VW is reforming the semiconductor supply chain

26 July 2022

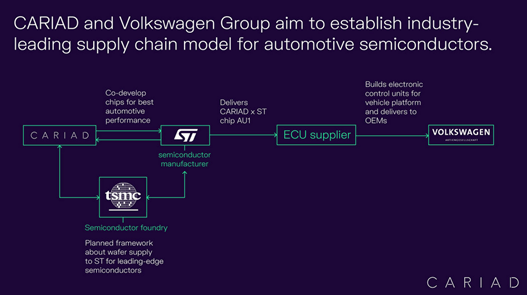

Volkswagen (VW) Group’s software unit Cariad will start co-developing semiconductors, with the move helping the carmaker to secure a direct supply of chips years in advance. It is the first time the group will be working directly with a tier two and tier three semiconductor supplier.

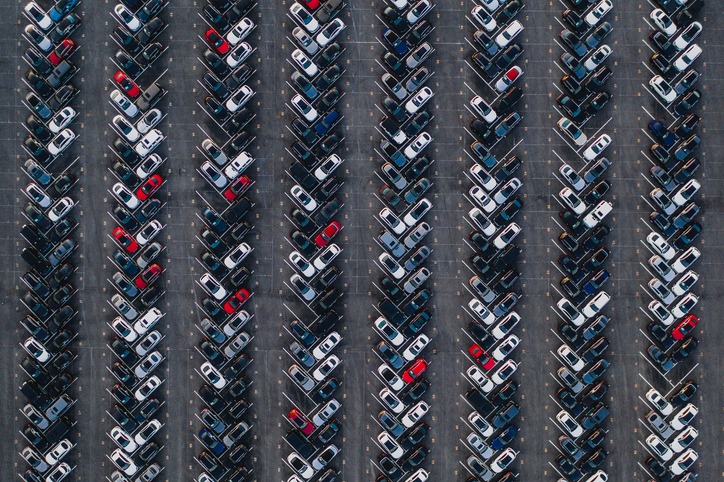

Chip shortages have plagued the automotive industry since the onset of the COVID-19 pandemic, and carmakers are increasingly trying to shorten the supply chain to gain direct access to key products. VW’s move highlights that manufacturers are eager to gain greater control over their value chains, a trend that is reshaping the car industry.

Cariad has teamed up with Geneva-headquartered chip specialist STMicroelectronics to co-develop the new chips, which are crucial in next-generation models. The companies will jointly create hardware for connectivity, energy management, and over-the-air updates.

The semiconductor strategy

Cariad told Autovista24 that the chips would be ‘used by the middle of the decade in the group-wide, scalable software platform on which VW Group vehicles will be based in the future.’ Semiconductors are a key component of electronic systems, including those in electric vehicles (EVs), with VW Group – Europe’s largest carmaker – heavily investing in electrifying its fleet.

Fully-electric cars can easily have twice as many semiconductors as fossil-fuel-powered ones. The average battery-electric vehicle (BEV) requires around 1,300 of these tiny and complex chips, which are used for connectivity and safety features, and to help control the powertrain and battery in an EV.

In VW’s case, the chips will be tailor-made to match Cariad’s software. They will be designed for all applications, be it networking, drivetrain, energy management, or comfort electronics.

Earlier this year, Cariad struck a partnership with US chip maker Qualcomm Technologies to source system-on-chips (SoCs) for its software platform. The deal was then estimated to be worth €1 billion although financial details were not disclosed.

Like Qualcomm, STMicroelectronics has now become one of VW’s top technology partners, with the new cooperation signalling a novel way of acquiring chips.

‘We are actively shaping our entire semiconductor supply chain. We are ensuring the production of the exact chips we need for our cars and securing the supply of critical microchips for years to come,’ said Murat Aksel, VW Group’s board member of purchasing. ‘In this way, we are setting new standards in strategic supply-chain management.’

The German carmaker is reforming how it sources crucial components, not only from traditional automotive suppliers, but more directly from electronics suppliers. A ongoing market disruptions have severely affected car production internationally, this approach is starting to gain traction across the industry.

Chip woes to last beyond 2023

Bosch, a key automotive supplier of semiconductors, told Autovista24 that the global procurement market is still experiencing a general shortage of certain chip components, which has also impacted the Germany-based company.

‘Despite the difficult market situation, Bosch is doing its utmost to maintain supplies and to keep any further impact to a minimum. The situation remains difficult, and although we expect it to ease slightly in the third quarter, it will remain challenging beyond 2023. This may affect certain semiconductor products, such as microcontrollers, power-management semiconductors, and voltage regulators,’ Bosch stated.

‘In this fraught situation, we are doing all we can to help our customers. We are investing a lot in expanding our own chip operations. The Dresden plant has been inaugurated and is now ramping up. In addition, we are working to expand the capacity of our existing plant in Reutlingen.’

Bosch is aiming to invest another €3 billion in its semiconductor division to bolster European chip supply. The company is seeing huge demand for silicon-carbide (SiC) chips, which it has been mass-producing since the end of last year. SiC chips are used to power electronics in all-electric and hybrid vehicles and can boost operating ranges by up to 6%.

Cariad’s standardised approach

While VW is restructuring its supply-chain strategies, the manufacturer’s software division Cariad has had to handle some setbacks recently. The unit is developing a unified architecture to serve as the basis for all future, software-defined vehicles across the VW Group.

The carmaker believes that a standardised approach is key to unlocking new-vehicle functions via OTA updates, as well as enabling highly automated driving at SAE Level 4. VW Group spends around €2.5 billion a year on software, but Cariad is struggling with delays and coordination problems among VW Group’s various brands.

The unit is now hoping that the partnership with STMicroelectronics will help to standardise and adapt all control units, which could give the software platform an overall boost.