US new-vehicle sales set to slump in September as inventory increases

26 September 2024

With Labor Day taking place in August, US new-vehicle sales are expected to decline during September. However, this does not tell the full story. In a new forecast, J.D. Power discusses its outlook.

Including retail and non-retail transactions, total US new-vehicle sales for September 2024 are projected to reach 1,164,900 units. This represents a 1.8% decrease from 12 months ago when adjusted for selling days. The month has 23 selling days, three fewer than September last year.

Comparing the same sales volume without adjusting for the number of selling days translates to a drop of 13.2% from 2023. The seasonally-adjusted annualised rate (SAAR) for total new-vehicle sales is expected to be 15.8 million units, which is stable from one year ago.

In the third quarter of 2024, new-vehicle sales are expected to reach 3,882,600 units. This is a 0.2% increase on the same period last year, where there were two fewer selling days.

Retail sales of new vehicles are forecast to reach 960,500 units in September. This is a 3.9% decline from one year ago on a selling-day adjusted basis. Comparing the same sales volume, without adjusting for the number of selling days, results in a 15% fall from 12 months ago.

New-vehicle retail sales in the third quarter of 2024 are projected to reach 3,263,500 units. This equates to a 1.4% rise from the same period last year.

Labour Day impact

‘September sales volumes will be lower than a year ago because of a calendar quirk that saw the Labor Day holiday weekend fall into the August sales month. This boosted August’s sales but will diminish September’s sales from a year ago,’ noted Thomas King, president of the data and analytics division at J.D. Power.

‘When August and September results are combined, retail sales increase 2.6% year on year.

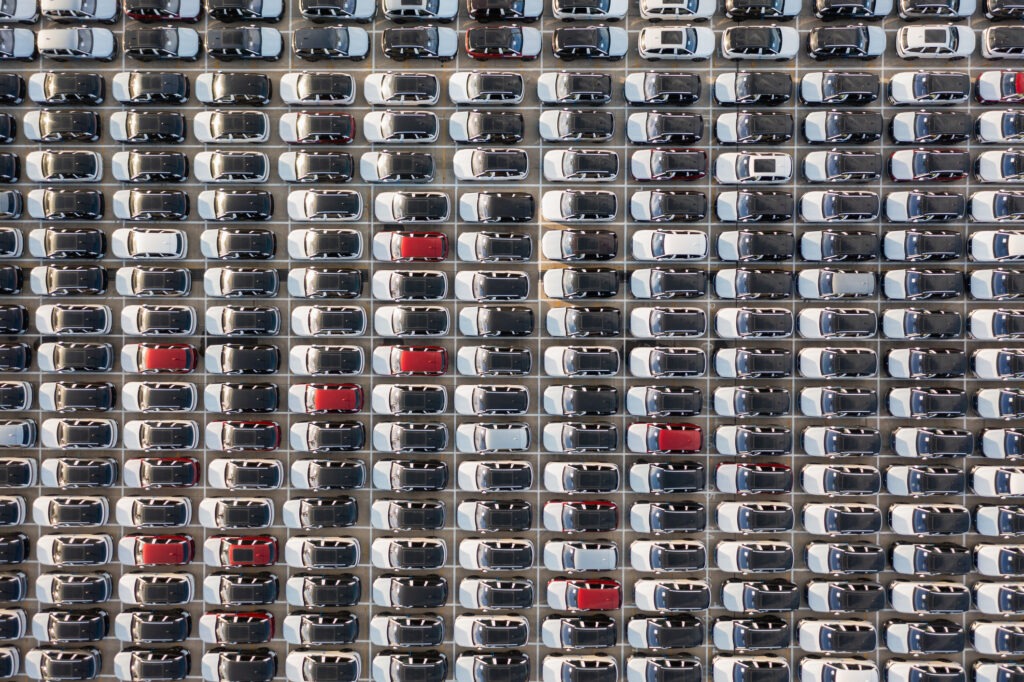

‘Retail inventory is projected to be 1.8 million units, a 6.2% increase from August and a 30.7% increase from September 2023. Rising inventories are leading to larger discounts from both manufacturers and retailers,’ explained King.

‘However, the inventory situation continues to be inconsistent across brands and models, with some popular vehicles remaining in short supply,’ he highlighted.

The average retail transaction price for new vehicles has fallen from a year ago. This is due to higher manufacturer incentives, larger retailer discounts and an increased availability of lower-priced vehicles.

Lower transaction prices

Transaction prices are trending towards $44,467 (€39,910) down $1,296 or 2.8% from September 2023. The combination of lower retail sales and lower transaction prices means that buyers are on track to spend nearly $40.4 billion on new vehicles this month. This is a 16.8% decline from 12 months ago.

