No year-end decline in European RVs ahead of 2022 slowdown

16 December 2021

Residual values (RVs) have continued to develop positively in December, defying the usual seasonal trend. A significant deceleration of growth is expected in the major European markets in 2022, including lower RVs in the UK, and battery-electric vehicles (BEVs) face especially acute pricing challenges. Senior data journalist Neil King explores the latest developments and outlook.

RVs tend to slow towards the end of a year because of the festive season. However, the latest Autovista Group RV data reveal that this is not the case in Europe’s big five markets as the end of 2021 approaches, with used-car prices continuing to rise.

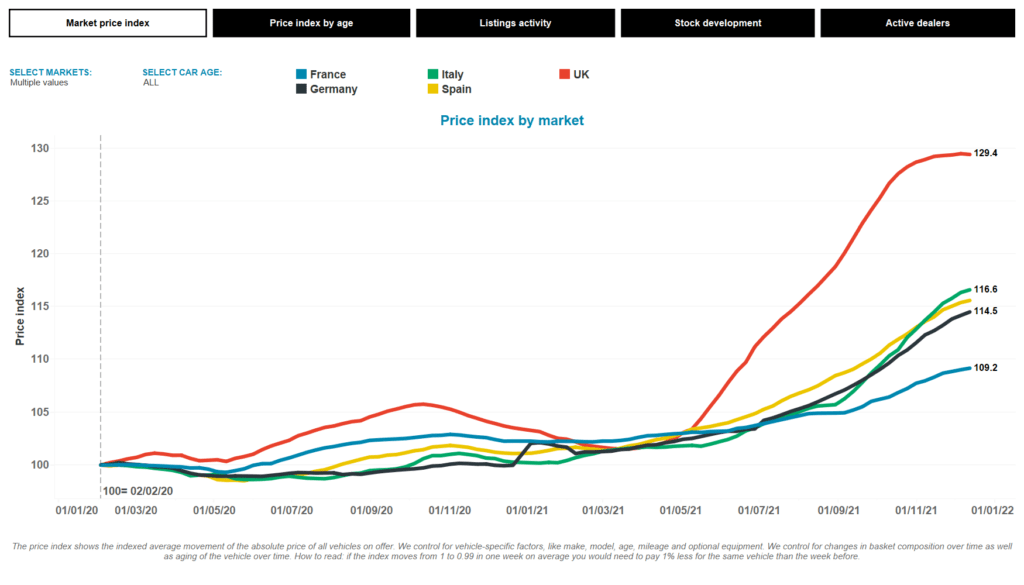

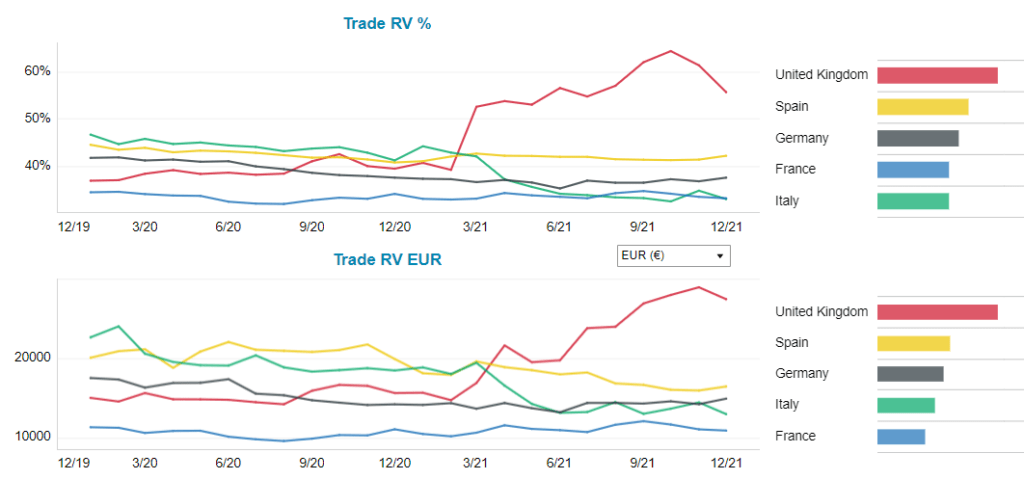

The UK has seen the strongest effects, with a 29% increase in RVs compared to the beginning of 2020, although this has levelled off in recent weeks. The used-car dynamics in the UK have been disrupted by supply-chain issues even beyond those experienced in continental Europe. The right-hand-drive setup represents another added challenge due to the limited import/export possibilities.

France is the only major market not to show a double-digit rise but has still experienced an extraordinary increase of 9% since January 2020. RVs in Germany, Spain, and Italy have risen by between 14% and 17% compared to pre-pandemic levels.

