Car manufacturers and suppliers grapple with chip shortage while tech giant Samsung gears up

01 December 2021

The global shortage of semiconductors is dragging on, hitting not only carmakers, but automotive industry suppliers. Due to a surge in demand for the critical components during the pandemic, millions of vehicles worldwide could not be produced, with rising raw-material and energy costs limiting scope for investments.

A recent study by PricewaterhouseCoopers (PwC) found that the chip deficit reached European automotive industry suppliers in the third quarter and the situation is continuously deteriorating. The consulting firm analysed the financial health of 494 suppliers from 35 countries, concluding that 42% of companies surveyed are now in a ‘financially-strained situation’ and need to take countermeasures swiftly. Only 24% of businesses were found to be in a solid financial position.

Feeling the strain

‘The chip crisis and other raw-material shortages hit many suppliers in the middle of a period of upheaval,’ said Jörg Krings, PwC partner and head of automotive strategy&, Germany. ‘Like the OEMs, they are faced with the Herculean task of making their companies fit for new, software-based products and for the post-combustion era. In other words, they have to drive the transformation of their processes and structures and massively advance the development of new technology. That not only costs time, but also a lot of money.’

Automotive supplier Bosch is in the middle of restructuring its business to become more competitive and future-proof, the company told Autovista24 last week. It also plans to invest €400 million in semiconductor factories in Germany and Malaysia. But Bosch also relies on suppliers to produce some of its chips and sensors and is feeling the pain of bottlenecks like automotive companies.

Meanwhile, research by Ernst & Young (EY) reveals that some carmakers reported record profits in the third quarter of 2021 despite a slump in sales and shutdowns. The 16 largest car manufacturers in the world generated more profit in the third quarter than ever before, EY said. Collectively, operating profit was up 11%, to €23.1 billion, compared to a year ago thus reaching a new record level.

Pricing upheld by high demand and short supply

‘Overall, the top car companies have survived the semiconductor crisis remarkably well so far,’ said Constantin Gall, EY managing partner and head of mobility Western Europe. ‘The scarce microchips are primarily installed in high-priced, high-margin vehicles, and the demand is significantly greater than the supply, so manufacturers do not currently have to sell their vehicles with discounts. The industry has not seen such good price enforcement for a very long time.’

Yet, suppliers are faced with enormous and sometimes existential challenges, EY found, warning that further upheavals could materialise in the fourth quarter – for both manufacturers and suppliers. Swedish car manufacturer Volvo said this week it sees the chip shortage extending into 2022.

‘The supply situation has improved going into the fourth quarter, but we expect the industry-wide shortage of semiconductors to remain a restraining factor,’ said Håkan Samuelsson, Volvo CEO. Sales volumes in the third quarter fell 17% compared to a year ago. While production was lower than demand, Volvo had improved month by month since September, it said.

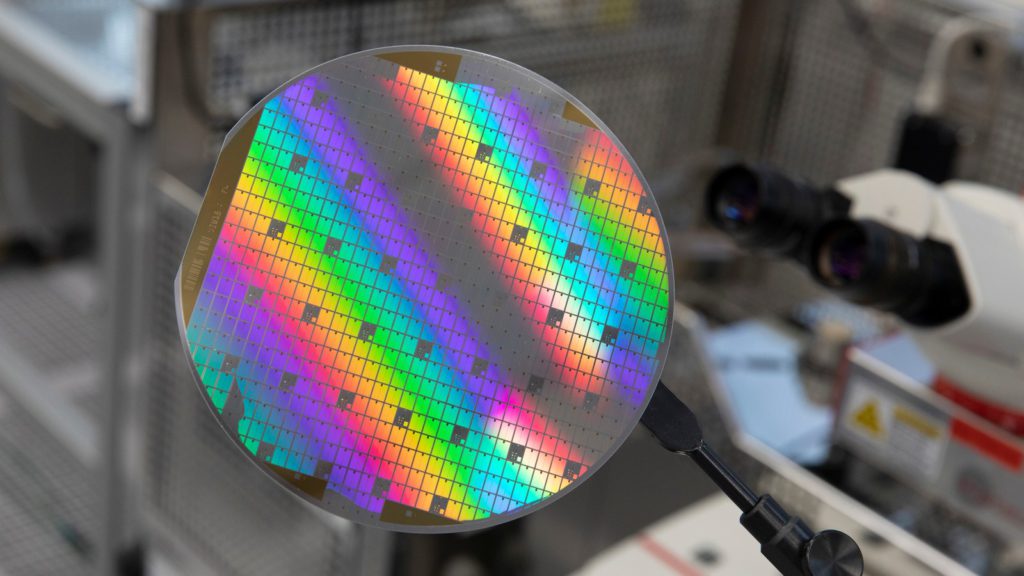

Samsung’s automotive 5G chip

With the automotive industry in dire need of semiconductors, Samsung Electronics plans to respond to the growing demand. The Korean tech company revealed it will roll out an automotive semiconductor chip that delivers 5G network connectivity for in-vehicle infotainment services.

Calling it an industry first, Samsung’s 5G chip is aimed at the next generation of connected cars. It delivers information to vehicles in real-time via a high-speed download of up to 5.1 gigabits per second, making content streaming and video calls on-the-go feasible. The new chip works in both standalone and non-standalone modes. It comes with two Cortex-A55 central-processing unit cores and a built-in global-navigation satellite system to enable enhanced telematics applications to monitor cars remotely.

Samsung unveiled a total of three chips this week that overall offer a more immersive in-car experience, data transmission, safer in-vehicle infotainment performance and more reliable operation of connected cars. One of these is used in Volkswagen’s latest in-car application server to power its next-generation in-vehicle infotainment system. The chip provides noiseless and distortion-free images for surround view and parking assistance while also being equipped with three audio processors to deliver improved audio quality for songs, films, and games. A third chip offers better power management for stable electricity supply.

Automotive expansion

‘Smarter and more connected automotive technologies for enriched in-vehicle experiences including entertainment, safety and comfort are becoming critical features on the road,’ said Jaehong Park, executive vice president of System LSI Custom SOC business at Samsung Electronics. ‘Samsung is transfusing its expertise in mobile solutions into its automotive line-up and is positioned to expand its presence within the field.’

Samsung is one of the world’s largest chipmakers and like others, it is spreading out its manufacturing operations in response to the shortage. The tech giant recently announced plans to build a $17 billion (€15 billion) semiconductor factory in Texas to boost production of hi-tech chips and improve supply-chain resilience – an ongoing issue in Europe. In September, the European Commission said it would unveil its European Chips Act next year as part of its strategy to foster semiconductor production.