UK new-car market suffers ‘worst start to the year since 1970’

04 February 2021

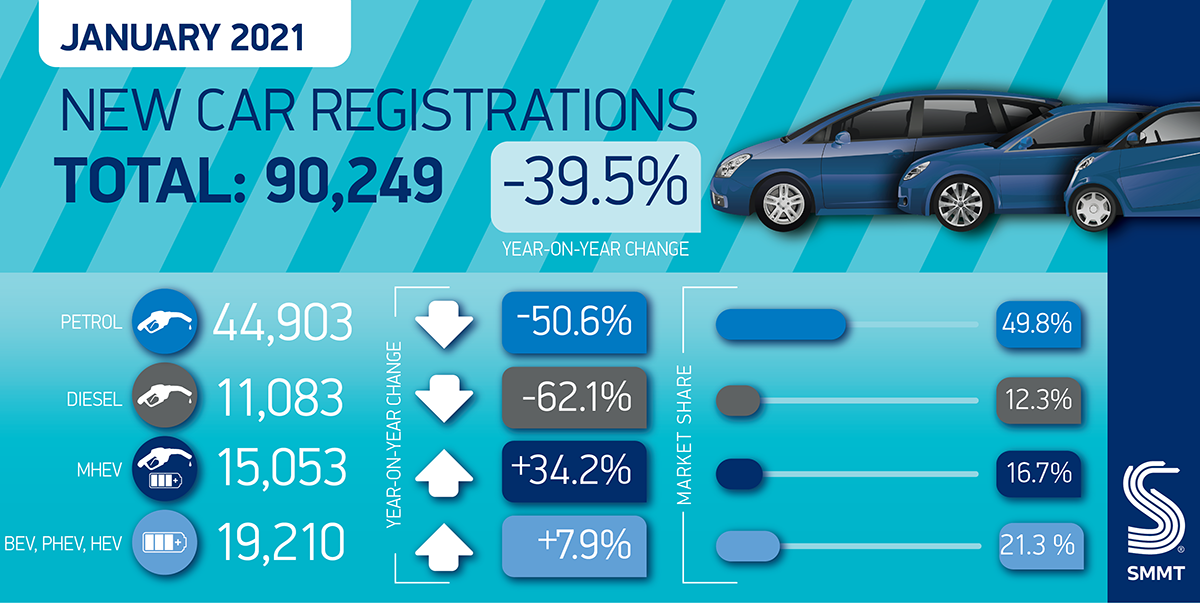

The combined negative effects of dealership closures and two fewer working days resulted in a 39.5% year-on-year decline in new-car registrations in the UK in January 2021. Autovista Group senior data journalist Neil King explores the latest figures and the market outlook.

A total of 90,249 new cars were registered in the UK in January, according to data released by the Society of Motor Manufacturers and Traders (SMMT). It highlighted that this was ′the worst start to the year since 1970.’

The UK emerged from its second lockdown on 2 December, only to see new regional restrictions imposed from 16 December. Subsequently, national lockdowns in England and Scotland were announced on 5 January, with ongoing restrictions across the rest of the UK. The pick-up and collection of cars is still permitted across the country, except in Northern Ireland. Collection has only been possible from an outdoor location in Scotland since 16 January, with direct deliveries to customers the only option prior to this.

Registrations were further constrained as there were two fewer working days in January 2021 than in January 2020. Autovista Group estimates that registrations fell by about 31% in the month on a comparable working-day basis. As in Germany, this aligns exactly with the Autovista Group expectation of a return to year-on-year declines of about 30% in countries where dealers were closed for physical car sales.

Registrations of petrol and diesel cars fell by 62.1% and 50.6% respectively, but still held a combined 62.1% share of the market. Registrations of standard hybrids (HEVs) also declined, by 23.9%, but the upward trend for plug-in hybrids (PHEVs) continued, with a 28% rise. Moreover, demand for battery-electric vehicles (BEVs) surged by 54.4% and electrically-chargeable vehicles (EVs) accounted for 13.7% of registrations, up from just 5.9% in January 2020.

4 February 2021

Source: SMMT

Stable underlying demand

On a positive note, without the lockdown and working-day effects, underlying demand was relatively stable in January compared to a year ago, running at about 2.3 million units on an annualised basis. The lockdown measures are currently expected to last until March and will hinder the automotive recovery in the UK, at least in the short term.

′With lockdown restrictions in place until March – the most important month of the year for the sector, accounting for one in five new-car registrations on average – the industry will face a challenging year as showroom closures depress consumer demand, which has a knock-on effect on manufacturing output,’ the SMMT stated.

Mike Hawes, chief executive of the SMMT, commented; ′Following a £20.4 billion (€23.2 billion) loss of revenue last year, the auto industry faces a difficult start to 2021. The necessary lockdown will challenge society, the economy and our industry’s ability to move quickly towards our ambitious environmental goals.

′Lifting the shutters will secure jobs, stimulate the essential demand that supports our manufacturing, and will enable us to forge ahead on the Road to Zero. Every day that showrooms can safely open will matter, especially with the critical month of March looming,’ added Hawes.

2021 forecast downgraded to 17% growth

Although underlying new-car demand appears to be holding up in the UK, supported by the aversion of the dreaded ′no-deal’ Brexit scenario, the ongoing lockdown means demand is not translating into registrations. Moreover, losses in the short term will not be fully recovered later in the year, as was the case in 2020. Autovista Group estimates that the extended lockdown in the UK will result in the loss of approximately 120,000 new-car registrations in the first quarter of 2021, most of which will not rematerialise later.

Accordingly, Autovista Group’s latest base-case forecast has been lowered to just over 1.9 million units, equating to 17% improvement in new-car registrations in 2021, with further growth of 11% predicted in 2022. This is predicated upon vaccination progress preventing any further lockdowns in 2021 and new-car deliveries being largely unimpaired by semiconductor shortages and/or post-Brexit border delays.

In a downside scenario, however, greater disruption to new-car registrations (and supply) is assumed for 2021, with no opportunity for the recovery of losses later in the year. The forecast for this worst-case scenario is for UK new-car registrations to recover by only 13% in 2021, to about 1.84 million units, with further growth of only 9% in 2022.

In a more positive upside scenario, lockdown disruption to the UK automotive sector will be even more short-lived than in the base-case forecast, with dealers quickly returning to full operational capacity. The less-severe impact on the wider economy would also bolster new-car registrations in 2021 and beyond. In this scenario, the UK new-car market is forecast to grow by 21% in 2021, to almost 2 million units, and expand by 13% in 2022.