‘Overall, we are seeing a significant increase in used-car prices in each of the markets where we operate. Indeed, some of the most highly-demanded models and specifications – such as the Volkswagen Passat, Ford Focus and Skoda Octavia – are increasing by 20% to 30% year on year,’ Stan Galik, CEO of Driverama, told Autovista 24.

‘Because of large differences in residual-value change among countries, this unprecedented situation creates great opportunities for all traders benefiting from cross-border operations and strong imports and exports, like Driverama,’ Galik added.

RV index, major European used-car markets, January 2020 to December 2021

While the supply of used cars is substantially lower across Europe because of the lack of new-car registrations, used-car transactions in 2021 have been much closer to the levels of 2019. France even saw a 6% increase in used-car transactions in the first three quarters of 2021, compared with the same period in 2019.

Consequently, RVs have risen over the past two years – up to and above pre-crisis levels. There have been four distinct phases in movements on used-car markets:

- The initial period of lockdowns resulted in a temporary decline in RVs between January 2020 and June 2020.

- As lockdowns ended, pent-up demand and supply issues supported a swift recovery to above pre-crisis levels between July 2020 and December 2020 in most markets.

- Markets stabilised between January 2021 and June 2021 at above-pre-crisis levels. Economies were recovering quickly and supported this stabilisation.

- Over the past six months, besides the reality of the fourth wave of COVID-19, new factors materialised, which have resulted in a further heating-up of used-car markets. They are now consistently outperforming 2019. These new factors are more substantial supply-chain issues, for example around the continued shortage of semiconductors.

A seller’s market

Europe’s used-car markets became a seller’s market in 2021, with up to 30% fewer used cars being offered than in pre-COVID-19-times. This stems from the lack of new-car registrations, with 2021 not recovering from the disastrous performance in 2020 and year-on-year contractions expected in Germany and the UK.

Demand for individual mobility in the form of a car is at a record level and people are turning to the used-car market. Therefore, the sector has not faced declines comparable to new-car markets over the past two years. The magnitude and duration of these effects have been unexpected and are further compounded by the continued supply-chain disruptions, which will remain to some extent in 2022.

RV high-level stabilisation

Following the unusual RV development in 2020 and 2021, an air of uncertainty remains but RVs (in the 36-month/60,000km scenario) are expected to largely stabilise over the course of 2022, remaining on a far higher level than in the pre-pandemic years. The supply issues stemming from the semiconductor crisis and the latest wave of COVID-19 are expected to ease by mid-2022 and once the new-car market recovers, the used-car market will start to normalise as well.

However, there will be clear differences in RV performance and development between countries. While Germany expects a further increase of 3.3% for 36-month-old vehicles in 2022 before values stabilise in 2023, Italy, France and Spain expect additional growth of no more than 1% in 2022.

The UK is the only major European market forecast to face a decrease in RVs in 2022, of 4%. Given the phenomenal price inflation in 2021, however, this contraction is comparatively small, and the used-car market is expected to sustain the larger part of any price increases.

BEVs challenged

The positive RV developments this year and in the outlook, albeit to a far lesser extent, are reserved for internal-combustion engine (ICE) cars. The pricing development of BEVs has certainly not been able to keep up with the recovery pattern of ICE vehicles.

BEV RVs, 36months and 45,000km, big five European markets, January 2020 to December 2021

Looking at used-car market demand and supply from the electrification angle provides the rationale for this weaker performance: used-car markets were still largely unaffected by the disruption caused by the electrification of mobility in 2019, simply because the number of used BEVs had not reached a significant market share. Across the big five European countries, their share of one-year-old used cars was at just 0.7% in December 2019, but this has surged to a more relevant 4.1% in December 2021. Germany and Spain have the highest share of used BEVs in December, at 4.4% each, while Italy ranks lowest with 2.4%.

So, although the used-car supply has finally started to kick in with higher market shares, this has not translated into growing RVs. Used-car market adoption is still behind the new-car market and cannot keep up with the growing supply. The main reasons for this are the very attractive BEV incentive programmes for new cars in most countries, the fast-improving technology, and the resulting stark competition between used and new vehicles. The main focus of OEMs is still on the new-car market and the same holds true for government incentives, which mainly stimulate the purchase of a BEV, not the ownership of one.

We anticipate that the rapid phase-out of ICE in new-car markets will continue to create a supply shortage of used cars. Conversely, we forecast that RVs of BEVs and, to a lesser extent, plug-in hybrids (PHEVs) will continue to suffer from stronger lifecycle depreciation than ICE vehicles in 2022. The gap between BEVs and ICE in used-car markets has already widened and while there are substantial technological advancements, this trend will persist beyond 2022.