Plan needed for electric-van charging in the UK

27 May 2022

As the passenger-car market continues to shift to electric mobility, the light-commercial vehicle (LCV) sector is experiencing slower uptake. Concerns over electric-van charging infrastructure are a bigger barrier to entry for LCV drivers, who need their vehicles on the road for long periods each day.

A new survey by the Society of Motor Manufacturers and Traders (SMMT) and Savanta ComRes reveals that 57% of people who own or lease a van in the UK are worried they would not be able to find a public charging point when required. Although the country’s charging infrastructure is growing, the time required to charge an electric vehicle (EV), upwards of 30 minutes, could leave logistics workers searching for a free point to continue their driving duties.

The SMMT believes that persuading drivers to switch to electric vans is essential if the UK is to become net-zero while keeping the nation on the move. Vans directly support around one in 10 workers in the country, acting as the essential workhorse for numerous sectors. This includes construction, industry, trades such as plumbers, landscapers, and cleaners, and home delivery services.

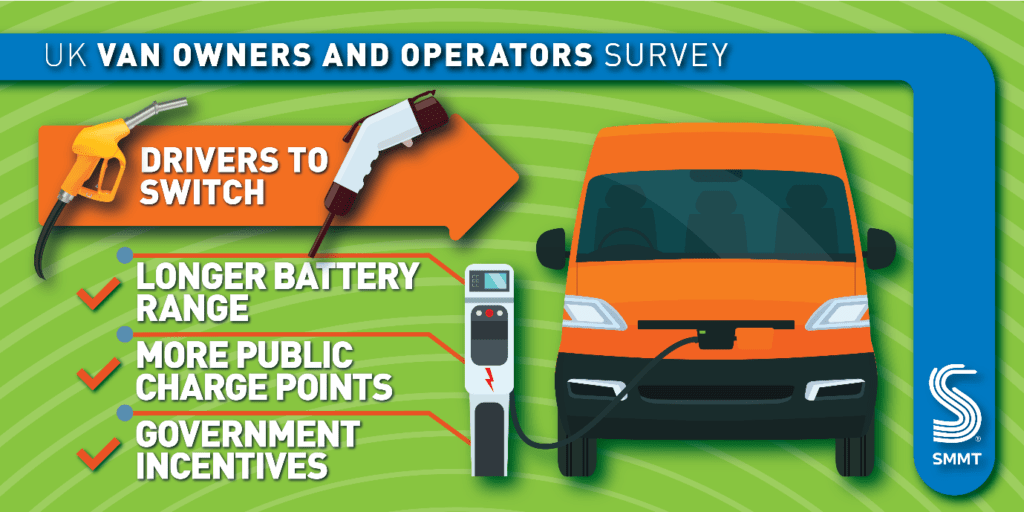

While just one in eight owners say they do not plan to switch to an electric van, the vast majority (88%) of respondents said they would go electric by 2035. But a fifth confirmed they would defer the decision for three to seven years. Overcoming this reticence is critical, with many people (58%) suggesting they might be convinced to buy an EV sooner if there was a greater number of public charging points.

Electric infrastructure struggles

The UK already has a lack of standard public-charging points as the takeup of EVs increases. Currently, there is only one point available for every 32 vehicles on the road, but the problem is exacerbated for van owners. Some public charge points are designed solely for cars, or are not in the right locations for vans. Problems can include height restrictions in car parks or spaces that are too small for longer-wheelbase vehicles.

As a result, the SMMT states that an electric-van charging provision must be factored into national infrastructure plans, with commensurate and binding targets for charge points for passenger cars and commercial vehicles to match the commitments of the automotive industry.

The survey reveals perceived battery capacity to be an influence on range anxiety, with 65% of respondents stating that a longer range would encourage them to switch. But the SMMT believes these fears may be overstated, with the average single-charge range of an electric van now around 150 miles (241km). Just 6% of van owners who responded to the survey said they exceeded this distance regularly, while four out of five averaged fewer than 100 miles in a day.

‘Britain’s businesses run on vans and if we are to deliver the nation’s carbon emission cuts, we need them to move to electric,’ stated SMMT chief executive Mike Hawes. ‘There is an electric van to suit every business case, but we need a ‘van plan’ to ensure zero-emission driving works for the millions of people for whom their van is their livelihood and the millions more who rely on these workhorses for the delivery of their daily needs. The automotive industry is getting these new technology vehicles into the showrooms – we need government and other stakeholders to match our commitments to get them out on the road.’

LCVs ‘two-years behind’ car market

There are more than four million LCVs on the road in the UK and electrifying this parc will substantially reduce the country’s transport-related carbon emissions. It would also help to deliver cleaner air in cities and built-up areas where they are most likely to operate.

More than a third of all new van models now on sale come with a plug-in option following billions of euros of investment by manufacturers. This has delivered improved payloads and EV-battery range. The survey found that confidence in EV range is high, with just 20% saying there is not enough variety of models to meet their needs.

However, despite electric-van uptake doubling in the last year, these vehicles still account for just one in 20 new-van registrations. This means the market is currently about two years behind the passenger-car market, where the registration of zero-emission models is closer to one in five.

With vans facing the same 2035 end-of-sale date for non-zero emission vehicles as cars in the UK, however, the automotive sector is calling on all stakeholders to match its commitment to drive the electric transition.