Austrian car market remains a mixed bag

14 February 2022

Robert Madas, regional head of valuations Austria, Poland, Switzerland at Eurotax (part of Autovista Group), analyses the development of the Austrian car market in the past year and ventures an outlook for 2022.

The automotive industry hoped that last year would see a recovery for the market from the disruption of the COVID-19 pandemic. However, this did not happen. Since the start of the pandemic in spring 2020, new-car registrations have sat consistently below pre-COVID19 levels. A lack of microchips and raw materials, as well as the accompanying delays in the delivery of new vehicles prevented an upturn last year.

The new-car market in Austria is still in crisis as the latest figures show: in 2021, the country saw 239,803 new-car registrations, correlating to a decline of 3.6% or 8,937 units, compared to the already weak numbers seen in 2020. When juxtaposed to the pre-crisis year of 2019, this corresponds to a steep slump of 27.2%.

Meanwhile, electrically-chargeable vehicles (EVs) experienced a renewed surge. In 2021, new-car registrations of battery-electric vehicles (BEVs) more than doubled year-on-year and amounted to 33,366 units (up 108.9%), accounting for 13.9% of the market. Plug-in hybrids (PHEVs) have seen a similar growth rate (up 91.4%), making up 14,626 of new registrations and thus holding a market share of 6.1%. Combined, these powertrains had a market share of around 20% in 2021, compared to 9.5% in the prior year. Classic petrol and diesel cars suffered declines, with the market share of diesel engines plummeting to 24.3% (or 58,263 units) from 36.5% (90,909 units) in the previous year.

Weak upswing expected

‘For 2022, we do not expect a real recovery of the new-car market, as chip shortages and supply chain issues will keep us busy for some time. From today’s perspective, 250,000 new-passenger car registrations are realistic, representing a volume that is significantly below the ones seen before the COVID19 pandemic,’ said Madas. ‘However, the actual figures will strongly depend on the availability of microchips and raw materials, i.e. whether the ordered new cars can actually be delivered.’

Used-car high

The used-car market, meanwhile, is on a high, driven by bullish demand and steadily decreasing supply. Last year’s 871,065 used-car transactions showed an increase of 3.6% compared to 2020 – which means they are almost on par with 2019 (872,043 units).

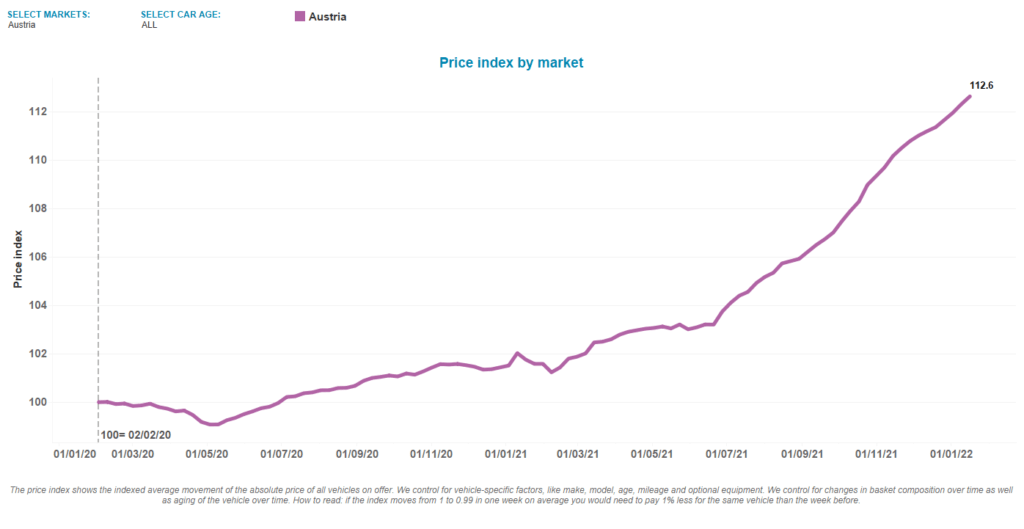

Since the beginning of last year, offer prices have only been pointing in one direction: upwards. In the second half of 2021 in particular, average asking prices rose significantly. Compared to the February 2020 level, the price index in January 2022 is on average about 12% above the level seen before the start of the pandemic (see chart below).

‘Stable demand meets low supply, especially for younger used cars of up to 24 months, which are missing on the market. The supply in this group is more than 40% below that seen before the pandemic,’ said Madas. Overall, the volume of active offers on the market is currently 33% down, compared to February 2020.

Price index Austria: January 2020 to January 2022

Residual values to see a high in 2022

This market environment is reflected in rising residual values (RVs). Currently, the trade-in value of a three-year-old car averages 46.6% of its list price. This corresponds to an increase of 9.1% compared to January 2021. The highest average value for three-year-old cars is currently 47.5% for petrol cars, followed by PHEVs with 47.2%, and diesel cars with 46.4%.

Regarding the future outlook of RVs, the further development of supply will play a decisive factor. Since new-car registrations are currently still markedly down when compared to pre-pandemic levels, we assume that the market parameters will not change in the medium term – hence RVs for three-year-old passenger cars will continue to rise this year. RVs will probably only come under pressure when the new-car market picks up significantly, thus leading to an increase of volumes on the used-car market – but this will likely not be the case until 2023.