Automotive Trends & Opportunities Report

Read a sample from the 2022 Automotive Trends & Opportunities Report below. The report provides essential forecasts and insights from our experts to help you with managing risks and automotive decision-making.

Table of contents

To get a feel for the level of information contained in our automotive report, Trends & Growth Opportunities 2022, we have provided the Table of Contents and Introduction below. For further information, or if you have any questions about the report please request a callback.

Dashboard: Residual value outlook 2022/23

Executive Summary

1. Introduction

2. Europe – I New-car market trends

2. Europe – II The shift to ‘green’

2. Europe – III Used-car market dynamics

3. France

4. Germany

5. Italy

6. Spain

7. UK

Appendix

Disclaimer

Authors and Contributors

Report Introduction:

Mastering the trends in used-car markets has always been critical to the survival of those with asset risks on their books. It is not only sudden shocks, like the Lehman Brothers collapse that led to an international financial crisis from 2007 to 2009, which have an impact and are challenging to forecast. Gradual but continuing trends also make their mark, if over a longer period. This means it is essential to create meaningful data-driven forecasts and re-evaluate car market trends and their impact regularly. That is the purpose of this automotive report and its subsequent updates – to enable you to keep on top of automotive megatrends and their effect on new- and, in particular, used-car markets.

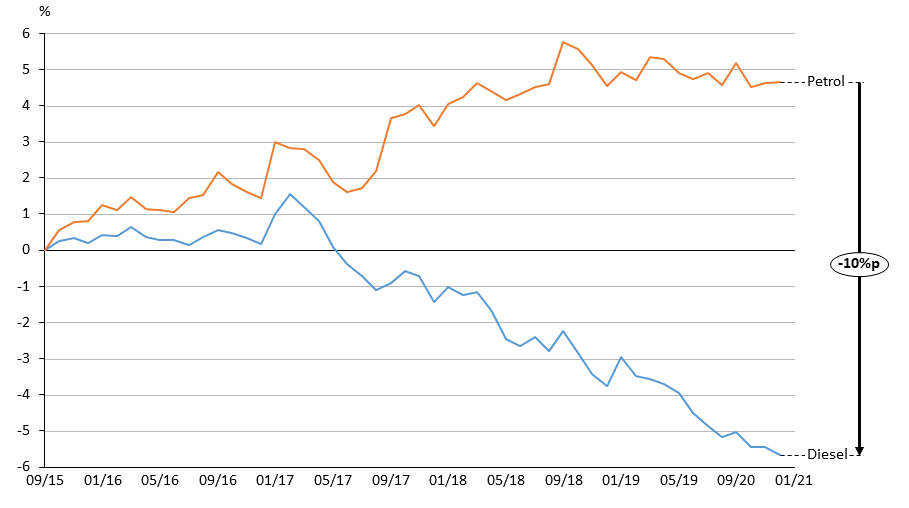

For example, years before ‘Dieselgate’ erupted; the price of diesel used cars had been under pressure. Between 2012 and 2014, diesel RV premiums over petrol powertrains were falling in France, the Netherlands, UK, and Spain. ‘Dieselgate’ started in September 2015. Figure 1.1 shows how the price of diesel cars subsequently declined. Between September 2015 and December 2019, the value of diesel vehicles fell by 10pp compared with petrol cars. Over the last two years (2020-2021; see later chapters of this report), this gap stabilised in many countries and even decreased in some as diesel vehicles began to be phased out of used-car markets much more quickly than any falls in demand.

