What are the effects of psychologically-optimised vehicle prices?

10 December 2019

10 December 2019

Andreas GeilenbrÃœgge, Head of Valuations and Insights at Schwacke, considers smart vehicle pricing tactics and their impact on profitability.

Nobody would deny that the price of a product influences the purchase decision. Alongside the absolute price level, however, there is another factor when it comes to pricing considerations: the psychological effect. In supermarkets for example, the price of the majority of products ends in a ″9″. Whether a packet of butter costs €1.91 or €1.99, the customer will hardly consider the difference. There is the same price difference of eight cents between €1.99 and €2.07 but, in terms of pricing consideration, the difference is much greater.

This type of price-setting is not exclusive to the retail trade – car dealers also seek to optimise their margins through smart pricing. Accordingly, the retail cost of the majority of cars sits in the ″psychologically attractive″ pricing bracket, where prices end between 800 and 999. As an indicator of the level of success of these pricing measures, the number of stock days can be analysed as well as the difference between these ′optimised’ sale prices and the typical market value for a comparable vehicle in the segment.

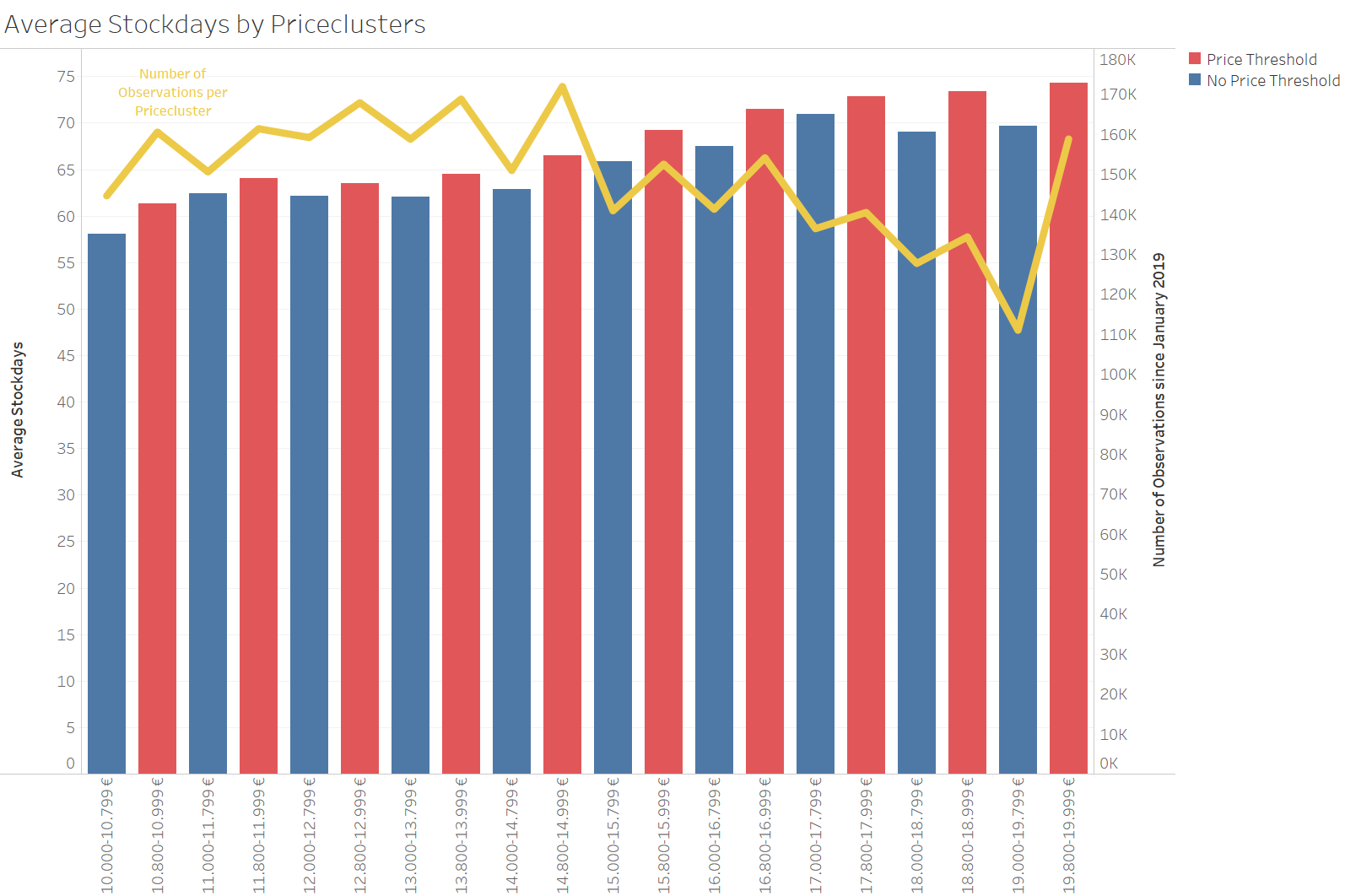

Average stock days and observations by price segment

Source: SAE

Considering stock days alone, vehicles priced close to the next €1,000 threshold tend to take longer to sell. The difference is two days on average, which is the opposite of what many would expect; the psychologically favourable pricing should increase the attractiveness of the offer and, consequently, reduce the number of stock days. This is perhaps due to the search-engine logic of the used-car portals, which identifies the offers closest to the price threshold as the “most expensive” when listed by price ″up to €X,000″. Another reason could be the higher stock volume of price-optimised models.

