What can be expected from Europe’s automotive markets in the second half of 2023?

16 August 2023

Despite concerns, Europe’s automotive markets have so far fended off fears of a recession. As central banks keep turning the dial on interest rates, Dr Christof Engelskirchen, chief economist at Autovista Group, draws a line under the first half of 2023 and considers what might come next.

Europe’s automotive sector has eased into 2023. Businesses have been cushioned by strong order backlogs, high prices on new and used-car markets and somewhat resilient demand, all on the back of strong labour markets.

Registrations are growing again

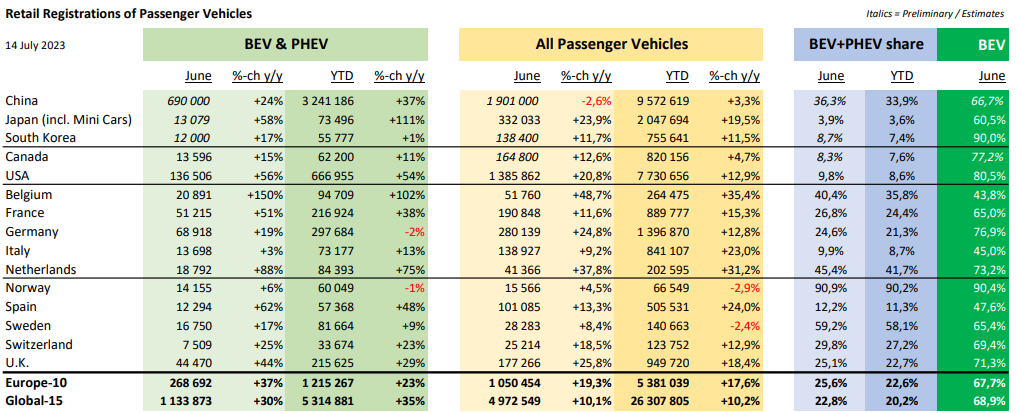

The recovery of new-car markets began in the second half of 2022, and so far this year new-car registrations have continued to rise strongly. Between January and June, 10 European automotive markets (Belgium, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden, Switzerland, and the UK) saw collective year-on-year registration growth of 18%.

The combined share of battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) in this Europe-10 reached almost 26% in June alone, and 23% in the first half of the year. Of these electric vehicle (EV) registrations, roughly two-thirds were BEVs.

Registrations of new passenger vehicles

While this is a promising recovery, there is still a long way to go to compensate for the average 30% loss of volume that took place in 2020, 2021 and 2022. These years also fall into the shadow of a particularly strong, marginally inflated, pre-COVID 2019. In the first half of 2023, new-car registrations across Europe (encompassing the EU, UK and EFTA markets), are still down 21.8% on the same period in 2019.

Order backlogs drive growth

There are justified concerns about the sustainability of 2023’s growth trajectory. First, delayed orders from 2021 and 2022 have fuelled most of the current recovery, so a strong order backlog is masking underlying demand challenges.

Secondly, interest rates keep rising. At the start of August, the European Central Bank (ECB) announced a further 0.25 point hike to 4.25%, making financing and leasing cars more expensive. The core interest rate is now almost nine times higher than a year ago (0.5% in July 2022).

Thirdly, rising interest rates installed by central banks across the world are effectively cooling economies. They push demand down with the intention of bringing inflation levels back to target zones of around 2%. This tighter monetary policy is now having an observable effect.

Inflation rates are down across the board. Germany sat at 6.4% in June and France at 4.5%. The US was furthest ahead of the pack, with an inflation level of 3% halfway through 2023. Poland has also seen a contraction, although its levels of inflation remain very high at almost 12%.

There is still a long way to go to reach target zones and this cannot be expected to happen in Europe this year, according to the latest forecasts from the likes of the Organisation for Economic Co-operation and Development (OECD).

Projections for 2023

The economic cool-down is now palpable. According to the ECB’s macroeconomic projections in June, Germany’s economic activity is expected to contract by 0.3% this year, while the eurozone is forecast to grow by a mere 0.9%.