Source: Autovista Group analysis

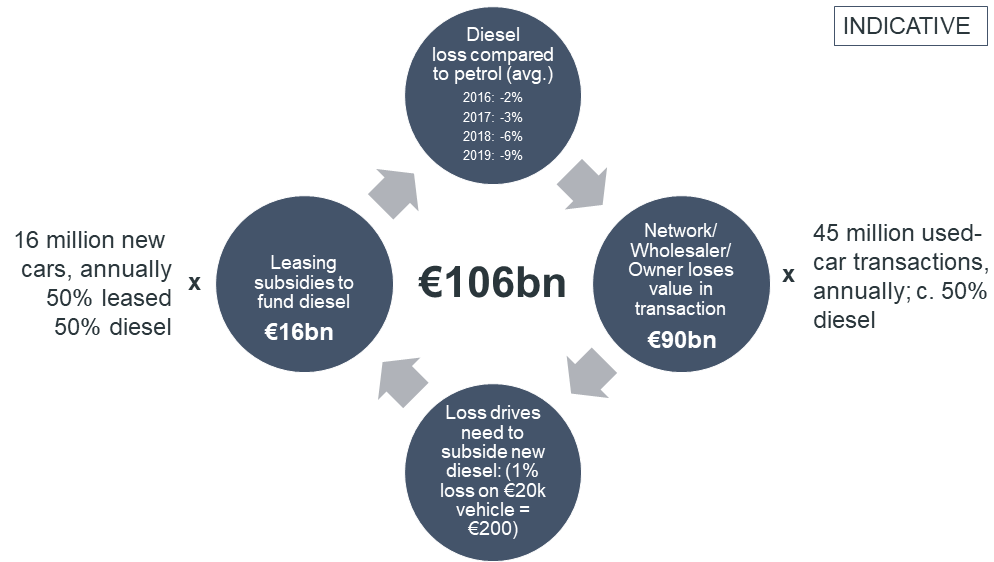

We estimate that the decline in diesel residual values (RVs) cost European participants €106 billion between 2016 and 2019 (Figure 1.2) in both new and used-car markets. In new-car mar-kets, a continuing drop in RVs will put pressure on leasing rates because of a need to finance higher losses in value. While leasing rates could rise to compensate, in practice, there is little wiggle room for this to take place. Instead, OEMs will be forced to subsidise leasing rates and compensate for higher losses in value. On the used car side, the effect is more direct: those selling used vehicles will have to absorb the loss in value. Based on our simulation, we estimate the cost for European new-car markets will be €16 billion and for used-car markets €90 billion.

Source: Autovista Group analysis

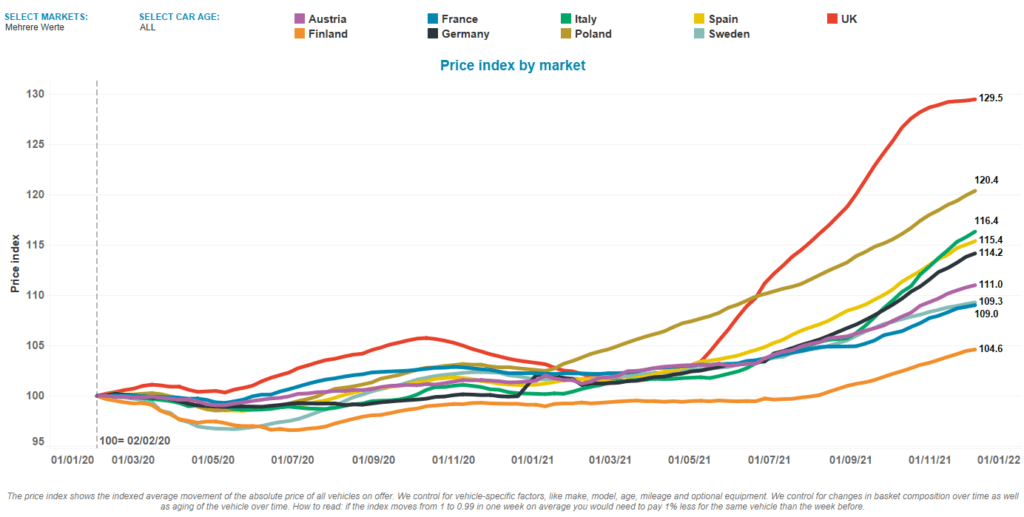

Events in 2020 and 2021 have created more turmoil for the automotive industry. The COVID-19 pandemic and supply-chain issues have presented a serious threat to economies, and it is unclear when they will abate. We expect 2021 new-car registrations to be maintained at similar levels to 2020 (see 2.1.1) – a contraction of roughly one quarter on 2019 levels. For used-car markets, COVID-19 has had different effects (Figure 1.3). While the supply of used cars is substantially down due to a lack of new cars entering the market, used-car transactions in 2021 have stayed close to 2019 levels. Consequently, RVs have risen over the last two years – up to and above pre-crisis levels. Used-car markets have experienced four distinct phases:

- The initial lockdown periods resulted in a temporary decline in RVs between January 2020 and June 2020.

- As lockdowns ended, pent-up demand and supply issues supported a swift recovery to above pre-crisis levels between July 2020 and December 2020 in most markets. Markets stabilised between January 2021 and June 2021 at above-pre-crisis levels. Economies recovered quickly, which further supported this stabilisation.

- In the second half of 2021, on top of a fourth COVID-19 wave, new factors also came into play, which resulted in a further heating-up of used-car markets. As a result, sales consistently outperformed 2019. These new factors included fresh and more substantial supply-chain issues, such as a continuing shortage of semiconductors.

