4WD cars – the quattro effect in used-car markets

13 April 2022

Those driving to the Alps for winter sports know about the advantages of four-wheel-drive (4WD) cars. But is it economical to spend the extra money on them? Christof Engelskirchen, chief economist of the Autovista Group, investigates, and not just for Audi quattro, but across all brands.

Where two-wheel-drive (2WD) cars begin to require snow chains, 4WD cars can go without. 4WD setups provide better traction in rainy conditions and when towing. There are some disadvantages to 4WD cars in the form of higher costs for wear and tear due to more moving parts. 4WD vehicles also consume more energy due to greater weight and higher frictional losses if the setup is permanent. They have a bigger turning radius than 2WD cars. More importantly, they are more expensive as new cars.

The question is how much of this premium over two-wheel-drive can be maintained in used-car markets? The answer appears to be tied to how many mountains there are in a country.

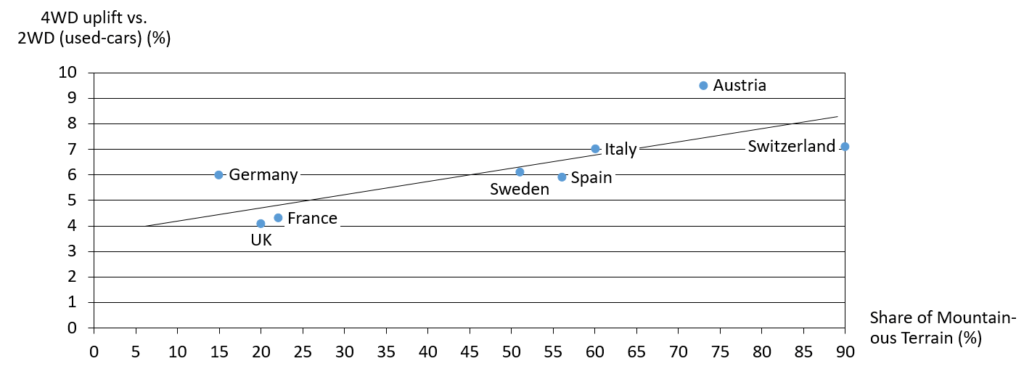

Not surprisingly, the uplift of 4WD cars versus 2WD in a side-by-side comparison is higher where mountainous terrain occupies more of a country’s geography.

Average residual-value uplift 4WD vs. 2WD (across all brands 36m/60,000km/trade) by share of mountainous terrain

Leading countries in terms of share of mountainous terrain are Switzerland (90%) and Austria (73%). Their average uplifts of 4WD cars lie at 9.5% (Austria) and 7.1 % (Switzerland). Next comes Italy with a 7% uplift and 60% of terrain classified as mountainous. Germany appears to be a bit of an outlier, possibly hinting at the strong spending power of consumers, who tie four-wheel drive to premiumness and are willing to pay 6% more for a comparable 4WD version of the same 2WD model.

It is worth noting that in this analysis we compare models with similar power output and trim lines. High-performance 4WD cars, which do not have a 2WD equivalent, do not affect the analysis.

Substantial uplifts

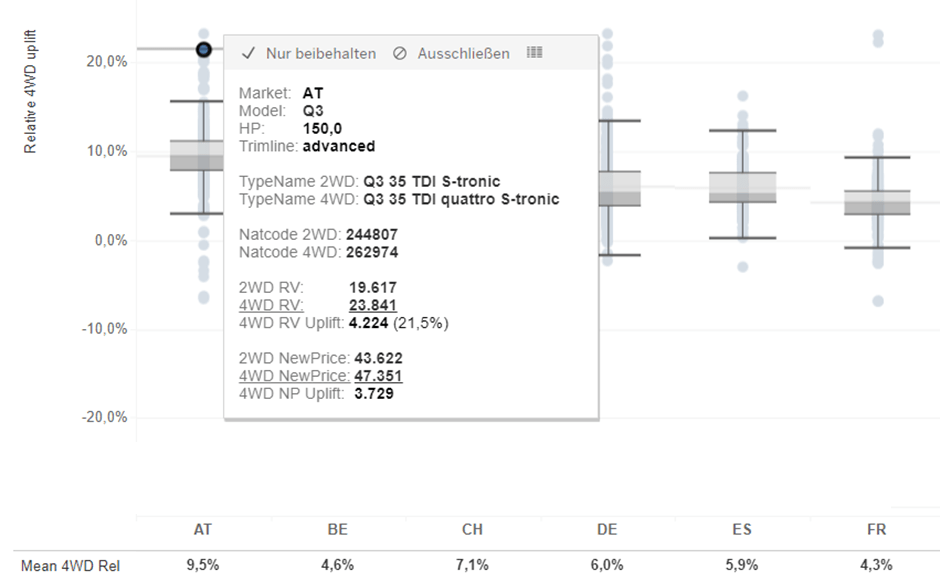

Uplifts can be substantial. On average, and across all segments, they amount to €2.332 (gross) in Austria, for example, for a three-year-old vehicle with 60,000km. In the screenshot below, there is an example from the pairs that we have compared across markets: the Audi Q3 35 TDI S-tronic is the 2WD version and the Q3 35 TDI Quattro S-tronic is the four-wheel-drive version, in the advanced trim line.

Both offer 150 horsepower. Three years ago, they sold as new cars with a differential of €3,729. The RV uplift for the 4WD version is 21.5%, or €4,224, and higher than the average uplift observed in Austria. In fact, from a used-car market perspective it makes sense to buy the 4WD version new because it depreciates by around €500 less than the two-wheel-drive alternative.

It is worth mentioning that premium- and near-premium brands dominate 4WD used-car markets. Consequently, about 90% of the analysed uplifts between 2WD and 4WD cars are related to premium- and near-premium-branded models. Mainstream brands offer 4WD vehicles selectively in their line-up, at least for diesel and petrol versions.

The brands offering 4WD and 2WD for the same model, and which we have captured in our analysis, – include Dacia, Hyundai, Kia, Mazda, Nissan, Opel, Skoda, and Toyota. In relative terms, premium- or near-premium-brands do not outperform mainstream brands when it comes to 4WD uplifts over 2WD. And absolute uplifts for mainstream brands are also significant. On this basis, our conclusions do not differ relative to the level of premiumness associated with a brand.

Similar absolute uplifts across most segments

In absolute terms, the average 4WD vehicle uplifts appear to also be stable across the B-D segments (around €2,000), as they add similar absolute costs and benefits to two-wheel drive. In the higher segments, E and F, they add €2,500-3,500, on average, to the price of the used vehicle. In these segments, this may be due to a perceived element of exclusivity that contributes to the higher price realisation.

Example of a 4WD premium over 2WD for Audi Q3 in Austria (36m/60tkm/trade)

The quattro effect

The market share of 4WD cars may have declined on new-car markets, but they retain their value better than two-wheel-drive cars. There is no reason not to buy them out of fear that the additional costs when buying new cannot be recovered later when sold as used.

What used to be a unique selling point for Audi – quattro – has permeated into mainstream. The absolute 4WD uplifts are relatively stable across brands and (mainstream) segments. Used-car buyers tie a particular value to 4WD vehicles over 2WD, largely irrespective of brand and segment.

What is surprising, though, is that there are not more four-wheel-drive battery-electric vehicles (BEVs), yet, when there should be no concern around remarketing opportunities.

Range and EV charging infrastructure are beginning to reach levels where going to the Alps becomes viable in a BEV. Be sure, four-wheel drive is on the shopping list for electric cars.