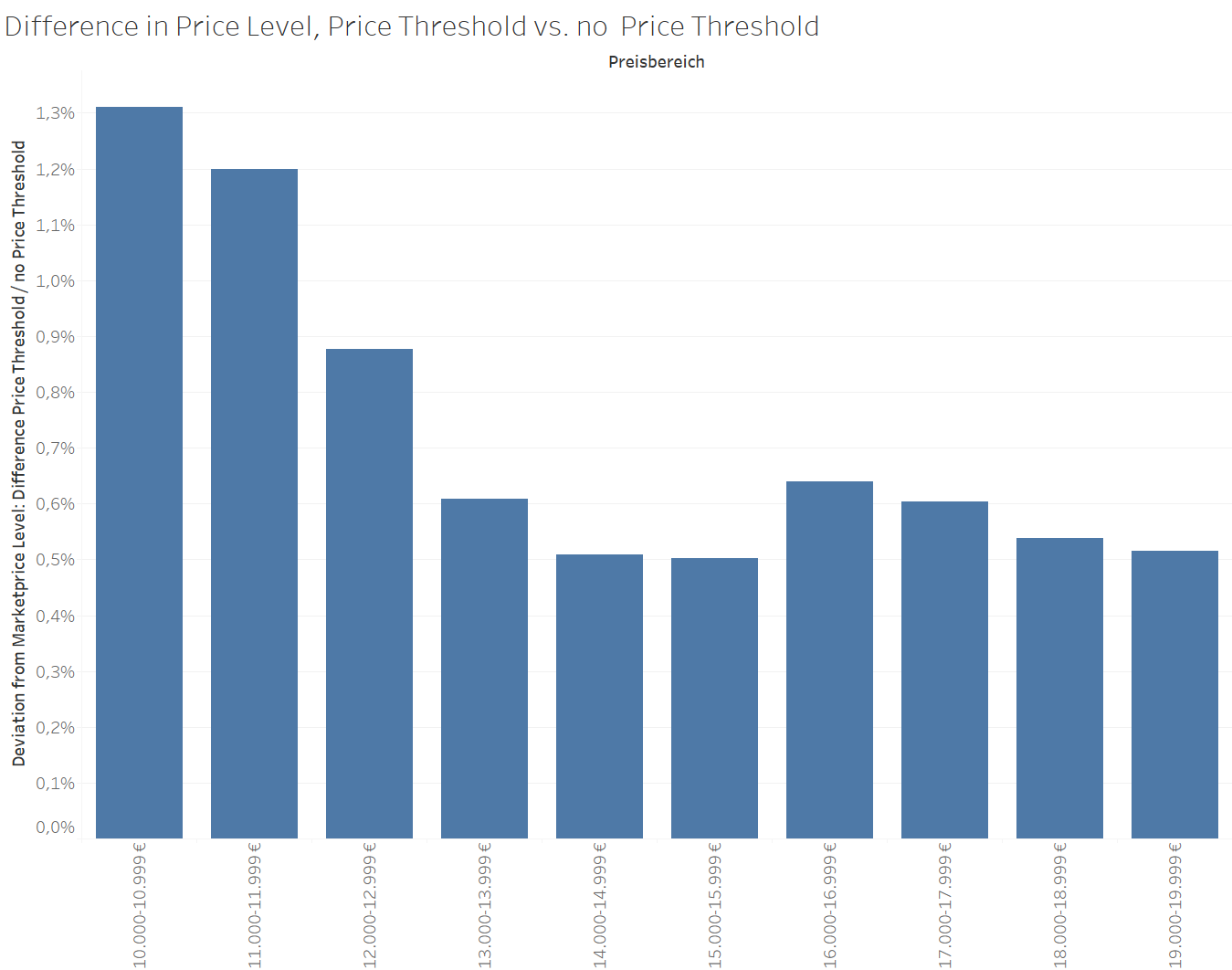

Optimised selling prices versus market value

For this purpose, the difference between the offer price observed at the time of sale and the market value, according to Schwacke (Spotprice[1]), was calculated for each vehicle sold. This deviation was calculated for both the price threshold and underlying non-threshold offer prices.

One concrete example is that vehicles in the price range of €10,800 to €10,999 achieved revenue that was on average 1.3 percentage points higher than those in the price range of €10,000 to €10,799, relative to the market price. Measured against the market level, psychologically-priced vehicles therefore generate higher average yields.

Deviation in price difference between optimised prices and typical market values

Source: SAE

Considering stock days alone, vehicles priced close to the next €1,000 threshold tend to take longer to sell. The difference is two days on average, which is the opposite of what many would expect; the psychologically favourable pricing should increase the attractiveness of the offer and, consequently, reduce the number of stock days. This is perhaps due to the search-engine logic of the used-car portals, which identifies the offers closest to the price threshold as the “most expensive” when listed by price ″up to €X,000″. Another reason could be the higher stock volume of price-optimised models.

Optimised selling prices versus market value

For this purpose, the difference between the offer price observed at the time of sale and the market value, according to Schwacke (Spotprice[1]), was calculated for each vehicle sold. This deviation was calculated for both the price threshold and underlying non-threshold offer prices.

One concrete example is that vehicles in the price range of €10,800 to €10,999 achieved revenue that was on average 1.3 percentage points higher than those in the price range of €10,000 to €10,799, relative to the market price. Measured against the market level, psychologically-priced vehicles therefore generate higher average yields.

Deviation in price difference between optimised prices and typical market values

Source: Schwacke/SAE

In summary, optimised prices are more profitable but, unfortunately, do not accelerate the sale. Depending on stock day costs, the figures do not always add up. Success therefore lies in offering both a car that is equipped for optimal demand and a smart-pricing strategy.

[1] The Schwacke Spotprice excludes long-unprocessed offer prices and outliers from the comparative calculation but takes into account the prices of recently-sold vehicles. It tends to always be below the price level of current offers. The Spotprice therefore better reflects the actual market price level than the partly inflated current-offer prices and the calculated spot-price difference shows how good or bad the achieved sale price was in relation to the market situation.