The new-vehicle market will also lose steam in the second half of 2023, according to recent projections from EV-volumes.com. It forecasts that Europe’s new-car market will end the year with 12.5 million registrations, only up around 10% compared to 2022.

‘For 2023, we expect European EV sales, including BEVs and PHEVs, to increase by 15% over 2022, supported by a brisk passenger-car market recovery of about 10% year on year,’ stated Neil King, forecasting lead at EV-volumes.com. ‘As in 2022, PHEV volumes are stagnating and so all growth is in BEVs, which we forecast will improve year-on-year by 29% and will occupy about 70% of the EV market in 2023.’

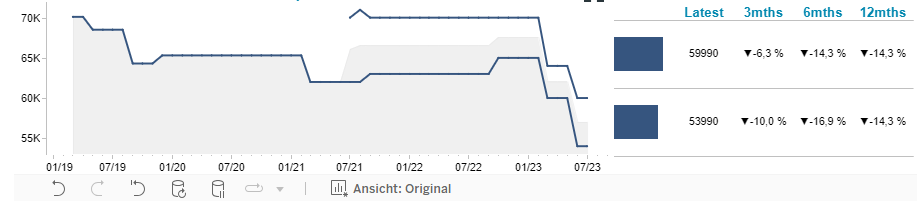

Tesla slashes prices

Subsidy cuts across Europe, protracted market recoveries, and the proclaimed move into the mass market were among the reasons Tesla initiated price cuts in Europe. In Spain, prices for the Model 3 Long Range Dual Motor Performance AWD have dropped by approximately 17% over the past six months, with prices for the Model Y Performance AWD down by 14%. Other manufacturers have followed suit, mostly by maintaining list price positions and increasing subsidies on leasing offers in an attempt to mask the pressure on transaction prices.

New Tesla price development in Spain, January 2019 to July 2023

VW Group leads

Amidst price cuts, Tesla managed to more than double its registrations in the first half of 2023 compared to 2022. The BEV brand saw almost 190,000 units registered in Europe between January and June. But this still puts Tesla in second for BEV registrations, behind Volkswagen (VW) Group.

BMW and Mercedes-Benz still manage a large portfolio of PHEVs and BEVs, which make up roughly half of their registrations. Hyundai, Geely-Volvo (including Polestar) and the Renault-Nissan-Mitsubishi Alliance brands perform strongly as well.

BYD and Nio leave only a small mark. There is more to come over the next six to 18 months from these two carmakers as well as other ‘new-Asian’ brands, some of which have a substantial history in vehicle manufacturing and scaled productions, which may not yet be visible in Europe. For example, BYD is the world’s largest producer of EVs (BEVs and PHEVs).

Resilient used-car markets?

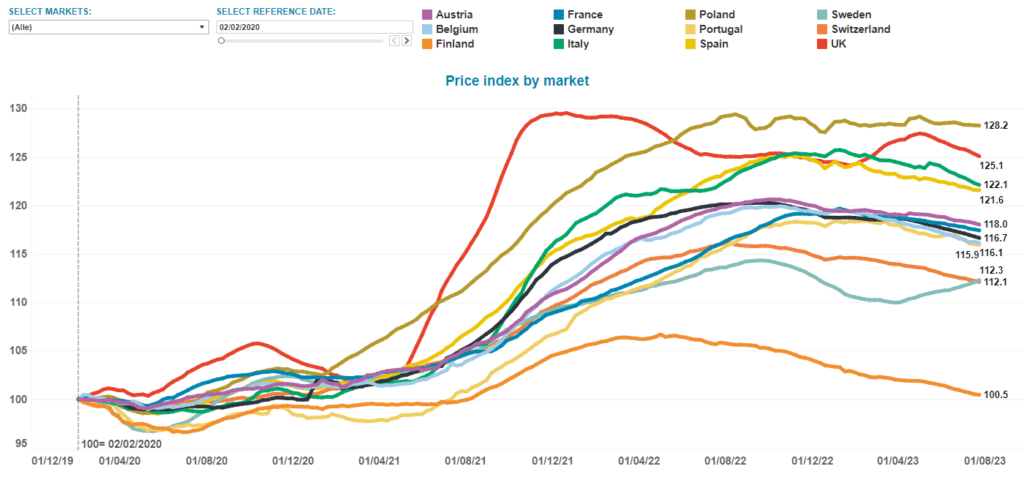

The combination of new-car order backlogs, the lack of used-car supply following three years of drought and strong labour markets supporting private spending, has cushioned pre-owned model transactions for now.