Source: Autovista Group Residual Value Intelligence

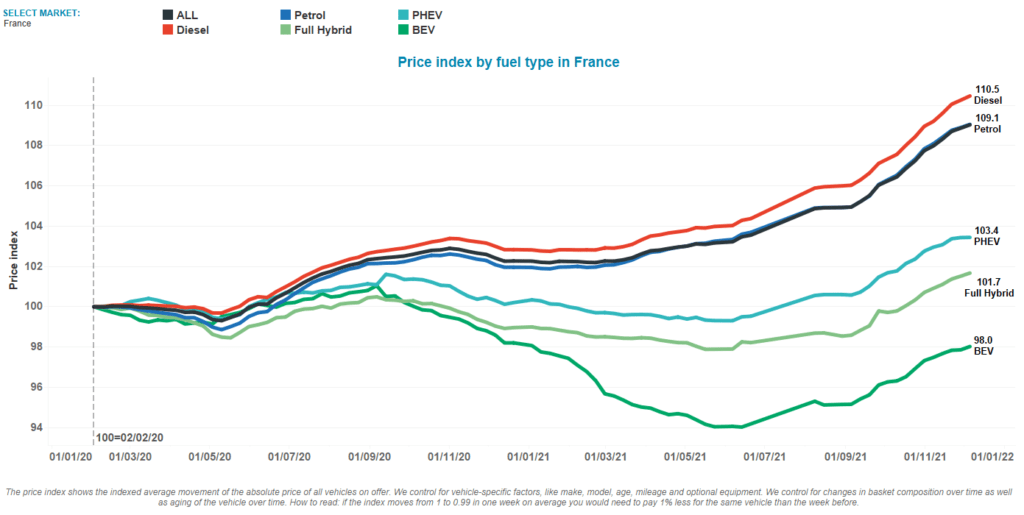

Some of the trends driving the current used-car market rally will moderate as supply-chain issues start to ease during 2022. But other car trends will persist and even intensify. We anticipate the rapid phase-out of ICE vehicles will create a supply shortage of used cars. Demand will outstrip supply in Eastern and Southern Europe. We also anticipate that the RVs of BEVs will continue to suffer from stronger lifecycle depreciation than ICE vehicles. It will be important to factor this scenario both into used-car forecasts and when undertaking risk management. The gap between the value of BEVs and ICEs in used-car markets has already widened and, as substantial technological advancements are likely, this gap will persist – and eventually even increase (Figure 1.4).

Source: Autovista Group analysis

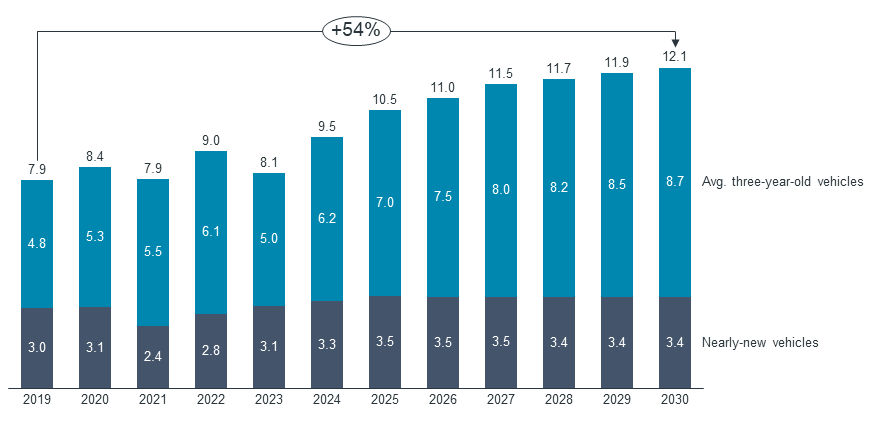

Leasing, meanwhile, currently represents a greater share of new-car sales and this trend will continue, creating additional volumes of used cars that require remarketing (Figure 1.5).

Transactions involving young used cars will rise by 54% between 2019 and 2030. In used-car markets, cross-border remarketing and the digitalisation of business models will create easier-to-skim arbitrage opportunities.

Source: Autovista Group analysis

The aim of this automotive report is to answer the following questions:

- How quickly will used-car markets normalise and at what levels?

- Will there be a golden age for ICE vehicles on used-car markets and how much will ICE RVs increase over the coming years?

- Given substantial incentives and subsidies, electric vehicles are in demand as new purchases, but the same is not true in the case of used-cars. Will this disconnect intensify and what impact will it have on RV performance?

- What are Autovista Group’s RV forecasts for 2022-2023 across different segments and fuel types for the Big 5 European countries, France, Germany, Italy, the UK and Spain?

- What do we recommend major stakeholders do to manage the risks effectively and leverage the many opportunities that present themselves?

How to use it:

- The Automotive Trends Report is digital, we give you online access

- Analyse data, graphs, and tables and use in your own systems and simulations

Price €1,995 plus VAT where applicable.

contact form