Source: Schwacke/SAE

In summary, optimised prices are more profitable but, unfortunately, do not accelerate the sale. Depending on stock day costs, the figures do not always add up. Success therefore lies in offering both a car that is equipped for optimal demand and a smart-pricing strategy.

[1] The Schwacke Spotprice excludes long-unprocessed offer prices and outliers from the comparative calculation but takes into account the prices of recently-sold vehicles. It tends to always be below the price level of current offers. The Spotprice therefore better reflects the actual market price level than the partly inflated current-offer prices and the calculated spot-price difference shows how good or bad the achieved sale price was in relation to the market situation.

Source: SAE

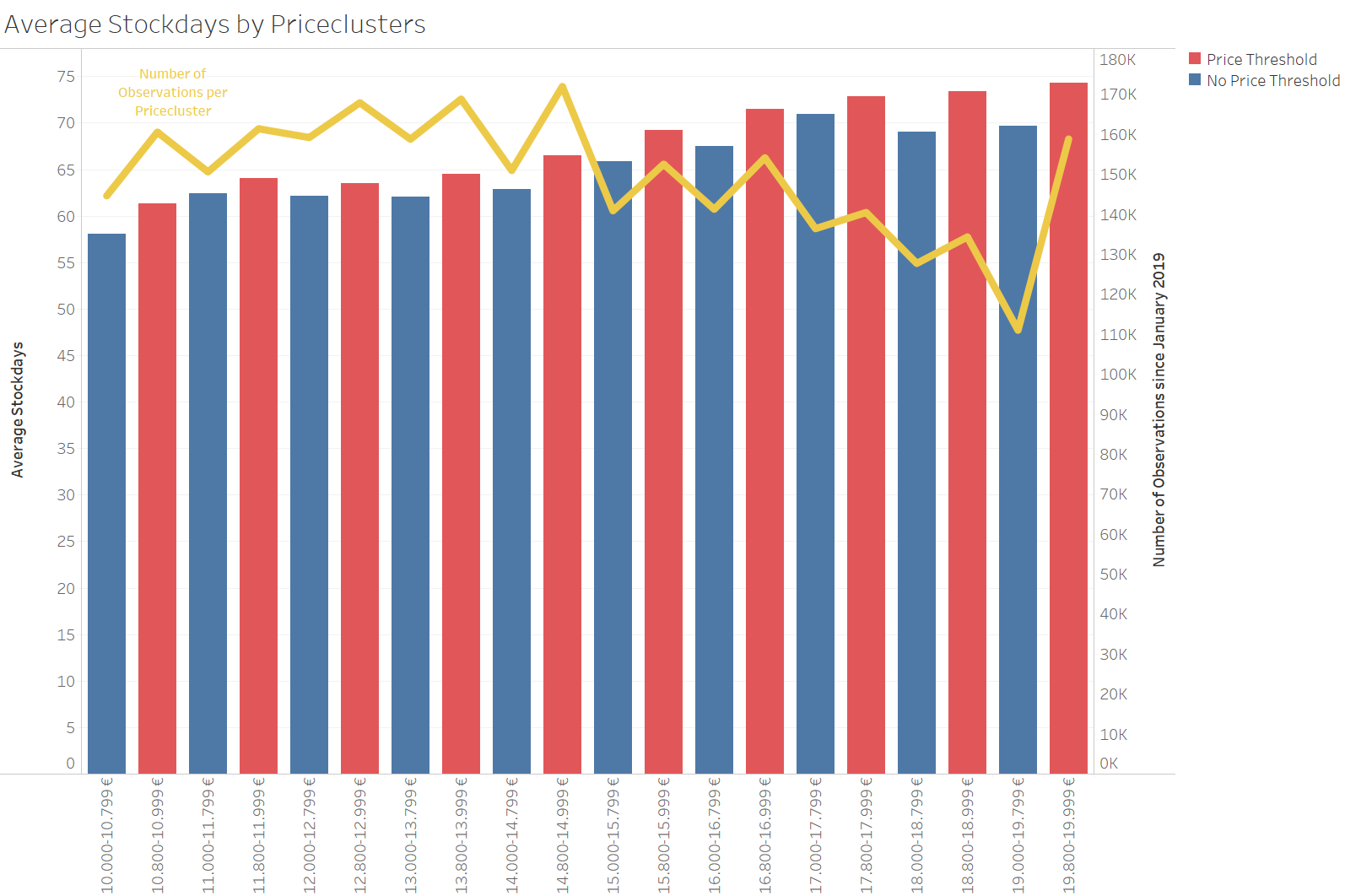

Considering stock days alone, vehicles priced close to the next €1,000 threshold tend to take longer to sell. The difference is two days on average, which is the opposite of what many would expect; the psychologically favourable pricing should increase the attractiveness of the offer and, consequently, reduce the number of stock days. This is perhaps due to the search-engine logic of the used-car portals, which identifies the offers closest to the price threshold as the “most expensive” when listed by price ″up to €X,000″. Another reason could be the higher stock volume of price-optimised models.

Optimised selling prices versus market value

For this purpose, the difference between the offer price observed at the time of sale and the market value, according to Schwacke (Spotprice[1]), was calculated for each vehicle sold. This deviation was calculated for both the price threshold and underlying non-threshold offer prices.

One concrete example is that vehicles in the price range of €10,800 to €10,999 achieved revenue that was on average 1.3 percentage points higher than those in the price range of €10,000 to €10,799, relative to the market price. Measured against the market level, psychologically-priced vehicles therefore generate higher average yields.

Deviation in price difference between optimised prices and typical market values

Source: SAE

Considering stock days alone, vehicles priced close to the next €1,000 threshold tend to take longer to sell. The difference is two days on average, which is the opposite of what many would expect; the psychologically favourable pricing should increase the attractiveness of the offer and, consequently, reduce the number of stock days. This is perhaps due to the search-engine logic of the used-car portals, which identifies the offers closest to the price threshold as the “most expensive” when listed by price ″up to €X,000″. Another reason could be the higher stock volume of price-optimised models.

