TCO in France – is there an alternative to diesel?

12 July 2018

12 July 2018

Across Europe, diesel is falling out of favour, and we are seeing buyers defecting to petrol-driven cars. Given the higher purchase price of diesel cars and as their residual values suffer, this is entirely understandable for low-mileage buyers. Fleet buyers need to increasingly consider alternatives too as leasing companies seek to move away from financing diesel. They should take a closer look at hybrids – especially given the fantastic utilisation cost savings they offer.

Diesel defection

In France, the diesel share of new car registrations dropped to 40.3% in H1 2018, down 7.6 percentage points (pp) compared to the same period in 2017, according to the latest CCFA data. Of this loss in share, 6.5 pp were picked up by petrol cars with hybrids gaining less than 1 pp of share and electric remaining static.

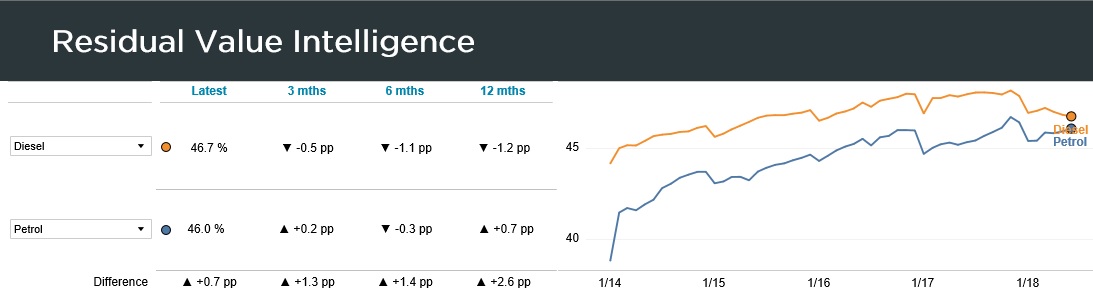

In the used car market, Autovista Group’s Residual Value Intelligence service reveals that for the weighted average across all models, diesels now have only a 0.7pp advantage over petrol cars.

The advantage of diesel in France has been further eroded due to increased fuel costs at the pump. The cost advantage has reduced to just €0.09 per litre compared to an average of €0.15 in 2017.

TCO Review

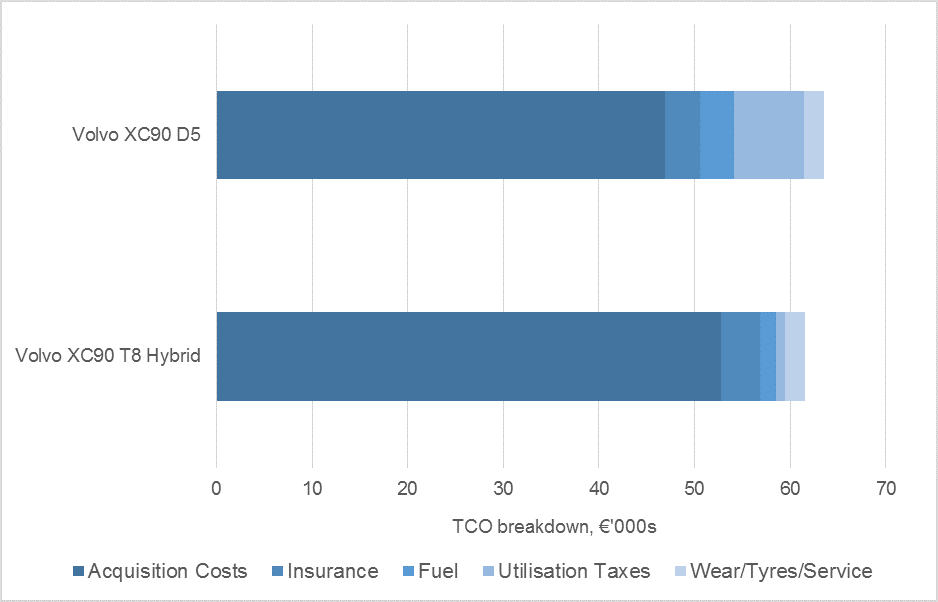

The reduced residual value and fuel price advantages in France have implications for the TCO competitiveness of diesel models. Data in Autovista Group’s Fleet Cost Expert reveals that acquisition costs1 for the Volvo XC90 T8 hybrid are now just €6,000 higher in France after 36 months and 60,000km than for the XC90 D5 diesel variant. Moreover, total utilisation costs for the XC90 hybrid are now almost €8,000 lower than for the diesel, with the fuel cost saving alone in this scenario approaching €1,800. Utilisation taxes in France, which are almost €7000 lower for the hybrid variant, predominantly account for the lower overall utilisation costs. The net TCO saving is just over €2,000.

