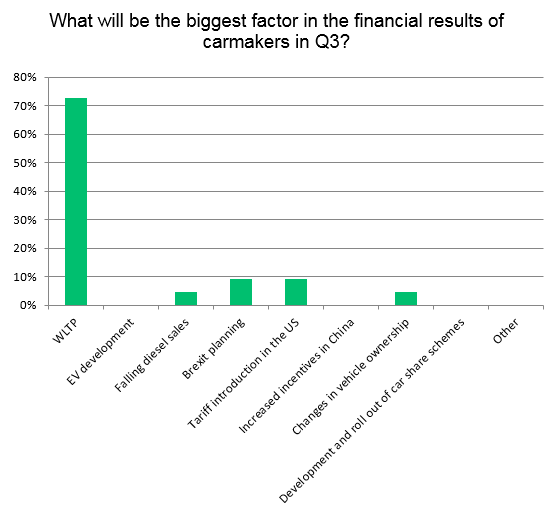

Survey results: The biggest impact on manufacturer Q3 results

10 August 2018

10 August 2018

With every vehicle company declaring their Q2 results in the last month, many announced that Q3 would see some difficult trading times due to a number of factors.

Autovista Group wanted to find out which issue would have the biggest impact on the financial results of carmakers.

A clear winner in this poll, with 73% of the vote, was the new Worldwide Harmonised Light-Vehicle Test Procedure (WLTP), which is already having an impact on manufacturer’s schedules and production. Together with the Real Driving Emissions (RDE) portion, the test is more complex and time-consuming than the former New European Driving Cycle (NEDC) testing, which was laboratory based. Time constraints are added to by the need to test every available model together with every option possible.

The knock on effect of this is that manufacturers may need to pre-register vehicles that are currently built but do not have WLTP compliance, or pause production of some models. Additionally, they will need to re-engineer vehicles to meet the stricter emissions regulations, with petrol cars needing a Petrol Particulate Filter (PPF). This also takes time and impacts financials.

Following this, with 9% of the vote, was Brexit planning. Carmakers are already creating strategies to make sure that they are ready for any eventuality. For those with plants in the UK, this means working out strategies for import and export tariffs on parts and vehicles, while for those based in Europe, it means planning for changes in the supply chain, as well as ensuring vehicles can clear customs efficiently. The UK is leaving Europe in March 2019, and negotiations are expected to begin between September and October.

With 8% of the vote, potential tariffs in the US was next in the poll. The US Trump administration is looking to introduce charges on vehicles imported to the country due to ′security’ issues. While European Commission president Jean-Claude Juncker recently met with US President Donald Trump and discussed trade issues, no mention was made on resolving the pending tariff introduction on automobiles.

With 5% of the vote, falling diesel sales and the changing landscape of vehicle ownership were the next most popular impacts on financial results in Q3. Carmakers have invested heavily in diesel technology over the years, but the fall in sales means models are going unsold, while development is needed to ensure they remain within strict CO2 targets set by the EU. Meanwhile, many consumers are choosing not to buy new vehicles, instead relying on car-share schemes and rail hailing companies such as Uber to get around. Any drop in sales means an impact on financial results.

No respondents to the poll felt that EV Development, increased Chinese incentives or the development of car-share schemes would have an impact in Q3.