Prices remain steady, although used cars are consistently trading below the highs of 2022. On average, Autovista Group editors see markets holding up relatively well in 2023, but the majority also expect a moderate contraction of used-vehicle prices looming in 2024.

Used-car price index in Europe, January 2019 to August 2023

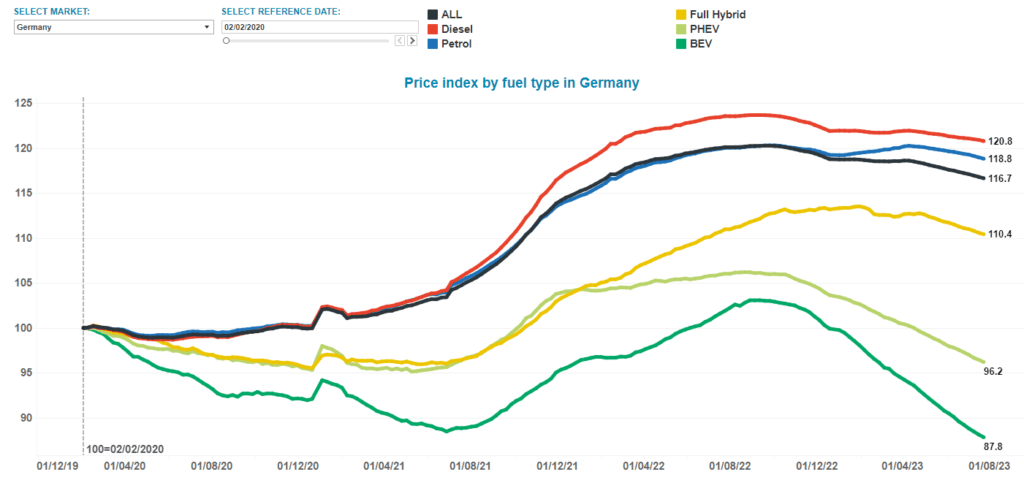

There are heightened concerns about the used-car market performance of BEVs. The dark green line in the graph below represents several combined market effects in Germany. This includes higher lifecycle depreciation for the electric powertrain as the technology advances, as well as subdued demand on used-car markets compared to internal-combustion-engine vehicles.

Used-EV price realisation is also under the influence of recent new-model price cuts, discounting, and lower leasing rates. These relative performance differences between powertrains in Germany are representative of what is happening in other European markets.

Used-car price index by fuel type in Germany, January 2019 to August 2023

Risk of supply pressure

Autovista Group experts will be closely observing any supply pressures forming on new-car markets across the latter half of this year. Bursts of activity around attractive new BEV models with mass-market intent mean more launches across the rest of this year and into 2024. This should stimulate demand and support new-vehicle sales.

Furthermore, brands that are already highly established outside of Europe will make inroads into the region. This will push new-car supply up and average list prices down. It will also help stimulate mass markets and promote adoption of the new technology.

The combination of mass-market compatible prices for BEVs and technological advancement (higher ranges, lower charging times) may put further pressure on used-car prices for existing BEVs. Growing infrastructure will take some heat from this, as it tapers range anxiety. Lower incremental perceived benefits beyond high real-life ranges of above 400km will also help. However, few models can currently make this claim.

Importantly, as long as inflation levels are above target zones, monetary policy will depress demand. Governments will try to cushion the blow on certain societal groups but they will not counter central banks’ actions with adverse fiscal policy.

There are further risks to current economic outlooks. Two primary examples are the war in Ukraine and increasing protectionism, which is harmful to global trade and economic expansion. Current outlooks from the ECB reflect this fragility and uncertainty. After an expected expansion of 0.9% in 2023 for the EU, growth rates are predicted to move to 1.5% in 2024 and 1.6% in 2025.