‘Total retailer profit per unit, which includes vehicles gross plus finance and insurance income, is expected to be $2,294, a 29% decline from September 2023,’ stated King.

‘Rising inventory is the primary factor behind the profit decline and fewer vehicles are selling above the manufacturer's suggested retail price (MSRP). So far, only 13.6% of new vehicles have been sold above MSRP, down 26.1% from 12 months ago.’

Total aggregate retailer profit from new-vehicle sales for this month is projected to reach $2.1 billion. This is a 39% slump compared to September 2023.

Increasing inventory

‘Increased inventory means fewer vehicles are being pre-sold by retailers, with more shoppers able to buy directly off dealer lots. J.D. Power forecasts that 32.4% of vehicles will sell within 10 days of arriving at the dealership,’ King said.

‘This is down from a peak of 58% in March 2022. The average time a new vehicle remains in the dealer's possession before sale is expected to be 48 days, up from 29 days in September 2023,’ he added.

Manufacturer discounts are continuing to rise. The average incentive spend per vehicle has grown 63.2% from 12 months ago and is currently on track to reach $3,047.

Expressed as a percentage of MSRP, incentive spending is currently at 6.2%. This is an increase of 2.4 percentage points (pp) from a year ago. Spending has decreased by $21 per unit from last month.

Changing leasing activity

‘One of the drivers of higher incentive spending from a year ago is the increased availability of discounted lease payments. This month, leasing is expected to account for 21.8% of retail sales. This is a 1pp increase from 20.8% in September 2023,’ outlined King.

‘While attractive lease deals are driving the lease mix upward, the industry continues to contend with the long-term effects of reduced leasing activity from three years ago.

‘The number of leases expiring this September is 13.1% lower than last month and 28.1% lower than September 2023. Fewer expiring leases mean fewer opportunities for new sales,’ he commented.

Declining interest rates

Average monthly finance payments this month are on track to reach $734, up $11 from 12 months ago. The average interest rate for new-vehicle loans is expected to be 6.8%, down 46 basis points from a year ago (with one basis point equal to 0.01%).

So far in September, average used-vehicle retail prices are at $28,465. This reflects a drop of 3.2% from a year ago, equating to a drop of $937. The decline in used-vehicle values is translating to lower trade-in equity for owners. This is now trending towards $7,886, which is a $1,120 decrease from one year ago.

‘In October, attention will centre on the evolving effect of recent interest rate cuts. The rate adjustment is a positive for the industry. However, the effect will be neither immediate nor linear whether it is improving vehicle affordability for consumers, reducing the cost of low annual percentage rate deals for manufacturers or helping retailers with floorplan expenses,’ explained King.

‘Furthermore, the effect on monthly payments will be dampened by the ongoing decline in trade-in equity. The drop in trade-in equity is one of the reasons why monthly payments are up from a year ago, even though transaction prices are falling,’ he stated.

The details

- Average incentive spending per unit in September is expected to reach $3,047, up $1,210 from September 2023. Spending as a percentage of the average MSRP is expected to increase to 6.2%, a 2.4pp increase from 12 months ago.

- Average incentive spending per unit on trucks/SUVs in September is expected to be $3,243, a rise of $1,296 from one year ago. Meanwhile, the average spending on cars is expected to be $2,208, up $803 from a year ago.

- Retail buyers are on pace to spend $40.4 billion on new vehicles, declining $8.2 billion from September 2023.

- Trucks/SUVs are on pace to account for 80.8% of new-vehicle retail sales in September.

- Fleet sales are expected to total 204,416 units in September, an increase of 9.2% from September 2023. Fleet volume is expected to account for 17.5% of total light-vehicle sales, improving 1.8pp from a year ago.

- Average interest rates for new-vehicle loans are expected to be 6.8%, down 46 basis points from a year ago.

Low point for EVs

‘In September, the interest in electric vehicles (EVs) by new-vehicle shoppers reached a low point for the year. Just 21.7% of new-vehicle shoppers said they were ‘very likely’ to consider an EV for their next new-vehicle purchase. This is a 4.2pp drop from a year ago,’ explained Elizabeth Krear, vice president, electric vehicle practice at J.D. Power.

‘Even though fewer shoppers are considering EVs, the sales share for EVs peaked at 9.4% in August and has held through the middle of September. This is a healthy position. The contradiction of lower interest and higher sales will lead many to ask, ‘How can that be?’ The answer is incredibly discounted transaction prices.

‘Buyers are always looking for a deal. What they are paying now for an EV, thanks in part to federal incentives, is less than the comparable segment average price in both mass market and premium segments,’ concluded Krear.