How much further will new-car prices rise?

22 March 2022

Christof Engelskirchen, chief economist of Autovista Group, explores how much further new-car list prices could increase on the back of recent global developments.

Disrupted automotive supply chains and semiconductor shortages cut a quarter off new-car registrations in 2021/2020 versus 2019. Scarce supply and pent-up demand propelled new-car prices to record highs. The war in Ukraine and sanctions on Russia are causing more disruption as costs for raw materials, energy, and logistics are rising.

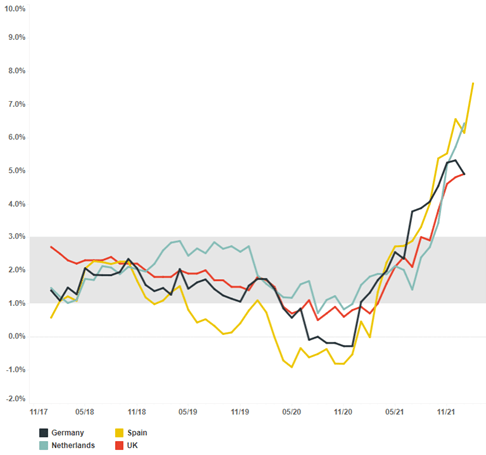

Inflationary trends drive up prices, including those of new cars – and vice versa. However, list prices for new vehicles rose more steadily than inflation rates during the past years. The last decade was characterised by record-low inflation in the Eurozone and the UK. In an attempt to move the needle towards healthy inflation levels (grey corridor in the chart below; around 2%), the European Central Bank (ECB) rates went negative. Inflation remained unimpressed, dropping further and even going negative in several Eurozone markets and Switzerland during the second half of 2020.

The pandemic depressed private spending across several sectors and oil prices were in freefall during the first half of 2020. COVID-19 reactive VAT reductions also played a role in many markets. Three factors reversed this trend in 2021. First, there were base effects compared to periods of very low prices. Second, energy costs rose substantially in 2021, beyond pre-COVID-19 levels. Third, CO2 prices were added to fuel, oil and gas in January last year. By the end of 2021, monthly inflation hit 5.3% in Germany, 5.7% in the Netherlands, 6.5% in Spain and 4.8% in the UK.

Monthly inflation rates (y/y) by country

Steady rise of new-car prices during the pandemic

Between Q1 2019 and March 2022, average prices in the D-segment (e.g. BMW 3-series, Mercedes-Benz C-class, Volkswagen Passat) rose by 16% in Spain, or €7,183. In Germany, new-car prices surged by 14% in the segment, while France increased slightly less – by 11%. Sweden topped this comparison with a steep 23% list-price jump over the three-year-period.

These price increases were not due to a change in mix. It is consistent across the more expensive versions of a model (turquoise coloured line in the chart below) as well as the cheaper ones (blue line). Not visualised, but noteworthy, smaller-vehicle segments increased even more than larger-vehicle segments. OEMs took the opportunity to increase prices, as supply was short and demand was building. These price rises were also seen in used-car markets.

Average new-car list price development, indexed and unweighted, D-segment

Best-case scenario: stagflation in 2022

Eurozone inflation hit a new high of 5.8% in February and this could increase further. Analysts are reviewing their inflation forecasts upwards – and outlooks will be suspect to frequent changes. Reviewing different year-on-year forecasts for 2022, Autovista24 expects inflation for the Eurozone to hit 3.5% to 4% (versus 2.6% in 2021); double this for the UK (7% versus 2.6% in 2021). In the US, inflation is expected to be around 4.5% to 5% in 2022 after an already substantial 4.7% inflation in 2021. One underlying assumption of these forecasts is that there will be no complete ban on Russian energy imports into Europe.

Stagflation is a likely scenario for many developed economies and is difficult to manage for central banks. It represents a period where prices keep rising (e.g. oil, gas, wheat, raw materials, other agricultural products, logistics, used-car prices, new-car prices), but the economy is not growing, or only slightly. Central banks face the question of how interest-rate increases would help bring inflation down.

This would probably have a limited impact because the prices for commodities like oil and gas are not rising because of an overheated economy. The real dilemma is if central banks do not act, consumers, employees, companies will get used to high inflation, which risks fuelling inflation even further. The ECB decision at the beginning of March, to maintain its interest rate at -0.5% and to reduce bond purchases is in line with stagflation expectations.

A recipe for rising list prices

Several major factors, depicted below, point towards further additional increases, with Autovista24 expecting list prices to remain on the growth trajectory depicted in the charts above.

- Semiconductor bottlenecks have not gone away and have become systemic. Demand for chips is rising beyond the automotive industry

- Supply chains continue to be fragile. The Russian invasion of Ukraine has exposed some OEM supply-chain issues in the areas of neon (critical for semiconductor production) and wire harnesses, which are model-specific. Ukraine-based companies assemble many of them

- Demand for cars will outstrip supply in the coming years. There may be a dent in demand versus any pre-war scenario, but pent-up demand, which has been building up over the past two years, will more than compensate

- Prices for raw materials, energy, production and logistics have risen substantially and this will wash through to higher prices.

Of course, there is a limit to how much consumers and companies will be able to pay for vehicles. An expected dip in economic growth will affect personal incomes and profits. Some car consumers may put a purchase on hold, or consider downsizing or buying used. It all depends on how successful the containment of the Russian invasion of Ukraine is. Should the war escalate further and the EU invokes a full Russian energy embargo, a deeper recession is probable. This would reduce the demand for cars, which may halt the rise of new-car prices, but it does not mean that they will come down.