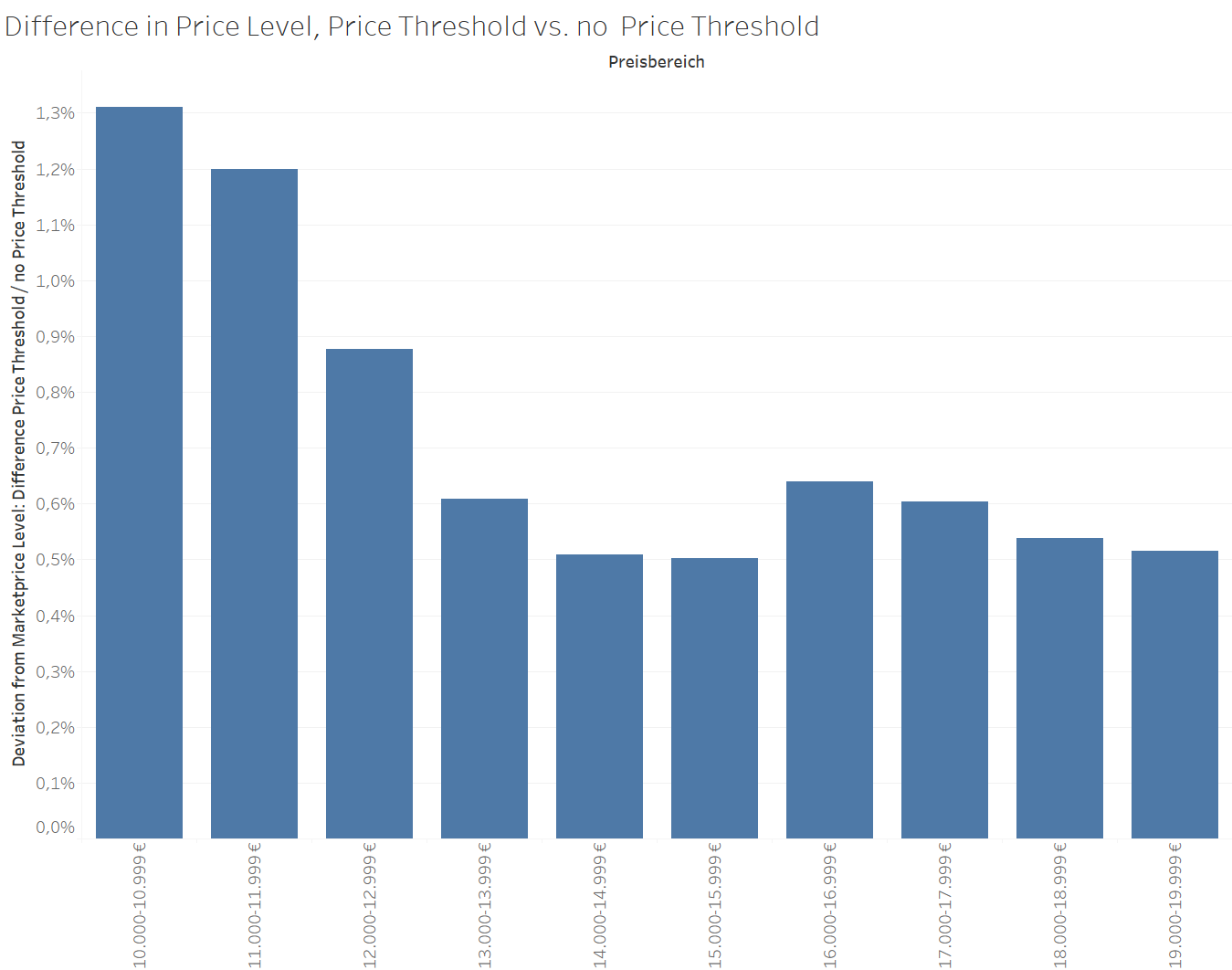

Optimised selling prices versus market value

For this purpose, the difference between the offer price observed at the time of sale and the market value, according to Schwacke (Spotprice[1]), was calculated for each vehicle sold. This deviation was calculated for both the price threshold and underlying non-threshold offer prices.

One concrete example is that vehicles in the price range of €10,800 to €10,999 achieved revenue that was on average 1.3 percentage points higher than those in the price range of €10,000 to €10,799, relative to the market price. Measured against the market level, psychologically-priced vehicles therefore generate higher average yields.

Deviation in price difference between optimised prices and typical market values

Source: Schwacke/SAE

In summary, optimised prices are more profitable but, unfortunately, do not accelerate the sale. Depending on stock day costs, the figures do not always add up. Success therefore lies in offering both a car that is equipped for optimal demand and a smart-pricing strategy.

[1] The Schwacke Spotprice excludes long-unprocessed offer prices and outliers from the comparative calculation but takes into account the prices of recently-sold vehicles. It tends to always be below the price level of current offers. The Spotprice therefore better reflects the actual market price level than the partly inflated current-offer prices and the calculated spot-price difference shows how good or bad the achieved sale price was in relation to the market situation.

Source: Schwacke/SAE

In summary, optimised prices are more profitable but, unfortunately, do not accelerate the sale. Depending on stock day costs, the figures do not always add up. Success therefore lies in offering both a car that is equipped for optimal demand and a smart-pricing strategy.

[1] The Schwacke Spotprice excludes long-unprocessed offer prices and outliers from the comparative calculation but takes into account the prices of recently-sold vehicles. It tends to always be below the price level of current offers. The Spotprice therefore better reflects the actual market price level than the partly inflated current-offer prices and the calculated spot-price difference shows how good or bad the achieved sale price was in relation to the market situation.