France, TCO breakdown, Volvo XC90 T8 hybrid and D5 diesel, 36months/60,000km, €’000s

Using Fleet Cost Expert to select popular models from different segments that have a hybrid and petrol counterpart with similar power output, we see some interesting TCO results2. Three model pairings across the C, E and D-SUV segments have been selected for comparison:

- Toyota Auris hybrid (Design Business trim) versus Toyota Auris 1.2T petrol (Design trim)

- BMW 530e iPerformance hybrid (Business trim) versus BMW 530i petrol (Business trim)

- Mitsubishi Outlander 2.0I PHEV (Intense trim) versus Mitsubishi Outlander 2.0I MIVEC 150 petrol (Invite trim)

France, TCO breakdown, selected petrol and hybrid models, 36months/60,000km, €’000s

Acquisition cost findings

Hybrids commonly command more than a 10% price premium over their closest petrol engine equivalents. But hybrid variants retain more of their value after 36 months and 60,000km (our base scenario) than petrol, typically retaining 45-50% and 40-45% respectively. Nevertheless, due to their higher list price, hybrids still suffer from higher depreciation in value terms.

Given the higher list prices, VAT is naturally greater for hybrids, but this is often more than compensated for by the lower registration taxes under the French bonus-malus scheme. Buyers pay an increasingly punitive ′malus’ penalty tax dependent on official emissions figures. This ranges from €50 for a car that emits 120g CO2/km to a maximum of €10,500 for cars that emit 185g CO2/km or more. Consequently, acquisition taxes are usually lower for hybrids in France than their petrol equivalents.

The net effect is that total acquisition costs for hybrids in France are less than 10% higher than for their petrol equivalents. In fact, the acquisition costs of the BMW 530e are already 1% lower for than for its petrol counterpart, the 530i.

Utilisation cost findings

The real cost savings for hybrids come from reduced utilisation costs. Fuel is the highest utilisation cost, ahead of utilisation taxes. In our standard scenario, fuel costs for hybrids compared to their petrol equivalents range from being 36%-58% lower. In real terms, this equates to a cost saving of more than €10,000 for the Outlander hybrid versus its petrol equivalent. For the Auris hybrid and the 530e, the utilisations cost savings amount to €4,000 and €6,000 respectively.

The cost savings in utilisation taxes are even more dramatic. Compared to their petrol equivalents, utilisation taxes can be up to 90% lower for the hybrid variants. This equates to a tax saving of almost €6750 for the Outlander PHEV compared to the petrol variant. There are even further cost savings in insuring hybrids, and wear, tyre – and even servicing – costs are comparable.

TCO conclusions

Overall, we found that TCO costs are lower for hybrids than their petrol equivalents in France as savings on utilisation costs outweigh higher acquisition costs. Our research shows that TCO ranges from being 9% lower for the Toyota Auris hybrid to 18% lower for the Mitsubishi Outlander PHEV. The TCO of the BMW 530e is 12% lower than for the 530i. In value terms, the cost saving for the Auris hybrid is over €2700, for the BMW 530e it is over €6700, and for the Outlander PHEV it is over €7800. Hybrids are even challenging diesels when it comes to TCO, as exemplified by the Volvo XC90 T8 hybrid versus the D5 diesel. Although the TCO of the XC90 hybrid is only 3% lower, this still equates to a saving of more than €2000 in real terms after 36 months and 60,000km.

In addition to the financial advantage of hybrids, the environmental benefits are also clear – especially as CO2 emissions are rising in Europe because of the defection from diesel to petrol. As fleets seek alternatives to diesels, they should increasingly be considering hybrids. In the short term, however, we believe that petrol cars will inevitably continue to benefit the most from any further contraction in the share of diesels in the broader market.

For more information or a demonstration on Fleet Cost Expert, click here.

For more information or a demonstration on Residual Value Intelligence, click here.

—————————————————————————————————-

1 Comprising acquisition taxes, depreciation and financing

2 Based on a scenario for France of 36 months and 60,000km